|

市場調查報告書

商品編碼

1797703

外用藥物包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Topical Drugs Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

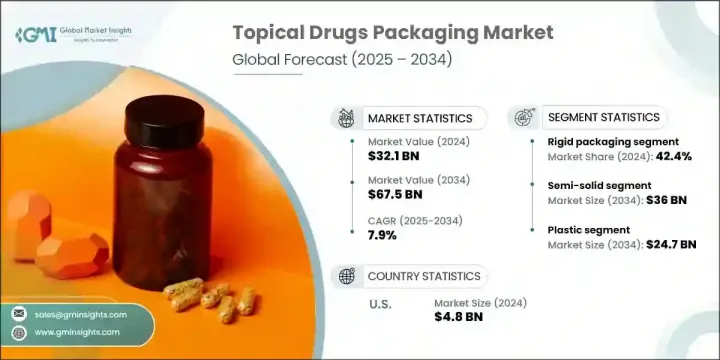

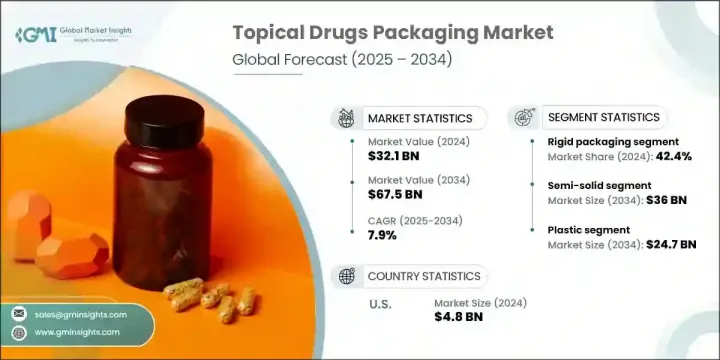

2024年,全球外用藥物包裝市場規模達321億美元,預計到2034年將以7.9%的複合年成長率成長,達到675億美元。日益嚴重的皮膚問題以及日益成長的直銷管道(尤其是線上管道)是主要的成長動力。電子商務的蓬勃發展為製藥公司(尤其是提供外用解決方案的公司)開闢了新的途徑,使其能夠直接接觸更廣泛的受眾。

隨著痤瘡、濕疹和牛皮癬等皮膚病日益普遍,製藥公司更加重視便利有效的局部治療,這反過來又刺激了對安全創新包裝的需求。2D碼驗證、防篡改密封和追蹤追蹤等數位技術在包裝中的應用,在高價值和非處方皮膚病產品中越來越受歡迎。永續性持續重塑包裝選擇。市場參與者正在整合環保解決方案,包括可回收塑膠、補充裝系統和可生物分解薄膜,這反映了製藥業消費者和監管部門不斷變化的期望。這些永續包裝創新不僅有助於減少環境影響,還能提升品牌聲譽和消費者信任。企業擴大投資於輕質、資源高效的材料開發,以最大限度地減少整個產品生命週期中的浪費。使用單一材料結構以便於回收,並減少碳足跡的包裝工藝,在整個行業中變得越來越普遍。此外,對閉迴路系統的需求日益成長,該系統將廢舊包裝收集起來並重新加工成新產品。這些措施符合全球永續發展目標,同時滿足了對符合道德和環境責任的醫療保健解決方案日益成長的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 321億美元 |

| 預測值 | 675億美元 |

| 複合年成長率 | 7.9% |

2024年,硬質包裝佔了42.4%的市場。瓶子、玻璃容器和罐子廣泛用於高階和處方護膚品,因為它們能夠提供保護、保持產品品質並支持儲存穩定性。這些容器尤其受到青睞,因為它們能夠處理黏稠的配方,並在敏感應用領域保持結構完整性。

預計 2025 年至 2034 年期間液體產品領域的複合年成長率為 7.9%。液體(包括防腐劑和藥用噴霧)需要精確、安全的包裝,以防止溢出和污染,同時支持活性成分的保存和劑量準確性。

2024年,北美外用藥物包裝市場佔據37.6%的市場佔有率,預計在2025-2034年期間的複合年成長率將達到6.9%。強大的醫藥基礎設施、對非處方藥的偏好以及日益成長的自我照護習慣,正在推動該地區的包裝創新。對電子商務的依賴程度不斷提高,以及確保安全性和合規性的方便用戶使用型包裝,將繼續塑造美國和加拿大的需求格局。

