|

市場調查報告書

商品編碼

1797691

泌尿科設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Urology Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

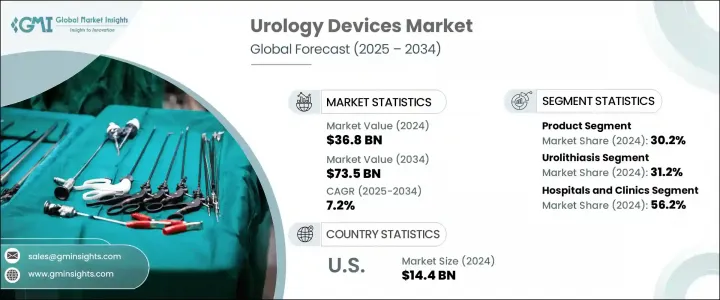

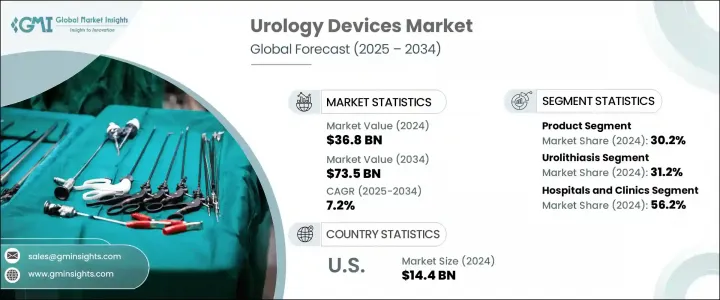

2024年,全球泌尿科設備市場規模達368億美元,預計2034年將以7.2%的複合年成長率成長,達到735億美元。該市場的成長軌跡主要受泌尿科疾病發病率激增的驅動,包括腎結石、良性前列腺增生 (BPH) 和尿失禁。泌尿健康意識的提升,加上全球人口老化,進一步推動了泌尿科設備需求的成長。診斷和治療方案的技術進步,以及微創手術和居家照護的轉變,是先進泌尿科設備日益普及的關鍵因素。

醫療保健提供者越來越依賴智慧數據驅動的工具來改善患者治療效果並降低手術風險。公營和私營部門也正在增加對泌尿科服務的投資,以擴展泌尿科服務,並將機器人和人工智慧融入臨床工作流程。隨著全球醫療保健支出的不斷成長以及對個人化醫療解決方案的需求不斷成長,泌尿科設備市場預計將在各種醫療環境中呈現強勁成長勢頭。該領域的設備在支持患者更快康復、改善患者舒適度和提高診斷準確性方面發揮核心作用,以滿足日益成長的患者群體的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 368億美元 |

| 預測值 | 735億美元 |

| 複合年成長率 | 7.2% |

泌尿科器械是用於診斷、監測及治療泌尿道及男性生殖系統相關疾病的專用儀器。這些醫療工具廣泛用於結石碎裂、膀胱功能檢測、尿流監測和攝護腺治療等手術。它們廣泛部署於外科中心、醫院和專科泌尿科診所,這些地方擁有先進的基礎設施,能夠支援大量的手術和術後護理。

預計到2034年,雷射碎石設備市場將以8%的複合年成長率成長,這得益於市場對微創治療方案的需求,這些方案能夠提供精準的干涉、更快的癒合速度和更少的併發症。這些設備方便用戶使用且經濟高效,使其成為結石管理和其他泌尿外科干預措施的首選。這些設備使醫生能夠接觸和治療整個泌尿道系統,包括腎臟、膀胱、尿道和輸尿管,從而提供高度針對性的治療效果。

2024年,醫院和診所細分市場佔據56.2%的市場佔有率,這得益於其處理複雜手術、提供先進技術和提供專業護理的能力。這些機構仍然是急診和常規泌尿外科病例的首選治療點,因為它們能夠支持大量患者,並提供全面的診斷和手術方案。它們對尖端技術的投入和對創新的承諾,使其成為市場持續擴張的核心。

