|

市場調查報告書

商品編碼

1797708

建築規模 3D 列印聚合物長絲市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Polymer Filaments for Construction-Scale 3D Printing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

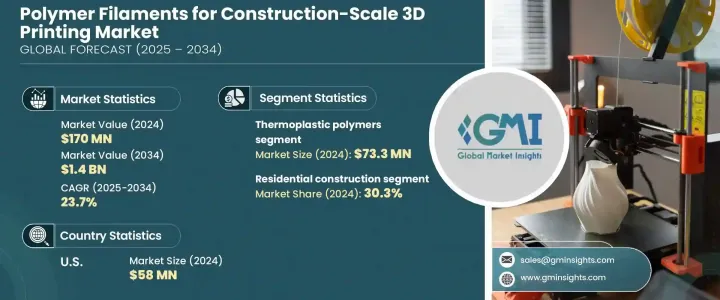

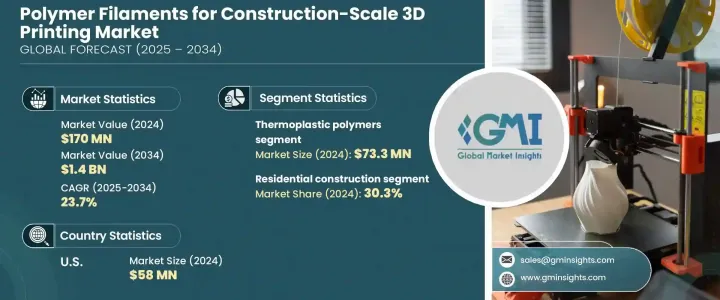

2024年,全球建築級3D列印聚合物細絲市場價值達1.7億美元,預計2034年將以23.7%的複合年成長率成長,達到14億美元。這一快速成長的動力源於對創新和永續建築方法日益成長的需求。 ABS、PLA和PET等工程熱塑性塑膠正在針對從結構部件到整棟建築的大幅面積層製造應用進行最佳化。 3D列印的多功能性使建築師和工程師能夠創建傳統方法無法支援的輕量化複雜結構。這種能力正在促進先進聚合物細絲的快速普及。

政府支持的基礎設施發展計畫和永續性標準正在加速人們對這項技術的興趣。 3D列印的自動化功能還能減少材料浪費和人工,使其成為更具成本效益的建築解決方案。全球對智慧基礎設施的重視,尤其是在快速城市化的亞太地區,使得印度、中國和日本等國家在建築和開發項目中採用高性能3D列印材料方面處於領先地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.7億美元 |

| 預測值 | 14億美元 |

| 複合年成長率 | 23.7% |

2024年,住宅建築領域佔30.3%的市場。該應用因其在解決住房短缺和負擔能力方面的作用而日益受到關注。使用聚合物長絲可以快速生產組件,從而縮短施工工期並降低人力成本。這些材料還支持翻新和模組化建築,使其成為滿足市場迫切需求的各種住房解決方案的理想選擇。

大型熔融沈積成型 (FDM) 技術因其操作簡單且設定成本相對較低,在 2024 年佔據了顯著佔有率。其可擴展性使其成為不同層次建築的理想解決方案—從基礎構件到全尺寸住宅或商業建築。擠壓成型設備的普及性也促進了其廣泛應用和性能可靠性。

2024年,美國建築規模3D列印用聚合物線材市場產值達5,800萬美元。強勁的市場表現得益於強大的創新生態系統、不斷增加的研發投入以及對永續建築方法的需求。美國企業正在加速開發先進的線材材料,以滿足大型建築的技術需求,同時兼顧環保和成本效益。這項舉措將持續鞏固美國在該領域的領先地位。

