|

市場調查報告書

商品編碼

1782157

結核病診斷測試市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Tuberculosis Diagnostics Test Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

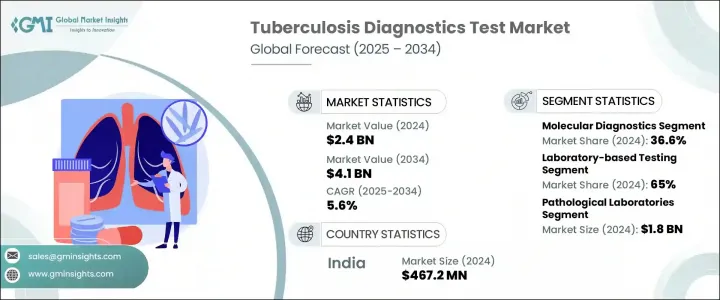

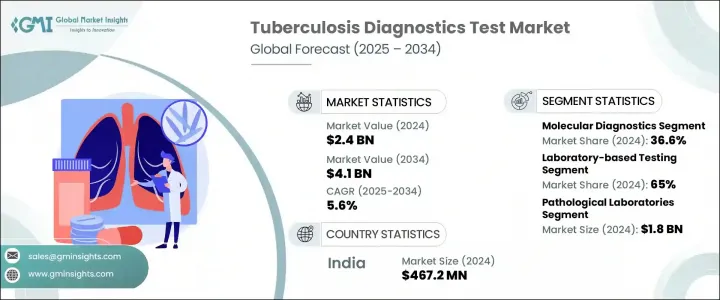

2024年,全球結核病診斷檢測市場規模達24億美元,預計到2034年將以5.6%的複合年成長率成長,達到41億美元。全球結核病病患病率的上升,加上診斷技術的進步和公共衛生意識的急劇提升,正在推動對可靠檢測工具的需求。即時檢測的普及和結構化篩檢計畫的實施,有助於提高早期結核病的發現率。這些努力得到了公共和私營部門的支持,旨在簡化及時診斷和治療流程,這是控制結核病傳播的關鍵步驟。

市場擴張的主要驅動力是全球加強早期篩檢措施的努力。政府支持的醫療保健計畫正在推出結構化策略,為高風險族群提供更便捷的診斷途徑。這些措施正在透過社區檢測和推廣加速早期識別。結核病診斷檢測用於檢測結核分枝桿菌的存在,並確定個體是否感染活動性結核病或潛伏性結核病,這對於指導治療決策至關重要。隨著對準確識別的日益重視,市場對診斷平台創新和基礎設施的投資持續增加。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 41億美元 |

| 複合年成長率 | 5.6% |

2024年,分子診斷成為領先細分市場,貢獻了36.6%的市場佔有率,預計到2034年將以5.9%的複合年成長率成長。這些診斷技術透過快速、靈敏、準確地檢測結核分枝桿菌及其抗藥性,改變了產業格局。聚合酶鍊式反應(PCR)作為該領域的核心技術,使醫療保健提供者能夠精確地從臨床樣本中檢測出結核菌,從而更有效地制定早期治療決策。

2024年,實驗室檢測類別佔最大佔有率,達65%。其主導地位主要歸功於精準的集中檢測方法,這對於診斷複雜抗藥性結核病病例至關重要。這些檢測通常在醫院、公共衛生機構和經認證的私人實驗室進行。常見的檢測技術包括抹片顯微鏡檢查、基於培養的診斷和干擾素-γ釋放試驗 (IGRA),所有這些技術都能深入了解疾病的嚴重程度和潛在的抗藥性,並指導臨床醫生製定個人化治療方案。

預計2025年至2034年,亞太地區結核病診斷檢測市場將以5.6%的複合年成長率成長。推動這一成長的因素包括結核病病例數量的增加、公共衛生教育的不斷普及、診斷實驗室的普及以及旨在加強診斷基礎設施的政府支持性政策。隨著該地區在醫療保健領域的持續投入,對先進結核病檢測解決方案的需求預計將持續成長。

