|

市場調查報告書

商品編碼

1797838

門診手術中心市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ambulatory Surgical Centers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球門診手術中心市場規模達996億美元,預計到2034年將以4.7%的複合年成長率成長,達到1,593億美元。強勁成長可歸因於多個關鍵因素,包括在門診手術中心(ASC)進行的手術數量不斷增加、癌症、糖尿病和肥胖症等慢性病發病率不斷上升,以及支持性報銷政策。 ASC作為門診醫療機構,為患者提供當日手術的便利,使其成為熱門選擇。隨著對經濟高效、便捷易得的醫療解決方案的需求日益成長,這些中心正成為醫生們頗具吸引力的選擇,因為它們不僅能提供額外收入來源,還能更好地掌控醫療服務。

癌症、糖尿病和肥胖症等慢性疾病的日益流行,大大促進了門診手術中心 (ASC) 市場的成長。這些疾病需要定期進行外科手術干預,從而產生了對門診手術的穩定需求。此外,包括完善的報銷結構和門診護理激勵措施在內的優惠政府政策也正在推動該行業的成長。鼓勵經濟高效的醫療服務的政策正在進一步加速從傳統醫院轉向更經濟實惠的門診手術中心 (ASC) 的轉變。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 996億美元 |

| 預測值 | 1593億美元 |

| 複合年成長率 | 4.7% |

醫生主導的醫療服務領域在2024年佔據了58.8%的市場佔有率,由於其賦予醫療專業人士的自主權,該領域仍將佔據主導地位。醫生能夠掌控其診療實踐中的關鍵環節,例如手術安排、設備選擇和設施管理,從而受益匪淺。這種靈活性不僅提升了醫療品質,也為醫生提供了額外的收入來源,使其成為眾多醫療從業者眼中極具吸引力的選擇。

此外,眼科領域佔最大佔有率,達23.7%,這得益於眼科手術需求的不斷成長,尤其是白內障摘除手術。人們轉向更經濟實惠、更有效率的門診治療,進一步推動了這一成長,許多患者選擇透過眼科中心進行常見的眼科手術,例如LASIK雷射視力矯正手術和視網膜手術。

2024年,美國門診手術中心市場規模達400億美元,預計到2034年將以3.5%的複合年成長率成長。推動這一成長的關鍵因素是越來越多的手術轉向門診,與傳統的住院手術相比,門診手術為患者提供了更具成本效益和便利性的替代方案。這種轉變不僅提高了醫療效率,也滿足了人們對個人化、及時照護日益成長的需求。

全球門診手術中心市場的主要參與者包括 AMSURG、ASD MANAGEMENT、Community Health Systems、Cura Day Surgery、Endeavor Health、HCA Healthcare、Mednation、Nova Medical Centers、Pediatrix、Physicians Endoscopy、Pinnacle III、Proliance SURGEONS、RamPMs Sante、Regent Surine、RGCliENTHSUg、RGC PARTNERS、Surgical Management Professionals、Tenet Health 和 Trias MD。為了鞏固市場地位,門診手術中心領域的公司專注於擴展網路並提高營運效率。其策略包括與醫療服務提供者建立合作夥伴關係、投資先進技術以改善患者護理,以及透過整合專門的外科手術程序來增強服務內容。此外,各公司也致力於利用基於價值的醫療模式,這種模式強調經濟高效的治療,同時改善患者的治療效果。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率不斷上升

- 外科手術數量增加

- 優惠的報銷和政府政策

- ASC 的感染風險低於醫院

- 產業陷阱與挑戰

- 醫療器材成本高昂

- 醫病比例低

- 市場機會

- 從住院轉為門診

- 人工智慧和機器人技術在 ASC 手術中的整合

- 成長動力

- 成長潛力分析

- 監管格局

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- ASC 的歷史時間表

- 未來市場趨勢

- 消費者行為分析

- 報銷場景

- 波特的分析

- PESTEL分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 美國

- 歐洲

- 世界其他地區 (RoW)

