|

市場調查報告書

商品編碼

1797764

軌道轉移飛行器 (OTV) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Orbital Transfer Vehicle (OTV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

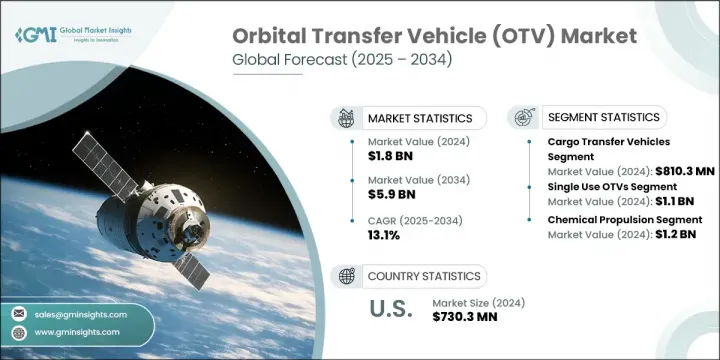

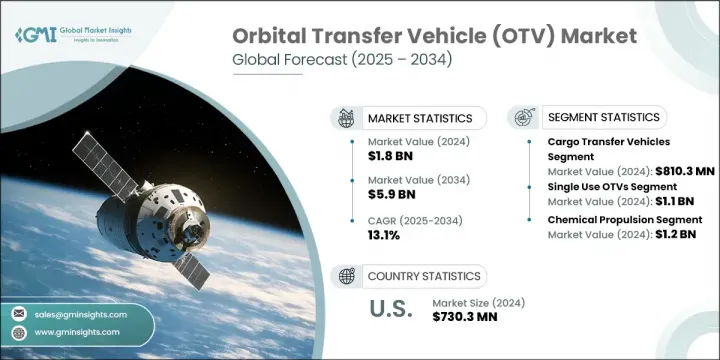

2024 年全球軌道轉移飛行器市值為 18 億美元,預計到 2034 年將以 13.1% 的複合年成長率成長至 59 億美元。市場成長的動力來自對適應性衛星部署方法日益成長的需求、小型衛星和立方體衛星發射頻率的提高、推進系統的快速進步、流入軌道基礎設施的資本激增以及商業太空計劃的穩步上升。隨著產業逐漸擺脫傳統發射系統,軌道轉移飛行器正在成為不可或缺的太空運載解決方案,能夠將有效載荷機動到各種軌道目的地,包括低地球軌道 (LEO)、中地球軌道 (MEO)、地球靜止軌道 (GEO) 以及更遠的地月空間。公共和私營部門都在投入大量資金開發衛星星座、太空服務艙、軌道棲息地和月球支持結構,進一步推動市場長期成長。

對靈活衛星運輸日益成長的需求是推動OTV空間擴張的關鍵因素。營運商如今尋求能夠提供更高反應速度和特定任務軌道定位的部署系統,而非局限於僵化的、預先定義的發射方案。軌道運輸飛行器作為太空物流解決方案,正在透過在各種軌道環境中實現按需衛星交付來取代舊系統。與此同時,從國防部門到商業航太新創公司等各種專注於太空的實體正在加緊努力,建立更強大的軌道生態系統。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 59億美元 |

| 複合年成長率 | 13.1% |

2024年,貨物轉運飛行器細分市場的收入為8.103億美元。該細分市場繼續受益於有效載荷補給任務頻率的不斷成長,這些任務旨在維護軌道站並為新興商業平台鋪平道路。對衛星服務和軌道資產維護的日益重視也加速了對專用貨運飛行器的需求,這些飛行器可確保及時、安全地運輸關鍵任務硬體。自主對接系統的發展以及航太組織之間不斷擴大的全球合作,正在推動可重複使用貨物運輸技術的普及。

2024年,一次性軌道轉移飛行器市場規模達11億美元。這類飛行器因其結構簡化、製造成本降低以及適用於一次性有效載荷部署任務而日益受到青睞。由於無需複雜的回收或再利用系統,它們為無法回收的高風險或長距離任務提供了理想的解決方案。這類飛行器在政府機構和國防相關任務中尤其普遍,因為這些任務對戰略交付的可靠性至關重要。此外,航太業的新創公司和新進業者通常會在測試、原型驗證或進行經濟可行的軌道演示的初始階段選擇一次性平台。