該領域的領導企業包括丹納赫集團、雅培實驗室、生物梅里埃、凱傑公司、碧迪公司和羅氏公司。為了鞏固市場地位,各大頂尖企業正大力投資研發,以推動分子診斷和快速診斷技術的發展。與醫療機構與研究機構的策略性併購與合作,正協助各企業拓展診斷產品組合與全球影響力。多家企業正致力於打造低成本、可攜式結核病檢測解決方案,以滿足資源匱乏地區(尤其是高負擔地區)的需求。此外,製造商正在最佳化檢測靈敏度,縮短週轉時間,並確保其平台符合國際監管標準。這些策略共同提升了檢測的可近性、準確性和效率,使企業在市場中佔據長期領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球結核病負擔不斷加重

- 結核病診斷技術進展

- 提高對結核病的認知和篩檢項目

- 即時檢驗(POCT)激增

- 產業陷阱與挑戰

- 敏感性和特異性有限

- 嚴格的監管情景

- 成長動力

- 成長潛力分析

- 技術格局

- 監管格局

- 北美洲

- 歐洲

- 未來市場趨勢

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按測試類型,2021 - 2034 年

- 主要趨勢

- 射線照相法

- 診斷實驗室方法

- 顯微鏡

- 基於文化的技術

- 血清學檢測

- 分子診斷

- 聚合酶鍊式反應(PCR)

- 核酸擴增試驗(NAAT)

- GeneXpert MTB/RIF

- 檢測潛伏感染

- 結核菌素皮膚試驗(TST)/純蛋白衍生物(PPD)

- 第一代基於 PPD 的 TST

- 新一代重組抗原皮膚測試

- 結核菌素皮膚試驗(TST)/純蛋白衍生物(PPD)

- 干擾素-γ釋放試驗(IGRA)

- 基於 ELISA 的 IGRA

- 基於 ELISPOT 的 IGRA

- 即時診斷 IGRA

- 細胞激素檢測試驗

- 抗藥性檢測(DST)

- 噬菌體試驗

- 其他測試類型

第6章:市場估計與預測:按方式,2021 - 2034 年

- 主要趨勢

- 即時檢驗(POCT)

- 實驗室檢測(非 POCT)

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 病理實驗室

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Anhui Zhifei Longcom Biopharmaceutical Co.

- Becton, Dickinson and Company

- bioMerieux

- Danaher Corporation (Cepheid)

- F. Hoffmann-La Roche

- Generium Pharmaceuticals

- Hain Lifescience

- Hologic

- Japan BCG Laboratory

- NIPRO

- Oxford Immunotec

- Qiagen NV

- Sanofi

- Siemens Healthineers

- Thermo Fisher Scientific

The Global Tuberculosis Diagnostics Test Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 4.1 billion by 2034. Increasing TB prevalence worldwide, coupled with advancements in diagnostic technologies and a sharp rise in public health awareness, are fueling demand for reliable testing tools. The rising adoption of point-of-care testing and the implementation of structured screening programs are helping improve early detection rates. These efforts, supported by both public and private sectors, aim to streamline timely diagnosis and treatment, crucial steps in controlling the spread of tuberculosis.

A major driver behind the market's expansion is the global effort to strengthen early screening initiatives. Government-backed healthcare programs are rolling out structured strategies to support high-risk populations with better diagnostic access. These initiatives are accelerating early identification through community-based testing and outreach. Tuberculosis diagnostic tests are used to detect the presence of the mycobacterium tuberculosis bacteria and to determine if an individual has active TB or a latent TB infection, which is essential for guiding treatment decisions. With more emphasis on accurate identification, the market continues to witness greater investment in innovation and infrastructure across diagnostic platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.6% |

In 2024, molecular diagnostics emerged as the leading segment, contributing 36.6% share and projected to grow at a CAGR of 5.9% through 2034. These diagnostics have changed the game by offering fast, sensitive, and accurate detection of Mycobacterium tuberculosis and its drug resistance traits. The use of polymerase chain reaction (PCR) as a central technique in this space enables healthcare providers to detect TB bacteria from clinical samples with precision, making early treatment decisions more effective.

