|

市場調查報告書

商品編碼

1797858

焊接鋼罐市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Welded Steel Tanks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

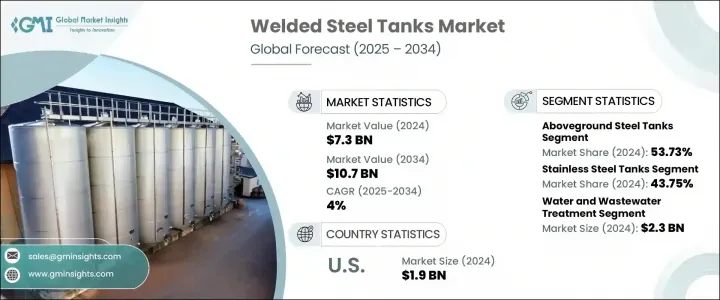

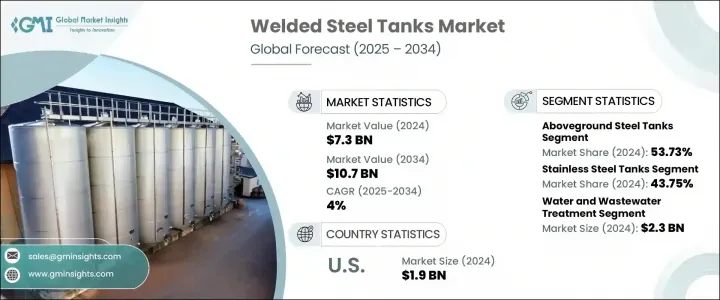

2024年,全球焊接鋼罐市場規模達73億美元,預計到2034年將以4%的複合年成長率成長,達到107億美元。隨著企業面臨日益嚴格的環境法規和營運標準,各行各業對堅固耐腐蝕的儲存解決方案的需求持續成長。焊接鋼罐因其耐用性、使用壽命以及在惡劣條件下的適應性,已成為水處理、化學品、石油天然氣和農業等領域的必備材料。

隨著各行各業轉向更永續的基礎設施,這些儲罐因其可回收和易於維護的特性而越來越受歡迎。多個地區工業的快速成長也推動了用於燃料、水和化學品儲存的大容量儲罐的需求。此外,自動焊接系統、模組化儲槽設計和物聯網整合等技術進步正在提高效率,減少營運停機時間,並提高這些系統的成本效益。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 73億美元 |

| 預測值 | 107億美元 |

| 複合年成長率 | 4% |

隨著各行各業都將永續性和長期資源管理放在首位,人們對環境保護和能源儲存的日益關注進一步推動了市場擴張。政府旨在減少碳排放和節約用水的指令促使企業投資支持綠色計劃的基礎設施,而焊接鋼罐為安全高效的儲存提供了可行的解決方案。這些儲槽擴大用於雨水收集、生物燃料儲存和再生能源系統,包括氫能和熱能儲存應用。

2024年,地上焊接鋼罐佔最大市場佔有率,達到53.73%,預計2034年複合年成長率將達到4.46%。與地下儲槽相比,地上儲槽因其成本效益高、安裝快速、檢查和維護方便而備受青睞。其適應性強、安裝成本低,適用於各種規模的工業。地上儲槽具有移動性和靈活性,這在快速變化的工業環境中至關重要。這些系統可以根據需要進行調整、重新定位或擴展,同時確保符合安全和環境協定。

2024年,不銹鋼儲罐市場貢獻了約43.75%的總收入,預計在預測期內將以4.6%的複合年成長率成長。不銹鋼儲槽以其卓越的耐腐蝕和耐化學腐蝕性能而聞名,廣泛應用於對衛生、安全和強度要求嚴格的環境。這些儲槽因其耐微生物生長、易於消毒且清潔所需的系統停機時間極短而受到製藥、食品加工和化學等行業的青睞。其使用壽命長、維護要求低,使其成為有價值的投資,同時降低了總擁有成本。

美國焊接鋼罐市場佔86.85%的市場佔有率,2024年產值達6.045億美元。這一優勢源自於美國強大的工業基礎、成熟的基礎設施以及對水資源管理、能源和加工產業的持續投資。隨著各機構嚴格執行安全和環境標準,高等級焊接鋼罐的採用率正在不斷成長。該地區的設施都依賴這些儲罐來儲存化學品、廢水和其他材料,並遵守嚴格的法規。此外,老化基礎設施的持續更新換代,使得耐腐蝕且可客製化的焊接儲槽成為公共和私營部門專案的首選解決方案。