外用藥品包裝市場的領導公司包括 West Pharmaceutical Services、Schott、AptarGroup、Gerresheimer 和 Amcor。外用藥品包裝公司正在大力投資永續材料、數位安全和先進的配藥系統,以滿足消費者和製藥客戶不斷變化的需求。各大品牌正透過可再填充容器、可生物分解包裝膜和低碳製造進行創新,以符合環境法規和消費者偏好。產品差異化正在透過防篡改封蓋、人體工學設計和序列化技術來增強,這些技術可以提高可追溯性和消費者信心。各公司也正在與製藥商建立策略夥伴關係,共同開發針對特定皮膚病產品的包裝形式。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 皮膚病和皮膚病盛行率不斷上升

- 對便捷、方便用戶使用的包裝形式的需求不斷成長

- 非處方外用藥品的擴張

- 電子商務和直接面對消費者的藥品銷售成長

- 單位劑量和控制分配系統的創新

- 產業陷阱與挑戰

- 嚴格的監管合規和核准流程

- 設計兒童安全且老年人友善的包裝的複雜性

- 市場機會

- 向皮膚病學需求尚未充分滿足的新興市場擴張。

- 整合智慧包裝技術,用於身份驗證和患者參與。

- 對永續和可生物分解包裝解決方案的投資不斷增加。

- 零售藥局連鎖店的自有品牌外用產品線不斷成長。

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 歷史價格分析(2021-2024)

- 價格趨勢促進因素

- 區域價格差異

- 價格預測(2025-2034)

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 永續材料評估

- 碳足跡分析

- 循環經濟實施

- 永續性認證和標準

- 永續性投資報酬率分析

- 全球消費者情緒分析

- 專利分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按包裝類型,2021 - 2034 年

- 主要趨勢

- 軟包裝

- 硬質包裝

- 半硬質包裝

第6章:市場估計與預測:按包裝材料,2021 - 2034 年

- 主要趨勢

- 塑膠

- 玻璃

- 金屬

- 紙

- 鋁

- 其他

第7章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 瓶子

- 瓶蓋和封口

- 吸入器

- 管

- 罐子

- 其他

第 8 章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 液體

- 半固體

- 堅硬的

- 透皮

第9章:市場估計與預測:按關閉類型,2021 - 2034 年

- 主要趨勢

- 螺旋蓋

- 翻蓋

- 泵浦式分配器

- 滴管

- 噴嘴

第10章:市場估計與預測:按管理模式,2021 - 2034 年

- 主要趨勢

- 眼科用途

- 鼻腔使用

- 皮膚使用

第 11 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 皮膚科

- 眼科

- 其他

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- Global Key Players

- Regional Key Players

- 利基市場參與者/顛覆者

- CCL工業公司

- LOG Pharma 初級包裝

- 尼利帕克

The Global Topical Drugs Packaging Market was valued at USD 32.1 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 67.5 billion by 2034. Rising skin conditions and growing direct-to-consumer sales channels, particularly online, are among the primary growth drivers. The boom in e-commerce has opened new pathways for pharmaceutical companies, especially those offering topical solutions, to reach broader audiences directly.

With skin conditions like acne, eczema, and psoriasis becoming increasingly prevalent, pharmaceutical firms are focusing more on accessible and effective topical treatments, which in turn boosts demand for safe and innovative packaging. Digital tech adoption in packaging-such as QR verification, tamper-proof seals, and track-and-trace capabilities-is gaining traction in high-value and OTC dermatology products. Sustainability continues to reshape packaging choices. Market players are integrating eco-conscious solutions, including recyclable plastics, refill systems, and biodegradable films, reflecting shifting consumer and regulatory expectations in the pharmaceutical sector. These sustainable packaging innovations are not only helping reduce environmental impact but also enhancing brand reputation and consumer trust. Companies are increasingly investing in the development of lightweight, resource-efficient materials that minimize waste throughout the product lifecycle. The use of mono-material structures for easier recyclability, along with reduced carbon footprint packaging processes, is becoming more common across the industry. Additionally, there's a growing push for closed-loop systems, where used packaging is collected and reprocessed into new products. Such initiatives align with global sustainability goals while meeting the rising demand for ethical and environmentally responsible healthcare solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.1 Billion |

| Forecast Value | $67.5 Billion |

| CAGR | 7.9% |

In 2024, the rigid formats segment held a 42.4% share. Bottles, glass containers, and jars are widely used for premium and prescription skin treatments as they offer protection, preserve product quality, and support storage stability. These containers are particularly favored for their ability to handle viscous formulations and maintain structural integrity for sensitive applications.

