|

市場調查報告書

商品編碼

1797850

地暖致動器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Underfloor Heating Actuator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

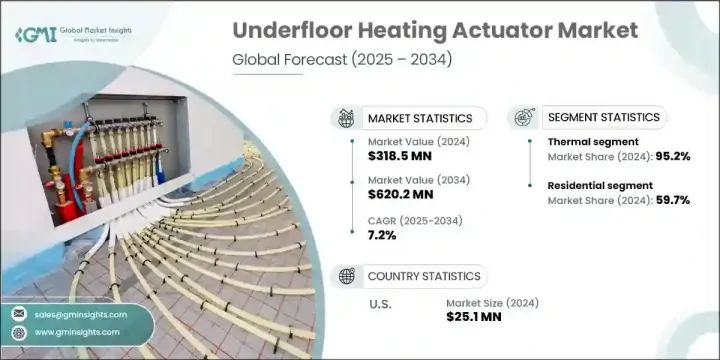

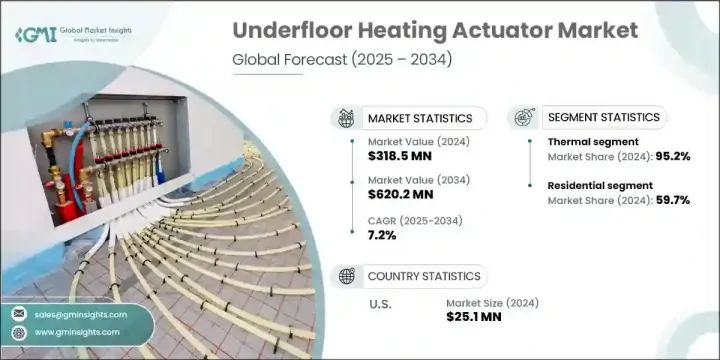

2024年,全球地暖致動器市場規模達3.185億美元,預計複合年成長率為7.2%,到2034年將達到6.202億美元。初始設置和安裝成本的顯著下降,使地暖從高階設施轉變為普及的技術。無論是浴室、廚房等緊湊區域,還是更大規模的安裝,創新技術都在加速產業發展。執行器是地暖系統的重要組成部分,能夠確保分集水器高效運行,並提升系統性能。

工業設施和製造園區對可靠、節能供暖的需求日益成長,推動了先進執行器系統的採用。智慧控制的突破、更長的產品壽命和更高的精度顯著提升了人們對這些系統的興趣。快速發展地區的消費者越來越重視永續且經濟高效的解決方案,這進一步支持了市場的成長。隨著住宅和商業環境(尤其是醫療保健設施)對安全、均勻分佈供暖的需求不斷成長,地暖執行器產業持續受到關注。消費者意識的提升和更具競爭力的價格點可能會在整個預測期內維持這一成長軌跡。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.185億美元 |

| 預測值 | 6.202億美元 |

| 複合年成長率 | 7.2% |

2024年,住宅應用領域佔據了59.7%的市場佔有率,預計到2034年將以7%的複合年成長率成長。由於地暖分佈均勻,且能夠在適度溫度下高效運行,屋主們正在逐漸轉向地暖。與在較高溫度範圍內運作的傳統散熱器相比,地暖系統使用恆溫器和感測器實現更智慧的加熱。 Wi-Fi連接和分區控制系統的加入,使家庭節能高達15%,同時由於沒有暴露元素或空氣中的過敏原,空氣品質也得到了改善。這使得地暖系統對於多戶住宅和追求安全和便利的家庭尤其具有吸引力。

電動執行器市場在2024年佔據4.8%的市場佔有率,預計到2034年將以7%的複合年成長率成長。這些執行器因其高效的性能、成本效益和精準的控制而需求旺盛。製造商對傳統液壓和熱力執行器的日益青睞,促使其加強對電動執行器生產的投入。馬達設計、系統相容性和通訊標準的持續進步,正在推動產品的普及。此外,針對能源效率和室內舒適度的嚴格建築規範,也推動電動執行器進一步融入現代暖氣系統。

