|

市場調查報告書

商品編碼

1797771

甜餅乾市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Sweet Biscuits Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

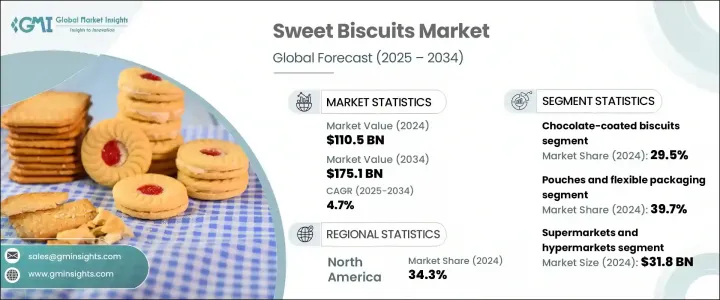

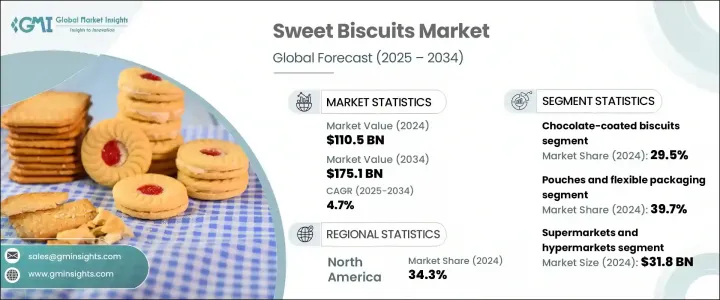

2024年,全球甜餅乾市場規模達1,105億美元,預計到2034年將以4.7%的複合年成長率成長,達到1,751億美元。推動這一成長的因素包括:人們對美味便攜零食的需求日益成長,以及城市生活方式的改變,這些生活方式提高了人們的可支配收入,增加了零食的食用頻率。隨著消費者追求更便利的口感,製造商紛紛推出創新配方、有機原料和新穎的風味組合。健康問題正在重塑這一品類,人們對低糖、無麩質、富含益生菌、維生素和全食物萃取物的功能性餅乾的興趣日益濃厚。成熟市場的產品高階化趨勢正在加速,而亞洲和非洲等新興地區則在飲食習慣轉變和零食消費成長的推動下,擁有快速擴張的潛力。

隨著製造商不斷投資開發低糖、高纖維、無麩質和強化型產品,以滿足消費者不斷變化的生活方式,持續的產品多元化和順應健康趨勢,使甜餅乾行業實現了永續擴張。這些創新,加上人們對便攜零食和功能性零食日益成長的需求,使品牌能夠觸及更廣泛的人群,包括注重健康的千禧世代、老齡化人口和注重健康的消費者。此外,在甜餅乾配方中加入植物成分、天然甜味劑和消化健康益處,正在增強消費者忠誠度,同時在成熟市場和新興市場開闢新的收入來源。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1105億美元 |

| 預測值 | 1751億美元 |

| 複合年成長率 | 4.7% |

威化餅乾市場在2024年的銷售額為163億美元,預計到2034年將達到245億美元,複合年成長率為4.2%。這些輕盈酥脆的產品因其層次豐富的口感和豐富的口味選擇(例如水果奶油、巧克力和香草)而越來越受歡迎。製造商正在透過添加抗氧化劑、益生菌、膳食纖維和超級食物萃取物等功能性成分來增強吸引力。隨著消費者尋求更健康的零食選擇,這些強化威化餅乾兼具美味和營養價值。

軟包裝領域在2024年佔據了39.7%的市場佔有率,預計到2034年將以4.5%的複合年成長率成長。這些包裝形式具有方便用戶使用的優勢——輕巧、易開啟、可重複密封和保鮮,使其成為現代快節奏生活方式的理想選擇。傳統的盒裝包裝仍然具有吸引力,但正在重新設計,採用醒目的圖案和永續材料,以吸引貨架上的注意力並支持環保品牌的推廣。

2024年,北美甜餅乾市場佔據34.3%的市場佔有率,預計到2034年將以4%的複合年成長率成長,這得益於強勁的消費者購買力、健康驅動的創新以及對高階和小眾產品的需求。同時,由於城鎮化進程加快、飲食習慣的轉變以及印度和中國等人口大國零食消費的增加,亞太地區正在經歷快速擴張。

在競爭激烈的甜餅乾市場中,領先的企業包括費列羅集團、億滋國際、賓堡集團、瑪氏公司和雀巢公司。這些公司繼續在全球市場的創新、品牌和分銷方面引領潮流。糖果類別的頂尖公司正在透過推出優質、健康的產品(如低糖、無麩質和功能性餅乾)來追求創新。他們正在投資研發,以開發獨特的風味,並添加纖維、益生菌和超級食物等營養成分。透過在地化生產和分銷擴大在新興市場的影響力提供了成長機會。與零售連鎖店和食品服務平台的合作可以擴大知名度和影響力。品牌也在改進包裝,轉向靈活、可重新密封和永續的形式。行銷策略強調成分透明度、清潔標籤認證和生活方式的一致性,以建立客戶忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 原味甜餅乾

- 巧克力餅乾

- 奶油夾心餅乾

- 威化餅乾

- 健康功能性餅乾

- 早餐餅乾

第6章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 包裝袋和軟包裝

- 盒子

- 罐子和容器

- 獨立包裝和份量控制

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 超市和大賣場

- 便利商店

- 電子商務與網路零售

- 特色食品店

- 餐飲服務及機構銷售

- 傳統貿易和獨立零售商

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Mondelez International, Inc.

