|

市場調查報告書

商品編碼

1782162

發炎性腸道疾病治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Inflammatory Bowel Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

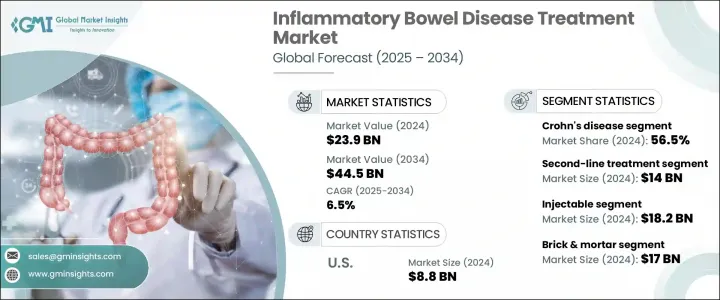

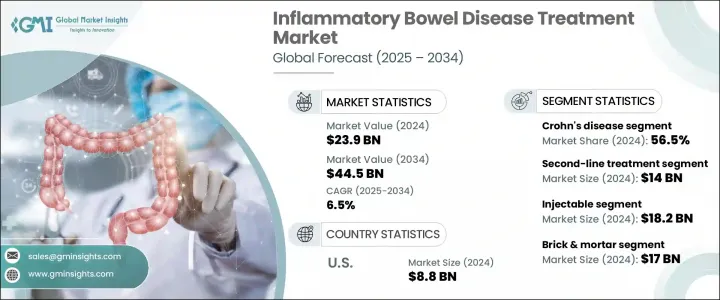

2024年,全球發炎性腸道疾病治療市場規模達239億美元,預計到2034年將以6.5%的複合年成長率成長,達到445億美元。這一成長主要源於全球發炎性腸道疾病(IBD)盛行率的上升,包括克隆氏症和潰瘍性結腸炎,以及早期診斷和治療管道的不斷擴展。飲食習慣的改變、久坐的生活方式以及環境因素導致IBD病例數不斷增加,尤其是在已開發國家。加強宣傳活動和更優惠的報銷結構正在提高診斷率和患者依從性。

針對生物製劑和小分子等治療方法的創新顯著提高了治療效果,並減少了治療相關併發症。政府以公共資金和更快的監管審查形式提供的支持也促進了下一代療法的開發和應用。隨著患者人數的穩定成長,對能夠改善生活品質和減少疾病發作的長期有效解決方案的需求持續成長。這些因素共同塑造了未來十年IBD療法強勁且充滿活力的市場環境。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 239億美元 |

| 預測值 | 445億美元 |

| 複合年成長率 | 6.5% |

2024年,克隆氏症細分市場佔據56.5%的市場佔有率,預計2025-2034年期間的複合年成長率為6.3%。這一成長主要歸因於年輕群體中新診斷病例的增加,尤其是在北美和歐洲。由於克隆氏症可涉及胃腸道的任何部位並滲透至更深的組織層,因此與潰瘍性結腸炎相比,它往往需要更複雜、更長期的治療方法。因此,醫療保健提供者擴大使用免疫抑制劑和生物製劑等高價值療法。包括Janus激酶抑制劑和抗整合素藥物在內的先進治療方案的日益普及,重新定義了該疾病的治療方式,並顯著促進了該細分市場的成長。

注射療法領域在2024年創造了最高的收入,價值182億美元,預計到2034年將維持6.4%的複合年成長率。這個領域主要由生物製劑(尤其是單株抗體)的廣泛應用引領,這些生物製劑通常透過注射給藥。這些療法透過精準靶向發炎通路,已成為治療中度至重度發炎性腸道疾病(IBD)的基石。在分子層面調節免疫活性的藥物已被證明在維持緩解和最大程度降低疾病復發方面非常有效,尤其對於對傳統藥物無效的患者。長效注射劑也有助於提高依從性並提升患者滿意度。

