|

市場調查報告書

商品編碼

1797788

橘子罐頭市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Canned Oranges Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

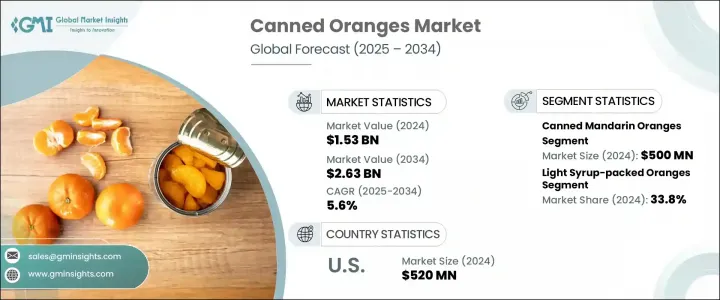

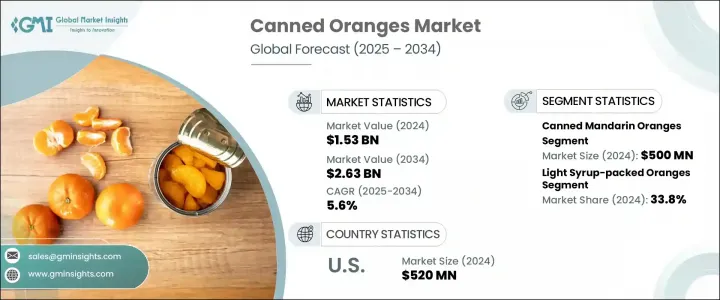

2024年全球罐裝柳橙市場規模達15.3億美元,預計到2034年將以5.6%的複合年成長率成長至26.3億美元。這一市場成長主要源自於消費者對便利、耐儲存水果產品的需求不斷成長,以及人們健康意識的不斷增強。此外,消費者也明顯傾向於使用清潔標籤、天然成分和低糖含量的產品。對永續包裝(包括不含BPA和可回收材料)的需求正在推動包裝領域的創新。鋁罐、鋼罐、玻璃罐和軟包裝袋越來越受歡迎,它們既是環保的替代品,又能確保產品的持久新鮮感。隨著全球永續發展目標和監管要求日益嚴格,製造商正在探索新的包裝解決方案以適應市場變化。

例如,某些地區推出了類似德國《一次性塑膠基金法案》的舉措,鼓勵生產商透過報告所用包裝材料來符合永續標準。此類法規正在推動罐裝食品和飲料行業的製造商重新評估其包裝策略。它不僅促進了問責制,還激勵企業向可回收、可重複使用和環保包裝形式的轉變。這些政策正在促進材料科學的創新,並促使企業採用可最大限度減少生態影響的替代品,例如不含雙酚A的內襯、可生物分解的聚合物以及輕質金屬或玻璃容器。隨著越來越多國家推出類似的環保法規,永續包裝正成為全球消費市場的關鍵競爭的優勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15.3億美元 |

| 預測值 | 26.3億美元 |

| 複合年成長率 | 5.6% |

罐裝柑橘在市場中佔據主導地位,2024 年價值達 5 億美元。預計該細分市場的複合年成長率為 6.3%。罐裝柳橙因其能夠全年提供新鮮水果風味、方便食用和保存期限長而備受青睞。該產品因其卓越的口感、天然的甜度以及對大部分營養成分的保留而備受青睞,使其成為家庭和餐飲業的理想選擇。罐裝柳橙用途廣泛,包括甜點、沙拉和飲料。這種多功能性,加上其符合品質和穩定性標準的能力,使其廣受歡迎。

在包裝方面,金屬罐,尤其是鋁罐和鋼罐,在2024年將繼續佔據市場佔有率的主導地位。這些材質因其耐用性、優異的保鮮性能和可回收性而備受青睞,能夠確保橙子罐頭長時間保鮮。此外,玻璃罐因其密封性和可重複使用性而備受追捧,尤其受到注重永續性和方便查看產品的消費者的青睞。同時,對不含BPA的塑膠容器以及諸如包裝袋和小袋等軟性包裝形式的需求也在不斷成長,這些包裝形式方便攜帶,符合健康和安全標準。

