|

市場調查報告書

商品編碼

1797733

微創脊椎手術設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Minimally Invasive Spine Surgery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

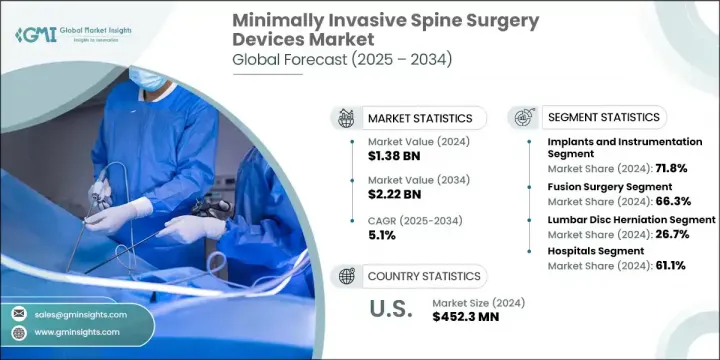

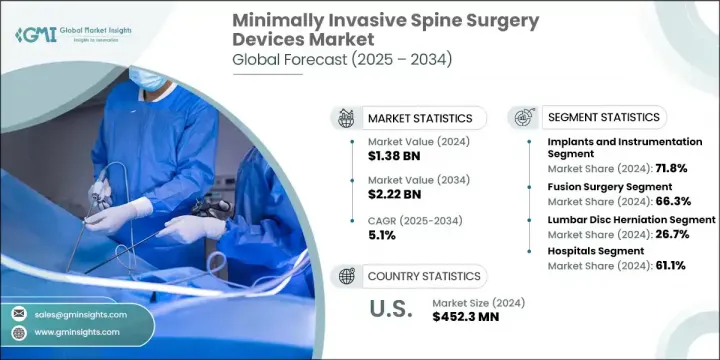

2024年,全球微創脊椎手術器械市場規模達13.8億美元,預計2034年將以5.1%的複合年成長率成長,達到22.2億美元。微創脊椎手術器械因其切口小、住院時間短、恢復期短等優勢,日益受到病患的青睞。這些手術疼痛程度較低,且能減少疤痕,因此越來越受到患者的青睞。醫學影像和導航技術的進步提高了手術的精確度,有助於提高手術安全性,並使其得到更廣泛的應用。

隨著微創脊椎手術需求的不斷成長,市場在人口老化和脊椎疾病發病率上升的推動下持續成長。在全球老化人口中,退化性椎間盤疾病、椎管狹窄和椎間盤突出等疾病的發生率正在上升,這些疾病通常需要手術介入。此外,久坐不動和身體壓力增加等生活型態因素也導致各年齡層脊椎疾病的盛行率上升。隨著患者和醫護人員逐漸認知到微創技術的優勢,例如創傷小、失血少、康復快,人們對此類手術的偏好也日益成長。此外,隨著外科技術的進步以及新興地區高品質醫療機構的普及,患者群體也不斷擴大。隨著人們對此類手術的認知度不斷提高以及醫療覆蓋範圍的擴大,預計市場將在人口結構變化和醫療創新的共同推動下進一步加速發展。這一趨勢凸顯了市場對更安全、更有效率的脊椎手術器械的持續需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13.8億美元 |

| 預測值 | 22.2億美元 |

| 複合年成長率 | 5.1% |

2024年,植入物和器械領域佔據71.8%的市場佔有率,這得益於旨在提高手術精準度和患者康復的先進脊椎固定系統和植入物的日益普及。外科醫生更青睞這些器械,因為它們能夠增強穩定性、減少術中併發症並促進更快癒合。導航輔助器材、椎間融合器和機器人輔助技術的日益融合也推動了該領域的應用。

2024年,融合手術市場佔據66.3%的市場佔有率,這得益於退化性椎間盤疾病、椎管狹窄症和脊椎滑脫症的盛行率不斷上升,這些疾病都需要脊椎穩定。微創融合技術因其能夠最大限度地減少組織損傷並加快復健速度,越來越受到患者和外科醫生的青睞。融合器械的創新,包括更優的骨移植材料和增強型椎間融合器,顯著提高了手術成功率,並擴大了其在門診和住院環境中的應用。

