|

市場調查報告書

商品編碼

1797842

電烤架市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Grill Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

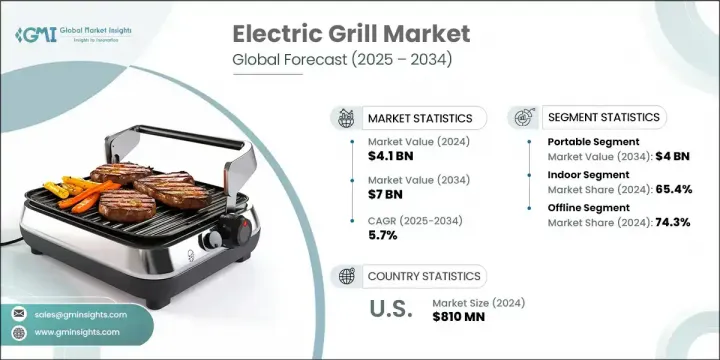

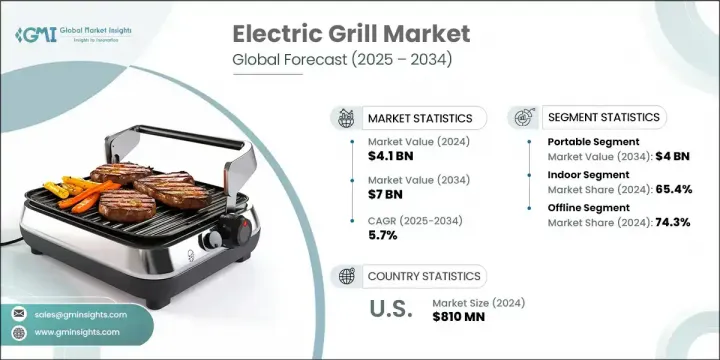

2024年,全球電烤架市場規模達41億美元,預計2034年將以5.7%的複合年成長率成長,達到70億美元。市場成長的主要驅動力包括:對便捷烹飪解決方案的需求不斷成長、可支配收入的提高、家電技術的融合以及人們健康意識的增強。消費者擴大從傳統的燒烤方式轉向更易於操作、準備時間更短、且提供可調節溫度設置,適合室內外烹飪的電烤架。

對使用者友善電器的需求正在不斷成長,尤其是在城市家庭中,時間效率和清潔便利至關重要。此外,隨著飲食習慣的改變,人們越來越傾向於使用更少油脂的更健康的烹飪方式,這也推動了家用電器的普及。據業內人士透露,近年來,一些地區對電烤架的需求實現了兩位數成長,這反映了人們生活方式的轉變以及向現代廚房設備的轉變。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 41億美元 |

| 預測值 | 70億美元 |

| 複合年成長率 | 5.7% |

技術進步已成為提升電烤架吸引力的關鍵因素。定時器、自動關機功能和無線連接等功能不僅提高了安全性,還簡化了烹飪流程。這些創新滿足了消費者對家用電器速度、效率和維護成本的期望。智慧技術的整合確保烤架能夠滿足現代烹飪需求,同時提升使用者體驗。緊湊型多功能烤架日益普及,能夠滿足各種烹飪風格,也推動了其在全球的普及。

按產品類型分類,電烤架市場分為攜帶式和嵌入式。攜帶式產品在2024年佔據市場主導地位,營收達23億美元,預計2034年將達到40億美元。隨著消費者擴大參與露營和野餐等戶外休閒活動,便攜性正成為一個重要的購買因素。這些設備重量輕、結構緊湊、易於運輸,比傳統的木炭或燃氣烤架具有更大的靈活性。攜帶式烤架也吸引了那些尋求節省空間、適合小型住宅或城市公寓的用戶。

從應用角度來看,電烤架市場分為室內和室外兩大類。 2024年,室內烤架佔據了約65.4%的市場佔有率,預計2025年至2034年期間的複合年成長率將達到5.9%。在戶外空間有限的大都會地區,室內烤架的市場需求顯著成長。無論天氣如何,室內烤架都能滿足全年烹飪的需求,而且易於清潔和存放,這對於居住在緊湊型住宅中的消費者來說至關重要。室內烤架能夠提供更健康、脂肪含量更低的膳食,進一步提升了消費者的偏好。

美國是重要的區域市場,2024 年市場價值達 8.1 億美元,預計預測期內複合年成長率為 5.5%。城市人口的成長,加上公寓居民比例的提高,推動了室內電烤架的強勁需求。人們越來越意識到電烤架的營養價值,例如減少食物中的脂肪滯留,也促進了市場擴張。此外,美國消費者對符合便利生活方式的創新烹飪設備表現出較高的接受度。

全球電烤爐市場的領導者正專注於創新、使用者友善設計,並透過多元化的零售管道擴大產品供應。產品開發工作強調節能、多功能性和便攜性,以滿足多樣化的消費者需求。製造商還採用先進的烹飪技術,例如無菸操作、精確溫控和耐用的不沾表面,以提高性能並簡化維護。競爭格局的特點是持續投入研發,推出融合智慧功能和永續設計元素的機型。這些舉措強化了品牌定位,並有助於在全球日益成長的電烤爐需求中佔據更大佔有率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 方便烹飪