2024年,美國罐裝柳橙市場規模達5.2億美元。美國柑橘產量強勁,尤其是在佛羅裡達州和加利福尼亞州,確保了全年生產的穩定原料供應。預計美國對罐裝柳橙的需求將大幅成長,這主要得益於消費者對方便、耐儲存且健康食品的偏好。此外,低糖和高汁產品日益流行的趨勢也進一步推動了罐裝柳橙市場的發展,這與消費者對營養透明度和健康飲食習慣日益關注的趨勢一致。

罐裝柳橙市場格局適度整合,主要參與者包括都樂食品公司 (Dole Food Company, Inc.)、康尼格拉食品公司 (ConAgra Foods, Inc.)、太平洋海岸生產商 (Pacific Coast Producers)、塞內卡食品公司 (Seneca Foods Corporation) 和德爾蒙特食品公司 (Del Monte Foods Company)。這些公司正在透過產品創新、拓展分銷管道以及迎合消費者對更健康、更永續產品的偏好來鞏固其市場地位。為了鞏固市場地位,罐裝柳橙市場的公司專注於創新,尤其是在包裝和產品配方方面。隨著永續性日益成為優先事項,製造商正在採用環保包裝方案,例如不含雙酚A (BPA) 和可回收材料,這引起了注重健康和環保的消費者的共鳴。此外,一些公司正在透過降低糖含量和提供清潔標籤產品來增強其產品供應,以滿足日益成長的天然成分需求。另一項關鍵策略是利用本地生產和分銷能力拓展新興市場,使企業能夠滿足全球對罐裝柳橙日益成長的需求。製造商也致力於使其產品組合多樣化,包括各種罐裝柑橘,如柑橘和濃縮橙汁,以滿足廣泛消費者的喜好。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 整罐橙子

- 橙片罐頭

- 橘子罐頭

- 罐裝濃縮柳橙汁

第6章:市場估計與預測:依包裝類型,2021-2034

- 主要趨勢

- 金屬罐

- 鋁罐

- 鋼罐

- 玻璃罐

- 軟性袋

- 不含 BPA 的永續包裝解決方案

第7章:市場估計與預測:按包裝介質,2021-2034 年

- 主要趨勢

- 水浸橙子

- 淡糖漿橙子

- 濃糖漿橙子

- 富含天然果汁的橘子

第 8 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 零售分銷

- 超市和大賣場

- 便利商店

- 線上零售平台

- 特色食品店

- 餐飲服務分銷

- 餐廳和咖啡館

- 機構餐飲

- 學校和醫療機構

- 工業和 B2B 分銷

- 食品加工公司

- 烘焙和糖果行業

- 出口和國際貿易

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- ConAgra Foods, Inc.

- Del Monte Foods Company

- Dole Food Company, Inc.

- Fomdas Foods

- Kunyutj

- Pacific Coast Producers

- Roland Food

The Global Canned Oranges Market was valued at USD 1.53 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 2.63 billion by 2034. This market growth is largely driven by increasing consumer demand for convenient, shelf-stable fruit products, as well as growing health awareness. There is also a notable shift toward products with clean labels, natural ingredients, and lower sugar content. The demand for sustainably packaged options, including BPA-free and recyclable materials, is driving innovation in packaging. Aluminum and steel cans, glass jars, and flexible pouches are becoming increasingly popular, providing both eco-friendly alternatives and ensuring the long-lasting freshness of the product. As global sustainability goals and regulatory requirements become more stringent, manufacturers are adapting by exploring new packaging solutions.

For example, certain regions have introduced initiatives like Germany's Single-Use Plastics Fund Act, which encourages producers to align with sustainability standards by reporting packaging materials used. This kind of regulation is pushing manufacturers across the canned food and beverage industry to reevaluate their packaging strategies. It not only promotes accountability but also incentivizes the transition to recyclable, reusable, and environmentally responsible packaging formats. Such policies are fostering innovation in material science and driving companies to adopt alternatives that minimize ecological impact, such as BPA-free linings, biodegradable polymers, and lightweight metal or glass containers. As more countries adopt similar environmental mandates, sustainable packaging is becoming a key competitive differentiator in global consumer markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.53 Billion |

| Forecast Value | $2.63 Billion |

| CAGR | 5.6% |

The canned mandarin oranges segment holds a dominant position in the market, valued at USD 500 million in 2024. This segment is projected to grow at a CAGR of 6.3%. Canned oranges are in high demand due to their ability to provide fresh fruit flavor year-round, ease of use, and long shelf life. The product is favored for its superior taste, natural sweetness, and retention of most nutrients, making it an appealing option for both households and the food service industry. Canned oranges also have versatile applications, including desserts, salads, and beverages. This versatility, combined with their ability to meet quality and stability standards, drives their popularity.