預計2034年,北美地暖致動器市場規模將達到6,420萬美元。人們對再生能源技術的興趣日益濃厚,以及對綠色能源政策的遵守,正在塑造該地區的成長。商業基礎設施建設活動的增加,以及住宅裝修中地暖系統(尤其是在加拿大和美國的多單元住宅中)的廣泛應用,正在提振市場需求。消費者在房屋升級方面的支出增加以及對現代設計的偏好,也是該產業發展的關鍵因素。

活躍於全球地暖執行器市場的主要公司包括 Mohlenhoff、西門子、施耐德電氣、Intatec、江森自控、霍尼韋爾國際、SMLGHVAC、丹佛斯、Belimo、Uponor、Schluter-Systems、Warmup、Pentair、Heatmiser、艾默生電氣、Hunt Hepun、Hunt、Ele領先的製造商正在優先考慮產品創新,透過提高執行器性能、整合智慧控制功能以及提高與先進建築管理系統的兼容性。他們還透過合作夥伴關係、分銷協議以及與區域公司的合併來擴大其地理覆蓋範圍。對研發的策略性投資正在幫助企業創造出更緊湊、更節能、更耐用的執行器。為了滿足不斷變化的客戶需求,許多公司正在實現產品線多元化,並為住宅和商業市場提供客製化解決方案。此外,遵守能源效率法規和永續發展目標仍然是確保在競爭激烈的市場中實現長期成長的關鍵關注領域。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 零件供應商

- 技術提供者

- 產品整合商

- 開發商和 EPC 承包商

- 最終用途

- 價格趨勢分析(美元/單位)

- 按產品

- 按地區

- 監管格局

- 產業衝擊力

- 成長動力

- 引入能源效率標準並增強空間供暖需求

- 極端氣候條件

- 生活水準提高

- 產業陷阱與挑戰

- 現有建築改造成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依產品,2021-2034

- 主要趨勢

- 熱的

- 運動性

第6章:市場規模及預測:依應用,2021-2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第7章:市場規模及預測:依地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 西班牙

- 奧地利

- 比利時

- 丹麥

- 芬蘭

- 挪威

- 瑞典

- 英國

- 義大利

- 俄羅斯

- 捷克共和國

- 瑞士

- 荷蘭

- 亞太地區

- 中國

- 日本

- 澳洲

- 印度

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

第8章:公司簡介

- Belimo

- Danfoss

- Uponor

- Eberle Controls

- Emerson Electric

- Honeywell International

- Hunt Heating

- Heatmiser

- Intatec

- Johnson Controls

- Mohlenhoff

- Oventrop

- Pentair

- Polypipe

- SMLGHVAC

- Sauter

- Siemens

- Schluter-Systems

- Schneider Electric

- Warmup

The Global Underfloor Heating Actuator Market was valued at USD 318.5 million in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 620.2 million by 2034. A notable drop in initial setup and installation costs has transformed underfloor heating from a high-end amenity to a widely accessible technology. Innovations supporting both compact areas like bathrooms and kitchens and larger-scale installations are accelerating industry momentum. Actuators are essential components in underfloor heating systems, enabling efficient operation of the manifold and contributing to system performance.

The growing need for reliable, energy-efficient heating in industrial facilities and manufacturing zones is driving the adoption of advanced actuator systems. Breakthroughs in smart controls, longer product lifespans, and increased accuracy have significantly boosted interest in these systems. Consumers in fast-developing regions are increasingly prioritizing sustainable and cost-efficient solutions, further supporting market growth. With rising demand for safe, evenly distributed heating in residential and commercial environments-particularly in healthcare facilities-the underfloor heating actuator sector continues to gain traction. Increased consumer awareness and more competitive price points are likely to sustain this growth trajectory throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $318.5 Million |

| Forecast Value | $620.2 Million |

| CAGR | 7.2% |

In 2024, the residential applications segment held a 59.7% share and is expected to grow at a CAGR of 7% through 2034. Homeowners are turning to underfloor heating due to its uniform heat distribution and ability to run efficiently at moderate temperatures. Compared to traditional radiators that function at higher heat ranges, underfloor systems use thermostats and sensors for smarter heating. The addition of Wi-Fi connectivity and zoned control systems allows households to achieve energy savings of up to 15%, all while enjoying improved air quality due to the lack of exposed elements or airborne allergens. This makes the system especially appealing for multi-family units and households seeking safety and convenience.

