|

市場調查報告書

商品編碼

1797833

雷射印表機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Laser Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

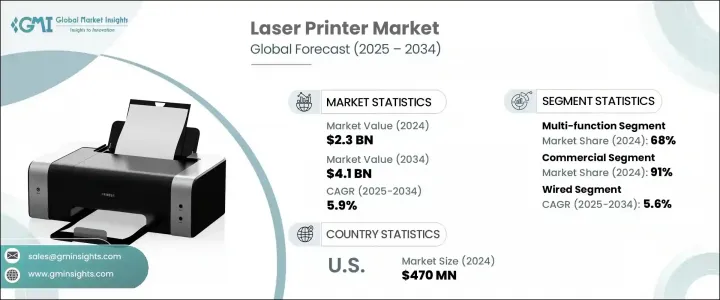

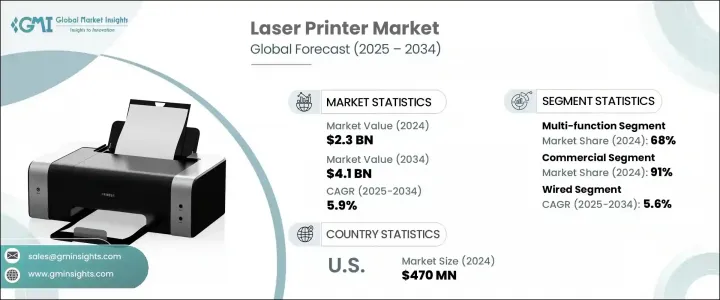

2024年,全球雷射印表機市場規模達23億美元,預計2034年將以5.9%的複合年成長率成長,達到41億美元。隨著企業和機構持續在數位轉型與高品質、可靠列印解決方案的需求之間取得平衡,該市場正穩步成長。儘管許多行業正在迅速採用數位化工作流程,但教育、醫療保健、法律和金融等行業仍然嚴重依賴紙本文件。對耐用、快速、高效能列印設備的持續需求推動了市場需求。各組織機構紛紛選擇能夠提供卓越輸出和效率的先進雷射印表機。

此外,遠距辦公和混合辦公環境的廣泛應用加速了對無線和雲端印表機的需求。這種轉變正在重新定義工作場所生態系統,使團隊能夠從多個地點列印和管理文件。包括學校、政府機構和企業在內的機構買家擴大投資於滿足其高列印量需求的雷射印表機。雲端平台和行動連接與新型雷射印表機的無縫整合正在推動產業發展,使列印更加靈活,更加以用戶為中心。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 41億美元 |

| 複合年成長率 | 5.9% |

多功能雷射印表機 (MFP) 市場在 2024 年佔據了 68% 的最大市場佔有率,預計到 2034 年將以 6.1% 的複合年成長率成長。這些設備能夠將列印、影印、掃描和傳真功能集於一身,從而降低管理成本並簡化工作流程,因此在該領域佔據主導地位。 MFP 的高效性使其成為尋求降低營運支出和簡化設備管理的組織的理想選擇。由於耗材使用量和能耗的減少,以及集中維護的優勢,大型企業和小型企業對 MFP 的需求都在增加。

商業領域在2024年佔據了91%的市場佔有率,預計到2034年將以6%的複合年成長率成長。政府機構、企業辦公室、學校和醫療保健機構等商業用戶需要能夠每天處理大量列印的高速、高品質印表機。事實證明,多功能雷射印表機對於滿足這些期望至關重要,它能夠提供專業級的輸出,並將停機時間降至最低。其在持續使用下的耐用性和可靠性使其成為商業環境中的首選,因為在商業環境中,不間斷的性能至關重要。

美國雷射印表機市場佔了79%的市場佔有率,2024年市場規模達4.7億美元。美國市場的成長得益於列印技術的持續創新,例如更高的解析度、更快的處理速度、與物聯網系統的整合以及增強的無線功能。這些進步不僅提高了營運效率,也降低了長期成本。此外,美國機構正在投資升級其列印基礎設施,以配合持續的數位轉型目標,尤其是在醫療保健和教育領域。

全球雷射印表機市場的知名企業包括愛普生、羅蘭、柯尼卡美能達、奔圖國際、惠普開發、戴爾、佐藤美國、利盟國際、兄弟工業、全錄、東芝、衝電氣工業、佳能、京瓷和理光。為了保持並擴大市場佔有率,雷射印表機行業的公司正優先考慮創新和技術升級。他們專注於開發多功能、相容雲端技術且節能的機型,以滿足不斷變化的商業和消費者需求。研發方面的策略性投資仍然至關重要,這有助於推出輸出速度更快、影像品質更高、環境影響更小的產品。領先的製造商也在與軟體開發商結盟,以增強雲端整合和行動可訪問性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 單一功能

- 多功能的

第6章:市場估計與預測:依輸出類型,2021 - 2034

- 主要趨勢

- 彩色雷射

- 黑白雷射

第7章:市場估計與預測:依連結性,2021 - 2034 年

- 主要趨勢

- 有線

- 無線的

第8章:市場估計與預測:按列印速度,2021 - 2034 年

- 主要趨勢

- 鋼彈 30ppm

- 30至50 ppm

- 高於 50 ppm

第9章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第10章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 個人

