|

市場調查報告書

商品編碼

1797845

AMI 瓦斯表市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測AMI Gas Meter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

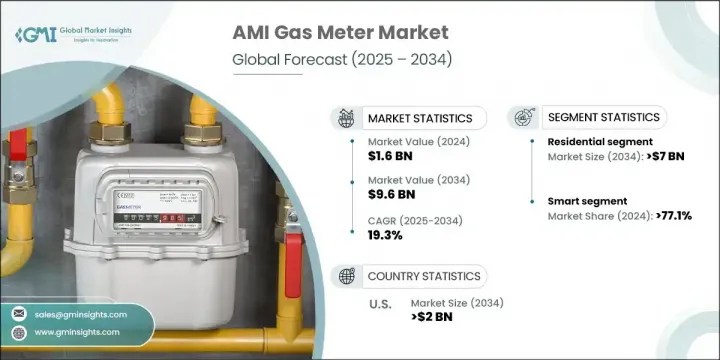

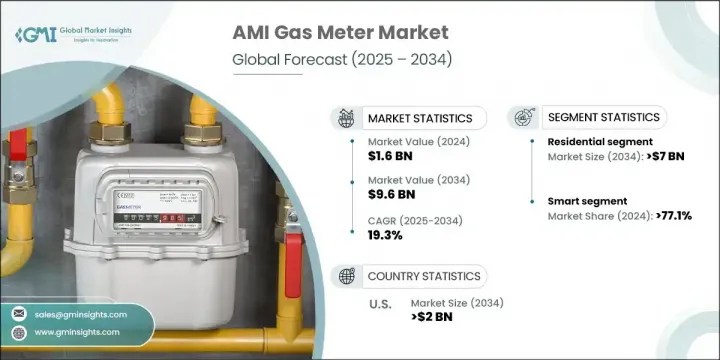

2024年,全球先進計量基礎設施 (AMI) 瓦斯表市場規模達16億美元,預計到2034年將以19.3%的複合年成長率成長,達到96億美元。受新興技術、不斷變化的監管規定以及對智慧能源管理系統日益成長的需求的推動,該市場正在經歷快速轉型。先進計量基礎設施 (AMI) 燃氣表支援即時能耗追蹤、遠端監控和雙向通訊,與傳統計量系統相比,顯著提升了營運能力。

不斷成長的需求與全球在節能減排和轉型為智慧城市基礎設施方面的努力密切相關。各國正在升級其公用事業框架,以減少能源浪費並實現永續發展目標。物聯網技術的融入,透過實現遠端診斷和預測分析,正在徹底改變AMI燃氣表。這種智慧連接提高了系統效率,減少了服務中斷,並提供了更準確的計費。公用事業提供者可以透過改善資產管理並最大限度地減少停機時間,從這些升級中受益。隨著客戶尋求更高的能源使用透明度,並受到能夠促進更高效能耗控制的工具的激勵,AMI燃氣表在工業、商業和住宅環境中的日益普及,這繼續加速了市場發展勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 96億美元 |

| 複合年成長率 | 19.3% |

隨著終端用戶領域需求的成長,預計到 2034 年,住宅市場規模將達到 70 億美元。這一成長主要得益於旨在提高家庭能源效率的現代化基礎設施政策和措施。隨著 AMI 瓦斯表在家庭中的普及率不斷提高,監測用量、檢測異常並及時提供洞察的能力已成為住宅市場成長的關鍵驅動力。按應用領域(包括住宅、商業和公用事業)進行細分,凸顯了 AMI 解決方案如何根據不同的營運需求進行客製化。

智慧電錶市場在2024年佔據了77.1%的市場佔有率,預計到2034年將以19%的複合年成長率成長。這一成長源於政府不斷加大的壓力,要求用能夠提供雙向資料交換、增強客戶控制並符合環境法規的數位智慧電錶取代過時的類比系統。大眾對節能和智慧解決方案的理解不斷加深,也推動了關鍵地區的智慧電錶應用。

預計到2034年,美國AMI瓦斯表市場規模將達到20億美元,這得益於強勁的基礎建設和成熟能源公司的佈局。技術進步、嚴格的能源法規以及對智慧公用事業項目的大量投資,為市場奠定了堅實的基礎。美國持續擴大其在能源創新領域的佈局,石油和天然氣等領域的大型專案進一步推動了智慧燃氣表系統的發展。由於全球15%的清潔能源支出集中在美國,美國在智慧燃氣基礎建設中發揮重要作用。

引領 AMI 瓦斯表市場的領先公司包括施耐德電氣、Aclara Technologies、Landis+Gyr、Itron 和霍尼韋爾國際。 AMI 瓦斯表市場的主要參與者致力於透過技術創新、策略聯盟和全球擴張來擴大其市場佔有率。各公司正大力投資研發,以開發具有增強連接性、資料分析和自我診斷功能的燃氣表。與公用事業供應商和智慧電網專案的合作有助於推動大規模部署。各公司也與電信和物聯網公司建立合作夥伴關係,以增強即時資料通訊能力。在地化策略,包括針對特定區域的產品設計和法規遵從性,進一步支持了新興市場的擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原物料供應情況

