|

市場調查報告書

商品編碼

1797856

旅行疫苗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Travel Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

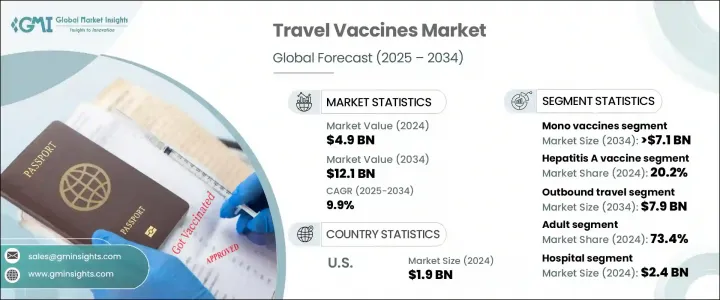

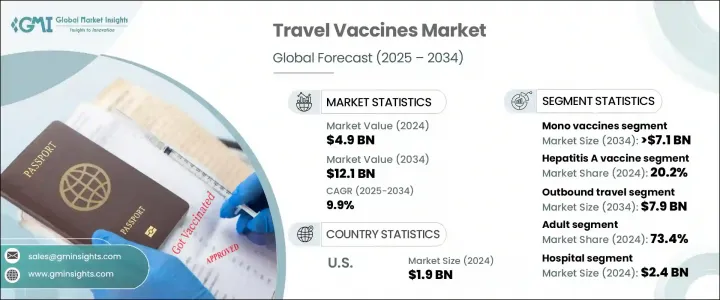

2024年,全球旅行疫苗市場規模達49億美元,預計2034年將以9.9%的複合年成長率成長,達到121億美元。受全球健康意識提升、疫苗研發快速推進以及國際旅行模式演變等因素的影響,該市場發展勢頭強勁。人們對區域性疾病風險以及疫苗接種在境外預防疾病中作用的認知不斷提高,正在推動疫苗的廣泛需求。政府的衛生政策、教育工作以及數位健康平台正在強化疫苗在旅行前規劃中的關鍵作用。

隨著全球旅遊業復甦並呈現多樣化,預防性免疫接種已成為維護公共衛生的關鍵組成部分,尤其是在醫療基礎設施有限的地區。技術創新簡化了物流流程,降低了成本,並延長了疫苗的保存期限,從而提升了疫苗的生產和配送。這些變革推動了旅遊疫苗在全球範圍內的廣泛應用,尤其是在醫療資源匱乏和高風險地區。旅行疫苗旨在保護旅行者免受狂犬病、傷寒、黃熱病和肝炎等疾病的侵害。市場細分為單藥疫苗和聯合疫苗,透過公立和私人醫療管道分銷。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 49億美元 |

| 預測值 | 121億美元 |

| 複合年成長率 | 9.9% |

單藥疫苗市場在2024年的營收為29億美元,預計到2034年將達到71億美元,複合年成長率為9.7%。這類疫苗持續佔據主導地位,得益於其精準的保護和較低的副作用風險,使其成為前往衛生條件差、疾病高發地區的旅行者的首選。傷寒和狂犬病等疾病的免疫接種通常根據目的地、旅行時間和當地醫療狀況進行建議。

就疫苗類型而言,甲型肝炎疫苗在2024年的市佔率為20.2%。其強勁的市場地位與其在預防食源性和水源性疾病方面發揮的重要作用息息相關,尤其是在拉丁美洲、亞洲和非洲等衛生狀況依然堪憂的地區。即使是短暫的旅行也可能帶來風險,尤其是對於品嚐當地美食或入住非商業性住宿的旅客而言。由於傳播風險較高,全球衛生部門強烈建議大多數國際旅客接種甲型肝炎疫苗作為標準措施。

美國旅行疫苗市場在2024年創收19億美元,預計2025年至2034年期間的複合年成長率將達到9.3%。這一成長與國際出境人數的增加以及積極的公共衛生措施相一致。聯邦機構正在透過更新指南和進行推廣活動來鼓勵旅行相關的免疫接種,從而支持市場擴張。出境旅遊的成長,加上疾病意識的提高,持續推動全美疫苗接種的普及。

全球旅行疫苗市場的領導者包括明治集團、Dynavax Technologies、印度血清研究所、賽諾菲、葛蘭素史克公司 (GSK)、Valneva SE、Bharat Biotech、輝瑞、CSL、Emergent BioSolutions、默克和 Bavarian Nordic。為了保持競爭優勢,旅行疫苗產業的公司正在實施以創新、擴張和可及性為中心的策略。對 mRNA 和單劑量解決方案等先進技術的投資有助於提高疫苗效力和給藥效率。各公司正在提升生產可擴展性,以滿足全球需求,尤其是在疫苗取得受限的地區。他們正在利用與公共衛生機構和旅行健康服務提供者的策略合作夥伴關係來提高知名度和分銷範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 出境旅遊和國際遊不斷增加

- 預防措施意識不斷增強

- 疫苗配方和生產效率的進步

- 產業陷阱與挑戰

- 物流和基礎設施挑戰

- 嚴格的法規核准流程

- 市場機會

- 客製化疫苗和組合疫苗

- 旅遊業蓬勃發展

- 成長動力

- 成長潛力分析

- 管道分析

- 技術格局

- 當前的技術趨勢

- 新興技術

- 監管格局

- 差距分析

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

第5章:市場估計與預測:按疫苗類型,2021-2034

- 主要趨勢

- 單藥疫苗

- 聯合疫苗

第6章:市場估計與預測:依疾病類型,2021 - 2034 年

- 主要趨勢

- 甲型肝炎

- 腦膜炎球菌疾病

- 流感

- 白喉、百日咳、破傷風(DPT)