2024年,歐洲泌尿科設備市場規模達到99億美元,這得益於泌尿科疾病發生率的上升,尤其是在老年人群中。歐盟醫療器材法規 (MDR) 框架下的強力監管政策強化了產品安全性和有效性的重要性,進一步增強了醫療專業人士的信心。政府旨在擴大機器人輔助手術可及性並支持微創技術創新的舉措,也推動了整個地區的市場需求。

全球泌尿科設備市場的一些主要參與者包括 Intuitive Surgical、Richard Wolf、Dornier MedTech、Olympus Corporation、Cook Medical、Ambu、Siemens Healthineers、BESDATA、NIPRO、Coloplast、Laborie Medical Technologies、Teleflex、B. Braun、Boston Scientific Corporation 和 HugeMed。泌尿科設備市場的領先公司非常注重持續創新,推出根據患者特定需求量身定做的更智慧、更安全、更有效率的設備。許多公司正在透過整合數位診斷和機器人系統來增強其產品線,以提供具有更好結果的微創解決方案。與醫院、研究機構和技術開發商的策略合作夥伴關係正在幫助他們擴大產品範圍並支持產品開發管道。這些參與者也透過本地化製造、分銷網路和法規遵從措施在新興市場擴張。研發投資加上泌尿科設備的即時資料整合對於提高手術成功率和營運效率至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 泌尿系統疾病盛行率上升

- 提高認知和早期診斷

- 治療設備的技術進步

- 居家透析和門診手術的需求不斷成長

- 產業陷阱與挑戰

- 嚴格的監管障礙

- 農村地區交通受限

- 市場機會

- 擴大門診及微創手術

- 診斷工具需求增加

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 技術進步

- 當前的技術趨勢

- 新興技術

- 供應鏈分析

- 定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 產品

- 內視鏡

- 膀胱鏡

- 一次性的

- 可重複使用的

- 輸尿管鏡

- 一次性的

- 可重複使用的

- 膀胱鏡

- 雷射和碎石設備

- 透析設備

- 其他產品

- 內視鏡

- 配件

- 導管

- 支架

- 潤滑劑和凝膠

- 其他配件

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 泌尿系統結石

- 尿道惡性腫瘤

- 膀胱疾病

- 腎臟疾病

- 性功能障礙

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 透析中心

- 居家照護環境

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Ambu

- B. Braun

- BESDATA

- Boston Scientific Corporation

- Coloplast

- Cook Medical

- Dornier MedTech

- HugeMed

- Intuitive Surgical

- Laborie Medical Technologies

- NIPRO

- Olympus Corporation

- Richard Wolf

- Siemens Healthineers

- Teleflex

The Global Urology Devices Market was valued at USD 36.8 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 73.5 billion by 2034. The growth trajectory of this market is being driven by a surge in urological conditions, including kidney stones, benign prostatic hyperplasia (BPH), and urinary incontinence. Rising awareness of urinary health, coupled with an aging global population, is further driving demand. Technological progress in diagnostics and treatment options, along with a shift toward minimally invasive procedures and home-based care, are key contributors to the rising adoption of advanced urology devices.

Healthcare providers are increasingly relying on smart, data-enabled tools to support patient outcomes and reduce surgical risks. The market is also seeing greater investment from both public and private sectors to expand urological services and integrate robotics and AI in clinical workflows. With increasing global healthcare spending and a demand for personalized medical solutions, the urology device market is expected to experience strong momentum across diverse care settings. Devices in this space are playing a central role in supporting faster recovery, improved patient comfort, and enhanced diagnostic accuracy for a growing patient base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.8 Billion |

| Forecast Value | $73.5 Billion |

| CAGR | 7.2% |

Urology devices are specialized instruments used to diagnose, monitor, and treat conditions related to the urinary tract and the male reproductive system. These medical tools are used extensively for procedures such as stone fragmentation, bladder function testing, urinary flow monitoring, and prostate treatments. They are widely deployed in surgical centers, hospitals, and specialty urology clinics where advanced infrastructure supports high procedure volumes and post-operative care.