In terms of packaging, metal cans, particularly aluminum and steel, continue to dominate the market share in 2024. These materials are favored for their durability, excellent preservation properties, and recyclability, ensuring that canned oranges remain fresh for extended periods. Additionally, glass jars are sought after for their airtight seals and reusability, particularly appealing to consumers who prioritize sustainability and the ability to view the product. Meanwhile, there has been a rising demand for BPA-free plastic containers and flexible packaging formats like pouches and sachets, which offer convenience, portability, and alignment with health and safety standards.

U.S. Canned Oranges Market was valued at USD 520 million in 2024. The country's robust citrus production, particularly in Florida and California, ensures a constant supply of raw materials for year-round production. The demand for canned oranges in the U.S. is anticipated to grow significantly, driven by consumer preference for convenient, shelf-stable foods that are perceived as healthy. Additionally, the growing trend toward low-sugar and juice-rich products further boosts the market for canned oranges, aligning with the increased consumer focus on nutritional transparency and healthy eating habits.

The Canned Oranges Market is moderately consolidated, with key players including Dole Food Company, Inc., ConAgra Foods, Inc., Pacific Coast Producers, Seneca Foods Corporation, and Del Monte Foods Company. These companies are strengthening their market presence through product innovation, expanding their distribution channels, and adapting to consumer preferences for healthier and more sustainable products. To strengthen their foothold, companies in the canned oranges market are focusing on innovation, particularly in packaging and product formulations. As sustainability becomes a growing priority, manufacturers are embracing eco-friendly packaging options, such as BPA-free and recyclable materials, which resonate with health-conscious and environmentally aware consumers. Additionally, some companies are enhancing their product offerings by reducing sugar content and providing clean-label products that cater to the rising demand for natural ingredients. Another key strategy involves expanding into emerging markets by leveraging local production and distribution capabilities, allowing businesses to meet the increasing global demand for canned oranges. Manufacturers are also focusing on diversifying their product portfolios to include a variety of canned citrus options, such as mandarin oranges and orange juice concentrate, to cater to a wide range of consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Packaging type trends

- 2.2.3 Packing medium trends

- 2.2.4 Distribution channel trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Whole Canned Oranges

- 5.3 Canned Orange Segments

- 5.4 Canned Mandarin Oranges

- 5.5 Canned Orange Juice Concentrate

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021-2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Metal Cans

- 6.2.1 Aluminum Cans

- 6.2.2 Steel Cans

- 6.3 Glass Jars

- 6.4 Flexible Pouches

- 6.5 BPA-Free and Sustainable Packaging Solutions

Chapter 7 Market Estimates and Forecast, By Packing Medium, 2021-2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Water-Packed Oranges

- 7.3 Light Syrup-Packed Oranges

- 7.4 Heavy Syrup-Packed Oranges

- 7.5 Natural Juice-Packed Oranges

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Retail Distribution

- 8.2.1 Supermarkets and Hypermarkets

- 8.2.2 Convenience Stores

- 8.2.3 Online Retail Platforms

- 8.2.4 Specialty Food Stores

- 8.3 Foodservice Distribution

- 8.3.1 Restaurants and Cafes

- 8.3.2 Institutional Catering

- 8.3.3 Schools and Healthcare Facilities

- 8.4 Industrial and B2B Distribution

- 8.4.1 Food Processing Companies

- 8.4.2 Bakery and Confectionery Industries

- 8.4.3 Export and International Trade

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 ConAgra Foods, Inc.

- 10.2 Del Monte Foods Company

- 10.3 Dole Food Company, Inc.

- 10.4 Fomdas Foods

- 10.5 Kunyutj

- 10.6 Pacific Coast Producers

- 10.7 Roland Food