|

市場調查報告書

商品編碼

1797782

汽車冷凝器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Condenser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

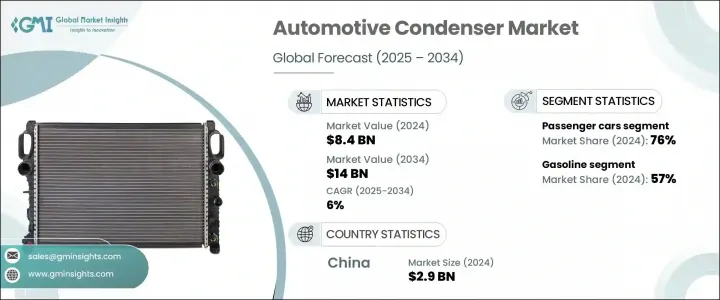

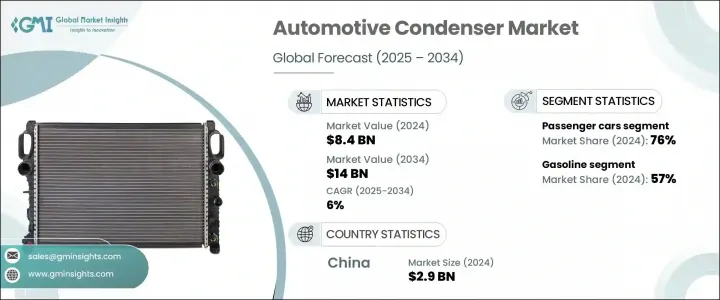

2024年,全球汽車冷凝器市場規模達84億美元,預計到2034年將以6%的複合年成長率成長,達到140億美元。電動車和下一代熱管理系統的持續轉型,正在顯著影響汽車冷凝器的開發和應用。隨著現代汽車採用更緊湊、更高效的部件,對先進冷媒流動、熱負荷平衡以及電動車專用暖通空調(HVAC)配置的技術能力的需求日益成長。這一發展趨勢促使原始設備製造商(OEM)和一級供應商優先考慮人才培養和專業培訓,以滿足新興需求。

汽車製造商正將重點轉向低GWP冷媒的使用、輕量化材料以及專為混合動力和電動平台量身定做的高效能冷凝器系統。這種技術轉型使得基於角色和特定任務的培訓至關重要,尤其是在熱系統維護、診斷和組件整合方面。培訓機構與私營部門之間加強合作,以培養熟練的勞動力,也推動了市場的成長。隨著汽車平台的不斷發展,確保產品在不同氣候區域的效率並保持最佳熱性能正成為全球製造商的關鍵考慮因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 84億美元 |

| 預測值 | 140億美元 |

| 複合年成長率 | 6% |

2024年,乘用車市場佔了76%的市場佔有率,預計2025年至2034年期間的複合年成長率為6.8%。此領域冷凝器的設計著重節省空間的結構、燃油經濟性以及符合冷媒的國際標準。汽車製造商正在透過整合高效輕量化的冷凝器單元來增強內燃機和電動車平台的性能,以支援座艙氣候控制和電池溫度調節。高產量,尤其是在亞太地區和歐洲地區,正在推動該領域的成長發揮至關重要的作用。

2024年,汽油動力汽車市場佔據57%的市場佔有率,預計2025-2034年的複合年成長率為7%。汽油車持續佔據主導地位,很大程度上得益於其在全球乘用車和輕型商用車領域的廣泛應用。由於這些車輛需要可靠的冷卻和除霧性能,汽車製造商正在推進鋁基冷凝器解決方案,以提供卓越的熱交換效率,同時保持成本效益和輕量化。設計創新對於提高熱效率和滿足此類車輛平台不斷變化的需求至關重要。

2024年,中國汽車冷凝器市場規模達29億美元,佔65%的市佔率。其領先地位得益於中國強大的汽車製造能力、成熟的供應鏈網路以及雄心勃勃的汽車電氣化發展策略。此外,國家在節能減排和冷媒替代方面的政策正在加速先進熱技術在國內汽車生產中的應用,從而鞏固中國在全球冷凝器市場的地位。

汽車冷凝器市場表現優異的公司包括 Modine Manufacturing Company、Valeo、Keihin、Sanden Holdings、Hanon Systems、Denso Corporation 和 MAHLE。這些參與者正在透過技術創新和營運規模來塑造市場。為了鞏固其在汽車冷凝器市場的競爭地位,領先的公司正在大力投資研發,以開發針對電動車和混合動力平台最佳化的高性能輕量化冷凝器解決方案。 Hanon Systems、Keihin 和 Modine 等製造商專注於設計緊湊、節能的設備,以滿足現代行動解決方案的熱需求。與汽車原始設備製造商合作開發特定於平台的熱管理系統是一項核心策略。許多公司也正在擴大全球生產設施並加強區域供應鏈,以確保更快的交付和本地合規性。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 全球汽車產量不斷成長