The laser and lithotripsy devices segment is forecasted to grow at a CAGR of 8% through 2034, propelled by the demand for minimally invasive treatment options that provide precise intervention, faster healing, and fewer complications. Their user-friendly design and cost-efficiency have made them highly preferred for stone management and other urologic interventions. These devices allow physicians to access and treat conditions across the entire urinary tract, including the kidneys, bladder, urethra, and ureters, offering highly targeted therapeutic outcomes.

In 2024, the hospitals and clinics segment accounted for a 56.2% share, fueled by their ability to handle complex procedures, offer advanced technology, and deliver specialized care. These facilities remain the first point of treatment for both emergency and routine urological cases, given their ability to support a high number of patients and provide comprehensive diagnostic and surgical options. Their investment in cutting-edge technologies and commitment to innovation make them central to the market's continued expansion.

Europe Urology Devices Market reached USD 9.9 billion in 2024, driven by a rising incidence of urologic disorders, particularly among elderly populations. Strong regulatory policies under the EU Medical Device Regulation (MDR) framework have reinforced the importance of product safety and efficacy, further boosting confidence among healthcare professionals. Government initiatives aimed at expanding access to robotic-assisted surgeries and supporting innovations in minimally invasive technologies are also propelling market demand across the region.

Some of the key players in the Global Urology Devices Market include Intuitive Surgical, Richard Wolf, Dornier MedTech, Olympus Corporation, Cook Medical, Ambu, Siemens Healthineers, BESDATA, NIPRO, Coloplast, Laborie Medical Technologies, Teleflex, B. Braun, Boston Scientific Corporation, and HugeMed. Leading companies in the urology devices market are heavily focused on continuous innovation, introducing smarter, safer, and more efficient devices tailored to patient-specific needs. Many firms are enhancing their product lines by integrating digital diagnostics and robotic systems to offer minimally invasive solutions with improved outcomes. Strategic partnerships with hospitals, research institutes, and technology developers are helping them expand their product reach and support product development pipelines. These players are also expanding in emerging markets through localized manufacturing, distribution networks, and regulatory compliance initiatives. Investment in R&D, coupled with real-time data integration in urology devices, has been pivotal in improving procedural success and operational efficiency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of urological disorders

- 3.2.1.2 Increasing awareness and early diagnosis

- 3.2.1.3 Technological advancements in therapeutic devices

- 3.2.1.4 Growing demand for home dialysis and outpatient procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory hurdles

- 3.2.2.2 Limited access in rural areas

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and minimally invasive procedures

- 3.2.3.2 Increased demand for diagnostic tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Product

- 5.2.1 Endoscopes

- 5.2.1.1 Cystoscopes

- 5.2.1.1.1 Disposable

- 5.2.1.1.2 Reusable

- 5.2.1.2 Ureteroscopes

- 5.2.1.2.1 Disposable

- 5.2.1.2.2 Reusable

- 5.2.1.1 Cystoscopes

- 5.2.2 Laser and lithotripsy devices

- 5.2.3 Dialysis devices

- 5.2.4 Other products

- 5.2.1 Endoscopes

- 5.3 Accessories

- 5.3.1 Catheters

- 5.3.2 Stents

- 5.3.3 Lubricants and gels

- 5.3.4 Other accessories

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Urolithiasis

- 6.3 Urethral malignancies

- 6.4 Bladder disorders

- 6.5 Kidney diseases

- 6.6 Erectile dysfunction

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Dialysis centers

- 7.4 Home care settings

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ambu

- 9.2 B. Braun

- 9.3 BESDATA

- 9.4 Boston Scientific Corporation

- 9.5 Coloplast

- 9.6 Cook Medical

- 9.7 Dornier MedTech

- 9.8 HugeMed

- 9.9 Intuitive Surgical

- 9.10 Laborie Medical Technologies

- 9.11 NIPRO

- 9.12 Olympus Corporation

- 9.13 Richard Wolf

- 9.14 Siemens Healthineers

- 9.15 Teleflex