建築規模 3D 列印聚合物長絲市場的主要參與者包括 Coex 3D、阿科瑪、巴斯夫 SE、西卡 AG、Skanska AB、科思創、MudBots、Mighty Buildings、Tvasta Manufacturing Solutions 和 Manlon Polymers。建築規模 3D 列印聚合物長絲市場的公司正專注於開發高性能、可回收和耐氣候性的材料,以滿足建築業不斷變化的需求。研發投資有助於提高長絲成分的強度、耐用性和耐熱性。許多製造商正在與建築科技公司和學術機構合作,以加速創新和商業準備。擴大全球分銷和本地化生產能力也使公司能夠為快速發展地區的基礎設施項目提供服務。策略性合併和技術許可用於獲取專有積層製造平台的使用權。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依材料類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按材料類型,2021-2034 年

- 主要趨勢

- 熱塑性聚合物

- PLA(聚乳酸)和生物基熱塑性塑膠

- ABS(丙烯腈丁二烯苯乙烯)及工程塑膠

- PETG(聚對苯二甲酸乙二醇酯)和特殊聚合物

- 高性能工程塑膠(PEEK、PEI、PEKK)

- 纖維增強複合材料

- 碳纖維增強聚合物(CFRP)

- 玻璃纖維增強聚合物(GFRP)

- 天然纖維增強複合材料

- 連續纖維增強系統

- 永續和生物基材料

- 生物基聚合物配方

- 回收材料和消費後材料

- 可生物分解和可堆肥的聚合物

- 廢棄物衍生材料和循環經濟材料

- 特種和功能材料

- 耐火和阻燃聚合物

- 隔熱節能材料

- 導電和智慧材料系統

- 多功能混合材料解決方案

- 新興和先進材料

- 奈米複合材料和增強性能材料

- 形狀記憶和響應性聚合物系統

- 自修復和自適應材料技術

- 仿生和自然啟發的材料解決方案

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 住宅建築

- 商業建築

- 基礎設施和土木工程

- 建築和裝飾元素

- 專業和利基應用

第7章:市場估計與預測:按技術,2021-2034 年

- 主要趨勢

- 大規模熔融沈積成型(FDM)

- 機器人施工系統

- 連續生產技術

- 新興和先進技術

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 建築公司和總承包商

- 建築師和設計專業人士

- 房地產開發商和建築物業主

- 研究和教育機構

- 政府和公共部門

第9章:市場估計與預測:依設備規模,2021-2034

- 主要趨勢

- 大型工業系統

- 中型工業系統

- 緊湊、便攜的系統

- 混合和多技術系統

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Arkema

- BASF SE

- Coex 3D

- Covestro

- Manlon Polymers

- Mighty Buildings

- MudBots

- Sika AG

- Skanska AB

- Tvasta Manufacturing Solutions

The Global Polymer Filaments for Construction-Scale 3D Printing Market was valued at USD 170 million in 2024 and is estimated to grow at a CAGR of 23.7% to reach USD 1.4 billion by 2034. This rapid growth is driven by the increasing demand for innovative and sustainable building methods. Engineered thermoplastics such as ABS, PLA, and PET are being optimized for large-format additive manufacturing applications, from structural parts to entire buildings. The versatility of 3D printing enables architects and engineers to create lightweight, complex structures that traditional methods cannot support. This capability is fostering rapid adoption of advanced polymer filaments.

Government-backed infrastructure development initiatives and sustainability standards are accelerating interest in this technology. The automation capabilities of 3D printing also reduce material waste and manual labor, making it a more cost-efficient solution for construction. Global emphasis on smart infrastructure, especially across rapidly urbanizing regions in Asia-Pacific, is positioning countries like India, China, and Japan as leaders in the adoption of high-performance 3D printing materials for building and development projects.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $170 million |

| Forecast Value | $1.4 billion |

| CAGR | 23.7% |

The residential construction segment held a 30.3% share in 2024. This application is gaining traction for its role in addressing housing shortages and affordability. Using polymer filaments, components can be produced quickly, cutting down both construction timelines and labor costs. These materials also support renovation and modular builds, making them ideal for a wide range of housing solutions that respond to immediate market needs.

The large-scale fused deposition modeling (FDM) technology segment held a notable share in 2024 due to its operational simplicity and relatively low setup costs. Its scalable nature makes it an ideal solution for different levels of construction - from foundational components to full-scale residential or commercial buildings. The accessibility of extrusion-based equipment has contributed to its widespread adoption and performance reliability.