2024年,美國軌道轉移飛行器 (OTV) 市場產值達7.303億美元。這一強勁地位得益於政府機構和商業營運商的持續努力,包括提升衛星發射能力、開發在軌維護系統以及實施軌道碎片減緩策略。這些合作投資旨在提高軌道運行效率、增強有效載荷機動性並延長航太資產的使用壽命。對軌道永續性和任務靈活性的日益重視,進一步鞏固了美國在該領域的領導地位。

積極塑造全球軌道轉移飛行器 (OTV) 市場的知名參與者包括 Astroscale Holdings Inc.、Virgin Galactic、D-Orbit SpA、Relativity Space、OHB SE、Quantum Space LLC、Northrop Grumman Corporation、ArianeGroup SAS、Space Machines Company Pty Ltd、Sierra Space 訂單(CALT)、SpaceX、MaiaSpace SAS、三菱重工、 Altius Space Machines Inc.、Impulse Space Inc.、Roscosmos / Energia、Firefly 航太 、Atomos Space LLC、Gama Space SAS、Rocket Lab USA Inc.、Blue SAigin LLC、Eunch Ltd、CASIC / ExPace、Momentus Inc. 和 Starfish Space Inc. 軌道轉移飛行器市場的領先公司正在優先考慮創新和合作,以鞏固其競爭優勢。許多公司正在投資專有推進系統和模組化運載火箭設計,以支援靈活的任務配置。跨國和跨組織的策略合作正在幫助各公司獲得更廣泛的發射平台,並將其運載火箭整合到不同的任務架構中。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 衛星部署靈活性的需求日益增加

- 小型衛星和立方體衛星發射不斷增加

- 推進技術的進步

- 增加太空基礎設施的投資

- 日益成長的商業太空活動

- 陷阱與挑戰

- 技術可靠性和任務保證

- 監理複雜性與空間交通管理

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 新興商業模式

- 合規性要求

- 國防預算分析

- 全球國防開支趨勢

- 區域國防預算分配

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 重點國防現代化項目

- 預算預測(2025-2034)

- 對產業成長的影響

- 各國國防預算

- 永續發展舉措

- 供應鏈彈性

- 地緣政治分析

- 勞動力分析

- 數位轉型

- 合併、收購和策略夥伴關係格局

- 風險評估與管理

- 主要合約授予(2021-2024)

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各區域市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 貨物轉運車輛

- 機組人員轉移車輛

- 為車輛加油

- 衛星服務和碎片清除車輛

- 其他

第6章:市場估計與預測:按車輛類型,2021 - 2034 年

- 主要趨勢

- 一次使用OTV

- 可重複使用的OTV

第7章:市場估計與預測:按推進系統,2021 - 2034 年

- 主要趨勢

- 化學推進

- 電力推進

- 核熱推進

- 其他

第8章:市場估計與預測:按有效載荷容量,2021 - 2034 年

- 主要趨勢

- 有效載荷較小(最多 200 公斤)

- 中等有效載重(200 公斤至 1,000 公斤)

- 大有效載重(1,000 公斤以上)

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 衛星部署

- 太空探索

- 在軌服務

- 太空旅遊

- 太空站補給和機組人員輪換

- 其他

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 政府航太機構

- 商業航太公司

- 公私部門合作夥伴關係

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- Global Key Players

- Regional Key Players

- 顛覆者/利基市場參與者

- 海星空間公司

- Atomos Space LLC

- Astroscale控股公司

- 維珍銀河

The Global Orbital Transfer Vehicle Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 13.1% to reach USD 5.9 billion by 2034. The market growth is driven by an increasing need for adaptable satellite deployment methods, the rising frequency of small satellite and CubeSat launches, rapid progress in propulsion systems, surging capital flow into orbital infrastructure, and a steady uptick in commercial space initiatives. As the industry shifts away from traditional launch systems, OTVs are emerging as indispensable in-space delivery solutions capable of maneuvering payloads to various orbital destinations-including low Earth orbit (LEO), medium Earth orbit (MEO), geostationary orbit (GEO), and beyond to cislunar space. Both public and private sectors are channeling considerable investments into developing satellite constellations, in-space service modules, orbital habitats, and lunar support structures-further fueling long-term growth in the market.

