|

市場調查報告書

商品編碼

1797698

濃縮罐頭湯市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Condensed Canned Soups Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

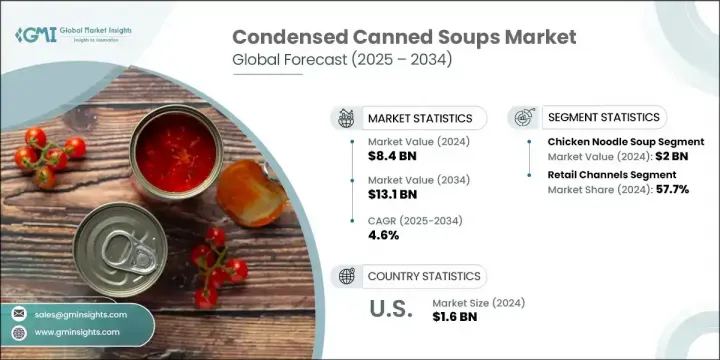

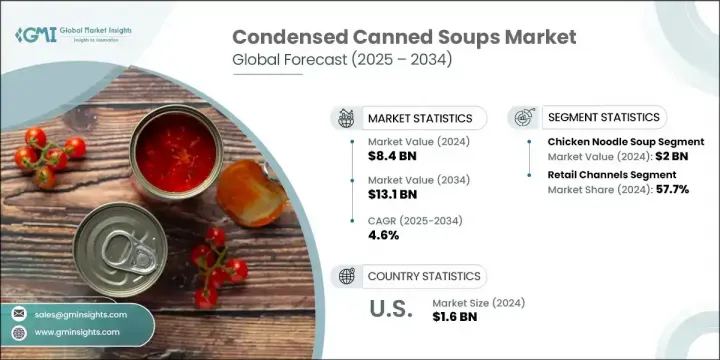

2024年,全球濃縮罐裝湯市場規模達84億美元,預計到2034年將以4.6%的複合年成長率成長,達到131億美元。濃縮罐裝湯因其價格實惠、易於製作且保存期限長,仍然是包裝食品領域的主打產品。然而,消費者的偏好發生了顯著變化,促使各大品牌重新構思產品。越來越多的消費者選擇更乾淨的標籤、天然成分和注重健康的產品,這促使產品配方不斷改進,並強調低鈉含量、有機認證和植物成分。食品製造商也不斷創新,推出營養豐富、富含蛋白質的濃縮湯,其帶來的不僅是便利。

如今,這些產品不僅定位為即食食品,還可作為各種家常食譜的多功能基礎。隨著越來越多的消費者轉向健康飲食,對營養豐富、可客製化的膳食成分的需求也隨之成長。這一趨勢在快速城市化的地區尤為突出,尤其是在亞太地區。這些地區不斷壯大的中產階級和快節奏的生活方式推動了人們對營養豐富、省時膳食的需求。隨著人們越來越傾向於選擇簡便食品,以適應不斷變化的飲食習慣,該地區各國的濃縮湯消費量正在強勁成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 84億美元 |

| 預測值 | 131億美元 |

| 複合年成長率 | 4.6% |

2024年,雞肉麵湯市場產值達20億美元。其他熱門品種包括番茄湯、蘑菇奶油湯和雞肉奶油湯,這些湯品已被證明既可單獨享用,也可作為更廣泛膳食的配料。人們對「更健康」食品的興趣日益濃厚,也推動了蔬菜湯和牛肉湯的成長,而植物性食品和高蛋白食品也越來越受歡迎。為了滿足現代消費者的期望,各大品牌正在重新審視傳統配方,推出有機、防過敏和低鈉配方,在不犧牲風味和口感的前提下,擴大對注重健康的消費者的吸引力。

2024年,零售店市佔率達57.7%。超市、大賣場和社區雜貨店仍然是主要的分銷管道,為消費者提供各種品牌、價格和口味的商品。這些商店受益於醒目的產品展示、季節性促銷以及強大的自有品牌競爭,這些因素影響著消費者的購買行為,並使該管道與主流消費者保持高度關聯。

2024年,北美濃縮罐頭湯市場產值達16億美元,這得歸功於人們對罐頭湯的強烈文化認同。隨著飲食習慣的改變和健康意識的增強,美國市場對清潔標籤、有機和植物性湯類產品的需求強勁。完善的零售網路,加上對先進食品加工和技術的投資,使美國企業能夠快速回應新興趨勢,從而始終引領該領域的創新。

全球濃縮罐裝湯市場的主要參與者包括雀巢公司、艾米廚房公司、BCI 食品公司、卡夫亨氏公司、聯合利華(家樂)、金寶湯公司、通用磨坊公司、康尼格拉品牌公司、百特食品集團和 Vanee 食品公司。濃縮罐裝湯市場的領導品牌正透過配方改良,推出低鈉、有機、無麩質和植物性品種,以實現產品多樣化。許多公司正在投資永續包裝並提升風味,以滿足不斷變化的消費者偏好。研發也推動了創新,將超級食物、植物蛋白和抗過敏成分整合在一起。此外,各大品牌正在最佳化供應鏈並擴大零售合作夥伴關係,以提高貨架曝光。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按產品類型趨勢

- 按配銷通路趨勢

- 按包裝形式趨勢

- 按地區

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 濃縮湯品種

- 雞肉麵湯

- 番茄湯

- 奶油蘑菇湯

- 奶油雞湯

- 蔬菜湯

- 牛肉湯

- 奶油特色湯

第6章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 零售通路

- 超市和大賣場

- 便利商店

- 折扣零售商

- 特色食品店

- 網路零售與電子商務

- 餐飲服務管道

- 餐廳和快餐

- 機構餐飲服務

- 醫療保健和教育設施

- 直接面對消費者的管道

第7章:市場估計與預測:依包裝形式,2021-2034

- 主要趨勢

- 傳統金屬罐

- 標準尺寸罐(10.5-11盎司)

- 家庭裝罐裝(18-23 盎司)

- 機構尺寸罐

- 替代包裝格式

- 軟袋和立式袋

- 無菌紙盒和利樂包

- 微波爐適用容器

- 一次性杯子和碗

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Campbell Soup Company

- General Mills Inc. (Progresso)

- The Kraft Heinz Company

- Nestle SA

- Unilever (Knorr)

- ConAgra Brands Inc.

