|

市場調查報告書

商品編碼

1797802

家禽藥品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Poultry Pharmaceuticals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

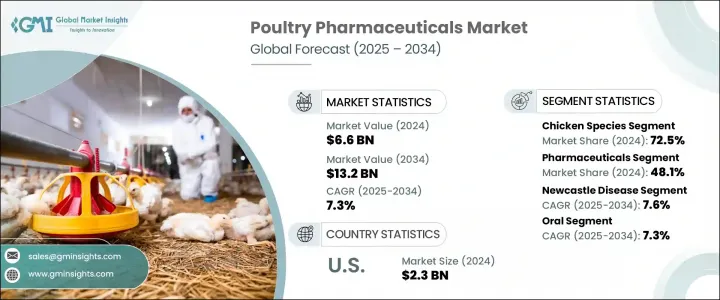

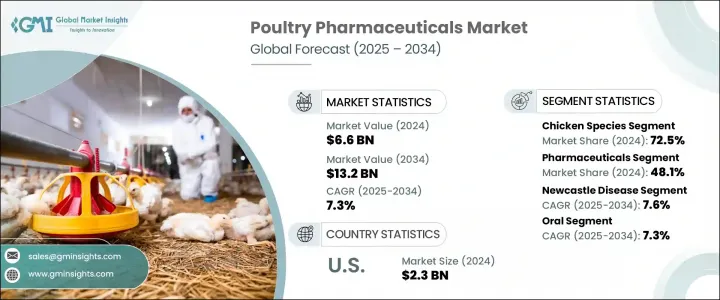

2024年,全球家禽藥品市場規模達66億美元,預計到2034年將以7.3%的複合年成長率成長,達到132億美元。受雞肉和雞蛋等產品價格實惠且蛋白質含量高的影響,全球家禽消費量不斷成長,這持續推動市場需求。同時,商業家禽養殖場對動物健康、預防保健和疾病管理的日益重視,也加速了對有效藥物解決方案的需求。隨著對抗生素抗藥性擔憂的加劇,監管機構正在對抗生素的使用施加更嚴格的限制,從而導致疫苗、益生菌和其他替代品的廣泛採用。

家禽養殖戶正在轉向永續的健康策略,以滿足消費者對無抗生素和有機家禽產品的需求。這一趨勢促進了生物製劑、先進疫苗和益生菌藥物的普及。該領域涵蓋了針對雞、鴨、火雞和其他禽類的各種健康解決方案,重點是減少疾病爆發並維持穩定的生產品質。整體市場的成長得益於對家禽保健創新的持續投資,以及在大規模生產中採用天然、非抗生素方法維護生物安全和生產力的轉變。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 66億美元 |

| 預測值 | 132億美元 |

| 複合年成長率 | 7.3% |

2024年,雞肉市場佔72.5%,到2034年將達到94億美元,複合年成長率為7.2%。雞肉在家禽生產中占主導地位,尤其容易感染馬立克氏症、發炎性腸道疾病、新城疫和球蟲病等疾病。因此,藥物介入主要著重於提高雞群免疫力,並透過預防性治療和結構化的疫苗接種計畫來支持大規模肉雞和蛋雞養殖。

2024年,藥品市場佔48.1%的佔有率。該領域的成長得益於抗感染藥、驅蟲藥和止痛藥等產品的廣泛使用,這些產品因其安全性、便利性和預防性而備受青睞。減少抗生素依賴的廣泛趨勢已將人們的注意力轉向益生菌和益生元解決方案,這些解決方案可以改善腸道健康並最大程度地降低感染風險。監管機構對抗菌藥物使用的壓力日益加大,進一步鼓勵了這些替代品的採用。

2024年,美國家禽藥品市場價值達23億美元。由於美國強勁的家禽消費率和對大規模商業化養殖的依賴,美國將繼續引領該地區的成長。集約化養殖體系中疾病風險的增加,以及嚴格的生物安全規定,促使美國和加拿大各地的農民優先考慮早期疫苗接種,並透過藥品進行持續的健康監測。

全球家禽藥品市場的主要參與者包括碩騰 (Zoetis)、詩華動物保健 (Ceva Sante Animale)、菲布羅動物保健 (Phibro Animal Health)、勃林格殷格翰 (Boehringer Ingelheim) 和禮來 (Elanco)。家禽藥品市場的主要公司正專注於研發,以提供下一代生物製劑、疫苗和傳統抗生素的永續替代品。禮來和詩華動物保健 (Ceva Sante Animale) 等企業正在擴大其生物製劑產品組合,以滿足市場對無抗生素產品日益成長的需求。策略性收購、與家禽生產商的合作以及區域擴張仍然是關鍵途徑。各公司也正在投資數位工具,監測雞群健康狀況,提高治療精準度和遵從性。針對特定物種疾病客製化產品、擴大新興市場的產品註冊以及確保法規合規性,這些舉措正在加強其全球影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 家禽產品需求不斷成長

- 家禽疾病發生率不斷上升

- 更重視食品安全和抗菌藥物管理

- 獸醫保健和疫苗接種的進步

- 產業陷阱與挑戰

- 新藥研發成本高

- 抗菌素抗藥性問題

- 市場機會

- 家禽預防性醫療保健需求不斷成長

- 新興經濟體需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按物種,2021 - 2034 年

- 主要趨勢

- 雞

- 土耳其

- 鴨子

- 其他物種

第6章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 生物製劑

- 疫苗

- 改良/減毒活疫苗

- 去活化(殺死)