Heightened demand for flexible satellite transportation is a critical factor powering the expansion of the OTV space. Operators now seek deployment systems that offer greater responsiveness and mission-specific orbital placement, rather than being tied to rigid, predefined launch profiles. Orbital transfer vehicles, acting as in-space logistics solutions, are replacing older systems by enabling on-demand satellite delivery across a diverse range of orbital environments. In tandem, various space-focused entities-from national defense divisions to commercial aerospace startups-are ramping up efforts to construct more robust orbital ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 13.1% |

The cargo transfer vehicles segment generated USD 810.3 million in 2024. This segment continues to benefit from the growing frequency of payload resupply missions designed to sustain orbital stations and pave the way for emerging commercial platforms. The growing emphasis on satellite servicing and orbital asset maintenance is also accelerating demand for dedicated cargo vehicles that ensure the timely, secure transport of mission-critical hardware. Developments in autonomous docking systems and expanding global cooperation between aerospace organizations are driving the adoption of reusable cargo transport technologies.

The single-use orbital transfer vehicles segment generated USD 1.1 billion in 2024. These vehicles are increasingly favored due to their simplified structure, reduced manufacturing costs, and suitability for missions involving one-time payload deployments. By eliminating the need for complex retrieval or reuse systems, they provide an ideal solution for high-risk or long-distance missions where vehicle recovery is impractical. Their utilization is particularly prevalent among government bodies and defense-related missions, where strategic delivery reliability is paramount. Additionally, startups and newer entrants to the aerospace industry often opt for single-use platforms during initial stages of testing, prototype validation, or conducting economically viable orbital demonstrations.

United States Orbital Transfer Vehicle (OTV) Market generated USD 730.3 million in 2024. This strong position is underpinned by sustained efforts from both governmental institutions and commercial operators to enhance satellite launch capabilities, develop in-orbit maintenance systems, and implement orbital debris mitigation strategies. These collaborative investments aim to enhance the efficiency of orbital operations, increase payload maneuverability, and extend the useful life of space assets. The growing emphasis on orbital sustainability and mission flexibility continues to strengthen the country's leadership in the sector.

Prominent players actively shaping the Global Orbital Transfer Vehicle (OTV) Market include Astroscale Holdings Inc., Virgin Galactic, D-Orbit S.p.A., Relativity Space, OHB SE, Quantum Space LLC, Northrop Grumman Corporation, ArianeGroup SAS, Space Machines Company Pty Ltd, Sierra Space, Moog Inc., ISRO / Antrix Corporation, China Academy of Launch Vehicle Technology (CALT), SpaceX, MaiaSpace SAS, Mitsubishi Heavy Industries, Altius Space Machines Inc., Impulse Space Inc., Roscosmos / Energia, Firefly Aerospace, Atomos Space LLC, Gama Space SAS, Rocket Lab USA Inc., Blue Origin LLC, Epic Aerospace LLC, Thales Alenia Space S.A., United Launch Alliance LLC (ULA), Orbital Operations Ltd, CASIC / ExPace, Momentus Inc., and Starfish Space Inc. Leading companies in the orbital transfer vehicle market are prioritizing innovation and partnerships to solidify their competitive edge. Many are investing in proprietary propulsion systems and modular vehicle designs to support flexible mission configurations. Strategic collaborations-both cross-border and inter-organizational-are helping firms access broader launch platforms and integrate their vehicles into diverse mission architectures.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Vehicle type trends

- 2.2.3 Propulsion system trends

- 2.2.4 Payload capacity trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing demand for satellite deployment flexibility

- 3.3.1.2 Rising small satellite and cubesat launches

- 3.3.1.3 Advancements in propulsion technologies

- 3.3.1.4 Increased investments in space infrastructure

- 3.3.1.5 The growing commercial space activities

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Technical Reliability and Mission Assurance

