|

市場調查報告書

商品編碼

1797821

縫合錨裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Suture Anchor Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

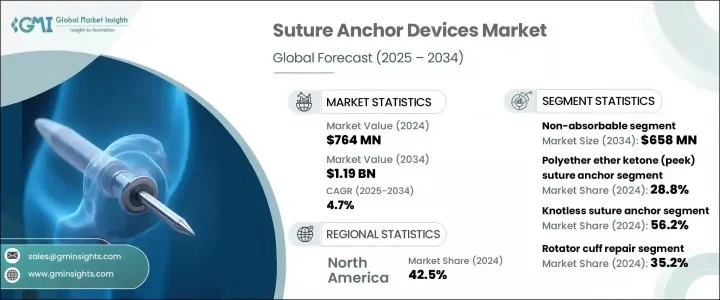

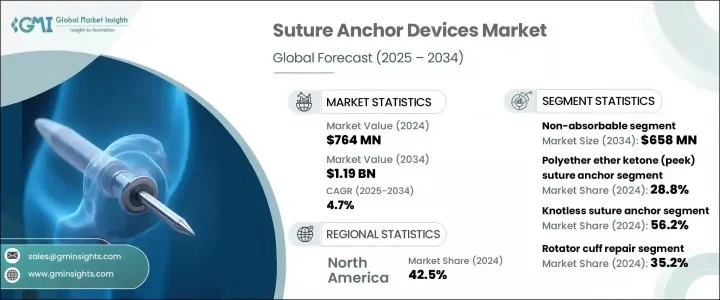

2024 年全球縫合錨裝置市場價值為 7.64 億美元,預計到 2034 年將以 4.7% 的複合年成長率成長至 11.9 億美元。這一成長主要源於運動傷害發生率的上升,以及肩袖修復、跟腱病治療和十字韌帶重建等手術的增多,這些手術通常都使用縫合錨裝置。這些植入物在骨科手術中起著至關重要的作用,它們將肌腱和韌帶等軟組織連接到骨骼上。老年人口的不斷成長也對市場成長做出了重大貢獻,因為與年齡相關的疾病需要更多的手術和介入。該行業的領導者包括 Arthrex、Zimmer Biomet、Smith & Nephew 和 Stryker。隨著手術技術和材料的創新,縫合錨裝置不斷發展,以提高固定強度、生物相容性和易用性。

縫合錨是現代骨科和運動醫學中必不可少的工具,用於在手術過程中將軟組織固定到骨骼上。材料科學的進步促進了機械強度和生物相容性更高的縫合錨的開發,從而確保了更好的療效和更高的患者滿意度。這些裝置是微創手術不可或缺的一部分,在微創手術中,精準度和組織保存對於術後成功恢復至關重要。隨著人們越來越重視縮短恢復時間和提高手術精準度,對高品質縫合錨裝置的需求也日益成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.64億美元 |

| 預測值 | 11.9億美元 |

| 複合年成長率 | 4.7% |

2024年,不可吸收縫合錨固裝置市場佔據主導地位,價值4.261億美元。預計到2034年,該市場規模將達到6.58億美元,複合年成長率為4.5%。不可吸收縫合錨固裝置因其卓越的機械強度和長期固定能力,在肩袖和盂唇修復等高負荷骨科手術中備受青睞。鈦和PEEK(聚醚醚酮)等材料具有高生物相容性、射線可透性和穩定的性能,其持續使用正在推動對不可吸收縫合錨固裝置的需求。這些材料確保縫合錨定裝置長期可靠地工作,為修復的組織提供永久支撐。

PEEK 縫合錨佔據最大市場佔有率,2024 年佔 28.8%。 PEEK 錨的廣泛應用歸功於其卓越的臨床表現、安全性以及外科醫生對其非金屬特性的青睞。 PEEK 錨具有出色的強度和射線可透性,使其成為肩部、膝蓋和髖部手術的理想選擇。長期研究表明,PEEK 無結錨的性能與可生物分解錨相當,進一步鞏固了其作為骨科手術安全可靠選擇的地位。