2024年,美國發炎性腸道疾病治療市場規模達88億美元。該市場的成長動力源自於不同人群中克隆氏症和潰瘍性結腸炎發生率的上升。診斷能力的提升、專科醫生就診機會的增加以及標靶治療的廣泛應用,都在加速市場發展。長效皮下注射劑和緩釋製劑等創新藥物傳遞技術的出現,提高了患者的治療順從性。這些進步使患者更容易控制病情並維持長期緩解,進一步刺激了對先進療法的需求。

全球發炎性腸道疾病治療市場的主要參與者包括輝瑞、百健、武田、Dr Falk、強生、CELLTRION、艾伯維、輝凌、默克、優時比、諾華、Tillotts Pharma、禮來和安進。這些公司透過策略性投資和創新藥物開發持續影響市場方向。為了鞏固其在發炎性腸道疾病治療領域的影響力,領先的製藥公司正在推動多管齊下的策略,包括研究驅動的創新、監管參與和合作夥伴關係。

該公司正在大力投資臨床試驗,以開發療效更高、副作用更少的新型生物製劑和小分子藥物。透過授權交易、併購等方式拓展產品線也已成為常見策略。許多公司正與衛生部門密切合作,以加快核准速度並確保廣泛的報銷管道。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- IBD盛行率不斷上升

- 技術進步

- 優惠的報銷政策

- 對 IBD 症狀的認知和早期診斷不斷提高

- 產業陷阱與挑戰

- 嚴格的監管情景

- 治療費用高昂

- 市場機會

- 生物製劑和標靶療法的採用率不斷上升

- 新興市場的擴張

- 成長動力

- 成長潛力分析

- 報銷場景

- 監管格局

- 管道分析

- 投資情境展望

- 治療轉換模式或排序趨勢

- 流行病學情景

- 未來市場趨勢/主要市場療法

- 品牌分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 公司矩陣分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按治療類型,2021 - 2034 年

- 主要趨勢

- 克隆氏症

- 潰瘍性結腸炎

第6章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 一線治療

- 氨基水楊酸鹽

- 皮質類固醇

- 二線治療

- TNF抑制劑

- 白血球介素抑制劑

- JAK抑制劑

- 抗整合素

- 合併治療

- TNF抑制劑+硫嘌呤

- 其他聯合療法

第7章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 注射劑

- 口服

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 傳統實體店

- 電子商務

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- Amgen

- Biogen

- CELLTRION

- Dr Falk

- Ferring

- Johnson & Johnson

- Lilly

- Merck

- Novartis

- Pfizer

- Takeda

- Tillotts Pharma

- UCB

The Global Inflammatory Bowel Disease Treatment Market was valued at USD 23.9 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 44.5 billion by 2034. This growth is primarily driven by a rising global prevalence of IBD, including Crohn's disease and ulcerative colitis, as well as expanding access to early diagnosis and treatment. Changing diets, sedentary lifestyles, and environmental factors are contributing to the increasing number of IBD cases, especially in developed nations. Enhanced awareness campaigns and more favorable reimbursement structures are improving diagnosis rates and patient adherence.

Innovation in treatment approaches-such as targeted biologics and small molecules-has significantly advanced therapeutic outcomes and reduced treatment-related complications. Government support in the form of public funding and faster regulatory reviews is also encouraging the development and uptake of next-generation therapies. With the patient population growing steadily, demand continues to rise for long-term, effective solutions that improve quality of life and reduce disease flare-ups. Collectively, these factors are shaping a robust and dynamic market environment for IBD therapies over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.9 Billion |

| Forecast Value | $44.5 Billion |

| CAGR | 6.5% |

In 2024, the Crohn's disease segment held a 56.5% share and is forecasted to grow at a CAGR of 6.3% during 2025-2034. This expansion is largely attributed to an uptick in newly diagnosed cases among younger individuals, particularly across North America and Europe. Crohn's disease tends to require more complex and long-term treatment approaches than ulcerative colitis, given that it can affect any part of the gastrointestinal tract and penetrate deeper layers of tissue. As a result, healthcare providers are increasingly utilizing high-value therapies such as immunosuppressants and biologics. The growing adoption of advanced treatment classes, including Janus kinase inhibitors and anti-integrin agents, has redefined how the disease is managed and significantly contributed to segment growth.

