|

市場調查報告書

商品編碼

1797781

小型運載火箭 (SLV) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Small Launch Vehicle (SLV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

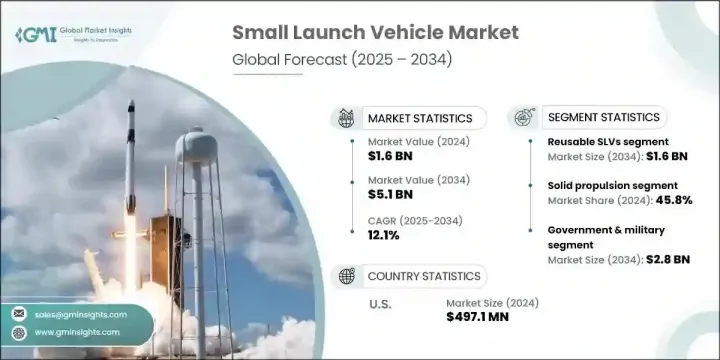

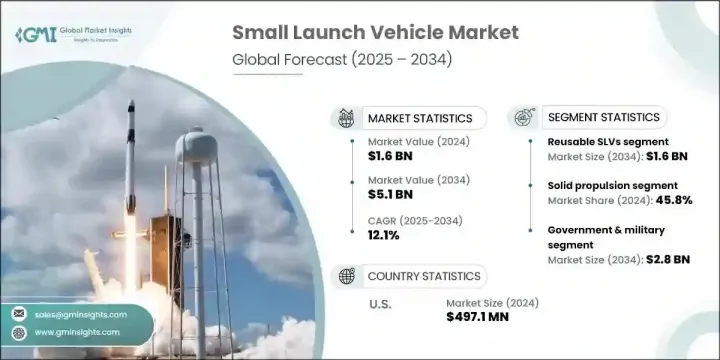

2024 年全球小型運載火箭市場規模達 16 億美元,預計到 2034 年將以 12.1% 的複合年成長率成長,達到 51 億美元。該市場擴張的主要動力來自航太商業化的不斷推進以及向低成本、更靈活的發射解決方案的轉變。隨著私人實體深入參與衛星部署、分析和天基服務,該產業正經歷創新、可負擔性和服務客製化的快速轉變。不斷發展的商業航太格局催生了電信、地球成像和物聯網系統等領域更專業化的商業模式,進一步刺激了小型運載火箭的需求。從共享發射有效載荷到客製化發射計畫和客製化軌道交付的轉變,推動了對響應迅速且針對特定任務的運載火箭設計的需求。

隨著對更快部署週期和更高發射頻率的需求日益成長,營運商必須打造低成本、適應性強的系統,以支援快速週轉和更強大的任務控制。隨著商業和政府航太任務越來越重視按需進入軌道,對可擴展、模組化發射解決方案的需求變得至關重要。營運商正在轉向精益製造、積層製造方法和簡化的設計架構,以縮短開發時間並簡化整合流程。這些靈活的系統旨在適應各種有效載荷,同時支援在最後一刻調整軌道參數,這對於對地觀測、國防通訊和災難響應等時間敏感的應用至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 51億美元 |

| 複合年成長率 | 12.1% |

2024年,固體推進系統市場以45.8%的市佔率領先市場。固體推進系統憑藉其可靠性、易於整合和儲存優勢,仍然是快速反應、亞軌道和國防相關任務的首選。新進入者傾向於採用固體基運載火箭(SLV),以最大限度地降低設計複雜性並簡化發射準備。供應商將固體燃料運載火箭定位於策略性用例,在這些用例中,簡單性和可靠性是首要考慮因素。

可重複使用發射系統正日益被採用,以降低單次發射成本並縮短週轉時間。預計到2034年,可重複使用運載火箭(SLV)市場規模將達16億美元。許多參與者正專注於可重複使用性,開發用於回收、翻新和重新發射的可擴展硬體。事實證明,這些技術對於減少浪費、降低營運成本以及支援頻繁軌道存取的長期環境和經濟永續性至關重要。

2024年,北美小型運載火箭 (SLV) 市場佔據34.6%的市場佔有率,預計到2034年將以11.1%的複合年成長率成長。憑藉雄厚的資金支持、日益加強的政府與私營部門合作,以及由小型衛星製造商和營運商組成的強大生態系統,該地區在全球SLV產業中處於領先地位。為了滿足國家安全和商業需求,該地區正大幅轉向更快速、更靈活的發射方式。