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按所有權分類,2021 - 2034 年

- 主要趨勢

- 僅限醫生

- 僅限醫院

- 限企業

- 醫生和醫院

- 醫生和企業

- 其他所有權類型

第6章:市場估計與預測:依手術類型,2021 - 2034 年

- 主要趨勢

- 眼科

- 內視鏡檢查

- 骨科

- 神經病學

- 疼痛管理

- 整型手術

- 足病學

- 耳鼻喉科

- 婦產科

- 牙科

- 其他手術類型

第7章:市場估計與預測:按專業類型,2021 - 2034 年

- 主要趨勢

- 單一專業

- 多專業

第8章:市場估計與預測:按服務,2021 - 2034 年

- 主要趨勢

- 治療

- 診斷

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AMSURG

- ASD MANAGEMENT

- Community Health Systems

- Cura Day Surgery

- Endeavor Health

- HCA Healthcare

- Mednation

- Nova Medical Centers

- Pediatrix

- Physicians endoscopy

- Pinnacle III

- Proliance SURGEONS

- Ramsay Sante

- Regent Surgical

- SCA HEALTH

- SURGCENTER DEVELOPMENT

- SURGERY PARTNERS

- Surgical Management Professionals

- Tenet Health

- Trias MD

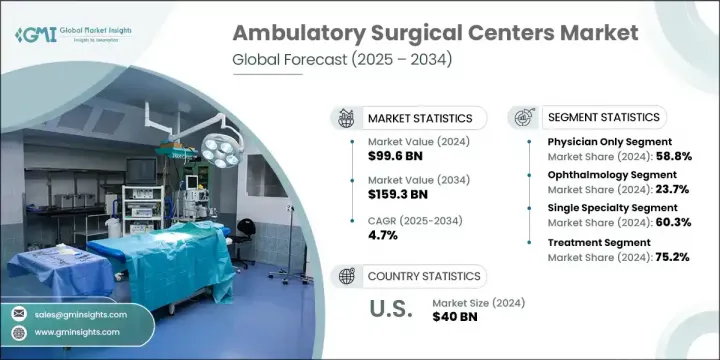

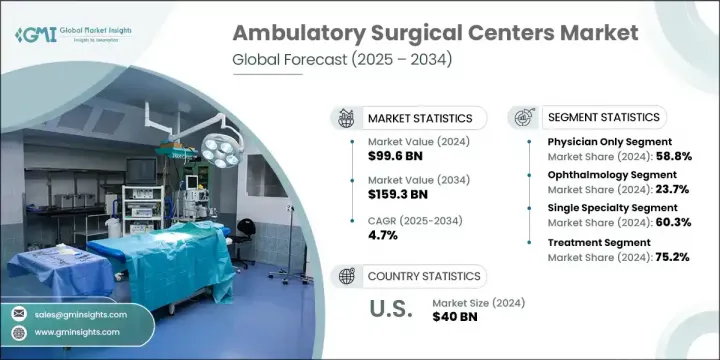

The Global Ambulatory Surgical Centers Market was valued at USD 99.6 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 159.3 billion by 2034. This robust growth can be attributed to several key factors, including the increasing number of surgical procedures conducted in ASCs, the rising prevalence of chronic diseases such as cancer, diabetes, and obesity, and supportive reimbursement policies. ASCs are outpatient healthcare facilities that offer patients the convenience of same-day surgeries, making them a popular choice. As the demand for cost-effective, accessible, and convenient healthcare solutions increases, these centers are becoming an attractive option for physicians, as they not only provide a source of additional income but also enable better control over care delivery.

The increasing prevalence of chronic diseases, such as cancer, diabetes, and obesity, is significantly contributing to the growth of the ambulatory surgical center (ASC) market. These conditions require regular surgical interventions, creating a steady demand for outpatient procedures. Alongside this, favorable government policies, including improved reimbursement structures and incentives for outpatient care, are bolstering the sector's growth. Policies that encourage cost-effective and efficient healthcare services are further accelerating the shift from traditional hospital settings to more affordable ASC alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $99.6 Billion |

| Forecast Value | $159.3 Billion |

| CAGR | 4.7% |

The physician-led segment, which captured 58.8% of the market in 2024, remains a dominant force due to the autonomy it offers healthcare professionals. Physicians benefit from the ability to control essential aspects of their practice, such as surgical scheduling, equipment selection, and facility management. This level of flexibility not only enhances the quality of care but also provides physicians with an additional income stream, making it a highly attractive option for many in the medical field.