The injectable therapies segment generated the highest revenue in 2024, valued at USD 18.2 billion, and is expected to maintain a CAGR of 6.4% through 2034. This category is led by the widespread use of biologics, particularly monoclonal antibodies, which are generally delivered via injection. These therapies have become the cornerstone for treating moderate to severe IBD by offering precision targeting of inflammation pathways. Agents that modulate immune activity at the molecular level are proving highly effective in maintaining remission and minimizing disease recurrence, especially for patients unresponsive to traditional medications. Long-acting injectables also contribute to higher compliance rates and improved patient satisfaction.

U.S. Inflammatory Bowel Disease Treatment Market was valued at USD 8.8 billion in 2024. Growth in this market is driven by a rising incidence of both Crohn's disease and ulcerative colitis across diverse demographics. Improved diagnostic capabilities, enhanced access to specialists, and expanding use of targeted therapies are all accelerating market development. The availability of innovative drug delivery technologies, such as long-acting subcutaneous injectables and sustained-release formulations, has improved treatment adherence. These advancements are making it easier for patients to manage their conditions and maintain long-term remission, further boosting demand for advanced therapeutics.

Key players operating in the Global Inflammatory Bowel Disease Treatment Market include Pfizer, Biogen, Takeda, Dr Falk, Johnson & Johnson, CELLTRION, AbbVie, Ferring, Merck, UCB, Novartis, Tillotts Pharma, Lilly, and Amgen. These companies continue to influence market direction through strategic investments and innovative drug development. To strengthen their presence in the IBD treatment space, leading pharmaceutical firms are advancing a multi-pronged approach that includes research-driven innovation, regulatory engagement, and collaborative partnerships.

Companies are investing significantly in clinical trials to develop novel biologics and small molecules with improved efficacy and fewer side effects. Expanding product pipelines through licensing deals, mergers, and acquisitions has also become a common strategy. Many are working closely with health authorities to secure accelerated approvals and ensure broad reimbursement access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Drug class trends

- 2.2.4 Route of administration trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of IBD

- 3.2.1.2 Technological advancements

- 3.2.1.3 Favorable reimbursement policies

- 3.2.1.4 Growing awareness and early diagnosis of IBD symptoms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High cost of treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of biologics and targeted therapies

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.6 Pipeline analysis

- 3.7 Investment scenarios outlook

- 3.8 Treatment switching patterns or sequencing trends

- 3.9 Epidemiological scenario

- 3.10 Future market trends/ Key marketed therapies

- 3.11 Brand analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Company matrix analysis

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Crohn's disease

- 5.3 Ulcerative colitis

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 First-line treatment

- 6.2.1 Aminosalicylates

- 6.2.2 Corticosteroids

- 6.3 Second-line treatment

- 6.3.1 TNF inhibitors

- 6.3.2 IL inhibitors

- 6.3.3 JAK inhibitors

- 6.3.4 Anti-integrin

- 6.4 Combination therapy

- 6.4.1 TNF inhibitors + thiopurines

- 6.4.2 Other combination therapies

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Injectable

- 7.3 Oral

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Brick & mortar

- 8.3 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amgen

- 10.3 Biogen

- 10.4 CELLTRION

- 10.5 Dr Falk

- 10.6 Ferring

- 10.7 Johnson & Johnson

- 10.8 Lilly

- 10.9 Merck

- 10.10 Novartis

- 10.11 Pfizer

- 10.12 Takeda

- 10.13 Tillotts Pharma

- 10.14 UCB