|

市場調查報告書

商品編碼

1797830

工業牽引電池市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Traction Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

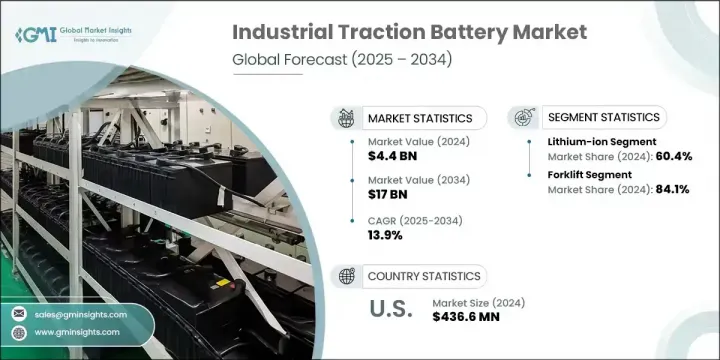

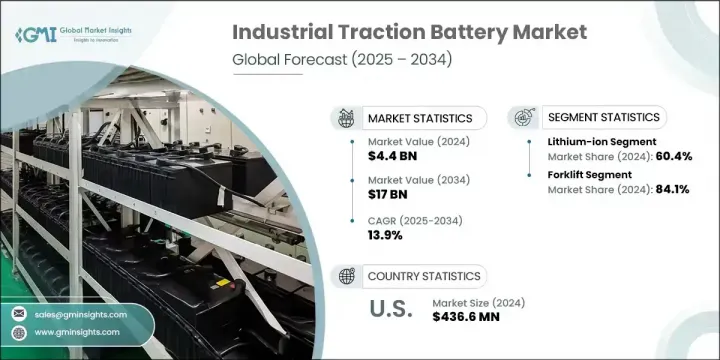

2024年,全球工業牽引電池市場規模達44億美元,預計2034年將以13.9%的複合年成長率成長,達到170億美元。這一成長主要源於現代工業設施對電動物料搬運設備、多用途手推車和自動化系統日益成長的需求。電池供電系統因其營運成本更低、排放更少、維護需求更少等優勢,正迅速取代燃油驅動機械。隨著倉儲、物流和製造業務不斷追求更高的效率和永續性,牽引電池在推動這一轉變方面發揮著至關重要的作用。自動化和機器人技術投資的不斷成長,正在推動電池供電工業資產的廣泛應用,從而改善工作流程並提升安全性。

同時,電池化學技術,尤其是鋰離子和超級電容器技術的快速進步,正在帶來更高的能源效率和更快的充電週期。這些優勢使製造商能夠減少停機時間並提高產量,同時仍遵守環保準則。政府為電動車隊轉型提供財政誘因和補貼的舉措,正在加強各行各業對清潔能源技術的採用。牽引電池系統現已成為下一代工業生態系統不可或缺的一部分,旨在減少碳排放,同時最大限度地提高正常運作時間和營運彈性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 44億美元 |

| 預測值 | 170億美元 |

| 複合年成長率 | 13.9% |

鋰離子電池佔了60.4%的市場佔有率,預計到2034年將以15%的複合年成長率成長。隨著企業尋求長期效率提升和遵守排放法規,倉儲、建築和生產領域對電池供電設備的日益青睞推動了這一成長。與其他類型的電池相比,鋰離子電池因其更高的能量密度、更長的使用壽命和極低的維護成本而備受青睞。它們相容於快速充電技術,並能夠支援高負載應用,使其成為持續運行的首選。

2024年,鐵路部門的價值為5.864億美元。作為脫碳戰略的一部分,國家和地區當局正在加大對混合動力和電動鐵路基礎設施的投資。隨著城市地區優先發展更清潔、更有效率的公共交通網路,電池供電的地鐵和輕軌車輛變得越來越重要。鐵路牽引電池不僅支持推進,還為輔助系統提供動力,從而在城市走廊中實現更安靜、零排放的交通選擇。

預計到2034年,北美工業牽引電池市場的複合年成長率將達到10%。智慧製造、電子商務和工業自動化的興起正在推動對電動工業車輛及其配套基礎設施的需求。電池技術的進步,尤其是縮短充電時間和延長維護間隔的技術,正在支撐這種成長勢頭。美國和加拿大的企業擴大轉向低排放設備,以滿足監管要求和內部永續發展目標。工業中心正在整合電池驅動的車隊,以符合綠色環保要求,並逐步降低能源相關成本。

推動工業牽引電池市場創新的頂尖企業包括 ENERSYS、比亞迪、Flux Power、Sunlight Group 和 EXIDE INDUSTRIES,它們都在積極塑造全球競爭格局。工業牽引電池市場的領先公司優先考慮對先進電池技術(尤其是鋰離子和固態化學技術)進行長期策略投資。這些企業正在擴大其全球製造足跡,以滿足區域需求並減少供應鏈限制。產品多樣化是其方法的核心,重點是與各種電動工業車輛相容的模組化電池系統。該公司還與原始設備製造商 (OEM) 和物流營運商合作,共同開發可提高性能和可靠性的整合電池解決方案。一些市場領導者正在透過嵌入遠端資訊處理和電池管理系統進行即時監控、預測分析和效能最佳化,從而增強其數位產品。此外,他們還透過推廣循環經濟模式和二次電池計畫來實現永續發展目標。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 價值鏈映射