- 其他疫苗

- 其他生物製劑

- 疫苗

- 製藥

- 殺寄生蟲劑

- 抗感染藥物

- 抗發炎鎮痛藥

- 其他藥品

- 藥物飼料添加劑

第7章:市場估計與預測:依疾病類型,2021 - 2034 年

- 主要趨勢

- 新城疫

- 傳染性支氣管炎

- 傳染性法氏囊病

- 球蟲病

- 沙門氏菌

- 馬立克氏症

- 其他疾病類型

第8章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 注射劑

- 外用

- 其他給藥途徑

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 獸醫醫院和診所

- 家禽養殖場

- 零售獸藥局

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Avimex

- Boehringer Ingelheim International

- Calier

- Ceva Sante Animale

- Elanco

- Hester Biosciences

- Indovax

- Kemin Industries

- Merck

- Phibro Animal Health

- Vaxxinova (EW Group)

- Vetanco

- Virbac

- Zoetis

The Global Poultry Pharmaceuticals Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 13.2 billion by 2034. Rising poultry consumption worldwide, driven by the affordability and high protein content of products like chicken and eggs, continues to fuel market demand. At the same time, the growing focus on animal health, preventive care, and disease management in commercial poultry operations is accelerating the need for effective pharmaceutical solutions. As concerns about antibiotic resistance increase, regulatory agencies are placing stricter limitations on antibiotic use, leading to greater adoption of vaccines, probiotics, and other alternatives.

Poultry farmers are shifting to sustainable health strategies to meet consumer demand for antibiotic-free and organic poultry products. This trend has boosted the uptake of biologics, advanced vaccines, and probiotic-based medications. The sector includes a wide range of health solutions for chickens, ducks, turkeys, and other birds, focusing on reducing disease outbreaks and maintaining consistent production quality. The overall market growth is supported by ongoing investments in poultry healthcare innovation and a shift toward natural, non-antibiotic approaches for maintaining biosecurity and productivity in large-scale operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $13.2 Billion |

| CAGR | 7.3% |

In 2024, the chicken segment held 72.5% and will reach USD 9.4 billion by 2034 at a CAGR of 7.2%. Chicken dominate poultry production and are especially prone to diseases such as Marek's disease, IBD, Newcastle disease, and coccidiosis. As a result, pharmaceutical interventions are primarily focused on improving flock immunity and supporting large-scale broiler and layer farming operations with preventive treatments and structured vaccination schedules.

The pharmaceuticals segment held a 48.1% share in 2024. This segment's growth is driven by widespread use of products like anti-infectives, parasiticides, and analgesics, which are favored for their safety, convenience, and preventive capabilities. A broader movement toward reducing antibiotic dependency has shifted attention to probiotic and prebiotic-based solutions that improve gut health and minimize infection risks. Increasing pressure from regulatory bodies regarding antimicrobial usage has further encouraged the adoption of these alternatives.

U.S. Poultry Pharmaceuticals Market was valued at USD 2.3 billion in 2024. The U.S. continues to lead regional growth due to its strong poultry consumption rates and reliance on large-scale commercial farming. Enhanced disease risks within intensive farming systems, along with strict biosecurity mandates, have prompted farmers across the U.S. and Canada to prioritize early vaccination and consistent health monitoring through pharmaceutical products.

Key industry players operating in the Global Poultry Pharmaceuticals Market include Zoetis, Ceva Sante Animale, Phibro Animal Health, Boehringer Ingelheim, and Elanco. Major companies in the poultry pharmaceuticals market are focusing on R&D to deliver next-generation biologics, vaccines, and sustainable alternatives to conventional antibiotics. Businesses like Elanco and Ceva Sante Animale are expanding their biologics portfolios to meet growing demand for antibiotic-free products. Strategic acquisitions, partnerships with poultry producers, and regional expansion remain critical approaches. Companies are also investing in digital tools to monitor flock health, improving treatment precision and compliance. Tailoring products for species-specific diseases, expanding product registrations across emerging markets, and ensuring regulatory compliance are strengthening global reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Species trends

- 2.2.3 Product trends

- 2.2.4 Disease type trends

- 2.2.5 Route of administration trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for poultry products

- 3.2.1.2 Growing incidence of poultry disease

- 3.2.1.3 Increasing focus on food safety and antimicrobial stewardship

- 3.2.1.4 Advancement in veterinary healthcare and vaccination

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of new drug development

- 3.2.2.2 Antimicrobial resistance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for preventive healthcare in poultry animals

- 3.2.3.2 Rising demand in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Species, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Chicken

- 5.3 Turkey

- 5.4 Ducks

- 5.5 Other species

Chapter 6 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Biologics

- 6.2.1 Vaccines

- 6.2.1.1 Modified/ attenuated live

- 6.2.1.2 Inactivated (killed)

- 6.2.1.3 Other vaccines

- 6.2.2 Other biologics

- 6.2.1 Vaccines

- 6.3 Pharmaceuticals

- 6.3.1 Parasiticides

- 6.3.2 Anti-infectives

- 6.3.3 Anti-inflammatory and analgesics

- 6.3.4 Other pharmaceuticals

- 6.4 Medicated feed additives

Chapter 7 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Newcastle disease

- 7.3 Infectious bronchitis

- 7.4 Infectious bursal disease

- 7.5 Coccidiosis

- 7.6 Salmonella

- 7.7 Marek's disease

- 7.8 Other disease types

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Injectable

- 8.4 Topical

- 8.5 Other routes of administration

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Poultry farms

- 9.4 Retail veterinary pharmacies

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Avimex

- 11.2 Boehringer Ingelheim International

- 11.3 Calier

- 11.4 Ceva Sante Animale

- 11.5 Elanco

- 11.6 Hester Biosciences

- 11.7 Indovax

- 11.8 Kemin Industries

- 11.9 Merck

- 11.10 Phibro Animal Health

- 11.11 Vaxxinova (EW Group)

- 11.12 Vetanco

- 11.13 Virbac

- 11.14 Zoetis