|

市場調查報告書

商品編碼

1797699

Compute Express Link (CXL) 組件市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Compute Express Link (CXL) Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

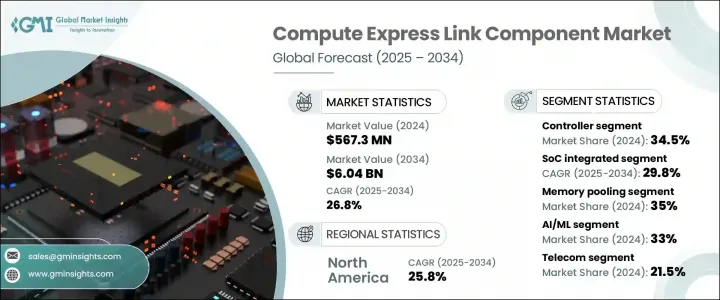

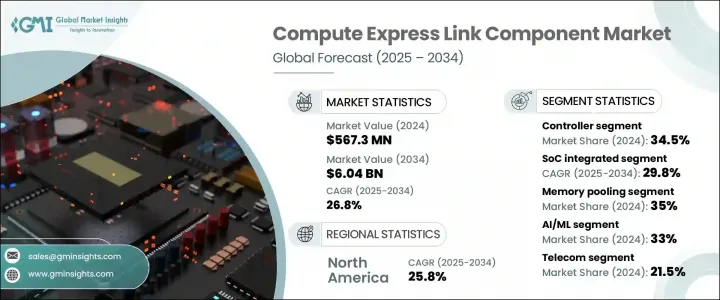

2024 年全球 Compute Express Link 組件市場價值為 5.6731 億美元,預計到 2034 年將以 26.8% 的複合年成長率成長,達到 60.4 億美元。這種快速擴張反映了現代資料中心對高效能運算、AI/ML 工作負載和記憶體分解的激增需求。 CXL 技術可實現靈活的記憶體架構和池化訪問,使其成為下一代基礎設施的關鍵驅動力。企業擴大尋求可擴展的記憶體管理,以避免冗餘並降低硬體成本。 CXL 的池化記憶體模型出現在 2020 年代初,當時資料中心正在尋求更好的資源利用率。透過將計算與記憶體分離,過度配置變得不必要,從而實現了成本效益。由 CXL 支援的記憶體分層和可組合伺服器架構的創新正在重塑伺服器設計,促進跨節點動態共享記憶體和儲存。

這項技術正在重塑資料中心架構,並為資源最佳化、效率和敏捷性樹立全新標準。透過將記憶體與運算資源分離,它實現了前所未有的工作負載分配可擴展性和靈活性。這項轉變支援即時資料處理、高頻寬連線以及跨系統的動態資源共享,從而大幅降低延遲和基礎設施成本。此外,它還透過最大限度地減少閒置資源和簡化營運工作流程,打造更節能的環境。隨著企業追求更快的創新週期和更智慧的資源利用,這項技術進步將成為下一代軟體定義資料中心的基礎要素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.6731億美元 |

| 預測值 | 60.4億美元 |

| 複合年成長率 | 26.8% |

2024年,網路介面控制器 (NIC) 市場規模遠小於控制器,市佔率為 5.9%,為 3,320 萬美元,但成長非常迅速。 NIC 對於支援可組合系統中的低延遲互連至關重要。隨著 CXL 的普及,NIC 在實現跨運算和記憶體層的可擴展、高吞吐量連接方面發揮著至關重要的作用,使其成為成長最快的元件類別。

預計到 2034 年,SoC 整合組件市場規模將達到 18 億美元,成為成長最快的組件形式。基於 SoC 的 CXL 解決方案提供緊湊、節能的架構,是邊緣和雲端部署的理想選擇。這些高密度模組可提高營運效率並節省空間,在尺寸或功率受限的領域更具吸引力,並支援精簡的硬體配置,以滿足現代運算需求。

美國計算快速連結 (CXL) 組件市場在 2024 年的產值達到 1.908 億美元,預計到 2034 年將以 25.1% 的複合年成長率成長。雲端服務的擴展以及對高階運算和資料處理的需求正在推動這一成長。此外,美國資料中心的持續建置和升級也推動了對 CXL 等高速互連技術的需求,以滿足不斷變化的效能和可擴展性需求。

