|

市場調查報告書

商品編碼

1797840

美國 SLI 電池市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測America SLI Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

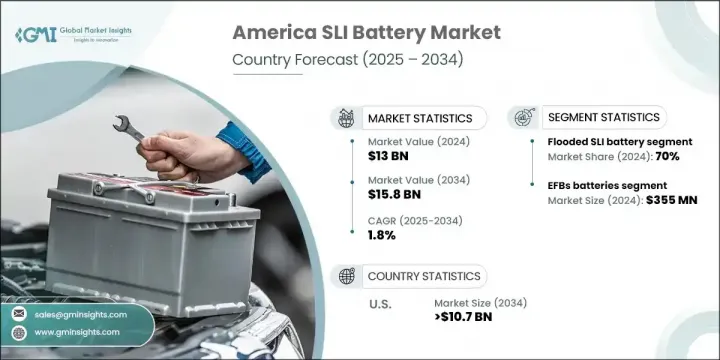

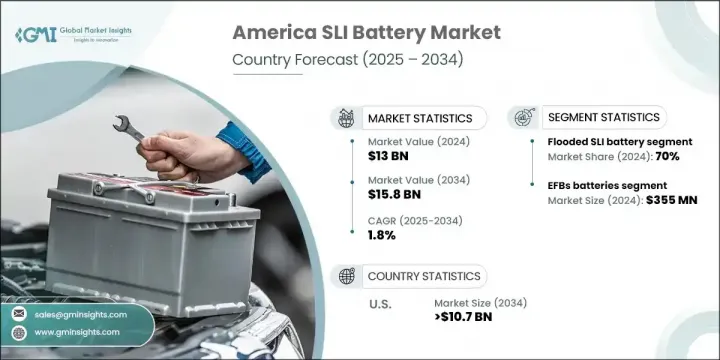

2024年,美國SLI電池市場規模達130億美元,預計到2034年將以1.8%的複合年成長率成長,達到158億美元。曳引機和收割機等農業機械中SLI電池的使用日益增多,這推動了市場需求,尤其是在多個國家農業產業擴張的背景下。墨西哥和拉丁美洲其他地區的城市化和中產階級的壯大也推動了汽車保有量的上升,這反過來又刺激了對可靠電池解決方案的需求。北美各地的環境法規鼓勵電池回收,這有助於SLI電池產業更永續的製造和處置方式。雖然這些電池主要支援內燃機汽車,但它們在混合動力汽車中作為輔助功能的作用正變得越來越突出。

美國和巴西混合動力車銷量的不斷成長,以及計程車、貨車和公車等商用車隊的需求,進一步推動了市場的發展。這些車輛依靠SLI電池實現點火、照明和電力支援系統等基本功能,即使在混合動力和啟動停止引擎技術中也是如此。由於車隊營運商致力於最大限度地減少停機時間和維護成本,對可靠、長壽命電池的需求變得更加重要。此外,隨著美洲各國政府推廣更乾淨的交通解決方案和電氣化,人們對混合動力車隊的興趣日益濃厚,這些車隊繼續使用SLI電池作為輔助功能。這種轉變不僅加速了人口稠密的城市中心的需求,也加速了物流網路和公共交通系統快速發展的郊區和農村地區的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 130億美元 |

| 預測值 | 158億美元 |

| 複合年成長率 | 1.8% |

2024年,富液式SLI電池市場佔了70%的市場佔有率,預計到2034年將以1.4%的複合年成長率成長。由於成本低廉且設計簡單,富液式電池在價格敏感的拉丁美洲市場仍然很受歡迎。由於價格實惠且易於生產,它們成為日常車輛和農業應用的首選,尤其是在汽車電氣化仍在發展的國家。

2024年,美國SLI電池市場產值達91億美元,佔70.2%的市佔率。受輕型卡車和SUV需求旺盛的推動,美國可望持續成長。這些車型需要更高儲備容量和更高冷啟動電流的電池。政府推出的支持性政策,包括透過基礎設施立法提供的補貼和激勵措施,正在促進國內電池製造業的發展。儘管電動車電池生產備受關注,但鉛酸電池生產商也受益於對供應鏈和勞動力發展的投資,從而增強了美國SLI電池市場的整體韌性和競爭力。

塑造美洲 SLI 電池格局的關鍵參與者包括 East Penn Manufacturing、Clarios、Exide Technologies、ACDelco 和 EnerSys。美洲 SLI 電池市場的領先公司專注於創新、成本最佳化和策略合作夥伴關係,以維持並提升其市場地位。他們投資研發,以提高電池性能、耐用性和環境永續性。企業擴大採用回收計劃和環保生產方法,以遵守嚴格的環境法規。與汽車製造商和農業設備供應商的合作有助於擴大應用範圍。企業也尋求地理擴張,瞄準汽車保有量不斷成長的新興市場和農業產業。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 供應鏈彈性和風險評估

- 原物料採購挑戰

- 製造能力分析

- 物流及配送網路

- 地緣政治風險因素

- 進出口貿易分析

- 主要進口國

- 主要出口國

- 價格趨勢分析,(美元/單位)

