|

市場調查報告書

商品編碼

1797683

清潔機器人市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cleaning Robot Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

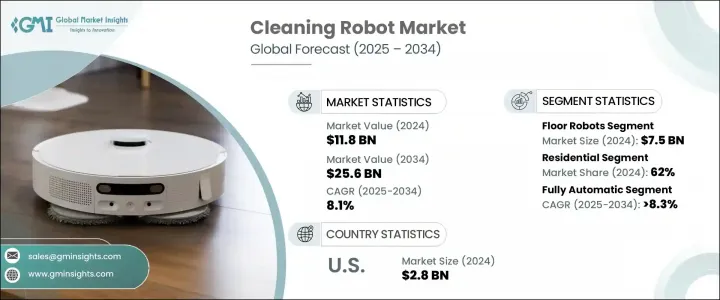

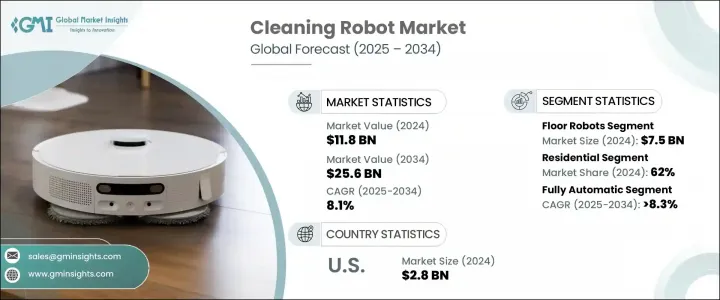

2024年,全球清潔機器人市場規模達118億美元,預計2034年將以8.1%的複合年成長率成長,達到256億美元。由於採用智慧家庭的不斷建設、技術的快速進步以及在住宅、商業和工業領域應用的不斷拓展,該市場正經歷強勁成長。隨著自動化日益成為主流,清潔機器人作為高效省時的解決方案正日益受到青睞。家庭和企業都在投資這些設備,以減少人工勞動,同時提高清潔度。在飯店、零售和醫療保健等衛生至上的商業領域,對清潔機器人的需求尤其高漲。目前市場上已有經濟實惠的型號,使這項技術更容易獲得,從而進一步推動了其普及。

智慧技術正成為清潔產業的標竿。這些機器人系統整合了感測器、互聯互通和即時資料分析功能,以提高營運效率。先進的模型能夠聰明地繪製空間地圖,並根據地面佈局和污垢程度調整其日常工作。在工業應用中,清潔機器人提供遠端監控和預測分析,可以追蹤性能、檢測磨損並識別需要額外關注的區域。人工智慧不斷增強其功能,使其更加智慧、更加自主。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 118億美元 |

| 預測值 | 256億美元 |

| 複合年成長率 | 8.1% |

2024年,地板清潔機器人市場規模達75億美元,預計2034年複合年成長率將達8.4%。這些機器人正在快速發展,將人工智慧導航與物件偵測和即時避障功能相結合。與智慧家庭平台整合,可實現語音指令、行動應用調度和遠端操作,使其成為現代家居的便捷解決方案。人工智慧與物聯網的協同效應是其日益普及的主要驅動力。

2024年,住宅市場佔據了62%的市場佔有率,預計到2034年將以8.3%的複合年成長率成長。這項需求源自於可支配收入的增加、繁忙的生活方式以及智慧家居創新的廣泛接受。屋主們開始青睞省時省力的掃地機器人和拖地機器人,而語音控制和自動化等功能也使其比傳統的清潔方式更受歡迎。

美國清潔機器人市場佔了80%的市場佔有率,2024年市場規模達28億美元。美國市場的成長得益於智慧家電的廣泛普及、機器人系統的技術整合以及消費者行為的轉變。家庭和企業都在投資這些設備,以提高生產力並減少對體力勞動的依賴。收入成長和生活方式的升級繼續支撐著美國在該領域的強勢地位。

全球清潔機器人市場的領導者包括 Verobotics、LG、美麗的、Milagrow、坦能、WYBOT、愛珀、三星、iRobot、Avidbots、Dreame、Gausium、Rictech Robotic、Peppermint 和凱馳。為了鞏固市場地位,清潔機器人產業的企業正大力關注技術創新、產品多元化和策略合作夥伴關係。許多企業正在投資人工智慧、機器學習和先進的感測器整合技術,以提供更智慧、更自主的清潔解決方案。主要企業正在推出具有增強連接性的多功能機器人,適用於住宅和商業用途。與智慧家庭生態系統和零售分銷管道的合作正在擴大其覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 家庭和商業空間擴大採用自動化

- 可支配所得增加和生活方式改變

- 技術進步

- 產業陷阱與挑戰

- 清潔機器人的初始成本高

- 發展中地區的認知有限

- 技術問題,例如導航錯誤和維護要求

- 機會

- 擴大工業和醫療保健領域的應用

- 開發具有成本效益和節能的模型

- 對環保清潔解決方案的需求不斷成長

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 地板機器人

- 窗戶機器人

- 草坪機器人

- 泳池機器人

- 其他(管道機器人等)