2024年,北美微創脊椎手術器材市場佔據35.3%的市場佔有率,這得益於其強大的醫療基礎設施,鼓勵人們迅速採用尖端手術方法和器械。患者和醫生對微創手術益處的認知度高,刺激了市場需求。此外,該地區主要醫療器材製造商的集中,促進了持續創新,並確保了產品的廣泛供應。

微創脊椎手術設備市場的知名公司包括 Heraeus、Orthofix Medical、Globus Medical、SI-BONE、Invibio、Wenzel Spine、Xenco Medical、Matexcel、Premia Spine、B. Braun、Medtronic、DePuy Synthes(強生)、Spinal Elements、N. Braun、Medtronic、DePuy Synthes(強生)、Spinal Elements、Nvons、Nvonus、Nker、ZM、Mak、Makus、Makaks、Mvonus Spers、Makk、ZM、Mform、Mak Vem、Makk、Misform、Mform、MakMis、Mak Vformings、M完成)微創脊椎手術設備市場的公司透過專注於持續創新並透過先進的植入物、導航工具和機器人輔助解決方案擴展其產品組合來鞏固其立足點。與醫院和研究機構的策略合作有助於提高設備的功效和外科醫生的培訓。許多公司在研發方面投入巨資,以開發以患者為中心的解決方案,從而提高手術效果並減少併發症。擴大地域覆蓋範圍,尤其是進入新興市場,也是滿足不斷成長的需求的優先事項。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 脊椎疾病盛行率上升

- 老年人口不斷增加

- 門診脊椎手術的採用率增加

- 導航和機器人技術的進步

- 產業陷阱與挑戰

- 先進MISS設備成本高

- 發展中地區缺乏熟練的外科醫生

- 市場機會

- 與人工智慧和擴增實境的融合

- 開發具有成本效益的MISS解決方案

- 成長動力

- 成長潛力分析

- 監管格局

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 供應鏈分析

- 消費者行為趨勢

- 市場進入策略分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 差距分析

- 2024年定價分析

- 專利態勢

- 報銷場景

- 報銷政策對市場成長的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 植入物和儀器

- 椎弓根螺釘和椎弓根棒

- 椎間融合器

- 固定系統

- 其他植入物和器械

- 生物材料

- 骨移植替代品

- 合成骨移植

- 其他生物材料

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 融合手術

- 非融合手術

第7章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 腰椎間盤突出

- 椎管狹窄

- 退化性脊椎疾病

- 頸椎間盤疾病

- 胸椎間盤突出

- 其他適應症

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- B. Braun

- DePuy Synthes (Johnson & Johnson)

- Evonik

- Globus Medical

- Heraeus

- Invibio

- Matexcel

- Medtronic

- Nexus Spine

- NuVasive

- Orthofix Medical

- Premia Spine

- SI-BONE

- Spinal Elements

- Stryker

- Wenzel Spine

- Xenco Medical

- Zimmer Biomet

The Global Minimally Invasive Spine Surgery Devices Market was valued at USD 1.38 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 2.22 billion by 2034. The growing preference for minimally invasive spine surgery devices is fueled by the advantages of smaller incisions, shorter hospital stays, and quicker recovery periods. These procedures are less painful and reduce scarring, making them increasingly favored by patients. Advances in medical imaging and navigation technology have enhanced surgical accuracy, contributing to safer procedures and wider adoption.

As demand for minimally invasive spinal surgeries increases, the market continues to grow, supported by an aging population and rising spinal disorders. Aging populations worldwide are experiencing higher incidences of conditions like degenerative disc disease, spinal stenosis, and herniated discs, which often require surgical intervention. Additionally, lifestyle factors such as sedentary habits and increased physical strain contribute to the prevalence of spinal issues across all age groups. With patients and healthcare providers recognizing the benefits of minimally invasive techniques-such as reduced trauma, less blood loss, and quicker rehabilitation-the preference for these procedures is steadily climbing. Furthermore, advancements in surgical technology and growing access to high-quality healthcare facilities in emerging regions are broadening the patient base. As awareness improves and insurance coverage expands for these procedures, the market is expected to accelerate further, driven by both demographic shifts and medical innovations. This trend underscores a sustained demand for devices that facilitate safer, more efficient spinal surgeries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.38 Billion |

| Forecast Value | $2.22 Billion |

| CAGR | 5.1% |

In 2024, implants and instrumentation segment accounted for 71.8% share, driven by the increasing use of advanced spinal fixation systems and implants designed to improve surgical precision and patient recovery. Surgeons prefer these devices due to their ability to enhance stability, reduce intraoperative complications, and support quicker healing. The growing integration of navigation-assisted instruments, interbody cages, and robotic-assisted technologies is also boosting the adoption of this segment.