- 依技術

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 淹沒

- 電子飛行包

- 閥控鉛酸蓄電池

- 年度股東大會

- 凝膠

第6章:市場規模與預測:依國家/地區,2021 - 2032 年

- 主要趨勢

- 美國

- 加拿大

- 阿根廷

- 巴西

- 墨西哥

- 智利

- 哥倫比亞

- 厄瓜多

- 巴拉圭

- 秘魯

- 烏拉圭

- 巴拿馬

- 多明尼加共和國

- 薩爾瓦多

第7章:公司簡介

- ACDelco

- Acumuladores Moura

- Banner

- Clarios

- Continental Battery Systems

- Crown Battery

- Discover Battery

- Dyno Battery

- East Penn Manufacturing

- EnerSys

- ETNA

- Exide Industries

- Exide Technologies

- FIAMM Energy Technology

- GS Yuasa

- Hankook & Company

- Interstate Batteries

- Leoch International

- MEBCO Batteries

- MOLL Batterien

America SLI Battery Market was valued at USD 13 billion in 2024 and is estimated to grow at a CAGR of 1.8% to reach USD 15.8 billion by 2034. The rising use of SLI batteries in agricultural machinery such as tractors and harvesters is driving demand, especially with the expansion of agro-industries across several countries. Urbanization and a growing middle class in regions like Mexico and other parts of Latin America are also fueling higher vehicle ownership, which in turn supports the need for dependable battery solutions. Environmental regulations throughout North America encourage battery recycling, contributing to more sustainable manufacturing and disposal practices within the SLI battery sector. While these batteries primarily support internal combustion engine vehicles, their role in hybrid vehicles for secondary functions is becoming more prominent.

The increasing sales of hybrid vehicles in the U.S. and Brazil, along with the demand from commercial vehicle fleets such as taxis, delivery vans, and buses, further boost the market. These vehicles rely on SLI batteries for essential functions like ignition, lighting, and power support systems, even in hybrid and start-stop engine technologies. As fleet operators aim to minimize downtime and maintenance costs, the need for dependable, long-life batteries becomes more critical. Additionally, with governments across the Americas promoting cleaner transport solutions and electrification, there's a growing interest in hybrid fleets, which continue to utilize SLI batteries for auxiliary functions. This shift is accelerating demand not only in densely populated urban centers but also in expanding suburban and rural areas where logistics networks and public transport systems are evolving rapidly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13 Billion |

| Forecast Value | $15.8 Billion |

| CAGR | 1.8% |

In 2024, the flooded SLI battery segment held a 70% share and is projected to grow at a CAGR of 1.4% through 2034. Due to their low cost and simple design, flooded batteries remain popular in price-sensitive Latin American markets. Their affordability and ease of production make them a preferred choice for everyday vehicles and agricultural applications, especially in countries where vehicle electrification is still developing.

U.S. America SLI Battery Market generated USD 9.1 billion in 2024, capturing a 70.2% share in 2024. The country is poised for continued growth, driven by the high demand for light-duty trucks and SUVs that require batteries with greater reserve capacity and cold-cranking amps. Supportive government policies, including grants and incentives through infrastructure legislation, bolster domestic battery manufacturing. Although electric vehicle battery production garners significant attention, lead-acid battery producers also benefit from investments in supply chains and workforce development, strengthening the overall resilience and competitiveness of the U.S. SLI battery market.

Key players shaping the Americas SLI battery landscape include East Penn Manufacturing, Clarios, Exide Technologies, ACDelco, and EnerSys. Leading companies in the America SLI Battery Market are focused on innovation, cost optimization, and strategic partnerships to maintain and grow their market position. They invest in R&D to enhance battery performance, durability, and environmental sustainability. Firms are increasingly adopting recycling initiatives and eco-friendly production methods to comply with stringent environmental regulations. Collaborations with automotive manufacturers and agricultural equipment providers help expand application reach. Companies also pursue geographic expansion, targeting emerging markets with growing vehicle ownership and agro-industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Technology trends

- 2.1.3 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Supply chain resilience and risk assessment

- 3.3.1 Raw material sourcing challenges

- 3.3.2 Manufacturing capacity analysis

- 3.3.3 Logistics and distribution networks

- 3.3.4 Geopolitical risk factors

- 3.4 Import export trade analysis

- 3.4.1 Key importing countries

- 3.4.2 Key exporting countries

- 3.5 Price trend analysis, (USD/Unit)

- 3.5.1 By technology

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.8.1 Bargaining power of suppliers

- 3.8.2 Bargaining power of buyers

- 3.8.3 Threat of new entrants

- 3.8.4 Threat of substitutes

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (Million Units & USD Million)

- 5.1 Key trends

- 5.2 Flooded

- 5.3 EFB

- 5.4 VRLA

- 5.4.1 AGM

- 5.4.2 GEL

Chapter 6 Market Size and Forecast, By Country, 2021 - 2032 (Million Units & USD Million)

- 6.1 Key trends

- 6.2 U.S.

- 6.3 Canada

- 6.4 Argentina

- 6.5 Brazil

- 6.6 Mexico

- 6.7 Chile

- 6.8 Colombia

- 6.9 Ecuador

- 6.10 Paraguay

- 6.11 Peru

- 6.12 Uruguay

- 6.13 Panama

- 6.14 Dominican Republic

- 6.15 El Salvador

Chapter 7 Company Profiles

- 7.1 ACDelco

- 7.2 Acumuladores Moura

- 7.3 Banner

- 7.4 Clarios

- 7.5 Continental Battery Systems

- 7.6 Crown Battery

- 7.7 Discover Battery

- 7.8 Dyno Battery

- 7.9 East Penn Manufacturing

- 7.10 EnerSys

- 7.11 ETNA

- 7.12 Exide Industries

- 7.13 Exide Technologies

- 7.14 FIAMM Energy Technology

- 7.15 GS Yuasa

- 7.16 Hankook & Company

- 7.17 Interstate Batteries

- 7.18 Leoch International

- 7.19 MEBCO Batteries

- 7.20 MOLL Batterien