焊接鋼罐市場的主要參與者包括 Tank Connection、Superior Tank Co.、Bulldog Steel Products、McDermott(前身為 CB&I)、Pittsburg Tank & Tower Group、BH Tank、United Industries Group(UIG Tanks & Domes)、Caldwell Tanks、Tech Fab、Skinner Tank Company、CST Industries、Hiqueland、CST Industries、Hankt、Tech Fab、Skinner Tank Company、CST PermianLide。焊接鋼罐市場的領先公司正專注於創新、區域擴張和客製化,以鞏固其市場地位。許多公司正在透過整合自動化、人工智慧品質檢查和精密焊接來升級其製造能力,以降低成本並提高耐用性。永續性是另一個重點領域,公司正在引入可回收材料和環保塗料。與政府機構和工業客戶的合作正在幫助公司贏得水管理和能源領域的大規模合約。根據行業特定需求提供客製化的罐體配置已成為一種常見策略,同時也投資於售後服務和即時監控技術。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 工業擴張和基礎設施成長

- 嚴格的環境法規和 ESG 舉措

- 技術進步和自動化

- 產業陷阱與挑戰

- 原料成本波動

- 替代材料的競爭

- 機會

- 擴大水利基礎設施項目

- 再生能源儲存需求

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS 編碼 - 73090090)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 地上鋼罐

- 地下鋼罐

- 客製化/模組化坦克

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 碳鋼罐

- 不銹鋼罐

- 304不鏽鋼

- 316不銹鋼

- 合金鋼罐

第7章:市場估計與預測:依設計,2021 - 2034 年

- 主要趨勢

- 開放式坦克

- 關閉坦克

第8章:市場估計與預測:按完成情況,2021 - 2034 年

- 主要趨勢

- 塗層或內襯鋼罐

- 無塗層鋼罐

第9章:市場估計與預測:依產能,2021 - 2034

- 主要趨勢

- 0-10,000加侖

- 10,000-20,000加侖

- 20,000-40,000加侖

- 4萬至5萬加侖

- 超過 50,000 加侖

第10章:市場估計與預測:依罐體形狀,2021 - 2034 年

- 主要趨勢

- 矩形的

- 圓柱形

第 11 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 石油和天然氣產業

- 化工

- 水和廢水處理

- 食品和飲料業

- 製藥業

- 發電

- 紙漿和造紙

- 建造

- 農業

- 其他(採礦、海洋等)

第 12 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 13 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 14 章:公司簡介

- BH Tank

- Bulldog Steel Products

- Caldwell Tanks

- CST Industries

- Highland Tank & Manufacturing Company

- Lipp GmbH

- McDermott (formerly CB&I)

- PermianLide

- Pittsburg Tank & Tower Group

- Skinner Tank Company

- Superior Tank Co.

- Tank Connection

- TechFab

- TF Warren Group (Tarsco)

- United Industries Group (UIG Tanks & Domes)

The Global Welded Steel Tank Market was valued at USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 10.7 billion by 2034. The demand for robust and corrosion-resistant storage solutions across various industries continues to rise, as companies face increasing environmental regulations and stricter operational standards. Welded steel tanks have become essential in sectors like water treatment, chemicals, oil and gas, and agriculture due to their durability, longevity, and adaptability to harsh conditions.

As industries move toward more sustainable infrastructure, these tanks are gaining popularity for being recyclable and easier to maintain. Rapid industrial growth across several regions is also boosting the demand for high-capacity storage tanks used for fuel, water, and chemical containment. Additionally, technological advancements such as automated welding systems, modular tank designs, and IoT integration are improving efficiency, reducing operational downtime, and making these systems more cost-effective.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 4% |

The growing focus on environmental conservation and energy storage is further driving market expansion, as industries across sectors prioritize sustainability and long-term resource management. Government mandates aimed at reducing carbon emissions and conserving water are prompting businesses to invest in infrastructure that supports green initiatives, and welded steel tanks offer a viable solution for safe and efficient storage. These tanks are increasingly being used for rainwater harvesting, biofuel storage, and renewable energy systems, including hydrogen and thermal energy storage applications.

Aboveground welded steel tanks held the largest market share in 2024 at 53.73% and are expected to register a 4.46% CAGR through 2034. These tanks are favored for being cost-effective, quicker to install, and easier to inspect and maintain than underground alternatives. Their adaptability and lower setup costs make them viable across small to large-scale industries. Aboveground tanks offer mobility and flexibility, which are highly valuable in rapidly changing industrial environments. These systems can be adjusted, repositioned, or expanded as needed while ensuring compliance with safety and environmental protocols.

The stainless-steel tanks segment contributed around 43.75% of total revenue in 2024 and is forecasted to grow at a CAGR of 4.6% through the forecast period. Known for their exceptional resistance to corrosion and chemical exposure, stainless steel tanks are extensively used in environments where hygiene, safety, and strength are critical. These tanks are preferred by businesses in sectors like pharmaceuticals, food processing, and chemicals because they resist microbial growth, are easy to sanitize, and require minimal system downtime for cleaning. Their long service life and low maintenance requirements make them a valuable investment with reduced total cost of ownership.

