|

市場調查報告書

商品編碼

1797794

魚類養殖設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fish Farming Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

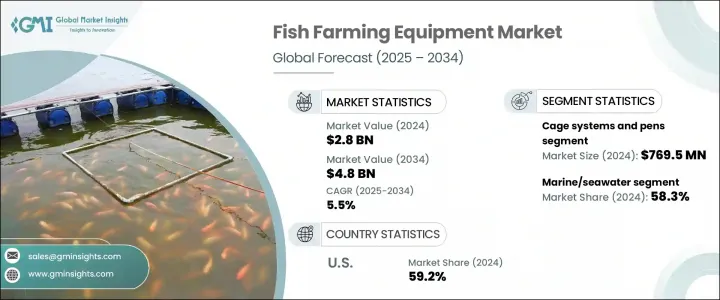

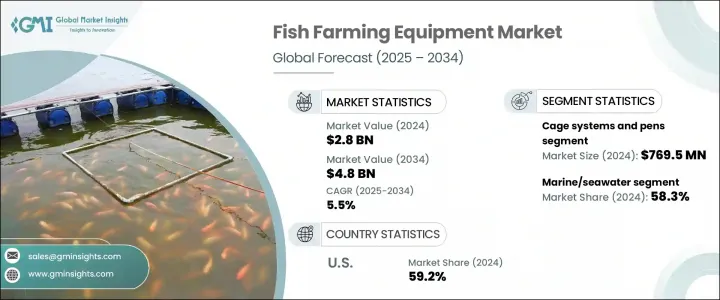

2024年,全球魚類養殖設備市場規模達28億美元,預計2034年將以5.5%的複合年成長率成長,達到48億美元。這一成長反映了全球對海鮮需求的不斷成長以及對糧食安全的日益重視。該市場涵蓋各種設備,包括水箱、曝氣系統、投餵裝置、過濾技術、水質監測器以及各種自動化監測設備。隨著水產養殖業的發展,對永續高效設備的追求也日益強烈。這些工具有助於最大限度地提高魚類健康水平,提高生長率,並提升營運效率,同時最大限度地減少對環境的影響。

世界各國政府正透過投資基礎設施和製定永續發展準則來鼓勵現代水產養殖實踐。包括自動化、物聯網和智慧分析在內的技術整合正在改變養魚場的管理方式,使人們能夠即時觀察環境參數和魚類狀況。這些創新不僅提高了效率,也降低了人力成本。隨著循環水養殖系統和近海養魚實踐的不斷擴展,對專業化和先進設備的需求必將成長,這將為全球製造商和供應商創造新的商機。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 48億美元 |

| 複合年成長率 | 5.5% |

2024年,網箱系統和圍籬市場收入達7.695億美元。這些系統憑藉其可擴展性、靈活性、成本效益和易於安裝的優勢,佔據了市場主導地位。它們能夠適應從淡水到鹹水的各種水生環境,成為養魚戶的首選。網箱系統和圍欄支持多種魚類養殖,使其在不同的水產養殖作業中用途廣泛。

2024年,海洋養殖佔比最大,達58.3%,產值達16億美元。由於戰略性地理利用以及在海洋環境中繁衍生息的優質品種的養殖,該領域繼續保持領先地位。海水養殖有助於減少對陸地和淡水資源的依賴,並可與負責任的環保實踐相結合。各國政府也透過支持性法規和基礎建設提供強而有力的支持,這提高了近海水產養殖的可行性,並促進了海洋養殖系統的推廣應用。

2024年,美國魚類養殖設備市場佔有59.2%的佔有率。美國市場正在向永續的魚類養殖方式轉型,並見證了消費者對海鮮的需求不斷成長。該地區的技術進步正在推動智慧監控設備和自動化系統的採用,從而提高了農場的整體生產力和環保合規性。

全球魚類養殖設備市場的領先公司包括 CPI Equipment、Frea Aquaculture Solutions、PentairAES、eWater Aquaculture Equipment Technology Limited、Merck & Co. Inc.、Grundfos Holding A/S、Morenot、ABB、LINN Geratebau、Asakua、Innovasea、Petal、Morenot、ABB、LINN Geratebau、Asakua、Innovasea、Peer Group、PTO、MC、A閾、alin、B有 A影響 A影響 A想法。為了保持競爭優勢,魚類養殖設備市場的公司將技術創新和永續性放在首位。許多領先的公司,如 Innovasea、ABB 和 AKVA Group,都在投資研發,以提高其系統的效率和自動化能力。人們越來越重視整合人工智慧、即時監控工具和物聯網感測器,以簡化餵食、水質控制和魚類健康追蹤。企業正在透過與區域水產養殖公司和政府建立策略合作夥伴關係,擴大其在新興市場的影響力。基於物種類型和水質條件的產品客製化也有助於品牌佔領利基市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 海鮮需求不斷成長

- 魚類養殖投資增加

- 技術進步

- 產業陷阱與挑戰

- 資本和營運成本高

- 創新技術採用率緩慢

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依設備類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按設備類型,2021 - 2034 年

- 主要趨勢

- 水處理系統

- 曝氣器

- 泵浦

- 過濾系統

- 紫外線消毒器

- 監控系統

- 清潔和廢棄物管理

- 收割和平整設備

- 籠養系統和圍欄

- 其他

- 水處理系統

第6章:市場估計與預測:按魚類類型,2021 - 2034 年

- 主要趨勢

- 鮭魚

- 鯰魚

- 鱒魚

- 鯉魚

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 淡水

- 海洋/海水

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 商業養魚場

- 研究與學術機構

- 政府漁業

- 小型農場

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ABB

- AKVA Group

- Asakua

- CPI Equipment

- eWater Aquaculture Equipment Technology Limited

- Frea Aquaculture Solutions

- Grundfos Holding A/S

- Innovasea

- INVE Aquaculture

- LINN Geratebau

- Merck & Co. Inc.

