|

市場調查報告書

商品編碼

1797695

情緒偵測與辨識市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Emotion Detection and Recognition Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

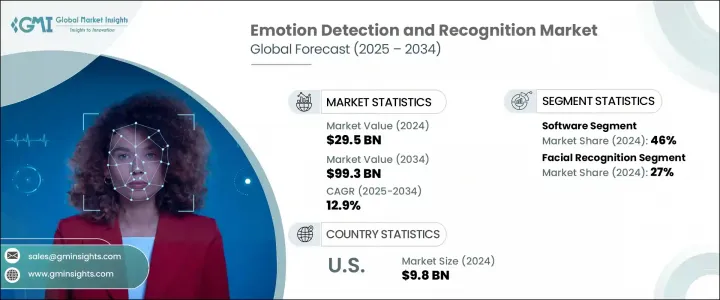

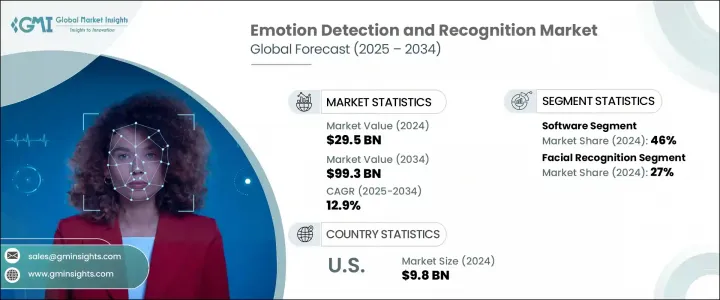

2024年,全球情緒偵測與辨識市場規模達295億美元,預計到2034年將以12.9%的複合年成長率成長,達到993億美元。這一成長主要得益於人工智慧、機器學習和多模式感測技術的持續進步。這些創新顯著提高了情緒辨識系統的即時能力和精確度,使其在醫療保健、汽車、安防和零售等領域的應用日益廣泛。該技術的應用範圍也正在不斷拓展,包括駕駛員行為監測、情緒健康追蹤、定向廣告和監控。

公眾對臉部辨識等一些關鍵技術的看法仍然存在分歧,持續的討論集中在隱私和倫理部署方面。針對EDR專業人員的教育和認證課程應運而生,涵蓋倫理AI培訓和社會責任。北美憑藉在醫療AI、車輛安全應用方面的強勁投資以及強大的研究機構,引領著市場;而亞太地區則在印度、中國和韓國等國家積極的數位轉型政策和AI投資的支持下,正在迅速趕上。不斷發展的監管框架和全球各地區不斷擴展的工業AI整合,進一步增強了市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 295億美元 |

| 預測值 | 993億美元 |

| 複合年成長率 | 12.9% |

軟體領域在2024年佔據了46%的市場佔有率,預計到2034年將以3.8%的複合年成長率成長。此領域涵蓋能夠進行臉部分析、語音辨識和多模式資料處理的情緒人工智慧平台。自然語言處理和神經網路架構的持續改進正在推動該領域的創新。這些軟體工具廣泛應用於基於情緒的客戶分析、心理健康診斷和員工篩檢等用例。隨著企業擴大投資於提供即時情感智慧的平台,以增強服務個人化和營運洞察力,該領域以人工智慧為主導的解決方案正日益受到青睞。

2024年,臉部辨識系統市場佔據27%的市場佔有率,預計到2034年將以10.7%的複合年成長率成長。該市場在汽車安全技術、零售分析和監控工具領域的廣泛應用使其佔據領先地位。臉部分析系統能夠在各種環境下準確評估使用者情緒、駕駛警覺性和消費者反應。隨著硬體效能的提升和臉部分析的日益精細化,其在智慧監控和行為評估平台中的整合度將持續提升。

美國情緒偵測與辨識市場佔85%的市場佔有率,2024年市場規模達98億美元。美國領先的地位源自於其成熟的醫療基礎設施、人工智慧在數位服務領域的廣泛應用,以及連網汽車和教育平台的持續創新。情緒人工智慧正擴大應用於個人化病患照護、分析課堂參與、監控道路安全以及提升各行各業的使用者體驗。美國在智慧系統和人工智慧整合方面的大力投資,使其成為情緒分析發展的中心樞紐。

