|

市場調查報告書

商品編碼

1797773

通風雨幕牆市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ventilated Rainscreen Facade Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

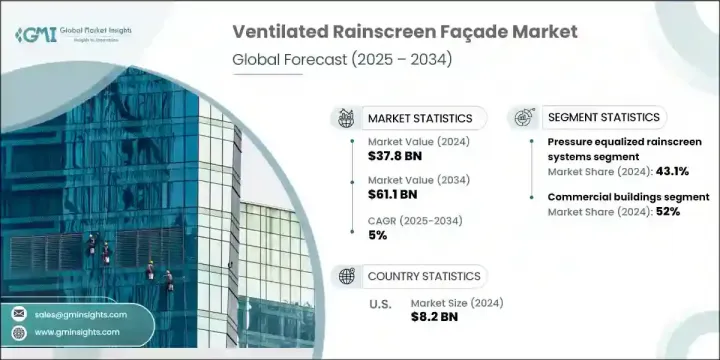

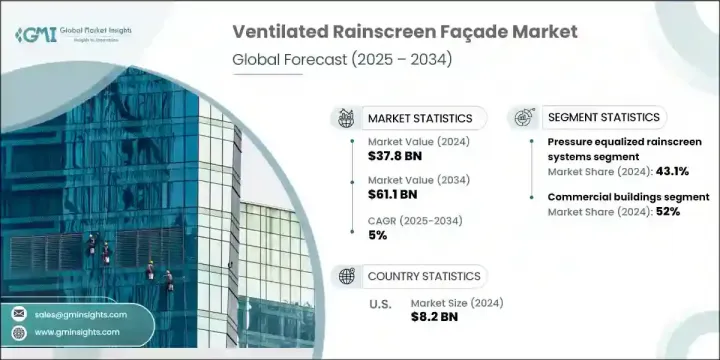

2024年,全球通風雨幕外牆市場規模達378億美元,預計2034年將以5%的複合年成長率成長,達到611億美元。對節能建築和現代建築設計日益成長的需求正在重塑外牆解決方案的模式。城鎮化和商業基礎設施的快速發展推動了對永續建築系統的需求。通風外牆系統因其能夠提供溫度調節、濕度管理和延長建築耐久性等功能而日益普及。教育、酒店和商業房地產等行業正擴大採用這些系統,以符合綠色建築標準和環境法規。美觀的多功能性與卓越的性能相結合,繼續吸引消費者的興趣,尤其是在優先考慮建築圍護結構效率的情況下。

為了滿足不斷變化的設計和性能需求,製造商正在投資新一代材料,包括鋁複合材料、纖維水泥和高壓層壓板,以確保結構完整性和視覺靈活性。這些外牆還支援被動式冷卻策略,透過降低對暖通空調 (HVAC) 的依賴,有助於降低不同氣候區域的營運能耗。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 378億美元 |

| 預測值 | 611億美元 |

| 複合年成長率 | 5% |

2024年,壓力平衡式雨幕系統引領全球市場,佔總營收的43.1%,預計到2034年將以5.4%的複合年成長率成長。這些系統因其先進的濕度和空氣管理能力而備受青睞,尤其是在高層建築和受風環境中。其內腔設計可平衡氣壓,有效減少滲水。隨著基礎設施性能要求的不斷提高,此類解決方案正成為現代設計理念不可或缺的一部分。它們能夠保護隔熱層並保持熱穩定性,有助於長期節能。

商業建築在2024年佔據了最大的市場佔有率,達到52%,預計在2025-2034年期間的複合年成長率將達到5.4%。高效且外觀獨特的商業房地產的興起是推動需求的主要因素。辦公大樓、購物中心和綜合用途開發項目都選擇通風立面系統,因為它們能夠改善室內氣候控制並降低整體能耗。這些系統在提升建築外觀吸引力的同時,也能提升資產性能,使其成為高密度城市建築的首選方案。隨著城市發展成為商業中心,兼具美觀和性能的立面對於市場競爭力日益重要。