- Baxters Food Group

- BCI Foods Inc.

- Vanee Foods Company

- Amy's Kitchen Inc

The Global Condensed Canned Soups Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 13.1 billion by 2034. These soups remain a staple in the packaged food space due to their affordability, ease of preparation, and extended shelf stability. However, consumer preferences have evolved significantly, pushing brands to reimagine their offerings. A growing number of consumers are opting for cleaner labels, natural ingredients, and health-focused variants, leading to product reformulations that emphasize low-sodium content, organic certification, and plant-based ingredients. Food manufacturers are increasingly innovating with nutrient-rich, protein-enhanced condensed soups that offer more than just convenience.

These products are now positioned not only as ready-to-eat meals but also as versatile bases for home-cooked recipes. As more consumers shift toward health-conscious eating, the demand for enriched, customizable meal components has accelerated. This trend is particularly prominent in rapidly urbanizing areas, especially across the Asia-Pacific region, where a growing middle class and fast-paced lifestyles are fueling increased demand for nutritious, time-saving meals. Countries in the region are witnessing a strong uptake in condensed soup consumption as part of the broader shift toward convenient food options that align with evolving dietary habits.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $13.1 Billion |

| CAGR | 4.6% |

The chicken noodle soup segment generated USD 2 billion in 2024. Other popular varieties include tomato-based, cream of mushroom, and cream of chicken soups, which have proven to be reliable both as standalone meals and as ingredients in broader meal preparation. Rising interest in better-for-you options is also driving growth in vegetable and beef-based soups, while plant-forward and high-protein selections are gaining traction. To align with modern consumer expectations, brands are revisiting traditional formulations to introduce organic, allergen-friendly, and reduced-sodium recipes, expanding their appeal to health-conscious audiences without compromising flavor or texture.

The retail outlets segment held a 57.7% share in 2024. Supermarkets, hypermarkets, and neighborhood grocery stores remain the dominant distribution channels, offering consumers access to various brands, prices, and flavors. These stores benefit from prominent product placement, seasonal promotions, and strong private-label competition, which influence purchasing behavior and keep this channel highly relevant for mainstream buyers.

North American Condensed Canned Soups Market generated USD 1.6 billion in 2024, driven by strong cultural familiarity with canned soups. With changing eating habits and increasing health awareness, the U.S. market shows a solid appetite for clean-label, organic, and plant-based soups. A well-established retail network, along with investments in advanced food processing and technology, allows American companies to respond quickly to emerging trends, keeping the U.S. at the forefront of innovation in this sector.

Key players contributing to the Global Condensed Canned Soups Market include Nestle S.A., Amy's Kitchen Inc., BCI Foods Inc., The Kraft Heinz Company, Unilever (Knorr), Campbell Soup Company, General Mills Inc., ConAgra Brands Inc., Baxters Food Group, and Vanee Foods Company. Leading brands in the condensed canned soups market are prioritizing product diversification through reformulation, introducing low-sodium, organic, gluten-free, and plant-based varieties. Many companies are investing in sustainable packaging and enhancing flavor profiles to meet evolving consumer preferences. Innovation is also fueled by R&D to integrate superfoods, plant proteins, and allergen-friendly ingredients. In addition, brands are optimizing supply chains and expanding retail partnerships for better shelf visibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Distribution channel trends

- 2.2.3 Packaging format trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By product type trends

- 3.8.2 By distribution channel trends

- 3.8.3 By packaging format trends

- 3.8.4 By region

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Condensed soup varieties

- 5.2.1 Chicken noodle soup

- 5.2.2 Tomato soup

- 5.2.3 Cream of mushroom soup

- 5.2.4 Cream of chicken soup

- 5.2.5 Vegetable soup

- 5.2.6 Beef-based soups

- 5.2.7 Cream-based specialty soups

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Retail channels

- 6.2.1 Supermarkets and hypermarkets

- 6.2.2 Convenience stores

- 6.2.3 Discount retailers

- 6.2.4 Specialty food stores

- 6.2.5 Online retail and e-commerce

- 6.3 Foodservice channels

- 6.3.1 Restaurants and quick service

- 6.3.2 Institutional foodservice

- 6.3.3 Healthcare and educational facilities

- 6.4 Direct-to-consumer channels

Chapter 7 Market Estimates and Forecast, By Packaging Format, 2021-2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Traditional metal cans

- 7.2.1 Standard size cans (10.5-11 oz)

- 7.2.2 Family size cans (18-23 oz)

- 7.2.3 Institutional size cans

- 7.3 Alternative packaging formats

- 7.3.1 Flexible pouches and stand-up pouches

- 7.3.2 Aseptic cartons and tetra packs

- 7.3.3 Microwaveable containers

- 7.3.4 Single-serve cups and bowls

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Campbell Soup Company

- 9.2 General Mills Inc. (Progresso)

- 9.3 The Kraft Heinz Company

- 9.4 Nestle S.A.

- 9.5 Unilever (Knorr)

- 9.6 ConAgra Brands Inc.

- 9.7 Baxters Food Group

- 9.8 BCI Foods Inc.

- 9.9 Vanee Foods Company

- 9.10 Amy’s Kitchen Inc