- 車輛空調系統需求不斷成長

- HVAC 系統的技術進步

- 政府支持電動車基礎設施和零件

- 轉向輕量化、緊湊型冷凝器設計

- 先進電池熱管理系統中冷凝器的整合

- 產業陷阱與挑戰

- 供應鏈中斷

- 嚴格的環境法規

- 市場機會

- 商用車隊的車輛電氣化程度提高

- 自動駕駛汽車對熱解決方案的需求

- 環保冷媒相容冷凝器技術的開發

- 新興經濟體售後市場需求擴大

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- 越野車

- 商用車

- 輕型

- 中型

- 重負

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 汽油

- 柴油引擎

- 電的

- 插電式混合動力

- 油電混合車

- 燃料電池汽車

第7章:市場估計與預測:依設計,2021 - 2034 年

- 主要趨勢

- 蛇紋石

- 平行流

- 管翅片

第8章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 鋁

- 銅

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 菲律賓

- 泰國

- 韓國

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- AVIC Xinhang

- Calsonic Kansei

- Chaoli Hi-Tech

- Delphi Technologies

- Denso

- Fawer

- Hanon Systems

- Keihin

- Koyorad

- LUZHOU North Chemical Industries

- MAHLE

- Mitsubishi Electric

- Modine Manufacturing Company

- Nissens Automotive A/S

- Pranav Vikas

- Sanden Holdings

- Tata AutoComp Systems

- Transpro

- Valeo

- Zhejiang Yinlun Machinery

The Global Automotive Condenser Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 14 billion by 2034. The ongoing transformation toward electric vehicles and next-generation thermal management systems is significantly influencing the development and adoption of automotive condensers. As modern vehicles incorporate more compact and efficient components, there is a growing need for technical proficiency in advanced refrigerant flow, thermal load balancing, and EV-specific HVAC configurations. This evolution is prompting both OEMs and Tier-1 suppliers to prioritize workforce development and specialized training to align with emerging demands.

Automotive manufacturers are shifting focus toward low-GWP refrigerant usage, lightweight materials, and high-efficiency condenser systems tailored for hybrid and electric platforms. This technological transition has made role-based and task-specific training essential, especially in thermal systems maintenance, diagnostics, and component integration. The market's growth is also being supported by increased collaboration between training institutions and the private sector to produce a skilled labor force. As automotive platforms continue to evolve, ensuring product efficiency across climate zones and maintaining optimal thermal performance is becoming a key consideration for global manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $14 Billion |

| CAGR | 6% |

The passenger cars segment held a 76% share in 2024 and is expected to grow at a CAGR of 6.8% between 2025 and 2034. Condensers in this segment are being designed with an emphasis on space-saving architecture, fuel economy, and compliance with international standards for refrigerants. Automakers are enhancing both internal combustion engine and electric vehicle platforms by integrating high-efficiency, lightweight condenser units to support cabin climate control and battery temperature regulation. High production volumes, particularly across Asia-Pacific and Europe, are playing a vital role in propelling growth in this segment.

The gasoline-powered vehicles segment held a 57% share in 2024, with growth projected at a CAGR of 7% during 2025-2034. The sustained dominance of gasoline vehicles is largely due to their widespread global presence in both passenger and light commercial segments. As these vehicles demand reliable cooling and defogging performance, automakers are advancing aluminum-based condenser solutions that deliver excellent heat exchange efficiency while remaining cost-effective and lightweight. Design innovation remains central to improving thermal efficiency and meeting evolving vehicle platform needs in this category.

China Automotive Condenser Market generated USD 2.9 billion and held a 65% share in 2024. Its leadership position is supported by the country's vast vehicle manufacturing capacity, established supply chain networks, and ambitious push for vehicle electrification. Additionally, national policies around energy savings, emissions control, and refrigerant substitution are accelerating the deployment of advanced thermal technologies in domestic vehicle production, thereby reinforcing China's stronghold in the global condenser market.

The top-performing companies in the Automotive Condenser Market include Modine Manufacturing Company, Valeo, Keihin, Sanden Holdings, Hanon Systems, Denso Corporation, and MAHLE. These players are shaping the market through technological innovation and operational scale. To reinforce their competitive position in the automotive condenser market, leading companies are heavily investing in R&D to develop high-performance and lightweight condenser solutions optimized for EVs and hybrid platforms. Manufacturers like Hanon Systems, Keihin, and Modine are focused on designing compact and energy-efficient units that meet the thermal demands of modern mobility solutions. Collaboration with automotive OEMs to co-develop platform-specific thermal management systems is a core strategy. Many companies are also expanding global production facilities and enhancing regional supply chains to ensure faster delivery and local compliance.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Design

- 2.2.5 Material

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global vehicle production

- 3.2.1.2 Growing demand for vehicle air conditioning system

- 3.2.1.3 Technological advancements in HVAC systems

- 3.2.1.4 Government supports EV infrastructure and components

- 3.2.1.5 Shift towards lightweight, compact condenser designs

- 3.2.1.6 Integration of condensers in advanced battery thermal management systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruptions

- 3.2.2.2 Stringent environmental regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Increased vehicle electrification in commercial fleets

- 3.2.3.2 Demand for thermal solutions in autonomous vehicles

- 3.2.3.3 Development of eco-friendly refrigerant-compatible condenser technologies

- 3.2.3.4 Expansion of aftermarket demand in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light duty

- 5.3.2 Medium duty

- 5.3.3 Heavy duty

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

- 6.4.1 PHEV

- 6.4.2 HEV

- 6.4.3 FCEV

Chapter 7 Market Estimates & Forecast, By Design, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Serpentine

- 7.3 Parallel flow

- 7.4 Tube and fin

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Aluminium

- 8.3 Copper

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Indonesia

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 South Korea

- 10.4.9 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AVIC Xinhang

- 11.2 Calsonic Kansei

- 11.3 Chaoli Hi-Tech

- 11.4 Delphi Technologies

- 11.5 Denso

- 11.6 Fawer

- 11.7 Hanon Systems

- 11.8 Keihin

- 11.9 Koyorad

- 11.10 LUZHOU North Chemical Industries

- 11.11 MAHLE

- 11.12 Mitsubishi Electric

- 11.13 Modine Manufacturing Company

- 11.14 Nissens Automotive A/S

- 11.15 Pranav Vikas

- 11.16 Sanden Holdings

- 11.17 Tata AutoComp Systems

- 11.18 Transpro

- 11.19 Valeo

- 11.20 Zhejiang Yinlun Machinery