U.S. Polymer Filaments for Construction-Scale 3D Printing Market generated USD 58 million in 2024. This strong market presence is driven by a robust innovation ecosystem, increasing R&D efforts, and the demand for sustainable construction methods. Companies in the U.S. are accelerating development of advanced filament materials that meet the technical needs of large-scale construction while aligning with environmental and cost-efficiency objectives. This focus continues to strengthen the country's leadership in the sector.

Key players in Polymer Filaments for Construction-Scale 3D Printing Market include Coex 3D, Arkema, BASF SE, Sika AG, Skanska AB, Covestro, MudBots, Mighty Buildings, Tvasta Manufacturing Solutions, and Manlon Polymers. Companies in the polymer filaments for construction-scale 3D printing market are focusing on developing high-performance, recyclable, and climate-resilient materials to meet the evolving needs of the construction sector. Investments in R&D help improve the strength, durability, and thermal resistance of filament compositions. Many manufacturers are forming collaborations with construction tech firms and academic institutions to speed up innovation and commercial readiness. Expanding global distribution and localized production capabilities also allows companies to serve infrastructure projects in fast-developing regions. Strategic mergers and technology licensing are used to gain access to proprietary additive manufacturing platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material type trends

- 2.2.2 Application trends

- 2.2.3 Technology trends

- 2.2.4 End use trends

- 2.2.5 Equipment scale trends

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Thermoplastic polymers

- 5.2.1 PLA (polylactic acid) and bio-based thermoplastics

- 5.2.2 ABS (acrylonitrile butadiene styrene) and engineering plastics

- 5.2.3 PETG (polyethylene terephthalate glycol) and specialty polymers

- 5.2.4 High-performance engineering plastics (PEEK, PEI, PEKK)

- 5.3 Fiber-reinforced composites

- 5.3.1 Carbon fiber reinforced polymers (CFRP)

- 5.3.2 Glass fiber reinforced polymers (GFRP)

- 5.3.3 Natural fiber reinforced composites

- 5.3.4 Continuous fiber reinforcement systems

- 5.4 Sustainable and bio-based materials

- 5.4.1 Bio-based polymer formulations

- 5.4.2 Recycled content and post-consumer materials

- 5.4.3 Biodegradable and compostable polymers

- 5.4.4 Waste-derived and circular economy materials

- 5.5 Specialty and functional materials

- 5.5.1 Fire-resistant and flame-retardant polymers

- 5.5.2 Thermal insulation and energy-efficient materials

- 5.5.3 Conductive and smart material systems

- 5.5.4 Multi-functional and hybrid material solutions

- 5.6 Emerging and advanced materials

- 5.6.1 Nanocomposite and enhanced performance materials

- 5.6.2 Shape memory and responsive polymer systems

- 5.6.3 Self-healing and adaptive material technologies

- 5.6.4 Biomimetic and nature-inspired material solutions

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Residential construction

- 6.3 Commercial construction

- 6.4 Infrastructure and civil engineering

- 6.5 Architectural and decorative elements

- 6.6 Specialty and niche applications

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Large-scale fused deposition modelling (FDM)

- 7.3 Robotic construction systems

- 7.4 Continuous manufacturing technologies

- 7.5 Emerging and advanced technologies

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 Construction companies and general contractors

- 8.3 Architects and design professionals

- 8.4 Real estate developers and building owners

- 8.5 Research and educational institutions

- 8.6 Government and public sector

Chapter 9 Market Estimates and Forecast, By Equipment Scale, 2021-2034 (USD Million) (Units)

- 9.1 Key trends

- 9.2 Large-scale industrial systems

- 9.3 Medium- scale industrial systems

- 9.4 Compact and portable systems

- 9.5 Hybrid and multi-technology systems

Chapter 10 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Arkema

- 11.2 BASF SE

- 11.3 Coex 3D

- 11.4 Covestro

- 11.5 Manlon Polymers

- 11.6 Mighty Buildings

- 11.7 MudBots

- 11.8 Sika AG

- 11.9 Skanska AB

- 11.10 Tvasta Manufacturing Solutions