2024年,美國縫合錨裝置市場規模達2.998億美元。美國在先進骨科技術的應用方面處於領先地位,包括機器人輔助手術和基於PEEK(聚醚醚酮)的縫合錨。美國強大的監管框架、高度的公眾認知度以及在研發方面的大量投入是市場成長的主要推動力。隨著運動傷害和與年齡相關的肌肉骨骼疾病的發病率不斷上升,預計美國市場將在公共衛生措施和私營部門技術創新的推動下持續成長。

縫合錨裝置市場的主要參與者包括全錄輝 (Smith & Nephew)、史賽克 (Stryker Corporation)、捷邁邦美 (Zimmer Biomet)、Arthrex 和康美 (ConMed)。縫合錨裝置市場的公司採用一系列策略來鞏固其地位並增加市場佔有率。一項關鍵策略是不斷創新材料和裝置設計,尤其專注於提高用於複雜手術的縫合錨的性能和耐用性。許多公司也透過推出基於 PEEK 和生物可吸收的縫合錨來擴展其產品組合,以滿足對這些材料日益成長的需求。另一項策略是與醫院、骨科診所和研究機構建立策略夥伴關係,以確保其產品得到更廣泛的應用。此外,透過投資本地製造工廠和分銷網路來增強其在新興市場的影響力是許多領先企業的重點關注點。這些公司還利用機器人輔助手術等技術進步,將縫合錨裝置整合到下一代外科手術中,以確保更高的準確性和更快的恢復時間。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 運動事故數量上升

- 老年人口不斷增加

- 微創手術的需求

- 錨設計的技術進步

- 產業陷阱與挑戰

- 高級錨和手術費用高昂

- 術後併發症的風險

- 市場機會

- 人工智慧與機器人輔助手術的融合

- 生物相容性和生物可吸收材料的創新

- 成長動力

- 成長潛力分析

- 監管格局

- 技術進步

- 當前的技術趨勢

- 新興技術

- 供應鏈分析

- 2024年定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 可吸收

- 不可吸收

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 金屬縫合錨

- 生物可吸收縫合錨

- 聚醚醚酮(PEEK)縫合錨

- 生物複合材料縫合錨

- 全軟縫合錨

第7章:市場估計與預測:按捆綁類型,2021 - 2034

- 主要趨勢

- 無結縫合錨

- 打結縫合錨

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 肩袖修復

- 跟腱病修復

- 十字韌帶修復

- 肱二頭肌肌腱固定術

- 其他應用

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 門診手術中心

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Anika Therapeutics

- Arthrex

- ConMed

- Enovis Corporation

- Fuse Medical

- Johnson & Johnson

- MJ Surgical

- NeoSys

- Orthomed

- Ossio

- Parcus Medical

- SBM

- Smith & Nephew

- Stryker Corporation

- Teknimed

- Tulpar Medical Solutions

- Zimmer Biomet

The Global Suture Anchor Devices Market was valued at USD 764 million in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 1.19 billion by 2034. This growth is primarily driven by the increasing incidence of sports-related injuries, as well as the rise in procedures like rotator cuff repair, Achilles tendinosis treatment, and cruciate ligament reconstruction, all of which commonly employ suture anchor devices. These implants play a crucial role in orthopedic surgeries by attaching soft tissues such as tendons and ligaments to bone. The expanding geriatric population is also contributing significantly to market growth, as age-related conditions require more surgeries and interventions. Leading players in the industry include Arthrex, Zimmer Biomet, Smith & Nephew, and Stryker. With innovations in surgical techniques and materials, suture anchor devices continue to evolve to offer improved fixation strength, biocompatibility, and ease of use.