影響全球小型運載火箭 (SLV) 市場的關鍵參與者包括 C6 Launch、Astra Space、Agnikul Cosmos、Interstellar Technologies、Galactic Energy、Firefly 航太、CAS Space、ABL Space Systems、HyImpulse 和 Dawn 航太。活躍於小型運載火箭市場的公司正在加強在創新、可重複使用性和特定任務配置方面的力度。許多公司正在投資模組化發射系統和可重複使用的階段開發,以提供具有成本效益和頻繁的部署週期。與衛星製造商和航太機構的策略合作有助於擴大客戶範圍並增強信譽。越來越多的公司也專注於垂直整合,控制從零件製造到發射後資料服務的每個步驟,確保品質、降低成本並加快產品上市時間。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對小型衛星和衛星星座的需求不斷成長

- 太空商業化程度不斷提高

- 對經濟高效且專用的發射服務的需求

- 國防和國家安全應用的成長

- 低成本發射基礎設施的擴展

- 產業陷阱與挑戰

- 新進入者的開發和發布成本高昂

- SLV的酬載容量限制

- 市場機會

- 基於星座的衛星部署需求激增

- 新興航太國家擴大採用SLV

- 整合可重複使用科技以提高成本效率

- 擴展按需和快速啟動服務

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 新興商業模式

- 合規性要求

- 國防預算分析

- 全球國防開支趨勢

- 區域國防預算分配

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 重點國防現代化項目

- 預算預測(2025-2034)

- 對產業成長的影響

- 各國國防預算

- 供應鏈彈性

- 地緣政治分析

- 勞動力分析

- 數位轉型

- 合併、收購和策略夥伴關係格局

- 風險評估與管理

- 主要合約授予(2021-2024)

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各區域市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按推進類型,2021 - 2034 年

- 主要趨勢

- 固體推進

- 液態推進

- 混合動力推進

第6章:市場估計與預測:按產能,2021 - 2034 年

- 主要趨勢

- 最多 100 公斤

- 100-500公斤

- 500-1000公斤

- 1000 -2000公斤

第7章:市場估計與預測:依可重複使用性,2021 - 2034 年

- 主要趨勢

- 可重複使用的 SLV

- 不可重複使用的 SLV

第8章:市場估計與預測:按發布平台,2021 - 2034 年

- 主要趨勢

- 陸基

- 海基

- 空基

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 政府與軍隊

- 國防機構

- 民用航太機構

- 國家安全組織

- 公共研究機構和大學

- 其他

- 商業的

- 衛星營運商

- 太空新創公司和技術演示者

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Global Key Players

- Regional Key Players

- 利基市場參與者/顛覆者

- 黎明航太

- 銀河能量

The Global Small Launch Vehicle Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 12.1% to reach USD 5.1 billion by 2034. Expansion in this market is largely driven by the increasing commercialization of space and a shift toward lower-cost and more agile launch solutions. As private entities deepen their involvement in satellite deployment, analytics, and space-based services, the industry is witnessing rapid shifts in innovation, affordability, and service customization. This evolving commercial space landscape is giving rise to more specialized business models across telecommunications, Earth imaging, and IoT-enabled systems, further fueling SLV demand. The shift from shared launch payloads to tailored schedules and customized orbital delivery is pushing the need for responsive and mission-specific vehicle design.

Growing demand for faster deployment cycles and greater launch frequency is compelling operators to create low-cost, adaptable systems that support rapid turnaround and increased mission control. As commercial and governmental space missions increasingly prioritize on-demand access to orbit, the need for scalable, modular launch solutions has become critical. Operators are shifting toward lean manufacturing, additive production methods, and simplified design architectures to reduce development timelines and streamline integration. These agile systems are built to accommodate a wide variety of payloads while enabling last-minute adjustments to orbital parameters, which is essential for time-sensitive applications such as Earth observation, defense communication, and disaster response.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 12.1% |

The solid propulsion segment led the market in 2024 with a 45.8% share. Solid propulsion systems remain a preferred choice for rapid-response, suborbital, and defense-related missions due to their reliability, ease of integration, and storage benefits. New entrants are leaning on solid-based SLVs to minimize design complexity and streamline launch readiness. Providers are positioning solid-fueled vehicles for strategic use cases where simplicity and dependability are top priorities.