2024年,美國通風雨幕立面市場佔據76%的市場佔有率,產值達82億美元。先進的建築實踐、嚴格的建築規範以及對能源效率的大力推動,共同支持了美國在該地區的主導地位。在建築改造專案和企業綠建築投資的推動下,高性能立面解決方案在商業和機構開發專案中已被廣泛採用。該地區具有韌性的基礎設施需求,加上成熟的製造基地,為壓力平衡立面系統的廣泛整合提供了支援。氣候因素和維護最佳化進一步促進了市場發展。

引領通風雨幕牆市場的關鍵企業包括 Trespa International、Benson Industries、Zahner、Simpson Strong-Tie、Cladding Corp、Enclos Corp、SFS Group (NV 1 Systems)、Kingspan Group、Powers Fasteners、ITW Construction Products、Central International、Permasteelisa North America、Walters & Wolf、Jamesie Industries。為了擴大影響力,領先的通風雨幕牆市場企業正在運用多項核心策略。這些策略包括大力投資材料創新,以提高耐候性、熱性能和設計適應性。企業強調與建築師和承包商的合作,為各種應用提供客製化解決方案。此外,企業也注重永續認證和綠色合規性,以吸引機構客戶。向新興建築市場的地理擴張,以及外牆系統設計和安裝流程的數位化,正在幫助企業提升服務交付和客戶體驗。此外,企業正在優先考慮改造解決方案和節能升級,以服務新建和翻新建築行業。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 節能建築解決方案的需求

- 偏愛現代建築美學

- 支持性綠建築法規

- 產業陷阱與挑戰

- 安裝和材料成本高

- 發展中地區認知度較低

- 機會

- 老化建築的改造需求

- 新興經濟體的擴張

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依系統類型

- 監理框架

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按系統類型,2021 - 2034 年(十億美元)

- 主要趨勢

- 壓力平衡雨幕系統

- 排水和回風系統

- 通風腔系統

- 跨系統分析

第6章:市場估計與預測:按材料類型,2021-2034 年(十億美元)

- 主要趨勢

- 金屬複合材料

- 纖維水泥板

- 天然石板

- 陶瓷和陶土板

- 高壓層壓板

第7章:市場估計與預測:按應用,2021 - 2034 年(十億美元)

- 主要趨勢

- 商業建築

- 住宅建築

- 工業建築

- 機構建築

第8章:市場估計與預測:按地區,2021 - 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Benson Industries

- Centria International

- Cladding Corp

- Enclos Corp

- Hilti Corporation

- ITW Construction products

- James Hardie Industries

- Kingspan Group

- Permasteelisa North America

- Power Fasteners

- SFS Group (NV1 Systems)

- Simpson Strong-Tie

- Trespa International

- Walters & Wolf

- Zahner

The Global Ventilated Rainscreen Facade Market was valued at USD 37.8 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 61.1 billion by 2034. The growing demand for energy-efficient construction and modern architectural design is reshaping the facade solutions landscape. Urbanization and the rapid growth of commercial infrastructure are fueling the need for sustainable building systems. Ventilated facade installations are gaining popularity due to their ability to offer thermal regulation, moisture management, and extended building durability. Industries such as education, hospitality, and commercial real estate are increasingly incorporating these systems to align with green building standards and environmental regulations. Aesthetic versatility combined with performance continues to drive consumer interest, especially where building envelope efficiency is prioritized.

To meet evolving design and performance demands, manufacturers are investing in next-generation materials, including aluminum composites, fiber cement, and high-pressure laminates, to ensure structural integrity and visual flexibility. These facades also support passive cooling strategies, helping reduce operational energy use in varied climate zones by lowering HVAC dependency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.8 Billion |

| Forecast Value | $61.1 Billion |

| CAGR | 5% |

In 2024, pressure-equalized rainscreen systems led the global market, representing 43.1% of total revenue, and are expected to grow at a 5.4% CAGR through 2034. These systems are preferred for their advanced moisture and air management capabilities, especially in high-rise and wind-exposed environments. Their internal cavity design allows for equalized air pressure, effectively minimizing water ingress. With the rise in infrastructure performance requirements, such solutions are becoming integral to modern design philosophies. Their capacity to protect insulation layers and maintain thermal stability contributes to long-term energy savings.