全球運算高速連結 (CXL) 組件市場的主要產業參與者包括英特爾公司、超微半導體公司 (AMD)、三星電子有限公司、美光科技公司、SK 海力士公司、Rambus 公司、Cadence 設計系統公司、瀾起科技股份有限公司、Astera Labs、Mobiveil 公司、Marvell 科技公司和新思科技公司。 CXL 組件市場的領先公司優先考慮在開放產業標準、策略合作夥伴關係和產品創新方面的合作,以深化其市場佔有率。許多公司正在與超大規模資料中心營運商和雲端供應商結盟,以驗證 CXL 設計並確保互通性。研發投資專注於提高速度、功率效率和整合能力,尤其是在 SoC 嵌入式 CXL 解決方案中。公司也利用併購來拓寬其產品組合和技術通路。擴大全球製造能力並與資料中心基礎設施的部署保持一致,使提供者能夠根據需求擴展規模。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業回應

- 供應鏈重構

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 記憶體分解需求不斷成長

- 加速人工智慧和機器學習工作負載

- 採用與 CXL 相容的伺服器平台

- CXL 2.0 和 3.0 標準的出現

- 超大規模和 HPC 基礎設施的成長

- 產業陷阱與挑戰

- 高成本和供應鏈複雜性

- 軟體和生態系統準備滯後

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- CXL 開關

- 記憶體擴充器

- 控制器

- 重定時器

- 網路介面卡

- 其他

第6章:市場估計與預測:依外形尺寸,2021 - 2034 年

- 主要趨勢

- 附加卡

- 企業和資料中心標準外形尺寸

- SoC整合

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 記憶體池

- 加速器

- 分層記憶體架構

- 可組合基礎設施

- 高速互連

- 其他

第8章:市場估計與預測:按工作量,2021 - 2034 年

- 主要趨勢

- 人工智慧/機器學習

- 高效能運算

- 數據分析

- 雲端運算

- 其他

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 電信

- 金融

- 衛生保健

- 石油和天然氣

- 航太

- 其他

第10章:市場估計與預測:按基礎設施,2021 - 2034 年

- 主要趨勢

- CSP/超大規模企業

- Neoclouds

- 企業資料中心

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- Advanced Micro Devices, Inc. (AMD)

- Astera Labs

- Cadence Design Systems, Inc.

- Intel Corporation

- Marvell Technology, Inc.

- Micron Technology, Inc.

- Microchip Technology Inc.

- Mobiveil, Inc.

- Montage Technology Co., Ltd.

- Rambus Inc.

- Samsung Electronics Co., Ltd

- SK hynix Inc.

- Synopsys, Inc.

The Global Compute Express Link Component Market was valued at USD 567.31 million in 2024 and is estimated to grow at a CAGR of 26.8% to reach USD 6.04 billion by 2034. This rapid expansion reflects surging demand for high-performance computing, AI/ML workloads, and memory disaggregation in modern data centers. CXL technology enables flexible memory architectures and pooled access, making it a key driver for next-generation infrastructure. Organizations are increasingly seeking scalable memory management to avoid redundancy and reduce hardware costs. CXL's pooled memory models emerged in the early 2020s as data centers sought better resource utilization. By decoupling compute from memory, overprovisioning becomes unnecessary, enabling cost efficiencies. Innovations in memory tiering and composable server architectures powered by CXL are reshaping server design, facilitating dynamic sharing of memory and storage across nodes.

The technology is reshaping data center architecture and setting new standards for resource optimization, efficiency, and agility. By decoupling memory from compute resources, it enables unprecedented scalability and flexibility in workload allocation. This shift supports real-time data processing, high-bandwidth connectivity, and dynamic resource sharing across systems-drastically reducing latency and infrastructure costs. It also fosters more energy-efficient environments by minimizing idle resources and streamlining operational workflows. As organizations strive for faster innovation cycles and smarter resource utilization, this advancement becomes a foundational element of next-generation, software-defined data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $567.31 Million |

| Forecast Value | $6.04 Billion |

| CAGR | 26.8% |

The network interface controller (NIC) segment was significantly smaller than controllers in 2024, capturing a 5.9% share with USD 33.2 million, but it is expanding very rapidly. NICs are essential to support low-latency interconnects in composable systems. As CXL becomes widespread, NICs play a vital role in enabling scalable, high-throughput connections across compute and memory tiers, positioning them as the fastest-growing component category.