The fusion surgery segment held 66.3% share in 2024, propelled by the rising prevalence of degenerative disc diseases, spinal stenosis, and spondylolisthesis, which require spinal stabilization. Minimally invasive fusion techniques are gaining popularity among patients and surgeons alike because they minimize tissue damage and accelerate recovery. Innovations in fusion devices, including better bone graft materials and enhanced interbody cages, have significantly improved surgical success rates and broadened their use across outpatient and hospital environments.

North America Minimally Invasive Spine Surgery Devices Market held 35.3% share in 2024, owing to its robust healthcare infrastructure that encourages swift adoption of cutting-edge surgical methods and devices. High patient and physician awareness regarding the benefits of minimally invasive procedures fuels demand. Furthermore, the region's concentration of key medical device manufacturers fosters ongoing innovation and ensures wide product availability.

Notable companies operating in the Minimally Invasive Spine Surgery Devices Market include Heraeus, Orthofix Medical, Globus Medical, SI-BONE, Invibio, Wenzel Spine, Xenco Medical, Matexcel, Premia Spine, B. Braun, Medtronic, DePuy Synthes (Johnson & Johnson), Spinal Elements, Nexus Spine, Stryker, Zimmer Biomet, NuVasive, and Evonik. Companies in the Minimally Invasive Spine Surgery Devices Market strengthen their foothold by focusing on continuous innovation and expanding their product portfolios with advanced implants, navigation tools, and robotic-assisted solutions. Strategic collaborations with hospitals and research institutions help improve device efficacy and surgeon training. Many firms invest heavily in R&D to develop patient-centric solutions that enhance surgical outcomes and reduce complications. Expanding geographic reach, particularly into emerging markets, is also a priority to tap into growing demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Indication trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of spine disorders

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Increased adoption of outpatient spine surgeries

- 3.2.1.4 Technological advancements in navigation and robotics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced MISS equipment

- 3.2.2.2 Lack of skilled surgeons in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with AI and augmented reality

- 3.2.3.2 Development of cost-effective MISS solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Consumer behaviour trend

- 3.8 Go-to-market strategy analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Gap analysis

- 3.13 Pricing analysis, 2024

- 3.14 Patent Landscape

- 3.15 Reimbursement scenario

- 3.15.1 Impact of reimbursement policies on market growth

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implants and instrumentation

- 5.2.1 Pedicle screws and rods

- 5.2.2 Interbody cages

- 5.2.3 Fixation systems

- 5.2.4 Other implants and instrumentations

- 5.3 Biomaterials

- 5.3.1 Bone graft substitutes

- 5.3.2 Synthetic bone grafts

- 5.3.3 Other biomaterials

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fusion surgery

- 6.3 Non-fusion surgery

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Lumbar disc herniation

- 7.3 Spinal stenosis

- 7.4 Degenerative spinal disease

- 7.5 Cervical disc disorders

- 7.6 Thoracic disc herniation

- 7.7 Other indications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 B. Braun

- 10.2 DePuy Synthes (Johnson & Johnson)

- 10.3 Evonik

- 10.4 Globus Medical

- 10.5 Heraeus

- 10.6 Invibio

- 10.7 Matexcel

- 10.8 Medtronic

- 10.9 Nexus Spine

- 10.10 NuVasive

- 10.11 Orthofix Medical

- 10.12 Premia Spine

- 10.13 SI-BONE

- 10.14 Spinal Elements

- 10.15 Stryker

- 10.16 Wenzel Spine

- 10.17 Xenco Medical

- 10.18 Zimmer Biomet