|

市場調查報告書

商品編碼

1797780

電動堆高機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Forklift Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

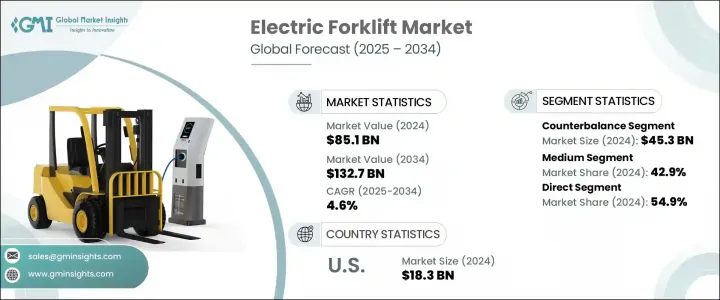

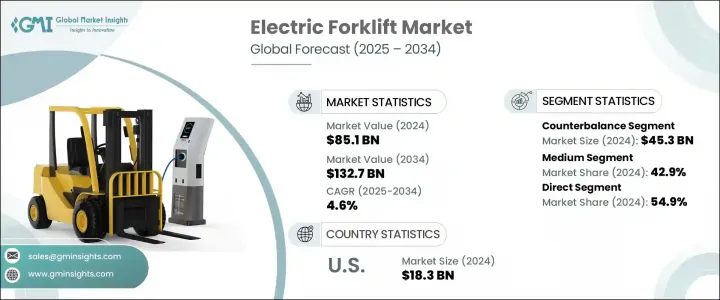

2024年,全球電動堆高機市場規模達851億美元,預計2034年將以4.6%的複合年成長率成長,達到1327億美元。這項穩定成長的動力源自於內燃機向更永續的電池驅動型替代能源的持續轉變。隨著各行各業尋求更清潔、更具成本效益的物料搬運解決方案,電動堆高機在物流、倉儲、製造和零售領域正獲得顯著發展。對環保營運和更低總擁有成本的日益成長的需求,促使企業採用排放更低、噪音更小、效率更高的電動堆高機。隨著各國政府和監管機構持續推行更嚴格的排放標準,電動堆高機正成為許多已開發經濟體和發展中經濟體的首選。

推動成長的關鍵因素是電池技術的快速發展。雖然鉛酸電池歷來為大多數電動堆高機提供動力,但它們的充電週期長且維護成本高。相較之下,鋰離子電池憑藉著更快的充電速度、更高的能量密度和極低的維護要求,正在重塑市場。它們還支援“隨機充電”,允許操作員在短暫的操作中斷期間補充電池電量,而不會縮短電池壽命。此功能有助於提高生產率,使機器能夠在整個工作日內更長時間地運作。氫燃料電池技術的興起也日益受到關注,尤其是在要求嚴格的工業應用中。這些系統提供超快速的加氫能力(通常不到三分鐘),並延長了運行時間,從而實現一致、不間斷的工作流程。在需要最大程度減少停機時間且長班次較為常見的領域,燃料電池正成為實用的替代方案。一些製造商正在利用氫燃料電池系統,與電池供電設備相比,將停機時間減少了兩位數的百分比。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 851億美元 |

| 預測值 | 1327億美元 |

| 複合年成長率 | 4.6% |

在所有產品類型中,平衡重型動力堆高機市場在2024年創造了453億美元的市場規模,預計在2025年至2034年期間的複合年成長率將達到3.5%。這類車款佔全球堆高機總銷量的近60%,憑藉著多功能性和便利的操作,仍是市場上的主力車款。這類堆高機的結構包括後部配重,可在提升前端重型負載時提供穩定性,使其成為高容量、高頻率起重環境的理想選擇。

2024年,中型電動堆高機市場佔42.9%的市場佔有率,預計2025年至2034年的複合年成長率為5.1%。這類車型在需要兼顧起重能力和機動性的作業中備受青睞,例如汽車、製造、港口和配送中心。隨著鋰離子電池技術的進步,其能量密度已高達200瓦時/公斤(比幾年前的水平高出一倍多),這些堆高機現在可以延長班次運行時間,並且只需1到2個小時即可充滿電,進一步提升了其實用性。