- 狂犬病

- 黃熱病

- 傷寒

- 麻疹、腮腺炎和德國麻疹 (MMR)

- B型肝炎

- 其他疾病類型

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 出境旅遊

- 國內旅遊

第8章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 兒科

- 成人

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 民眾

- 私人的

- 專科診所

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Bavarian Nordic

- Bharat Biotech

- CSL

- Dynavax Technologies

- Emergent BioSolutions

- GlaxoSmithKline plc (GSK)

- Meiji Group

- Merck

- Pfizer

- Sanofi

- Serum Institute of India

- Valneva SE

The Global Travel Vaccines Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 12.1 billion by 2034. This market is gaining momentum due to a mix of global health awareness, rapid advancements in vaccine development, and evolving international travel patterns. Increasing recognition of regional disease risks and the role of vaccination in preventing illness while abroad is fueling widespread demand. Government health policies, education efforts, and digital health platforms are reinforcing the critical role vaccines play in pre-travel planning.

As global travel recovers and diversifies, preventive immunization becomes a crucial component in maintaining public health, particularly in areas with limited healthcare infrastructure. Technology is enhancing vaccine production and delivery through innovations that streamline logistics, reduce costs, and improve shelf life. These shifts are enabling wider adoption of travel vaccines globally, especially in underserved and high-risk areas. Travel vaccines are administered to protect travelers from infections like rabies, typhoid, yellow fever, and hepatitis. The market is segmented into mono and combination vaccines, distributed through both public and private healthcare channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $12.1 Billion |

| CAGR | 9.9% |

The mono vaccines segment generated USD 2.9 billion in 2024 and is forecast to reach USD 7.1 billion by 2034 at a CAGR of 9.7%. Their continued dominance stems from targeted protection and lower risk of side effects, making them a preferred choice for travelers heading to areas with poor sanitation and high disease prevalence. Immunizations for diseases like typhoid and rabies are often recommended depending on the destination, duration of travel, and local healthcare conditions.

In terms of vaccine type, the Hepatitis A segment held a 20.2% share in 2024. Its strong position is linked to its essential role in protecting against food and water-borne illness, particularly in regions across Latin America, Asia, and Africa where sanitation remains a major concern. Even short visits can pose a risk, especially for those consuming local cuisine or staying in non-commercial accommodations. Due to the high transmission risk, global health authorities strongly recommend Hepatitis A vaccination as a standard measure for most international travelers.

United States Travel Vaccines Market generated USD 1.9 billion in 2024 and is expected to grow at a CAGR of 9.3% between 2025 and 2034. This growth aligns with increasing international departures and proactive public health initiatives. Federal agencies are supporting market expansion by encouraging travel-related immunization through updated guidelines and outreach efforts. The increase in outbound tourism, combined with rising disease awareness, continues to drive vaccine uptake across the country.

Leading players in the Global Travel Vaccines Market include Meiji Group, Dynavax Technologies, Serum Institute of India, Sanofi, GlaxoSmithKline plc (GSK), Valneva SE, Bharat Biotech, Pfizer, CSL, Emergent BioSolutions, Merck, and Bavarian Nordic. To maintain a competitive advantage, companies in the travel vaccines sector are implementing strategies centered around innovation, expansion, and accessibility. Investments in advanced technologies like mRNA and single-dose solutions are helping improve vaccine efficacy and delivery. Firms are enhancing their manufacturing scalability to meet global demand, particularly in regions with limited access. Strategic partnerships with public health institutions and travel health providers are being leveraged to increase awareness and distribution reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Vaccine type trends

- 2.2.3 Disease type trends

- 2.2.4 Application trends

- 2.2.5 Age group trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising outbound or international travel

- 3.2.1.2 Growing awareness of preventive measures

- 3.2.1.3 Advancements in vaccine formulation and production efficiency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Logistical & infrastructure challenges

- 3.2.2.2 Stringent regulatory approval process

- 3.2.3 Market opportunities

- 3.2.3.1 Customized & combination vaccines

- 3.2.3.2 Growing travel and tourism

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.7 Gap analysis

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Mono vaccines

- 5.3 Combination vaccines

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hepatitis A

- 6.3 Meningococcal diseases

- 6.4 Influenza

- 6.5 Diphtheria, pertussis, tetanus (DPT)

- 6.6 Rabies

- 6.7 Yellow fever

- 6.8 Typhoid

- 6.9 Measles, mumps, and rubella (MMR)

- 6.10 Hepatitis B

- 6.11 Other disease types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Outbound travel

- 7.3 Domestic travel

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatric

- 8.3 Adult

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.2.1 Public

- 9.2.2 Private

- 9.3 Specialty clinics

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Bavarian Nordic

- 11.2 Bharat Biotech

- 11.3 CSL

- 11.4 Dynavax Technologies

- 11.5 Emergent BioSolutions

- 11.6 GlaxoSmithKline plc (GSK)

- 11.7 Meiji Group

- 11.8 Merck

- 11.9 Pfizer

- 11.10 Sanofi

- 11.11 Serum Institute of India

- 11.12 Valneva SE