- 技術進步

- 更加重視健康和保健

- 產業陷阱與挑戰

- 傳統燒烤方法的競爭

- 初始成本高

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS 編碼-851660)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 便攜的

- 內建

第6章:市場估計與預測:按電壓,2021 - 2034 年

- 主要趨勢

- 高達150伏

- 151-250伏

- 251-300伏

- 超過300伏

第7章:市場估計與預測:依價格區間,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 室內的

- 戶外的

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 離線

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第12章:公司簡介

- Black+Decker

- Breville

- Char-Broil

- Cuisinart

- Delonghi

- George Foreman

- Gotham Steel

- Hamilton Beach

- Kenmore

- Krups

- Philips

- Tefal (a brand of Groupe SEB)

- T-fal

- Weber

- Wolf Gourmet

The Global Electric Grill Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 7 billion by 2034. Growth in the market is largely driven by increasing demand for convenient cooking solutions, rising disposable incomes, technological integration in appliances, and greater awareness of health and wellness. Consumers are increasingly shifting from traditional grilling methods to electric alternatives that are easier to operate, require less preparation time, and offer adjustable temperature settings suitable for both indoor and outdoor cooking.

Demand for user-friendly appliances is expanding, especially in urban households where time efficiency and ease of cleaning are essential. In addition, rising adoption is supported by the growing preference for healthier cooking methods that require minimal oil or fat, aligning with changing dietary habits. According to industry sources, demand for electric grills in several regions has recorded double-digit growth in recent years, reflecting evolving lifestyle choices and the shift toward modern kitchen equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $7 Billion |

| CAGR | 5.7% |

Technological advancements have become a key factor enhancing the appeal of electric grills. Features such as timers, automatic shut-off functions, and wireless connectivity not only improve safety but also streamline the cooking process. These innovations meet the expectations of consumers who seek speed, efficiency, and minimal maintenance in household appliances. Smart technology integration ensures that grills are capable of meeting modern culinary needs while enhancing user experience. The growing popularity of compact and versatile units that can cater to a variety of cooking styles is also fueling adoption worldwide.

By product type, the electric grill market is divided into portable and built-in models. The portable category dominated the market in 2024 with revenues of USD 2.3 billion and is projected to reach USD 4 billion by 2034. Portability is becoming a significant purchase factor as consumers increasingly engage in outdoor and leisure activities such as camping and picnics. These units are lightweight, compact, and easy to transport, offering greater flexibility than traditional grills that rely on charcoal or gas. Portables also appeal to users seeking space-saving solutions for smaller homes or urban apartments.

In terms of application, the market is segmented into indoor and outdoor electric grills. Indoor grills held approximately 65.4% of the total market share in 2024 and are forecast to grow at a CAGR of 5.9% between 2025 and 2034. Indoor models have gained notable traction in metropolitan areas where outdoor space is limited. They allow year-round cooking regardless of weather conditions and are designed for easy cleaning and storage, which is a key factor for consumers living in compact residences. Their ability to deliver healthier meals with reduced fat content further boosts consumer preference.

The United States represents a major regional market, valued at USD 810 million in 2024 and expected to grow at a CAGR of 5.5% during the forecast period. The rising population in urban areas, coupled with a high proportion of apartment dwellers, supports strong demand for indoor electric grills. Increasing awareness of the nutritional benefits associated with electric grilling, such as reduced fat retention in food, also contributes to market expansion. Moreover, U.S. consumers show a high acceptance of innovative cooking appliances that align with convenience-focused lifestyles.

Leading companies in the global electric grill market are focusing on innovation, user-friendly designs, and expanding product availability through diverse retail channels. Product development efforts emphasize energy efficiency, multifunctionality, and enhanced portability to cater to varied consumer needs. Manufacturers are also adopting advanced cooking technologies such as smokeless operation, precise temperature control, and durable non-stick surfaces to improve performance and ease of maintenance. The competitive landscape is characterized by continuous investment in research and development to launch models that combine smart features with sustainable design elements. These initiatives strengthen brand positioning and help capture a larger share of the growing global demand for electric grills.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Voltage trends

- 2.2.4 Pricing trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.2.7 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Convenient cooking

- 3.2.1.2 Technological advancements

- 3.2.1.3 Heightened focus on health and wellness

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Competition of traditional grilling methods

- 3.2.2.2 High initial cost

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-851660)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Portable

- 5.3 Built-in

Chapter 6 Market Estimates & Forecast, By Voltage, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Up to 150 volts

- 6.3 151 -250 volts

- 6.4 251 -300 volts

- 6.5 More than 300 volts

Chapter 7 Market Estimates & Forecast, By Price Range, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Indoor

- 8.3 Outdoor

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Black+Decker

- 12.2 Breville

- 12.3 Char-Broil

- 12.4 Cuisinart

- 12.5 Delonghi

- 12.6 George Foreman

- 12.7 Gotham Steel

- 12.8 Hamilton Beach

- 12.9 Kenmore

- 12.10 Krups

- 12.11 Philips

- 12.12 Tefal (a brand of Groupe SEB)

- 12.13 T-fal

- 12.14 Weber

- 12.15 Wolf Gourmet