塑造全球情緒偵測與識別市場的關鍵產業參與者包括 Kairos AR、蘋果、Realeyes、亞馬遜網路服務 (AWS)、Entropik、IBM、Google (Alphabet)、微軟、Uniphore、Smart Eye (Affectiva) 和 Verint。這些公司正在人工智慧驅動的情緒智慧和多模式分析領域積極創新,以獲得競爭優勢。產業領導者專注於高階分析平台、可擴展 API 和情緒資料集,以提高跨多種語言和文化的模型準確性。與汽車、醫療保健和零售業的策略合作使這些公司能夠將 EDR 技術嵌入到現實環境中。一些公司正在透過收購和遵守道德人工智慧準則來增強其產品,以滿足監管要求和用戶信任標準。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 人工智慧與多模式感測整合

- 執法部門使用率不斷提升

- 醫療保健和零售業的需求不斷成長

- 拓展遠距互動管道

- 多模式人工智慧的進步

- 產業陷阱與挑戰

- 隱私和道德問題

- 資料安全與合規性

- 市場機會

- 道德人工智慧框架的開發

- 汽車和智慧城市計畫的擴展

- 供應商與學術機構的合作

- 亞太新興市場

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 最佳情況

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按組件,2021 - 2034 年

- 硬體

- 相機

- 感應器

- 穿戴式裝置

- 軟體

- 臉部表情辨識軟體

- 語音辨識軟體

- 手勢辨識軟體

- 生物識別和生物感測器

- 服務

- 諮詢

- 整合與部署

- 支援與維護

第6章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 臉部辨識

- 語音辨識

- 機器學習與人工智慧(AI)

- 生物特徵分析

- 模式識別與分析

第7章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 基於雲端

- 本地

- 混合

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 醫療保健

- 人機互動(HCI)

- 行銷和廣告

- 安全與監控

- 教育

- 遊戲和互動娛樂

- 機器人和穿戴式技術

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Technology and cloud providers

- Specialized Emotion AI companies

- Emerging companies and startups

The Global Emotion Detection and Recognition Market was valued at USD 29.5 billion in 2024 and is estimated to grow at a CAGR of 12.9% to reach USD 99.3 billion by 2034. This surge is primarily fueled by ongoing advancements in artificial intelligence, machine learning, and multimodal sensing technologies. These innovations have significantly improved the real-time capabilities and precision of emotional recognition systems, which are increasingly used in sectors like healthcare, automotive, security, and retail. The technology is expanding into a wider array of applications, including driver behavior monitoring, emotional wellness tracking, targeted advertising, and surveillance.

Public opinion remains divided over some key technologies, such as facial recognition, with ongoing conversations centered around privacy and ethical deployment. Educational and certification programs for EDR professionals are emerging in response, incorporating ethical AI training and social accountability. North America is leading the market due to robust investments in healthcare AI, vehicle safety applications, and strong research institutions, while the Asia-Pacific region is rapidly catching up, backed by aggressive digital transformation policies and AI investments across countries like India, China, and South Korea. The market's growth is further strengthened by evolving regulatory frameworks and expanding industrial AI integrations across global regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.5 Billion |

| Forecast Value | $99.3 Billion |

| CAGR | 12.9% |

The software segment held a 46% share in 2024 and is expected to grow at a CAGR of 3.8% through 2034. This segment encompasses emotion AI platforms capable of facial analysis, voice recognition, and multimodal data processing. Continuous improvements in natural language processing and neural network architectures are driving innovation across this segment. These software tools are widely implemented in use cases such as emotion-based customer analytics, mental health diagnostics, and employee screening. AI-led solutions in this space are gaining traction as businesses increasingly invest in platforms that offer real-time emotional intelligence to enhance service personalization and operational insights.

The facial recognition systems segment held a 27% share in 2024 and is anticipated to grow at a CAGR of 10.7% through 2034. This segment leads due to its high adoption across automotive safety technologies, retail analytics, and monitoring tools. Facial analysis systems enable accurate assessment of user emotions, driver alertness, and consumer reactions in various environments. With hardware performance improving and facial analysis becoming more refined, its integration in smart surveillance and behavioral evaluation platforms continues to expand.