- Morenot

- PentairAES

- Pioneer Group

- Xylem

The Global Fish Farming Equipment Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 4.8 billion by 2034. This growth reflects the rising global demand for seafood and an increasing emphasis on food security. The market encompasses a broad range of equipment, including tanks, aeration systems, feeding units, filtration technologies, water quality monitors, and various automated monitoring devices. As the aquaculture sector evolves, the push for sustainable and high-efficiency equipment becomes stronger. These tools help maximize fish health, improve growth rates, and enhance operational productivity, all while minimizing the environmental footprint.

Governments worldwide are encouraging modern aquaculture practices by investing in infrastructure and regulating sustainability guidelines. Technological integration, including automation, IoT, and smart analytics, is transforming the way fish farms are managed, allowing for real-time observation of environmental parameters and fish conditions. These innovations not only increase efficiency but also reduce manual labor costs. As recirculating aquaculture systems and offshore fish farming practices continue to expand, the need for specialized and advanced equipment is set to grow, creating new business opportunities for manufacturers and suppliers globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 5.5% |

The cage systems and pens segment generated USD 769.5 million in 2024. These systems dominate the market due to their scalability, flexibility, cost-effectiveness, and ease of installation. Their adaptability to various aquatic environments-ranging from freshwater to saltwater-makes them a preferred choice among fish farmers. Cage systems and pens support a wide variety of species, making them highly versatile for different aquaculture operations.

The marine or seawater segment held the largest share in 2024, accounting for 58.3% share and generating USD 1.6 billion. This segment continues to lead due to strategic geographic utilization and the farming of premium species that thrive in marine environments. Seawater farming helps reduce reliance on land and freshwater sources and can be paired with responsible environmental practices. Governments are also providing strong backing through supportive regulations and infrastructure development, which enhances the viability of offshore aquaculture operations and promotes the use of marine-based farming systems.

U.S. Fish Farming Equipment Market held a 59.2% share in 2024. The U.S. market is transitioning toward sustainable fish farming approaches and witnessing growing consumer demand for seafood. Technological advancements in this region are leading to the adoption of smart monitoring equipment and automated systems, enhancing overall farm productivity and environmental compliance.

Leading companies in the Global Fish Farming Equipment Market include CPI Equipment, Frea Aquaculture Solutions, PentairAES, eWater Aquaculture Equipment Technology Limited, Merck & Co. Inc., Grundfos Holding A/S, Morenot, ABB, LINN Geratebau, Asakua, Innovasea, Pioneer Group, INVE Aquaculture, AKVA Group, and Xylem. To maintain their competitive edge, companies in the fish farming equipment market are prioritizing technological innovation and sustainability. Many leading firms like Innovasea, ABB, and AKVA Group are investing in R&D to enhance the efficiency and automation capabilities of their systems. There is a growing emphasis on integrating AI, real-time monitoring tools, and IoT sensors to streamline feeding, water quality control, and fish health tracking. Businesses are expanding their reach into emerging markets by forming strategic partnerships with regional aquaculture companies and governments. Product customization based on species type and water conditions is also helping brands capture niche market segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Fish type

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for seafood

- 3.2.1.2 Rising investments in fish farming

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and operating costs

- 3.2.2.2 Slow adoption rate of innovative technologies

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.1.1 Water treatment systems

- 5.1.1.1 Aerators

- 5.1.1.2 Pumps

- 5.1.1.3 Filtration systems

- 5.1.1.4 UV sterilizers

- 5.1.2 Monitoring and control systems

- 5.1.3 Cleaning and waste management

- 5.1.4 Harvesting and grading equipment

- 5.1.5 Cage systems and pens

- 5.1.6 Others

- 5.1.1 Water treatment systems

Chapter 6 Market Estimates and Forecast, By Fish Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Salmon

- 6.3 Catfish

- 6.4 Trout

- 6.5 Carp

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Freshwater

- 7.3 Marine/Sea water

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Commercial fish farms

- 8.3 Research & academic institutes

- 8.4 Government fisheries

- 8.5 Small-scale farms

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 AKVA Group

- 10.3 Asakua

- 10.4 CPI Equipment

- 10.5 eWater Aquaculture Equipment Technology Limited

- 10.6 Frea Aquaculture Solutions

- 10.7 Grundfos Holding A/S

- 10.8 Innovasea

- 10.9 INVE Aquaculture

- 10.10 LINN Geratebau

- 10.11 Merck & Co. Inc.

- 10.12 Morenot

- 10.13 PentairAES

- 10.14 Pioneer Group

- 10.15 Xylem