- 3.3.2.2 Regulatory Complexity and Space Traffic Management

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging business models

- 3.10 Compliance requirements

- 3.11 Defense budget analysis

- 3.12 Global defense spending trends

- 3.13 Regional defense budget allocation

- 3.13.1 North America

- 3.13.2 Europe

- 3.13.3 Asia Pacific

- 3.13.4 Middle East and Africa

- 3.13.5 Latin America

- 3.14 Key defense modernization programs

- 3.15 Budget forecast (2025-2034)

- 3.15.1 Impact on industry growth

- 3.15.2 Defense budgets by country

- 3.16 Sustainability initiatives

- 3.17 Supply chain resilience

- 3.18 Geopolitical analysis

- 3.19 Workforce analysis

- 3.20 Digital transformation

- 3.21 Mergers, acquisitions, and strategic partnerships landscape

- 3.22 Risk assessment and management

- 3.23 Major contract awards (2021-2024)

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market estimates and forecast, By Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Cargo transfer vehicles

- 5.3 Crew transfer vehicles

- 5.4 Refueling vehicles

- 5.5 Satellite servicing & debris removal vehicles

- 5.6 Others

Chapter 6 Market estimates and forecast, By Vehicle Type, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Single Use OTVs

- 6.3 Reusable OTVs

Chapter 7 Market estimates and forecast, By Propulsion System, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Chemical propulsion

- 7.3 Electric propulsion

- 7.4 Nuclear thermal propulsion

- 7.5 Others

Chapter 8 Market estimates and forecast, By Payload Capacity, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Small payload (up to 200 kg)

- 8.3 Medium payload (200 kg to 1,000 kg)

- 8.4 Large payload (1,000 kg and above)

Chapter 9 Market estimates and forecast, By Application, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Satellite deployment

- 9.3 Space exploration

- 9.4 Inorbit servicing

- 9.5 Space tourism

- 9.6 Space station resupply & crew rotation

- 9.7 Others

Chapter 10 Market estimates and forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 Government space agencies

- 10.3 Commercial space companies

- 10.4 Public-private partnerships

Chapter 11 Market estimates and forecast, By Region, 2021 - 2034 (USD Million & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company profiles

- 12.1 Global Key Players

- 12.1.1 SpaceX

- 12.1.2 Blue Origin LLC

- 12.1.3 Northrop Grumman Corporation

- 12.1.4 Thales Alenia Space S.A.

- 12.1.5 ArianeGroup SAS

- 12.1.6 United Launch Alliance LLC (ULA)

- 12.1.7 Mitsubishi Heavy Industries

- 12.1.8 China Academy of Launch Vehicle Technology (CALT)

- 12.1.9 Roscosmos / Energia

- 12.1.10 ISRO / Antrix Corporation

- 12.2 Regional Key Players

- 12.2.1 North America

- 12.2.1.1 Rocket Lab USA Inc.

- 12.2.1.2 Momentus Inc.

- 12.2.1.3 Epic Aerospace LLC

- 12.2.1.4 Quantum Space LLC

- 12.2.1.5 Impulse Space Inc.

- 12.2.1.6 Firefly Aerospace

- 12.2.1.7 Relativity Space

- 12.2.1.8 Sierra Space

- 12.2.1.9 Moog Inc.

- 12.2.1.10 Altius Space Machines Inc.

- 12.2.2 Europe

- 12.2.2.1 D-Orbit S.p.A.

- 12.2.2.2 OHB SE

- 12.2.2.3 Orbital Operations Ltd

- 12.2.2.4 Gama Space SAS

- 12.2.2.5 MaiaSpace SAS

- 12.2.3 Asia-Pacific

- 12.2.3.1 CASIC / ExPace

- 12.2.3.2 Space Machines Company Pty Ltd

- 12.2.1 North America

- 12.3 Disruptors / Niche Players

- 12.3.1 Starfish Space Inc.

- 12.3.2 Atomos Space LLC

- 12.3.3 Astroscale Holdings Inc.

- 12.3.4 Virgin Galactic