The liquid product segment is forecasted to grow at a CAGR of 7.9% from 2025 to 2034. Liquids, including antiseptics and medicated sprays, demand precise, secure packaging that prevents spills and contamination while supporting active ingredient preservation and dosing accuracy.

North America Topical Drugs Packaging Market held 37.6% share in 2024 and is set to grow at a CAGR of 6.9% throughout 2025-2034. Strong pharmaceutical infrastructure, a preference for OTC medication, and growing self-care habits are advancing packaging innovation in this region. Increased reliance on e-commerce and user-friendly packaging that ensures safety and compliance continues to shape the demand landscape in the US and Canada.

Leading companies in Topical Drugs Packaging Market include West Pharmaceutical Services, Schott, AptarGroup, Gerresheimer, and Amcor. Topical drug packaging companies are investing heavily in sustainable materials, digital security, and advanced dispensing systems to cater to the evolving needs of both consumers and pharmaceutical clients. Brands are innovating with refillable containers, biodegradable packaging films, and low-carbon manufacturing to align with environmental regulations and consumer preferences. Product differentiation is being enhanced through tamper-proof closures, ergonomic design, and serialization technologies that add traceability and consumer confidence. Companies are also forming strategic partnerships with pharmaceutical manufacturers to co-develop packaging formats tailored to specialized dermatological products.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Packaging type trends

- 2.2.2 Packaging material trends

- 2.2.3 Product types trends

- 2.2.4 Drug type trends

- 2.2.5 Closure type trends

- 2.2.6 Mode of administration trends

- 2.2.7 Application trends

- 2.2.8 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of skin diseases and dermatological disorders

- 3.2.1.2 Growing demand for convenient and user-friendly packaging formats

- 3.2.1.3 Expansion of over-the-counter (OTC) topical drug products

- 3.2.1.4 Growth of e-commerce and direct-to-consumer pharmaceutical sales

- 3.2.1.5 Innovation in unit dose and controlled-dispensing systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory compliance and approval processes

- 3.2.2.2 Complexities in designing child-resistant yet senior-friendly packaging

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets with underserved dermatological needs.

- 3.2.3.2 Integration of smart packaging technologies for authentication and patient engagement.

- 3.2.3.3 Rising investment in sustainable and biodegradable packaging solutions.

- 3.2.3.4 Growth of private-label topical product lines by retail pharmacy chains.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price Forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI Analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Flexible packaging

- 5.3 Rigid packaging

- 5.4 Semi-rigid packaging

Chapter 6 Market Estimates and Forecast, By Packaging Material, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Glass

- 6.4 Metal

- 6.5 Paper

- 6.6 Aluminium

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Product Types, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Bottles

- 7.3 Caps & closures

- 7.4 Inhalers

- 7.5 Tubes

- 7.6 Jars

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Drug Type, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Liquid

- 8.3 Semi-solid

- 8.4 Solid

- 8.5 Transdermal

Chapter 9 Market Estimates and Forecast, By Closure Type, 2021 - 2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 Screw cap

- 9.3 Flip-top cap

- 9.4 Pump dispenser

- 9.5 Dropper

- 9.6 Nozzle

Chapter 10 Market Estimates and Forecast, By Mode of Administration, 2021 - 2034 (USD Million & Kilo Tons)

- 10.1 Key trends

- 10.2 Ophthalmic usage

- 10.3 Nasal usage

- 10.4 Dermal usage

Chapter 11 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Kilo Tons)

- 11.1 Key trends

- 11.2 Dermatology

- 11.3 Ophthalmology

- 11.4 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global Key Players

- 13.1.1 Amcor

- 13.1.2 AptarGroup

- 13.1.3 Gerresheimer

- 13.1.4 Schott

- 13.1.5 West Pharmaceutical Services

- 13.2 Regional Key Players

- 13.2.1 North America

- 13.2.1.1 Catalent

- 13.2.1.2 WestRock

- 13.2.1.3 Sonoco Products

- 13.2.1.4 ProAmpac

- 13.2.1.5 Silgan Holdings

- 13.2.2 Europe

- 13.2.2.1 Bormioli Pharma

- 13.2.2.2 Constantia Flexibles

- 13.2.2.3 Mondi

- 13.2.2.4 SGD Pharma

- 13.2.3 APAC

- 13.2.3.1 Huhtamaki

- 13.2.3.2 Nipro

- 13.2.3.3 EPL Limited

- 13.2.1 North America

- 13.3 Niche Players / Disruptors

- 13.3.1 CCL Industries

- 13.3.2 LOG Pharma Primary Packaging

- 13.3.3 Nelipak