|

市場調查報告書

商品編碼

1797814

自動樣品儲存系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automated Sample Storage Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

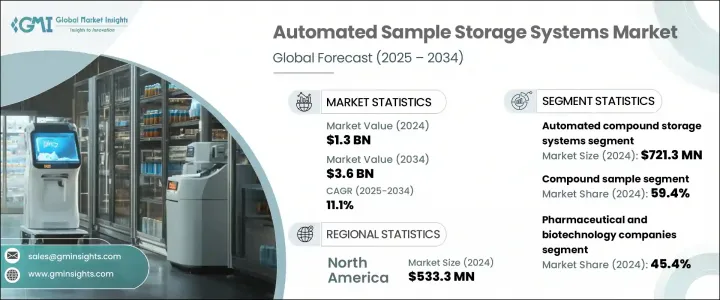

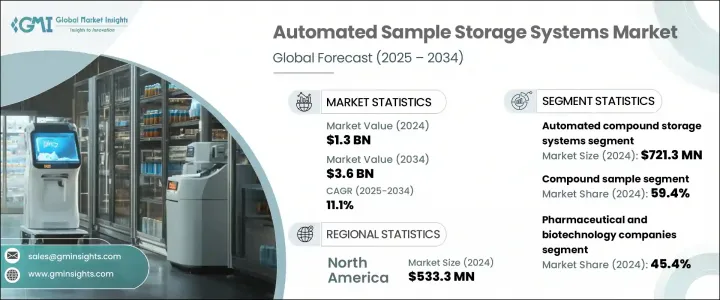

2024年,全球自動化樣本儲存系統市場規模達13億美元,預計2034年將以11.1%的複合年成長率成長,達到36億美元。強勁的成長勢頭源於生物樣本庫需求的不斷成長、對樣本完整性保護的日益重視以及生命科學和臨床實驗室的數位轉型。隨著藥物開發和基因組研究的不斷推進,全球各地的實驗室紛紛轉向自動化,以實現更準確、更安全、更可擴展的樣本管理。自動化儲存系統與實驗室數位化工具(例如實驗室資訊管理系統 (LIMS))的整合,可增強樣本追蹤、庫存控制和資料準確性。

大型研究計畫和公共衛生生物庫的投資不斷成長,推動了對可擴展、技術驅動的儲存解決方案的需求。自動化系統有助於實驗室減少人為錯誤、維持合規性並支援高通量工作流程,尤其是在製藥、生物技術和臨床領域。隨著樣本量和資料複雜性的上升,自動化正成為高效實驗室運作的基石,塑造現代實驗室基礎設施和臨床研究環境的未來。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 36億美元 |

| 複合年成長率 | 11.1% |

2024年,自動化化合物儲存系統細分市場收入達7.213億美元。這些系統能夠在最大程度上減少人工干預的情況下實現大規模化合物庫存儲,在藥物研發中發揮關鍵作用。它們能夠簡化化合物檢索並確保一致性,對藥物篩選工作流程和藥物研發運作至關重要。隨著化合物庫規模的不斷擴大以及對高通量環境下可重複結果的需求,對可靠化合物管理的需求持續成長。

2024年,化合物樣品市場佔據59.4%的佔有率,這得益於快節奏篩選環境中應用的不斷成長。隨著製藥公司尋求更快的周轉時間,提供精確追蹤、溫度控制和機器人處理的自動化解決方案有助於增強化合物篩選工作流程,最終縮短時間並提高藥物研發效率。

2024年,美國自動化樣本儲存系統市場規模達4.725億美元,鞏固了其作為區域主要貢獻者的地位。北美的領先地位源自於許多製藥和生物科技公司積極應用自動化技術進行樣本儲存。該地區還擁有服務研究計畫的大型生物樣本庫,進一步刺激了對可擴展且安全的樣本管理系統的需求。藥物研發管線的持續擴張以及精準醫療的推動也推動了該地區對先進儲存解決方案的採用。

引領全球自動化樣本儲存系統市場的領導者包括賽默飛世爾科技、布魯克斯自動化、MEGAROBO、ASKION、松下醫療、TTP LabTech、Biotron Healthcare、SPT Labtech、貝克曼庫爾特、海爾生物醫療、Angelantoni Life Science、LiCONiC、Azenta、Hamilton Company 和 MICRONIC。自動化樣本儲存系統市場的主要公司正致力於加強技術整合、拓展全球分銷管道,並開發滿足不斷變化的客戶需求的客製化系統。許多公司正在投資下一代機器人技術、基於人工智慧的樣本追蹤以及基於雲端的軟體,以實現與實驗室資訊學平台的無縫連接。各公司也透過策略合作夥伴關係和收購來加強其區域影響力,尤其是在新興的生物製藥中心。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 對生物樣本庫和維護生物庫的需求日益成長