- 利害關係人分析

- 產業結構演變

- 監管格局

- 全球安全標準

- 環境法規和永續性要求

- 區域監管差異

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 技術演進與創新趨勢

- 電池化學和發展時間表

- 能量密度改進軌跡

- 電池管理系統的演變

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 重要夥伴關係與合作

- 重大併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依化學成分,2021 - 2034 年

- 主要趨勢

- 鉛酸

- 鋰離子

- 鎳基

- 其他

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 堆高機

- 鐵路

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 韓國

- 澳洲

- 印度

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Amara Raja Batteries

- Aliant Battery

- BYD

- Camel Group

- East Penn

- EXIDE INDUSTRIES

- ecovolta

- ENERSYS

- Farasis Energy

- Flux Power

- Guoxuan High-tech Power Energy

- HOPPECKE Batteries

- Hitachi Energy

- Mutlu Corporation

- MIDAC

- Sunlight Group

- Sunwoda Electronic

- Toshiba Corporation

The Global Industrial Traction Battery Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 13.9% to reach USD 17 billion by 2034. This surge is largely fueled by the rising demand for electric material handling equipment, utility carts, and automation systems within modern industrial facilities. Battery-powered systems are rapidly replacing fuel-driven machinery due to their lower operational costs, reduced emissions, and minimal maintenance needs. As warehousing, logistics, and manufacturing operations push for greater efficiency and sustainability, traction batteries are playing a crucial role in enabling the shift. Growing investment in automation and robotics is supporting widespread use of battery-powered industrial assets that improve workflow and safety.

At the same time, rapid progress in battery chemistry, particularly in lithium-ion and ultracapacitor technologies, is delivering greater energy efficiency and faster charge cycles. These benefits are allowing manufacturers to cut downtime and increase throughput, while still adhering to environmental guidelines. Government initiatives offering financial incentives and subsidies for electric fleet conversions are reinforcing the adoption of clean-energy technologies across industries. Traction battery systems are now integral to next-gen industrial ecosystems aiming to reduce carbon output while maximizing uptime and operational resilience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $17 Billion |

| CAGR | 13.9% |

The lithium-ion segment held a 60.4% share and is projected to grow at a CAGR of 15% through 2034. This growth is being propelled by a growing preference for battery-powered equipment in warehousing, construction, and production, as organizations seek long-term efficiency gains and compliance with emissions regulations. Lithium-ion units are favored for their superior energy density, longer life span, and minimal maintenance compared to other battery types. Their compatibility with fast-charging technologies and ability to support high-duty applications make them a prime choice for continuous operation.

The rail segment was valued at USD 586.4 million in 2024. National and regional authorities are increasing investments in hybrid and electric rail infrastructure as part of decarbonization strategies. Battery-powered metro and light rail vehicles are becoming more prominent as urban areas prioritize cleaner, more efficient public transport networks. Traction batteries in rail not only support propulsion but also power auxiliary systems, enabling quieter, emission-free transit options in urban corridors.

North America Industrial Traction Battery Market is expected to register a CAGR of 10% through 2034. The rise of smart manufacturing, e-commerce, and industrial automation is pushing demand for electric industrial vehicles and supporting infrastructure. Advancements in battery technologies, particularly those that reduce charging time and extend service intervals, are supporting this momentum. Businesses across the U.S. and Canada are increasingly switching to low-emission equipment to meet both regulatory requirements and internal sustainability goals. Industrial hubs are integrating battery-powered fleets to align with green mandates and minimize energy-related costs over time.

Top players driving innovation in this Industrial Traction Battery Market include ENERSYS, BYD, Flux Power, Sunlight Group, and EXIDE INDUSTRIES, all of which are actively shaping the global competitive landscape. Leading companies in the industrial traction battery market are prioritizing long-term strategic investments in advanced battery technologies, particularly lithium-ion and solid-state chemistries. These players are expanding their global manufacturing footprints to address regional demand and reduce supply chain constraints. Product diversification is central to their approach, with a strong focus on modular battery systems compatible with a wide range of electric industrial vehicles. Companies are also collaborating with OEMs and logistics operators to co-develop integrated battery solutions that enhance performance and reliability. Several market leaders are enhancing their digital offerings by embedding telematics and battery management systems for real-time monitoring, predictive analytics, and performance optimization. Additionally, they are aligning with sustainability targets by promoting circular economy models and second-life battery programs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Value chain mapping

- 3.1.1.2 Stakeholder analysis

- 3.1.1.3 Industry structure evolution

- 3.2 Regulatory landscape

- 3.2.1.1 Global safety standards

- 3.2.1.2 Environmental regulations and sustainability requirements

- 3.2.1.3 Regional regulatory variations

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Technology evolution and innovation trends

- 3.7.1 Battery chemistry and advancement timeline

- 3.7.2 Energy density improvement trajectory

- 3.7.3 Battery management system evolution

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Chemistry, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Lead acid

- 5.3 Lithium-ion

- 5.4 Nickel-based

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Forklift

- 6.3 Railroads

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 Australia

- 7.4.5 India

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Amara Raja Batteries

- 8.2 Aliant Battery

- 8.3 BYD

- 8.4 Camel Group

- 8.5 East Penn

- 8.6 EXIDE INDUSTRIES

- 8.7 ecovolta

- 8.8 ENERSYS

- 8.9 Farasis Energy

- 8.10 Flux Power

- 8.11 Guoxuan High-tech Power Energy

- 8.12 HOPPECKE Batteries

- 8.13 Hitachi Energy

- 8.14 Mutlu Corporation

- 8.15 MIDAC

- 8.16 Sunlight Group

- 8.17 Sunwoda Electronic

- 8.18 Toshiba Corporation