Furthermore, the ophthalmology segment holds the largest share of 23.7%, driven by the growing demand for eye surgeries, particularly cataract removal. The shift towards more affordable and efficient outpatient treatments is further fueling this growth, with many patients opting for ASCs to undergo common eye procedures like LASIK and retinal surgeries.

United States Ambulatory Surgical Centers Market was valued at USD 40 billion in 2024 and is expected to grow at a CAGR of 3.5% through 2034. The key driver behind this growth is the increasing trend of surgeries moving to outpatient settings, which provides patients with more cost-effective and convenient alternatives compared to traditional hospital-based surgeries. This transition not only supports healthcare efficiency but also aligns with the growing demand for personalized, timely care.

Key players in the Global Ambulatory Surgical Centers Market include AMSURG, ASD MANAGEMENT, Community Health Systems, Cura Day Surgery, Endeavor Health, HCA Healthcare, Mednation, Nova Medical Centers, Pediatrix, Physicians Endoscopy, Pinnacle III, Proliance SURGEONS, Ramsay Sante, Regent Surgical, SCA HEALTH, SURGCENTER DEVELOPMENT, SURGERY PARTNERS, Surgical Management Professionals, Tenet Health, and Trias MD. To strengthen their position in the market, companies in the ambulatory surgical centers sector focus on expanding their networks and improving operational efficiency. Strategies include forging partnerships with healthcare providers, investing in advanced technologies to improve patient care, and enhancing their service offerings by integrating specialized surgical procedures. Additionally, firms aim to leverage value-based care models, which emphasize cost-effective treatment while improving patient outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Ownership trends

- 2.2.3 Surgery type trends

- 2.2.4 Specialty type trends

- 2.2.5 Service trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Rise in number of surgical procedures

- 3.2.1.3 Favorable reimbursements and government policies

- 3.2.1.4 Lower risk of infections in ASCs than hospitals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of medical devices

- 3.2.2.2 Low physician-to-patient ratio

- 3.2.3 Market opportunities

- 3.2.3.1 Shift from inpatient to outpatient settings

- 3.2.3.2 Integration of AI and robotics in ASC surgeries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Historical timeline of ASCs

- 3.7 Future market trends

- 3.8 Consumer behaviour analysis

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.2.1 U.S.

- 4.2.3 Europe

- 4.2.4 Rest of the world (RoW)

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Ownership, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Physician only

- 5.3 Hospital only

- 5.4 Corporate only

- 5.5 Physician and hospital

- 5.6 Physician and corporate

- 5.7 Other ownership types

Chapter 6 Market Estimates and Forecast, By Surgery Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ophthalmology

- 6.3 Endoscopy

- 6.4 Orthopedic

- 6.5 Neurology

- 6.6 Pain management

- 6.7 Plastic Surgery

- 6.8 Podiatry

- 6.9 Otolaryngology

- 6.10 Obstetrics / Gynecology

- 6.11 Dental

- 6.12 Others surgery types

Chapter 7 Market Estimates and Forecast, By Specialty Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Single specialty

- 7.3 Multi specialty

Chapter 8 Market Estimates and Forecast, By Service, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Treatment

- 8.3 Diagnosis

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AMSURG

- 10.2 ASD MANAGEMENT

- 10.3 Community Health Systems

- 10.4 Cura Day Surgery

- 10.5 Endeavor Health

- 10.6 HCA Healthcare

- 10.7 Mednation

- 10.8 Nova Medical Centers

- 10.9 Pediatrix

- 10.10 Physicians endoscopy

- 10.11 Pinnacle III

- 10.12 Proliance SURGEONS

- 10.13 Ramsay Sante

- 10.14 Regent Surgical

- 10.15 SCA HEALTH

- 10.16 SURGCENTER DEVELOPMENT

- 10.17 SURGERY PARTNERS

- 10.18 Surgical Management Professionals

- 10.19 Tenet Health

- 10.20 Trias MD