The SoC-integrated component segment is projected to reach USD 1.8 billion by 2034, making it the fastest-growing form factor. SoC-based CXL solutions offer compact, energy-efficient architectures ideal for edge and cloud deployments. These high-density modules deliver operational efficiency and space savings, making them increasingly attractive where size or power constraints are critical, and enabling streamlined hardware configurations that support modern compute needs.

United States Compute Express Link (CXL) Component Market generated USD 190.8 million in 2024 and is forecast to grow at a CAGR of 25.1% through 2034. Expansion of cloud services and demand for advanced computing and data processing are driving growth. In addition, continued data center buildouts and upgrades in the U.S. are fueling demand for high-speed interconnect technologies like CXL to support evolving performance and scalability needs.

Key industry players in the Global Compute Express Link (CXL) Component Market include Intel Corporation, Advanced Micro Devices, Inc. (AMD), Samsung Electronics Co., Ltd, Micron Technology, Inc., SK hynix Inc., Rambus Inc., Cadence Design Systems, Inc., Montage Technology Co., Ltd., Astera Labs, Mobiveil, Inc., Marvell Technology, Inc., and Synopsys, Inc. Leading companies in the CXL component market are prioritizing collaboration on open industry standards, strategic partnerships, and product innovation to deepen their market presence. Many are forging alliances with hyperscale data center operators and cloud providers to validate CXL designs and ensure interoperability. R&D investments are focused on enhancing speed, power efficiency, and integration capabilities, especially in SoC-embedded CXL solutions. Firms are also leveraging mergers and acquisitions to broaden their portfolio and technological access. Expanding global manufacturing capabilities and aligning with data center infrastructure roll-outs allow providers to scale with demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump Administration Tariffs

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact

- 3.2.2.1.1 Price Volatility in Key Components

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising Demand for Memory Disaggregation

- 3.3.1.2 Acceleration of AI and Machine Learning Workloads

- 3.3.1.3 Adoption of CXL-Compatible Server Platforms

- 3.3.1.4 Emergence of CXL 2.0 and 3.0 Standards

- 3.3.1.5 Growth in Hyperscale and HPC Infrastructure

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Cost and Supply Chain Complexity

- 3.3.2.2 Software and Ecosystem Readiness Lag

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 CXL switches

- 5.3 Memory expanders

- 5.4 Controllers

- 5.5 Retimers

- 5.6 Network interface card

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Form Factor, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Add-in card

- 6.3 Enterprise and datacenter standard form factor

- 6.4 SoC integrated

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Memory-pooling

- 7.3 Accelerators

- 7.4 Tiered memory architecture

- 7.5 Composable infrastructure

- 7.6 High-speed interconnect

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Workload, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 AI/ML

- 8.3 High performance computing

- 8.4 Data analytics

- 8.5 Cloud computing

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Telecom

- 9.3 Finance

- 9.4 Healthcare

- 9.5 Oil & Gas

- 9.6 Aerospace

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Infrastructure, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 CSP/Hyperscalers

- 10.3 Neoclouds

- 10.4 Enterprise datacenters

- 10.5 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Advanced Micro Devices, Inc. (AMD)

- 12.2 Astera Labs

- 12.3 Cadence Design Systems, Inc.

- 12.4 Intel Corporation

- 12.5 Marvell Technology, Inc.

- 12.6 Micron Technology, Inc.

- 12.7 Microchip Technology Inc.

- 12.8 Mobiveil, Inc.

- 12.9 Montage Technology Co., Ltd.

- 12.10 Rambus Inc.

- 12.11 Samsung Electronics Co., Ltd

- 12.12 SK hynix Inc.

- 12.13 Synopsys, Inc.