United States Emotion Detection and Recognition Market held an 85% share and generated USD 9.8 billion in 2024. The country's leadership stems from a mature healthcare infrastructure, broad implementation of AI in digital services, and ongoing innovation in connected vehicles and educational platforms. Emotion AI is increasingly used to personalize patient care, analyze classroom engagement, monitor road safety, and improve user experience across industries. Strong investments in intelligent systems and AI integration have made the US a central hub for emotion analytics development.

Key industry players shaping the Global Emotion Detection and Recognition Market include Kairos AR, Apple, Realeyes, Amazon Web Services (AWS), Entropik, IBM, Google (Alphabet), Microsoft, Uniphore, Smart Eye (Affectiva), and Verint. These companies are actively innovating in AI-driven emotional intelligence and multimodal analytics to gain a competitive advantage. Industry leaders are focusing on advanced analytics platforms, scalable APIs, and emotion datasets to improve model accuracy across multiple languages and cultures. Strategic collaborations with automotive, healthcare, and retail sectors enable these companies to embed EDR technologies into real-world environments. Several firms are enhancing their offerings through acquisitions and by aligning with ethical AI guidelines to meet regulatory requirements and user trust standards.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Deployment Mode

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 AI and multimodal sensing integration

- 3.2.1.2 Increasing use in law enforcement

- 3.2.1.3 Rising demand in healthcare and retail

- 3.2.1.4 Expansion of remote interaction channels

- 3.2.1.5 Advancements in multimodal AI

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Privacy and ethical concerns

- 3.2.2.2 Data security and compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Development of ethical AI frameworks

- 3.2.3.2 Expansion in automotive and smart city projects

- 3.2.3.3 Vendor-academic collaborations

- 3.2.3.4 Emerging markets in Asia-Pacific

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Hardware

- 5.1.1 Cameras

- 5.1.2 Sensors

- 5.1.3 Wearables

- 5.2 Software

- 5.2.1 Facial Expression Recognition Software

- 5.2.2 Speech & Voice Recognition Software

- 5.2.3 Gesture Recognition Software

- 5.2.4 Biometrics and Biosensors

- 5.3 Services

- 5.3.1 Consulting

- 5.3.2 Integration & Deployment

- 5.3.3 Support & Maintenance

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Facial Recognition

- 6.3 Speech Recognition

- 6.4 Machine Learning & Artificial Intelligence (AI)

- 6.5 Biometric Analysis

- 6.6 Pattern Recognition & Analytics

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Cloud-based

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Medical and Healthcare

- 8.3 Human-Computer Interaction (HCI)

- 8.4 Marketing and Advertising

- 8.5 Security and Surveillance

- 8.6 Education

- 8.7 Gaming and Interactive Entertainment

- 8.8 Robotics and Wearable Technology

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Technology and cloud providers

- 10.1.1 Amazon Web Services

- 10.1.2 Apple (Emotient)

- 10.1.3 Facebook (Meta Platforms)

- 10.1.4 Google

- 10.1.5 IBM

- 10.1.6 Intel

- 10.1.7 Microsoft

- 10.1.8 NVIDIA

- 10.2 Specialized Emotion AI companies

- 10.2.1 Affectiva (Smart Eye)

- 10.2.2 Beyond Verbal Communications

- 10.2.3 Cogito

- 10.2.4 Elliptic Labs

- 10.2.5 Eyeris Technologies

- 10.2.6 Kairos AR

- 10.2.7 Noldus Information Technology

- 10.2.8 Realeyes (Attention Insight)

- 10.2.9 Sightcorp

- 10.3 Emerging companies and startups

- 10.3.1 AnyVision

- 10.3.2 Avanade

- 10.3.3 Cognitec Systems

- 10.3.4 Facefirst

- 10.3.5 Hume AI

- 10.3.6 Paravision

- 10.3.7 Trueface

- 10.3.8 Uniphore

- 10.3.9 VoiceSense