第6章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 半自動

- 全自動

第7章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:按最終用戶,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 運輸

- 零售

- 辦公室

- 飯店業

- 其他(學校、大學等)

- 工業的

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 專業零售店

- 其他(獨立零售商等)

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Aiper

- Avidbots

- Dreame

- Gausium

- iRobot

- Karcher

- LG

- Midea

- Milagrow

- Peppermint

- Richtech Robotic

- Samsung

- Tennant

- Verobotics

- WYBOT

The Global Cleaning Robot Market was valued at USD 11.8 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 25.6 billion by 2034. This market is witnessing robust growth, fueled by the increasing construction of smart homes, rapid technological progress, and expanded use across residential, commercial, and industrial environments. With automation becoming more mainstream, cleaning robots are gaining traction as efficient and time-saving solutions. Both households and businesses are investing in these devices to reduce manual labor while improving cleanliness. The demand is especially rising in commercial spaces such as hospitality, retail, and healthcare, where hygiene is paramount. Cost-effective models now available on the market have made this technology more accessible, pushing adoption even further.

Smart technology is becoming standard in the cleaning sector. These robotic systems integrate sensors, connectivity, and real-time data analysis to improve operational efficiency. Advanced models intelligently map spaces and adjust their routines based on floor layout and dirt levels. In industrial use cases, cleaning robots offer remote monitoring and predictive analytics that track performance, detect wear, and identify areas needing extra attention. AI continues to enhance its functionality, making it smarter and more autonomous.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.8 Billion |

| Forecast Value | $25.6 Billion |

| CAGR | 8.1% |

In 2024, the floor cleaning robots segment generated USD 7.5 billion and is expected to grow at a CAGR of 8.4% through 2034. These robots are evolving rapidly, combining AI-driven navigation with object detection and real-time obstacle avoidance. Integration with smart home platforms enables voice commands, mobile app scheduling, and remote operation, making them a convenient solution for modern homes. This synergy between AI and IoT is a major driver behind their increasing popularity.

The residential segment held a 62% share in 2024 and is expected to grow at a CAGR of 8.3% through 2034. This demand stems from rising disposable incomes, busy lifestyles, and the widespread acceptance of smart home innovations. Homeowners are turning to robotic vacuums and mopping robots that save time and reduce effort, while features such as voice control and automation make them more desirable than traditional cleaning methods.

United States Cleaning Robot Market held an 80% share, generating USD 2.8 billion in 2024. The market growth in the US is driven by widespread adoption of smart appliances, technological integration in robotic systems, and changing consumer behavior. Households and businesses alike are investing in these devices to improve productivity and reduce reliance on manual labor. Higher incomes and lifestyle upgrades continue to support the country's strong position in this sector.

Leading companies in the Global Cleaning Robot Market include Verobotics, LG, Midea, Milagrow, Tennant, WYBOT, Aiper, Samsung, iRobot, Avidbots, Dreame, Gausium, Rictech Robotic, Peppermint, and Karcher. To strengthen their market position, companies in the cleaning robot industry are focusing heavily on technological innovation, product diversification, and strategic partnerships. Many are investing in AI, machine learning, and advanced sensor integration to deliver smarter, more autonomous cleaning solutions. Key players are launching multi-functional robots with enhanced connectivity, adapting to both residential and commercial use. Collaborations with smart home ecosystems and retail distribution channels are expanding their reach.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By type

- 2.2.3 By mode of operation

- 2.2.4 By price

- 2.2.5 By end user

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of automation in households and commercial spaces

- 3.2.1.2 Rising disposable income and changing lifestyles

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs of cleaning robots

- 3.2.2.2 Limited awareness in developing regions

- 3.2.2.3 Technical issues, such as navigation errors and maintenance requirements

- 3.2.3 Opportunities

- 3.2.3.1 Expanding applications in industrial and healthcare sectors

- 3.2.3.2 Development of cost-effective and energy-efficient models

- 3.2.3.3 Growing demand for eco-friendly cleaning solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Floor robots

- 5.3 Window robots

- 5.4 Lawn robots

- 5.5 Pool robots

- 5.6 Others (duct robots etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End User, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Transportation

- 8.3.2 Retail

- 8.3.3 Offices

- 8.3.4 Hospitality

- 8.3.5 Others (schools, universities etc.)

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Supermarkets/hypermarket

- 9.3.2 Specialty retail stores

- 9.3.3 Others (independent retailer etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aiper

- 11.2 Avidbots

- 11.3 Dreame

- 11.4 Gausium

- 11.5 iRobot

- 11.6 Karcher

- 11.7 LG

- 11.8 Midea

- 11.9 Milagrow

- 11.10 Peppermint

- 11.11 Richtech Robotic

- 11.12 Samsung

- 11.13 Tennant

- 11.14 Verobotics

- 11.15 WYBOT