|

市場調查報告書

商品編碼

1797826

羊毛加工機械市場機會、成長動力、產業趨勢分析及2025-2034年預測Wool Processing Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

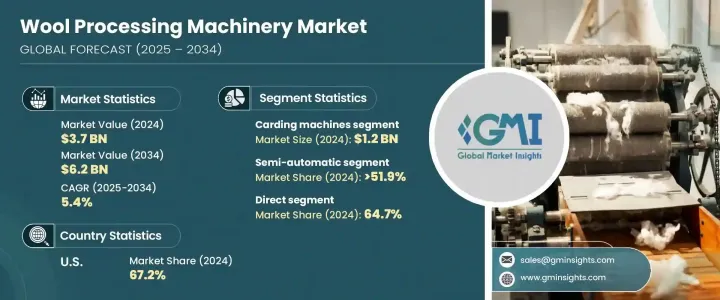

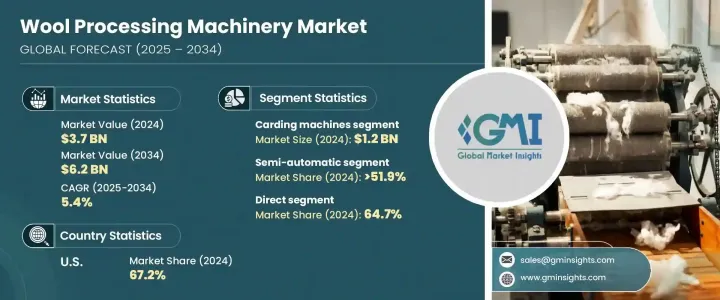

2024年,全球羊毛加工機械市場規模達37億美元,預計到2034年將以5.4%的複合年成長率成長,達到62億美元。這一穩定成長主要得益於羊毛製品需求的成長、紡織技術的進步以及製造業自動化程度的提高。紡織業的復甦,尤其是在南亞和東南亞地區,促使企業用現代、高效、環保的機械設備取代老舊過時的系統。對永續加工實踐的需求正在成長,尤其是在注重綠色營運的企業中。採用減少用水量和能耗的設備日益受到青睞。

此外,技術紡織品在服裝以外的應用領域不斷擴展,例如在隔熱材料和氈製品領域的應用,也推動了設備需求的成長。自動化和智慧製造的趨勢正在推動對人工智慧、物聯網和機器學習的投資,這些領域正在幫助工廠監控即時效能,透過預測性維護提高正常運行時間,並最大限度地提高產量。紡織公司也在投資用於羊毛回收的機械設備,這凸顯了向永續性和循環生產的更廣泛轉變。對精準、高效和環保營運的關注正在持續重塑全球羊毛機械格局。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 62億美元 |

| 複合年成長率 | 5.4% |

2024年,半自動機械市場佔據51.9%的市場佔有率,預計到2034年將以5.3%的複合年成長率成長。這些機器在成本效益和性能之間取得了平衡,因此對發展中市場的工廠尤其具有吸引力。它們之所以越來越受歡迎,是因為它們能夠超越手動設置,同時避免了全自動化的高成本。在勞動力短缺或預算有限的地區,半自動系統是理想的解決方案,能夠以具有競爭力的價格提供穩定的產量和可靠性。

2024年,北美羊毛加工機械市場佔有29.3%的市場佔有率,並將以5.6%的複合年成長率穩定成長,直至2034年。美國和加拿大都在推動本土紡織品製造,減少對進口的依賴,這鼓勵了對尖端羊毛加工技術的投資。對支持再生羊毛和低影響紡織品生產的機械的需求日益成長。此外,以安全為重點的法規和永續發展目標正在激勵北美紡織品生產商升級到現代化的自動化系統。精密製造程序,尤其是在技術紡織和服裝業,也促進了這項需求的激增。

積極影響全球羊毛加工機械市場的關鍵參與者包括 Savio Macchine Tessili SpA、Tritschler 集團、Rieter Holding AG、Lakshmi Machine Works Ltd. 和 Marzoli - Camozzi 集團。領先的羊毛加工機械製造商正專注於永續創新、數位整合和區域市場滲透,以提升其市場佔有率。許多公司正在使用支援人工智慧和物聯網的設備升級其產品組合,這些設備可實現即時效能監控、自動調整和預測性維護。產品多元化,包括羊毛回收、節能營運和低用水量工藝,也在滿足永續發展客戶需求方面發揮核心作用。企業擴大與紡織品製造商合作,提供根據當地生產需求量身定做的機械解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 全球羊毛需求不斷成長

- 服裝和紡織業的產品和成長

- 機械技術進步

- 產業陷阱與挑戰

- 初期投資成本高

- 原毛價格波動

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按機械類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS 編碼 - 84451950)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依機械類型,2021 - 2034 年