The laboratory-based testing category held the largest share 65% in 2024. Its dominance is primarily attributed to the use of accurate, centralized testing methods critical for diagnosing complex and drug-resistant TB cases. These tests are typically performed in hospitals, public health institutions, and private certified laboratories. Common testing techniques include smear microscopy, culture-based diagnostics, and interferon-gamma release assays (IGRAs), all of which offer in-depth insight into disease severity and potential resistance, guiding clinicians in creating tailored treatment plans.

Asia Pacific Tuberculosis Diagnostics Test Market is expected to grow at a CAGR of 5.6% from 2025 to 2034. Factors contributing to this growth include the increasing number of TB cases, expanding public health education, greater access to diagnostic labs, and supportive governmental policies aimed at strengthening diagnostic infrastructure. As the region continues to invest in healthcare, the demand for advanced TB testing solutions is forecasted to rise.

Prominent players leading this space include Danaher Corporation, Abbott Laboratories, bioMerieux, Qiagen N.V., Becton, Dickinson and Company, and F. Hoffmann-La Roche. To strengthen their market presence, top firms are heavily investing in R&D to advance molecular and rapid diagnostic technologies. Strategic mergers and collaborations with healthcare providers and research institutions are helping companies expand their diagnostic portfolios and global footprint. Several players are focusing on creating low-cost, portable TB testing solutions tailored for low-resource settings, particularly in high-burden regions. Additionally, manufacturers are optimizing test sensitivity, reducing turnaround time, and ensuring their platforms meet international regulatory standards. These strategies collectively enhance accessibility, accuracy, and efficiency, positioning companies for long-term market leadership.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Test type

- 2.2.3 Modality

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising burden of tuberculosis globally

- 3.2.1.2 Advancement in tuberculosis diagnostics techniques

- 3.2.1.3 Increasing awareness and screening programs regarding tuberculosis

- 3.2.1.4 Surge in point-of-care testing (POCT)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited sensitivity and specificity

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook matrix

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Radiographic method

- 5.3 Diagnostic laboratory methods

- 5.3.1 Microscopy

- 5.3.2 Culture-based techniques

- 5.3.3 Serological tests

- 5.4 Molecular diagnostics

- 5.4.1 Polymerase chain reaction (PCR)

- 5.4.2 Nucleic acid amplification tests (NAAT)

- 5.4.3 GeneXpert MTB/RIF

- 5.5 Detection of latent infection

- 5.5.1 Tuberculin skin test (TST)/ Purified protein derivative (PPD)

- 5.5.1.1 First-generation PPD-based TSTs

- 5.5.1.2 New-generation skin tests with recombinant antigens

- 5.5.1 Tuberculin skin test (TST)/ Purified protein derivative (PPD)

- 5.6 Interferon-gamma release assays (IGRAs)

- 5.6.1.1 ELISA-based IGRAs

- 5.6.1.2 ELISPOT-based IGRAs

- 5.6.1.3 Point-of-care IGRAs

- 5.7 Cytokine detection assays

- 5.8 Detection of drug resistance (DST)

- 5.9 Phage assay

- 5.10 Other test types

Chapter 6 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Point of care testing (POCT)

- 6.3 Laboratory-based testing (Non-POCT)

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pathological laboratories

- 7.3 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Anhui Zhifei Longcom Biopharmaceutical Co.

- 9.3 Becton, Dickinson and Company

- 9.4 bioMerieux

- 9.5 Danaher Corporation (Cepheid)

- 9.6 F. Hoffmann-La Roche

- 9.7 Generium Pharmaceuticals

- 9.8 Hain Lifescience

- 9.9 Hologic

- 9.10 Japan BCG Laboratory

- 9.11 NIPRO

- 9.12 Oxford Immunotec

- 9.13 Qiagen N.V.

- 9.14 Sanofi

- 9.15 Siemens Healthineers

- 9.16 Thermo Fisher Scientific