The motoric actuator segment held a 4.8% share in 2024 and is projected to grow at a CAGR of 7% through 2034. These actuators are in high demand because they deliver efficient performance, cost benefits, and precision control. Their increasing preference for traditional hydraulic and thermal variants is prompting manufacturers to invest more heavily in motoric actuator production. Continued advancements in motor design, system compatibility, and communication standards are pushing product adoption forward. In addition, stringent building codes targeting energy efficiency and indoor comfort are fueling further integration of motoric actuators into modern heating systems.

North American Underfloor Heating Actuator Market is expected to reach USD 64.2 million by 2034. Increased interest in renewable technologies and compliance with green energy policies are shaping regional growth. Rising construction activity in commercial infrastructure and the broader adoption of these systems in residential renovations, particularly in multi-unit properties across Canada and the U.S., are bolstering market demand. Higher consumer spending on home upgrades and modern design preferences are also key contributors to the sector's progress.

Key companies active in the Global Underfloor Heating Actuator Market include Mohlenhoff, Siemens, Schneider Electric, Intatec, Johnson Controls, Honeywell International, SMLGHVAC, Danfoss, Belimo, Uponor, Schluter-Systems, Warmup, Pentair, Heatmiser, Emerson Electric, Hunt Heating, Eberle Controls, Oventrop, Sauter, and Polypipe. Leading manufacturers are prioritizing product innovation by enhancing actuator performance, integrating smart control features, and improving compatibility with advanced building management systems. They are also expanding their geographic footprint through partnerships, distribution agreements, and mergers with regional firms. Strategic investments in R&D are helping companies create more compact, energy-efficient, and durable actuators. To cater to shifting customer needs, many firms are diversifying product lines and offering customized solutions for both residential and commercial markets. Additionally, compliance with energy efficiency regulations and sustainability goals remains a critical focus area to secure long-term growth in competitive markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component suppliers

- 3.1.2 Technology providers

- 3.1.3 Product integrators

- 3.1.4 Developers & EPC contractors

- 3.1.5 End use

- 3.2 Price trend analysis (USD/Unit)

- 3.2.1 By product

- 3.2.2 By region

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Introduction of energy efficiency standards and enhanced demand for space heating

- 3.4.1.2 Extreme climatic conditions

- 3.4.1.3 Increased standard of living

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High cost of retrofitting in existing buildings

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter's Analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL Analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Environmental factors

- 3.7.6 Legal factors

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size & Forecast, By Product, 2021-2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Thermal

- 5.3 Motoric

Chapter 6 Market Size & Forecast, By Application, 2021-2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size & Forecast, By Region, 2021-2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Spain

- 7.3.4 Austria

- 7.3.5 Belgium

- 7.3.6 Denmark

- 7.3.7 Finland

- 7.3.8 Norway

- 7.3.9 Sweden

- 7.3.10 UK

- 7.3.11 Italy

- 7.3.12 Russia

- 7.3.13 Czech Republic

- 7.3.14 Switzerland

- 7.3.15 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 Australia

- 7.4.4 India

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

Chapter 8 Company Profiles

- 8.1 Belimo

- 8.2 Danfoss

- 8.3 Uponor

- 8.4 Eberle Controls

- 8.5 Emerson Electric

- 8.6 Honeywell International

- 8.7 Hunt Heating

- 8.8 Heatmiser

- 8.9 Intatec

- 8.10 Johnson Controls

- 8.11 Mohlenhoff

- 8.12 Oventrop

- 8.13 Pentair

- 8.14 Polypipe

- 8.15 SMLGHVAC

- 8.16 Sauter

- 8.17 Siemens

- 8.18 Schluter-Systems

- 8.19 Schneider Electric

- 8.20 Warmup