- 影響價值鏈的因素

- 中斷

- 監管格局

- 進出口貿易分析

- 各地區價格趨勢分析(美元/單位)

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 新興機會和趨勢

- 數位化和物聯網整合

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 公司市佔率(按地區)

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭性基準描述

- 策略儀表板

- 創新與技術格局

第5章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 公用事業

第6章:市場規模及預測:依類型,2021 - 2034

- 主要趨勢

- 基本的

- 聰明的

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 瑞典

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第8章:公司簡介

- Aclara Technologies

- Ameresco

- Apator

- Azbil Kimmon

- Chint Group

- Core & Main

- Diehl Stiftung & Co. KG

- Holly technology

- Honeywell International

- Itron

- Landis+Gyr

- Neptune Technology Group

- Osaki Electric

- Raychem RPG

- Schneider Electric

- Sensus

- Siemens

- Waltero

- Wasion Group

- Zenner International

The Global AMI Gas Meter Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 19.3% to reach USD 9.6 billion by 2034. The market is undergoing rapid transformation, powered by emerging technologies, evolving regulatory mandates, and the surging need for intelligent energy management systems. Advanced metering infrastructure (AMI) gas meters enable real-time consumption tracking, remote monitoring, and two-way communication, which significantly enhance operational capabilities compared to conventional metering systems.

The expanding demand is strongly linked to global efforts around energy conservation and the transition to smart urban infrastructure. Countries are upgrading their utility frameworks to cut energy waste and meet sustainability goals. The incorporation of IoT technologies is revolutionizing AMI gas meters by enabling remote diagnostics and predictive analytics. This smart connectivity enhances system efficiency, reduces service interruptions, and delivers more accurate billing. Utility providers benefit from these upgrades by improving asset management and minimizing downtime. The growing acceptance of AMI gas meters across industrial, commercial, and residential environments continues to accelerate market momentum, as customers seek greater transparency in their energy usage and are motivated by tools that promote better consumption control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 19.3% |

With demand rising across end-use segments, the residential sector is forecasted to reach USD 7 billion by 2034. This surge is being driven by modern infrastructure policies and initiatives aimed at increasing energy efficiency in households. As AMI gas meter adoption grows in homes, the ability to monitor consumption, detect anomalies, and provide timely insights has become a key driver of residential market growth. Segmentation by application-including residential, commercial, and utility sectors-highlights how AMI solutions are being tailored to meet different operational needs.

The smart meter segment held 77.1% share in 2024 and is expected to grow at a CAGR of 19% through 2034. This growth stems from increased government pressure to replace outdated analog systems with digital smart meters capable of providing two-way data exchange, enhancing customer control, and meeting environmental regulations. Enhanced public understanding around energy savings and smart solutions is also bolstering adoption across key regions.

U.S. AMI Gas Meter Market is projected to reach USD 2 billion by 2034, supported by robust infrastructure development and the presence of well-established energy companies. Technological advancement, strict energy regulations, and heavy investment in smart utility projects contribute to the market's solid foundation. The country continues to expand its footprint in energy innovation, with large-scale projects across sectors like oil and gas reinforcing the push for smart gas metering systems. With 15% of global clean energy spending concentrated in the U.S., the country plays a significant role in the advancement of smart gas infrastructure.

Leading companies steering the AMI Gas Meter Market include Schneider Electric, Aclara Technologies, Landis+Gyr, Itron, and Honeywell International. Major players in the AMI Gas Meter Market are focused on expanding their market presence through technological innovation, strategic alliances, and global expansion. Companies are investing heavily in R&D to develop meters with enhanced connectivity, data analytics, and self-diagnostic capabilities. Collaborations with utility providers and smart grid projects help boost deployment at scale. Firms are also forming partnerships with telecom and IoT companies to strengthen real-time data communication capabilities. Localization strategies, including region-specific product design and regulatory compliance, further support expansion in emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability landscape

- 3.1.2 Factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Import/Export trade analysis

- 3.4 Price trend analysis, by region (USD/Unit)

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial

- 5.4 Utility

Chapter 6 Market Size and Forecast, By Type, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 Basic

- 6.3 Smart

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Sweden

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 Saudi Arabia

- 7.5.3 South Africa

- 7.5.4 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 Aclara Technologies

- 8.2 Ameresco

- 8.3 Apator

- 8.4 Azbil Kimmon

- 8.5 Chint Group

- 8.6 Core & Main

- 8.7 Diehl Stiftung & Co. KG

- 8.8 Holly technology

- 8.9 Honeywell International

- 8.10 Itron

- 8.11 Landis+Gyr

- 8.12 Neptune Technology Group

- 8.13 Osaki Electric

- 8.14 Raychem RPG

- 8.15 Schneider Electric

- 8.16 Sensus

- 8.17 Siemens

- 8.18 Waltero

- 8.19 Wasion Group

- 8.20 Zenner International