- 商業的

- 公司的

- 教育機構

- 媒體和出版機構

- 印刷中心和文具

- 其他(醫療保健、零售等)

- 政府機構

- 工業的

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 專業零售店

- 其他(獨立零售商等)

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- Brother Industries

- Canon

- Dell

- Epson

- HP Development

- Konica Minolta

- Kyocera

- Lexmark International

- Oki Electric Industry

- Pantum International

- Ricoh

- Roland DG

- SATO America

- Toshiba

- Xerox

The Global Laser Printer Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 4.1 billion by 2034. The market is witnessing steady growth as businesses and institutions continue to balance digital transformation with the need for high-quality, reliable print solutions. While many sectors are rapidly adopting digital workflows, industries such as education, healthcare, legal, and finance still heavily rely on physical documentation. This persistent need for durable, fast, and high-performance printing devices is propelling demand. Organizations are opting for advanced laser printers that deliver superior output and efficiency.

Additionally, widespread adoption of remote and hybrid work environments has accelerated the demand for wireless and cloud-enabled printers. This shift is redefining the workplace ecosystem, enabling teams to print and manage documents from multiple locations. Institutional buyers, including schools, government agencies, and corporations, are increasingly investing in laser printers that meet their high-volume requirements. The seamless integration of cloud platforms and mobile connectivity into newer laser printer models is pushing the industry forward, making printing more flexible and user-centric.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.9% |

The multifunction laser printers (MFPs) segment held the largest market share of 68% in 2024 and is forecast to grow at a CAGR of 6.1% through 2034. These devices are dominating the segment due to their ability to combine printing, copying, scanning, and faxing in one unit, allowing for reduced overhead costs and streamlined workflows. The efficiency offered by MFPs makes them ideal for organizations seeking to lower operational expenditures and simplify device management. The demand for MFPs is rising across both large enterprises and small businesses, thanks to the reduction in consumable usage and energy consumption, along with the benefits of consolidated maintenance.

The commercial segment held a 91% share in 2024 and is anticipated to grow at a CAGR of 6% through 2034. Commercial users such as government bodies, corporate offices, schools, and healthcare providers require high-speed, high-quality printers that can manage large volumes daily. Multifunction laser printers have proven to be essential in meeting these expectations, offering professional-grade output along with minimal downtime. Their durability and reliability under constant use make them the preferred choice in commercial settings, where uninterrupted performance is critical.

United States Laser Printer Market accounted for a 79% share and reached USD 470 million in 2024. The market's growth in the U.S. is being driven by continuous innovations in printing technology, such as enhanced resolution, quicker processing speeds, integration with IoT systems, and increased wireless functionality. These advancements are enabling more efficient operations while reducing long-term expenses. Additionally, U.S. institutions are investing in upgrading their print infrastructure to align with ongoing digital transformation goals, particularly within the healthcare and education sectors.

Prominent players in the Global Laser Printer Market include Epson, Roland DG, Konica Minolta, Pantum International, HP Development, Dell, SATO America, Lexmark International, Brother Industries, Xerox, Toshiba, Oki Electric Industry, Canon, Kyocera, and Ricoh. To maintain and expand their market presence, companies in the laser printer sector are prioritizing innovation and technology upgrades. They are focusing on developing multifunctional, cloud-compatible, and energy-efficient models that align with evolving business and consumer needs. Strategic investment in R&D remains crucial, enabling the introduction of products with faster output, improved image quality, and lower environmental impact. Leading manufacturers are also forming alliances with software developers to enhance cloud integration and mobile accessibility.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By type

- 2.2.3 By output type

- 2.2.4 By connectivity

- 2.2.5 By print speed

- 2.2.6 By price

- 2.2.7 By end use

- 2.2.8 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Single function

- 5.3 Multi-function

Chapter 6 Market Estimates & Forecast, By Output Type, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Color laser

- 6.3 Black & white laser

Chapter 7 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

Chapter 8 Market Estimates & Forecast, By Print speed, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Up to 30ppm

- 8.3 30 to 50 ppm

- 8.4 Above 50 ppm

Chapter 9 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key Trends

- 10.2 Individual

- 10.3 Commercial

- 10.2.1 Corporate

- 10.2.2 Education institutes

- 10.2.3 Media & publication houses

- 10.2.4 Printing centres & stationary

- 10.2.5 Others (healthcare, retail, etc.)

- 10.4 Government Agencies

- 10.5 Industrial

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E commerce

- 11.2.2 Company websites

- 11.3 Offline

- 11.3.1 Supermarkets/hypermarket

- 11.3.2 Specialty retail stores

- 11.3.3 Others (independent retailer etc.)

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Brother Industries

- 13.2 Canon

- 13.3 Dell

- 13.4 Epson

- 13.5 HP Development

- 13.6 Konica Minolta

- 13.7 Kyocera

- 13.8 Lexmark International

- 13.9 Oki Electric Industry

- 13.10 Pantum International

- 13.11 Ricoh

- 13.12 Roland DG

- 13.13 SATO America

- 13.14 Toshiba

- 13.15 Xerox