美國電動堆高機市場在2024年創下了183億美元的產值,預計到2034年將以5.3%的複合年成長率成長。美國領先的地位歸功於其完善的製造業基礎設施、自動化驅動的營運模式以及強力的永續發展監管。蓬勃發展的電子商務和倉儲行業推動了堆高機需求的飆升,而電動堆高機的營運成本和排放更低。美國也受益於強大的製造商和分銷商基礎、廣泛的服務網路以及熟練的勞動力,使其成為電動堆高機創新和部署領域的全球領導者。

引領全球電動堆高機市場的關鍵參與者包括海斯特-耶魯物料搬運公司、豐田物料搬運、三菱 Logisnext 有限公司、凱傲集團和永恆力股份公司。在競爭策略方面,主要電動堆高機製造商正在積極投資研發,以增強電池技術、系統整合和智慧車隊管理平台。許多製造商專注於模組化電池組和可擴展能源系統,以適應不同的應用需求。與能源公司和基礎設施供應商的合作有助於簡化電池充電和加氫站。製造商也在努力提高遠端資訊處理和遠端診斷能力,使車隊營運商能夠監控性能、安排維護並最佳化車隊利用率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業影響力量

- 成長動力

- 電池技術的進步

- 環境法規與永續發展目標

- 電子商務和倉儲的成長

- 產業陷阱與挑戰

- 初期投資成本高

- 重型能力有限

- 機會

- 向新興市場擴張

- 與智慧倉儲整合

- 快速充電和可更換電池解決方案的開發

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 抗衡

- 倉庫堆高機

- 堆高機和堆高機

- 前移式堆高機

- 其他

第6章:市場估計與預測:依產能,2021-2034

- 主要趨勢

- 小型(3噸以下)

- 中型(3-10噸)

- 重型(10噸以上)

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 工廠

- 倉庫

- 零售店

- 食品和製藥

- 建築工地

- 其他

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- Anhui Heli Co., Ltd.

- Clark Material Handling Company

- Crown Equipment Corporation

- Doosan Industrial Vehicle Co., Ltd.

- EP Equipment Co., Ltd.

- Hangcha Group Co., Ltd.

- Hyster-Yale Materials Handling, Inc.

- Hyundai Material Handling

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Lonking Holdings Limited

- Mitsubishi Logisnext Co., Ltd.

- Noblelift Intelligent Equipment Co., Ltd.

- Toyota Material Handling

The Global Electric Forklift Market was valued at USD 85.1 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 132.7 billion by 2034. This steady growth is being driven by the ongoing transition from internal combustion engines to more sustainable, battery-powered alternatives. As industries seek cleaner and more cost-efficient material handling solutions, electric forklifts are gaining significant traction across logistics, warehousing, manufacturing, and retail sectors. The growing demand for environmentally friendly operations and lower total cost of ownership is pushing businesses to adopt electric forklift models that offer reduced emissions, less noise, and improved efficiency. With governments and regulatory bodies continuing to push stricter emissions standards, electric forklifts are becoming a preferred choice in many developed and developing economies.

A key factor driving growth is the rapid evolution in battery technologies. While lead-acid batteries have historically powered most electric forklifts, they suffer from lengthy charge cycles and ongoing maintenance. In contrast, lithium-ion batteries are reshaping the market by offering faster charging, higher energy density, and minimal maintenance requirements. They also support "opportunity charging," which allows operators to top up battery power during brief operational breaks without diminishing battery life. This feature helps improve productivity by keeping machines operational longer throughout the workday. The emergence of hydrogen fuel cell technology is also gaining attention, especially for demanding industrial applications. These systems offer ultra-fast refueling-often under three minutes-and extended operation times that allow for consistent, uninterrupted workflow. Fuel cells are becoming a practical alternative where downtime needs to be minimized and long shifts are common. Several manufacturers are leveraging hydrogen-based systems to reduce downtime by double-digit percentages compared to battery-powered units.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $85.1 Billion |

| Forecast Value | $132.7 Billion |

| CAGR | 4.6% |

Among the product types, the counterbalance electric forklifts segment generated USD 45.3 billion in 2024 and is expected to grow at a CAGR of 3.5% between 2025 and 2034. These models represent nearly 60% of the total forklift units sold globally and remain the workhorse of the market due to their versatility and straightforward operation. Their construction includes rear counterweights that provide stability when lifting heavy front-end loads, making them ideal for high-capacity, high-frequency lifting environments.