The reusable launch systems are increasingly being adopted to cut per-launch expenses and increase turnaround times. The reusable SLV segment is projected to reach USD 1.6 billion by 2034. Many players are focusing on reusability by developing scalable hardware for recovery, refurbishment, and relaunch. These technologies are proving essential in reducing waste, lowering operational costs, and supporting long-term environmental and economic sustainability for frequent orbital access.

North America Small Launch Vehicle (SLV) Market held 34.6% share in 2024 and is projected to grow at a CAGR of 11.1% through 2034. With strong financial backing, increasing government-private sector collaboration, and a robust ecosystem of small satellite manufacturers and operators, the region is at the forefront of the global SLV industry. There's a marked shift toward faster, more flexible launch options catering to national security and commercial demands alike.

Key players shaping the Global Small Launch Vehicle (SLV) Market include C6 Launch, Astra Space, Agnikul Cosmos, Interstellar Technologies, Galactic Energy, Firefly Aerospace, CAS Space, ABL Space Systems, HyImpulse, and Dawn Aerospace. Companies active in the small launch vehicle market are intensifying their efforts around innovation, reusability, and mission-specific configurations. Many are investing in modular launch systems and reusable stage development to offer cost-effective and frequent deployment cycles. Strategic collaborations with satellite manufacturers and space agencies help extend their client reach and bolster credibility. A growing number of firms are also focusing on vertical integration, controlling every step from component fabrication to post-launch data services, ensuring quality, reducing costs, and speeding up time-to-market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Propulsion type trends

- 2.2.2 Capacity trends

- 2.2.3 Reusability trends

- 2.2.4 Launch platform trends

- 2.2.5 End use trends

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for small satellites and satellite constellations

- 3.2.1.2 Increasing commercialization of space

- 3.2.1.3 Demand for cost-effective and dedicated launch services

- 3.2.1.4 Growth in defense and national security applications

- 3.2.1.5 Expansion of low-cost launch infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and launch costs for new entrants

- 3.2.2.2 Payload capacity limitations of SLVs

- 3.2.3 Market opportunities

- 3.2.3.1 Surge in demand for constellation-based satellite deployments

- 3.2.3.2 Growing adoption of SLVs in emerging space nations

- 3.2.3.3 Integration of reusable technologies to enhance cost efficiency

- 3.2.3.4 Expansion of on-demand and rapid launch services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Propulsion Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Solid propulsion

- 5.3 Liquid propulsion

- 5.4 Hybrid propulsion

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Upto 100 kg

- 6.3 100-500 kg

- 6.4 500-1000 kg

- 6.5 1000 -2000 kg

Chapter 7 Market Estimates and Forecast, By Reusability, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Reusable SLVs

- 7.3 Non-reusable SLVs

Chapter 8 Market Estimates and Forecast, By Launch Platform, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Land-based

- 8.3 Sea-based

- 8.4 Air-based

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.1.1 Government & Military

- 9.1.2 Defense agencies

- 9.1.3 Civil space agencies

- 9.1.4 National security organizations

- 9.1.5 Public research institutions & universities

- 9.1.6 Others

- 9.2 Commercial

- 9.2.1 Satellite operators

- 9.2.2 Space startups & technology demonstrators

- 9.2.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Rocket Lab

- 11.1.2 Virgin

- 11.1.3 Relativity Space

- 11.1.4 Firefly Aerospace

- 11.1.5 Isar Aerospace

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 ABL Space Systems

- 11.2.1.2 Astra Space

- 11.2.1.3 X-Bow Systems

- 11.2.2 Europe

- 11.2.2.1 Rocket Factory Augsburg

- 11.2.2.2 Orbex

- 11.2.2.3 Skyrora Limited

- 11.2.2.4 HyImpulse

- 11.2.2.5 PLD Space

- 11.2.3 APAC

- 11.2.3.1 Agnikul Cosmos

- 11.2.3.2 Skyroot Aerospace

- 11.2.3.3 CAS Space

- 11.2.3.4 Interstellar Technologies

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 Dawn Aerospace

- 11.3.2 Galactic Energy