Suture anchors are essential tools in modern orthopedic and sports medicine, designed to fasten soft tissue to bone during surgical procedures. Advancements in materials science have led to the development of anchors with enhanced mechanical strength and biocompatibility, ensuring better outcomes and increased patient satisfaction. These devices are integral to minimally invasive surgeries, where precision and tissue preservation are critical for successful recovery. With a growing emphasis on reducing recovery times and improving surgical precision, the demand for high-quality suture anchor devices continues to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $764 Million |

| Forecast Value | $1.19 Billion |

| CAGR | 4.7% |

The non-absorbable segment dominated the suture anchor devices market in 2024, accounting for USD 426.1 million. This segment is projected to reach USD 658 million by 2034, growing at a CAGR of 4.5%. Non-absorbable anchors are preferred in high-load orthopedic procedures, such as rotator cuff and labral repairs, due to their superior mechanical strength and long-term fixation capabilities. The continued use of materials like titanium and PEEK (polyether ether ketone), which offer high biocompatibility, radiolucency, and consistent performance, is driving the demand for non-absorbable anchors. These materials ensure that the anchors perform reliably over time, providing permanent support to repaired tissues.

The PEEK suture anchor segment held the largest share of the market, accounting for 28.8% in 2024. The widespread adoption of PEEK anchors is attributed to their strong clinical performance, safety profile, and preference among surgeons for their non-metallic nature. PEEK anchors offer excellent strength and radiolucency, making them ideal for use in shoulder, knee, and hip surgeries. Long-term studies have shown that PEEK knotless anchors perform comparably to biodegradable anchors, further cementing their position as a safe and reliable choice for orthopedic procedures.

United States Suture Anchor Devices Market was valued at USD 299.8 million in 2024. The U.S. is at the forefront of adopting advanced orthopedic technologies, including robotic-assisted surgeries and PEEK-based suture anchors. The country's strong regulatory framework, high levels of public awareness, and substantial investments in research and development are major contributors to market growth. With the increasing prevalence of sports injuries and age-related musculoskeletal conditions, the U.S. market is expected to experience sustained growth, driven by both public health initiatives and innovations in private sector technologies.

Major players in the Suture Anchor Devices Market include Smith & Nephew, Stryker Corporation, Zimmer Biomet, Arthrex, and ConMed. Companies in the suture anchor devices market employ a range of strategies to solidify their position and increase market share. A key strategy is the continuous innovation in materials and device design, particularly focusing on improving the performance and durability of suture anchors used in complex surgeries. Many companies are also expanding their product portfolios by introducing PEEK-based and bioabsorbable suture anchors, catering to the growing demand for these materials. Another strategy involves forming strategic partnerships with hospitals, orthopedic clinics, and research institutions to ensure better adoption of their products. In addition, enhancing their presence in emerging markets by investing in local manufacturing facilities and distribution networks is a key focus for many leading players. These companies are also leveraging technological advancements such as robotic-assisted surgery to integrate suture anchor devices into next-gen surgical procedures, ensuring improved accuracy and faster recovery times.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 Tying type trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising number of sports accidents

- 3.2.1.2 Increasing geriatric population

- 3.2.1.3 Demand for minimally invasive surgeries

- 3.2.1.4 Technological advancements in anchor design

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced anchors and surgery

- 3.2.2.2 Risk of post operative complications

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and robotic assisted surgery

- 3.2.3.2 Innovation in biocompatible and bioabsorbable materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Absorbable

- 5.3 Non absorbable

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Metallic suture anchor

- 6.3 Bio absorbable suture anchor

- 6.4 Polyether ether ketone (PEEK) suture anchor

- 6.5 Bio composite suture anchor

- 6.6 All soft suture anchor

Chapter 7 Market Estimates and Forecast, By Tying Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Knotless suture anchor

- 7.3 Knotted suture anchor

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Rotator cuff repair

- 8.3 Archilles tendinosis repair

- 8.4 Cruciate ligament repairs

- 8.5 Biceps tenodesis

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital and clinics

- 9.3 Ambulatory surgical centres

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Anika Therapeutics

- 11.2 Arthrex

- 11.3 ConMed

- 11.4 Enovis Corporation

- 11.5 Fuse Medical

- 11.6 Johnson & Johnson

- 11.7 MJ Surgical

- 11.8 NeoSys

- 11.9 Orthomed

- 11.10 Ossio

- 11.11 Parcus Medical

- 11.12 SBM

- 11.13 Smith & Nephew

- 11.14 Stryker Corporation

- 11.15 Teknimed

- 11.16 Tulpar Medical Solutions

- 11.17 Zimmer Biomet