United States Welded Steel Tank Market held an 86.85% share and generated USD 604.5 million in 2024. This dominance stems from the country's strong industrial base, mature infrastructure, and consistent investment in water management, energy, and processing industries. With agencies enforcing strict safety and environmental standards, the adoption of high-grade welded steel tanks is growing. Facilities across the region rely on these tanks to store chemicals, wastewater, and other materials in compliance with rigorous regulations. Additionally, the ongoing replacement of aging infrastructure has made corrosion-resistant and customizable welded tanks a preferred solution in both public and private sector projects.

Key players in the Welded Steel Tank Market include Tank Connection, Superior Tank Co., Bulldog Steel Products, McDermott (formerly CB&I), Pittsburg Tank & Tower Group, BH Tank, United Industries Group (UIG Tanks & Domes), Caldwell Tanks, Tech Fab, Skinner Tank Company, CST Industries, Highland Tank & Manufacturing Company, Lipp GmbH, TF Warren Group (Tarsco), and PermianLide. Leading companies in the welded steel tank market are focusing on innovation, regional expansion, and customization to strengthen their market position. Many are upgrading their manufacturing capabilities by integrating automation, AI-powered quality checks, and precision welding to reduce costs and improve durability. Sustainability is another focus area, with firms introducing recyclable materials and environmentally safe coatings. Partnerships with government bodies and industrial clients are helping companies win large-scale contracts in water management and energy sectors. Offering tailored tank configurations for industry-specific needs has become a common strategy, along with investing in after-sales services and real-time monitoring technologies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Design

- 2.2.5 Finishing

- 2.2.6 Capacity

- 2.2.7 Tank Shape

- 2.2.8 End use

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.4 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial expansion and infrastructure growth

- 3.2.1.2 Stringent environmental regulations and ESG initiatives

- 3.2.1.3 Technological advancements and automation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Volatile raw material costs

- 3.2.2.2 Competition of alternative materials

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of water infrastructure projects

- 3.2.3.2 Renewable energy storage needs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code - 73090090)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Key trends

- 5.2 Aboveground steel tanks

- 5.3 Underground steel tanks

- 5.4 Custom/modular tanks

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Key trends

- 6.2 Carbon steel tanks

- 6.3 Stainless steel tanks

- 6.3.1 304 stainless steels

- 6.3.2 316 stainless steels

- 6.4 Alloy steel tanks

Chapter 7 Market Estimates & Forecast, By Design, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Key trends

- 7.2 Open tanks

- 7.3 Close tanks

Chapter 8 Market Estimates & Forecast, By Finishing, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Key trends

- 8.2 Coated or lined steel tanks

- 8.3 Uncoated steel tanks

Chapter 9 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Key trends

- 9.2 0-10,000 gallons

- 9.3 10,000-20,000 gallons

- 9.4 20,000-40,000 gallons

- 9.5 40,000-50,000 gallons

- 9.6 Above 50,000 gallons

Chapter 10 Market Estimates & Forecast, By Tank Shape, 2021 - 2034 ($Mn) (Thousand Units)

- 10.1 Key trends

- 10.2 Rectangular

- 10.3 Cylindrical

Chapter 11 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn) (Thousand Units)

- 11.1 Key trends

- 11.2 Oil & gas industry

- 11.3 Chemical industry

- 11.4 Water and wastewater treatment

- 11.5 Food & beverage industry

- 11.6 Pharmaceutical industry

- 11.7 Power generation

- 11.8 Pulp & Paper

- 11.9 Construction

- 11.10 Agriculture

- 11.11 Others (Mining, Marine, etc.)

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 12.1 Key trends

- 12.2 Direct

- 12.3 Indirect

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn, Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 UK

- 13.3.2 Germany

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Russia

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 MEA

- 13.6.1 UAE

- 13.6.2 South Africa

- 13.6.3 Saudi Arabia

Chapter 14 Company Profiles

- 14.1 BH Tank

- 14.2 Bulldog Steel Products

- 14.3 Caldwell Tanks

- 14.4 CST Industries

- 14.5 Highland Tank & Manufacturing Company

- 14.6 Lipp GmbH

- 14.7 McDermott (formerly CB&I)

- 14.8 PermianLide

- 14.9 Pittsburg Tank & Tower Group

- 14.10 Skinner Tank Company

- 14.11 Superior Tank Co.

- 14.12 Tank Connection

- 14.13 TechFab

- 14.14 TF Warren Group (Tarsco)

- 14.15 United Industries Group (UIG Tanks & Domes)