- 主要趨勢

- 煮練機

- 梳理機

- 聯合機

- 紡紗機

- 染色機

- 混合機

- 整理機

- 剪切機和打包機

第6章:市場估計與預測:依自動化類型,2021 - 2034 年

- 主要趨勢

- 手動/傳統機械

- 半自動機械

- 全自動機械

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 服飾和服飾

- 家用紡織品(毛毯、室內裝飾用品)

- 工業用布

- 地毯和地墊

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 毛紡廠

- 紡織品製造商

- 地毯編織單元

- 出口型單位

第9章:市場估計與預測:按配銷通路2021 - 2034

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Camozzi

- Fangzheng

- Fong's

- Jingwei

- Lakshmi

- NSC

- Rieter

- Saurer

- Savio

- Shanghai Texmac

- Tatham

- Texpro

- Trutzschler

The Global Wool Processing Machinery Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 6.2 billion by 2034. This steady growth is largely fueled by increased demand for wool-based products, advancements in textile technologies, and rising automation across the manufacturing sector. The resurgence of the textile industry, particularly across South and Southeast Asia, has encouraged companies to replace older, outdated systems with modern, efficient, and eco-friendly machinery. Demand is rising for sustainable processing practices, especially in companies focusing on green operations. The adoption of equipment that reduces water consumption and energy usage continues to gain traction.

Additionally, the expanding use of technical textiles beyond clothing, such as in insulation and felting applications, is boosting equipment demand. The trend toward automation and smart manufacturing is driving investments in AI, IoT, and machine learning, which are helping mills monitor real-time performance, improve uptime through predictive maintenance, and maximize production output. Textile companies are also investing in machinery designed for wool recycling, highlighting a broader shift toward sustainability and circular production. The focus on precision, efficiency, and eco-conscious operations continues to reshape the global wool machinery landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 5.4% |

In 2024, the semi-automatic machinery segment held a 51.9% share 2024 and is projected to grow at a CAGR of 5.3% through 2034. These machines strike a balance between cost-efficiency and performance, making them especially appealing to mills in developing markets. Their rising adoption is driven by their ability to outperform manual setups while avoiding the high cost of full automation. In regions with labor shortages or budget limitations, semi-automatic systems offer an ideal solution, delivering solid output and reliability at a competitive price.

North America Wool Processing Machinery Market held 29.3% share in 2024 and is growing steadily at a CAGR of 5.6% through 2034. Both the US and Canada are pushing for onshore textile manufacturing and reducing dependence on imports, which is encouraging investments in cutting-edge wool processing technologies. There's increasing demand for machinery that supports the production of recycled wool and low-impact textiles. Additionally, safety-focused regulations and sustainability goals are motivating textile producers in North America to upgrade to modern, automated systems. Precision-based manufacturing processes, particularly in the technical textile and garment industries, are also contributing to this demand surge.

Key players actively shaping the Global Wool Processing Machinery Market include Savio Macchine Tessili S.p.A., Tritschler Group, Rieter Holding AG, Lakshmi Machine Works Ltd., and Marzoli - Camozzi Group. Leading wool processing machinery manufacturers are focusing on sustainable innovation, digital integration, and regional market penetration to enhance their market presence. Many companies are upgrading their portfolios with AI-powered and IoT-enabled equipment that allows real-time performance monitoring, automated adjustments, and predictive maintenance. Product diversification toward wool recycling, energy-saving operations, and low-water-use processes also plays a central role in capturing demand from sustainability-driven customers. Firms are increasingly collaborating with textile manufacturers to offer customized machinery solutions tailored to local production needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machinery type

- 2.2.3 Automation type

- 2.2.4 Application

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.4 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global demand for wool

- 3.2.1.2 Products, growth of the apparel and textile industry

- 3.2.1.3 Technological advancements in machinery

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Fluctuating raw wool prices

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machinery type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code - 84451950)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machinery Type, 2021 - 2034 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Scouring machines

- 5.3 Carding machines

- 5.4 Combining machines

- 5.5 Spinning machines

- 5.6 Dying machines

- 5.7 Blending machines

- 5.8 Finishing machines

- 5.9 Shearing and baling machines

Chapter 6 Market Estimates & Forecast, By Automation Type, 2021 - 2034 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Manual/traditional machinery

- 6.3 Semi-automatic machinery

- 6.4 Fully automatic machinery

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Apparel & garments

- 7.3 Home textiles (blankets, upholstery)

- 7.4 Industrial fabrics

- 7.5 Carpets and rugs

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($ Bn, Units)

- 8.1 Key trends

- 8.2 Woolen mills

- 8.3 Textile manufacturers

- 8.4 Carpet weaving units

- 8.5 Export-oriented units

Chapter 9 Market Estimates & Forecast, By Distribution Channel 2021 - 2034 ($ Bn, Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Camozzi

- 11.2 Fangzheng

- 11.3 Fong's

- 11.4 Jingwei

- 11.5 Lakshmi

- 11.6 NSC

- 11.7 Rieter

- 11.8 Saurer

- 11.9 Savio

- 11.10 Shanghai Texmac

- 11.11 Tatham

- 11.12 Texpro

- 11.13 Trutzschler