- 臨床和研究實驗室的數位轉型

- 藥物發現和開發的成長

- 越來越關注樣本的完整性和合規性

- 產業陷阱與挑戰

- 需要大量的初始資本投資

- 與資料安全和備份相關的擔憂

- 市場機會

- 人工智慧和物聯網的技術進步

- 對捆綁一站式解決方案的需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 專利分析

- 定價分析

- 按產品

- 按地區

- 差距分析

- 波特的分析

- PESTLE 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 自動化複合儲存系統

- 自動化液體處理系統

- 其他產品

第6章:市場估計與預測:按樣本,2021 - 2034 年

- 主要趨勢

- 化合物樣品

- 生物樣本

- 其他樣品

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥和生物技術公司

- 學術和研究機構

- 生物樣本庫

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Angelantoni Life Science

- ASKION

- Azenta US

- Beckman Coulter

- Biotron Healthcare

- Brooks Automation

- Haier Biomedical

- Hamilton Company

- LiCONiC

- MEGAROBO

- MICRONIC

- Panasonic Healthcare

- SPT Labtech

- Thermo Fisher Scientific

- TTP LabTech

The Global Automated Sample Storage Systems Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 11.1% to reach USD 3.6 billion by 2034. This strong growth trajectory is driven by the rising demand for biorepositories, increased focus on preserving sample integrity, and digital transformation within life science and clinical laboratories. As drug development and genomic research advance, laboratories across the globe are turning to automation for more accurate, secure, and scalable sample management. The integration of automated storage systems with lab digitization tools, such as laboratory information management systems (LIMS), enhances sample tracking, inventory control, and data accuracy.

The growing investment in large-scale research programs and public health biobanks is fueling the need for scalable, tech-driven storage solutions. Automated systems help labs reduce human error, maintain compliance, and support high-throughput workflows, especially in pharmaceutical, biotech, and clinical settings. As sample volumes and data complexity rise, automation is becoming a cornerstone of efficient lab operations, shaping the future of modern laboratory infrastructure and clinical research environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 11.1% |

In 2024, the automated compound storage systems segment generated USD 721.3 million. These systems play a critical role in pharmaceutical discovery by enabling large-scale chemical library storage with minimal manual intervention. Their ability to streamline compound retrieval and ensure consistency makes them vital to drug screening workflows and pharmaceutical R&D operations. The need for reliable compound management continues to grow due to increasing chemical library sizes and demand for reproducible results in high-throughput environments.

The compound sample segment held a 59.4% share in 2024, driven by rising applications in fast-paced screening environments. As pharmaceutical companies seek faster turnaround times, automated solutions offering precise tracking, temperature control, and robotic handling help enhance compound screening workflows, ultimately reducing timelines and improving efficiency in drug discovery.

U.S. Automated Sample Storage Systems Market generated USD 472.5 million in 2024, solidifying its position as a key regional contributor. North America's leadership stems from a strong presence of pharmaceutical and biotech companies actively using automation in sample storage. The region also hosts major biobank facilities that serve research programs, further boosting demand for scalable and secure sample management systems. The ongoing expansion of drug discovery pipelines and the push for precision medicine are also driving regional adoption of advanced storage solutions.

Leading players shaping the Global Automated Sample Storage Systems Market include Thermo Fisher Scientific, Brooks Automation, MEGAROBO, ASKION, Panasonic Healthcare, TTP LabTech, Biotron Healthcare, SPT Labtech, Beckman Coulter, Haier Biomedical, Angelantoni Life Science, LiCONiC, Azenta, Hamilton Company, and MICRONIC. Key companies in the automated sample storage systems market are focusing heavily on enhancing technology integration, expanding global distribution channels, and developing systems tailored to evolving customer needs. Many are investing in next-gen robotics, AI-based sample tracking, and cloud-based software for seamless connectivity with lab informatics platforms. Companies are also strengthening their regional presence through strategic partnerships and acquisitions, particularly in emerging biopharma hubs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Sample

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing need for biobanking and maintaining biorepositories

- 3.2.1.2 Digital transformation across clinical and research laboratories

- 3.2.1.3 Growth in drug discovery and development

- 3.2.1.4 Growing focus on sample integrity and compliance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Requirement of substantial initial capital investments

- 3.2.2.2 Concerns related to data security and backup

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements in AI and IoT

- 3.2.3.2 Growing demand for bundled one-stop solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automated compound storage systems

- 5.3 Automated liquid handling systems

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By Sample, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Compound sample

- 6.3 Biological sample

- 6.4 Other samples

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmaceutical and biotechnology companies

- 7.3 Academic and research institutes

- 7.4 Biobanks

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profile

- 9.1 Angelantoni Life Science

- 9.2 ASKION

- 9.3 Azenta US

- 9.4 Beckman Coulter

- 9.5 Biotron Healthcare

- 9.6 Brooks Automation

- 9.7 Haier Biomedical

- 9.8 Hamilton Company

- 9.9 LiCONiC

- 9.10 MEGAROBO

- 9.11 MICRONIC

- 9.12 Panasonic Healthcare

- 9.13 SPT Labtech

- 9.14 Thermo Fisher Scientific

- 9.15 TTP LabTech