The medium-capacity electric forklifts segment held 42.9% share in 2024 and is forecast to grow at a CAGR of 5.1% from 2025 to 2034. These models are favored in operations that demand a balance between lifting capacity and maneuverability-such as in automotive, manufacturing, ports, and distribution hubs. With lithium-ion battery advancements pushing energy densities as high as 200 Wh/kg-more than double what was available just a few years ago-these forklifts can now operate for extended shifts and recharge in just 1 to 2 hours, further enhancing their practicality.

United States Electric Forklift Market generated USD 18.3 billion in 2024 and is projected to grow at a CAGR of 5.3% through 2034. The country's leadership is attributed to its well-established manufacturing infrastructure, automation-driven operations, and a strong regulatory push for sustainability. The booming e-commerce and warehousing segments are contributing to soaring forklift demand, with electric models offering lower operating costs and emissions. The U.S. also benefits from a strong base of manufacturers and distributors, extensive service networks, and a skilled labor force, positioning it as a global leader in electric forklift innovation and deployment.

Key players leading the Global Electric Forklift Market include Hyster-Yale Materials Handling, Inc., Toyota Material Handling, Mitsubishi Logisnext Co., Ltd., KION Group AG, and Jungheinrich AG. In terms of competitive strategies, major electric forklift manufacturers are aggressively investing in research and development to enhance battery technologies, system integration, and intelligent fleet management platforms. Many are focusing on modular battery packs and scalable energy systems that adapt to diverse application needs. Collaborations with energy companies and infrastructure providers help streamline battery charging and hydrogen refueling stations. Manufacturers are also working to improve telematics and remote diagnostics capabilities, allowing fleet operators to monitor performance, schedule maintenance, and optimize fleet utilization.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021-2034

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Regional trends

- 2.2.3 Type trends

- 2.2.4 Capacity trends

- 2.2.5 End use trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in battery technology

- 3.2.1.2 Environmental regulations & sustainability goals

- 3.2.1.3 Growth of e-commerce and warehousing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Limited heavy-duty capabilities

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Integration with smart warehousing

- 3.2.3.3 Development of fast-charging and swappable battery solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Counterbalance

- 5.3 Warehouse Forklifts

- 5.3.1 Pallet jacks and stackers

- 5.3.2 Reach trucks

- 5.3.3 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Small (under 3 tons)

- 6.3 Medium (3-10 tons)

- 6.4 Heavy (over 10 tons)

Chapter 7 Market Estimates & Forecast, By End use, 2021-2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Factories

- 7.3 Warehouses

- 7.4 Retail stores

- 7.5 Food and pharma

- 7.6 Construction sites

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution channel, 2021-2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Anhui Heli Co., Ltd.

- 10.2 Clark Material Handling Company

- 10.3 Crown Equipment Corporation

- 10.4 Doosan Industrial Vehicle Co., Ltd.

- 10.5 EP Equipment Co., Ltd.

- 10.6 Hangcha Group Co., Ltd.

- 10.7 Hyster-Yale Materials Handling, Inc.

- 10.8 Hyundai Material Handling

- 10.9 Jungheinrich AG

- 10.10 KION Group AG

- 10.11 Komatsu Ltd.

- 10.12 Lonking Holdings Limited

- 10.13 Mitsubishi Logisnext Co., Ltd.

- 10.14 Noblelift Intelligent Equipment Co., Ltd.

- 10.15 Toyota Material Handling