The commercial structures held the largest share of the market in 2024, accounting for 52% share, and are anticipated to grow at a CAGR of 5.4% during 2025-2034. The rise of high-efficiency and visually distinctive commercial properties is a major factor driving demand. Office towers, shopping centers, and mixed-use developments are opting for ventilated facade systems for their ability to improve indoor climate control and reduce overall energy usage. These systems enhance exterior appeal while boosting asset performance, making them a go-to option for densely occupied urban buildings. As cities evolve into business hubs, facades that deliver on both aesthetics and performance are increasingly vital to market competitiveness.

U.S. Ventilated Rainscreen FaASade Market held 76% share in 2024, generating USD 8.2 billion. This regional dominance is supported by advanced construction practices, stringent building codes, and a strong push for energy efficiency. High-performing facade solutions are widely adopted across commercial and institutional developments, driven by retrofitting initiatives and corporate green building investments. The region's resilient infrastructure needs, paired with a sophisticated manufacturing base, support the widespread integration of pressure-equalized facade systems. Climate considerations and maintenance optimization further contribute to market momentum.

Key companies shaping the Ventilated Rainscreen FaASade Market include Trespa International, Benson Industries, Zahner, Simpson Strong-Tie, Cladding Corp, Enclos Corp, SFS Group (NV 1 Systems), Kingspan Group, Powers Fasteners, ITW Construction Products, Central International, Permasteelisa North America, Walters & Wolf, James Hardie Industries, and Hilti Corporation. To expand their presence, leading Ventilated Rainscreen FaASade Market companies are leveraging several core strategies. These include heavy investment in material innovation for improved weather resistance, thermal performance, and design adaptability. Collaboration with architects and contractors is being emphasized to deliver customized solutions for varied applications. Companies are also focusing on sustainability certifications and green compliance to attract institutional clients. Geographic expansion into emerging construction markets, along with digitalization in facade system design and installation processes, is helping firms enhance service delivery and customer experience. Additionally, retrofitting solutions and energy-efficient upgrades are being prioritized to serve both new construction and renovation sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 By system type

- 2.2.2 By material type

- 2.2.3 By application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demand for energy-efficient building solutions

- 3.2.1.2 Preference for modern architectural aesthetics

- 3.2.1.3 Supportive green building regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High installation and material costs

- 3.2.2.2 Low awareness in developing regions

- 3.2.3 Opportunities

- 3.2.3.1 Retrofit demand in aging buildings

- 3.2.3.2 Expansion in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By system type

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger & acquisitions

- 4.6.2 Partnership & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By System Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Pressure equalized rainscreen systems

- 5.3 Drained and back-ventilated systems

- 5.4 Ventilated cavity systems

- 5.5 Cross-system analysis

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Metal composite materials

- 6.3 Fiber cement panels

- 6.4 Natural stone panels

- 6.5 Ceramic and terracotta panels

- 6.6 High-pressure laminate panels

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Commercial buildings

- 7.3 Residential buildings

- 7.4 Industrial buildings

- 7.5 Institutional buildings

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Benson Industries

- 9.2 Centria International

- 9.3 Cladding Corp

- 9.4 Enclos Corp

- 9.5 Hilti Corporation

- 9.6 ITW Construction products

- 9.7 James Hardie Industries

- 9.8 Kingspan Group

- 9.9 Permasteelisa North America

- 9.10 Power Fasteners

- 9.11 SFS Group (NV1 Systems)

- 9.12 Simpson Strong-Tie

- 9.13 Trespa International

- 9.14 Walters & Wolf

- 9.15 Zahner