- Nestle SA

- Ferrero Group

- Mars, Incorporated

- Pladis (United Biscuits)

- Britannia Industries Limited

- Parle Products Pvt. Ltd.

- ITC Limited

- Grupo Bimbo

- Lotus Bakeries

- UNIBIC Foods India Pvt. Ltd.

- Anmol Industries Ltd.

- Bisk Farm (SAJ Food Products)

- Burton's Biscuit Company

- Walkers Shortbread Ltd.

- Kellogg Company

The Global Sweet Biscuits Market was valued at USD 110.5 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 175.1 billion by 2034. This growth is driven by a growing demand for flavorful, on-the-go snacks and urban lifestyles that increase disposable income and snacking frequency. As consumers demand more convenience without compromising taste, manufacturers are responding with innovative recipes, organic ingredients, and novel flavor combinations. Health concerns are reshaping the category, with surging interest in low-sugar, gluten-free, and functional biscuits fortified with probiotics, vitamins, and whole-food extracts. Product premiumization is accelerating in mature markets, while emerging regions in Asia and Africa offer rapid expansion potential driven by shifting dietary habits and increasing snack consumption.

Continued product diversification and alignment with health-conscious trends position the sweet biscuits industry for sustainable expansion, as manufacturers increasingly invest in developing low-sugar, high-fiber, gluten-free, and fortified variants to cater to shifting consumer lifestyles. These innovations, paired with growing demand for on-the-go and functional snacks, allow brands to reach broader demographics, including health-aware millennials, aging populations, and wellness-driven consumers. Furthermore, the incorporation of plant-based ingredients, natural sweeteners, and digestive health benefits into sweet biscuit formulations is reinforcing consumer loyalty while opening up new revenue streams across both mature and emerging markets."

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110.5 Billion |

| Forecast Value | $175.1 Billion |

| CAGR | 4.7% |

The wafer biscuits segment generated USD 16.3 billion in 2024 and is expected to reach USD 24.5 billion by 2034, reflecting a CAGR of 4.2%. These light and crispy products are increasingly popular thanks to their layered texture and wide range of flavor options-such as fruit creams, chocolate, and vanilla. Manufacturers are enhancing appeal by adding functional ingredients like antioxidants, probiotics, fiber, and superfood extracts. As consumers seek healthier snacking options, these fortified wafers offer both indulgence and nutritional benefit.

The flexible packaging formats segment captured 39.7% share in 2024 and is projected to grow at a CAGR of 4.5% through 2034. These packaging formats deliver user-friendly advantages-lightweight, easy to open, resealable, and freshness-preserving, making them ideal for modern, fast-paced lifestyles. Traditional box packaging remains relevant but is being redesigned with eye-catching graphics and sustainable materials to attract attention on shelves and support eco-friendly branding.

North America Sweet Biscuits Market held 34.3% share in 2024 and is estimated to grow at a CAGR of 4% through 2034, which is underpinned by strong consumer purchasing power, health-driven innovation, and demand for premium and niche products. Meanwhile, Asia-Pacific region is experiencing rapid expansion thanks to accelerating urbanization, evolving eating habits, and heightened snack consumption in populous markets like India and China.

Leading players shaping the competitive sweet biscuits market include Ferrero Group, Mondelez International, Grupo Bimbo, Mars, Incorporation, and Nestle S.A. These companies continue to set the pace in innovation, branding, and distribution across global markets. Top firms in the sweets category are pursuing innovation by launching premium, health-forward products-such as low-sugar, gluten-free, and functional biscuits. They are investing in R&D to develop unique flavor profiles and incorporate nourishing ingredients like fiber, probiotics, and superfoods. Expanding their footprint in emerging markets through localized production and distribution provides growth opportunities. Partnerships with retail chains and food service platforms amplify visibility and reach. Brands are also enhancing packaging, transitioning to flexible, resealable, and sustainable formats. Marketing tactics emphasize ingredient transparency, clean-label credentials, and lifestyle alignment to build customer loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plain Sweet Biscuits

- 5.3 Chocolate-Coated Biscuits

- 5.4 Cream-Filled and Sandwich Biscuits

- 5.5 Wafer Biscuits

- 5.6 Healthy and Functional Biscuits

- 5.7 Breakfast Biscuits

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pouches and Flexible Packaging

- 6.3 Boxes

- 6.4 Jars and Containers

- 6.5 Individual Wrapping and Portion Control

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarkets and Hypermarkets

- 7.3 Convenience stores

- 7.4 E-commerce and online retail

- 7.5 Specialty food stores

- 7.6 Food service and Institutional sales

- 7.7 Traditional trade and Independent retailers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Mondelez International, Inc.

- 9.2 Nestle S.A.

- 9.3 Ferrero Group

- 9.4 Mars, Incorporated

- 9.5 Pladis (United Biscuits)

- 9.6 Britannia Industries Limited

- 9.7 Parle Products Pvt. Ltd.

- 9.8 ITC Limited

- 9.9 Grupo Bimbo

- 9.10 Lotus Bakeries

- 9.11 UNIBIC Foods India Pvt. Ltd.

- 9.12 Anmol Industries Ltd.

- 9.13 Bisk Farm (SAJ Food Products)

- 9.14 Burton's Biscuit Company

- 9.15 Walkers Shortbread Ltd.

- 9.16 Kellogg Company