|

市場調查報告書

商品編碼

1782153

直流純電動汽車車用充電器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測DC BEV On-Board Charger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

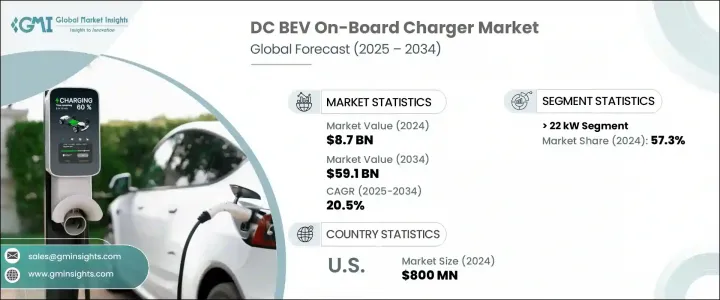

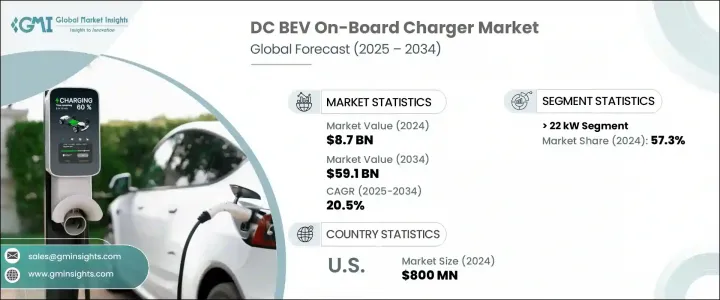

2024年,全球直流純電動車載充電器市場規模達87億美元,預計2034年將以20.5%的複合年成長率成長,達到591億美元。全球電動車的普及率不斷提高以及電動車充電基礎設施的持續發展,共同推動了這一成長。直流車載充電器對純電動車(BEV)至關重要,因為它們將電網交流電轉換為直流電,從而實現更有效率、更方便的電池充電。隨著對充電效能、續航里程和速度的需求不斷攀升,直流車載充電器的重要性也日益凸顯。

環保意識的增強、排放法規的嚴格以及政府激勵措施的擴大,共同推動市場的發展。汽車製造商和系統供應商正專注於緊湊、輕巧、高效的直流充電器,並配備雙向充電等新一代功能。隨著全球電動車銷量的激增,對高度整合和多功能直流充電系統的需求日益凸顯。市場參與者也強調通用相容性和行業標準設計方法,以增強充電網路的一致性和使用者體驗。在純電動車領域,最小化系統尺寸和重量至關重要,尤其對於那些優先考慮最佳續航里程和性能的車輛而言,這使得直流充電器對於更廣泛的電動車轉型至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 87億美元 |

| 預測值 | 591億美元 |

| 複合年成長率 | 20.5% |

2024年,額定功率超過22千瓦的高功率直流充電器市場佔有57.3%的佔有率。這些系統因其支援快速充電的能力而受到認可,並受到高要求應用的青睞。製造商正在根據預期的高速公路快速充電基礎設施發展調整其車載充電器配置。這些充電器的更大功率支援汽車製造商提供更快的充電時間和更好的駕駛便利性,這正成為一項關鍵的競爭優勢。

2024年,美國直流純電動汽車車載充電機市場規模達8億美元。強勁的電動車普及率、快速發展的基礎設施建設以及聯邦政府和州政府對清潔交通解決方案日益成長的支持,共同推動了北美市場的發展。電動車製造商和能源解決方案供應商越來越傾向於整合更快、更靈活的充電系統,以滿足消費者和監管機構的期望。

塑造直流純電動汽車車載充電器市場的領先公司包括豐田自動織機公司、法雷奧、鮑威爾工業、基洛斯卡電氣公司和伊頓公司。這些關鍵參與者正在積極推動創新和擴大生產,以滿足不斷變化的市場需求。領先的公司專注於策略性產品創新,包括開發具有更高功率密度和更低熱輸出的下一代緊湊型充電器。他們正在投資研發,以整合車輛到電網 (V2G) 整合和智慧能源管理的雙向功能。許多公司正在與電動車製造商和基礎設施提供商結盟,以確保系統互通性和與車輛平台的順利整合。市場領導者也透過合作和收購擴大其全球影響力,同時增加在地化生產以降低成本並增強供應鏈彈性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依評級,2021 - 2034 年

- 主要趨勢

- > 11 千瓦至 22 千瓦

- > 22 千瓦

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 挪威

- 德國

- 法國

- 荷蘭

- 英國

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- Alfanar Group

- Avid Technology

- Bell Power Solution

- BorgWarner

- Brusa Elektronik

- Current Ways

- Delphi Technologies

- Delta Energy Systems

- Eaton Corporation

- Ficosa International

- Innolectric

- Kirloskar Electric Company

- Powell Industries

- Stercom Power Solutions

- STMicroelectronics

- Toyota Industries Corporation

- Valeo

- Xepics Italia

The Global DC BEV On-Board Charger Market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 20.5% to reach USD 59.1 billion by 2034. This growth is being fueled by the rising adoption of electric vehicles across the world and the continuous advancement in EV charging infrastructure. DC on-board chargers are critical to battery electric vehicles (BEVs) as they convert grid-based AC power into DC power, enabling more efficient and convenient battery charging. Their importance grows as the demand for performance, range, and speed of charging continues to climb.

Increasing environmental awareness, stronger emissions regulations, and expanded government incentives are collectively strengthening the market's trajectory. Automakers and system providers are focusing on compact, lightweight DC chargers with high efficiency and next-gen capabilities like bidirectional charging. As global EV sales surge, the need for highly integrated and multifunctional DC charging systems is becoming more evident. Market participants are also emphasizing universal compatibility and industry-standard design approaches to enhance charging network consistency and user experience. In the BEV category, minimizing system size and weight is crucial, especially for vehicles that prioritize optimal range and performance, making DC chargers increasingly essential to the broader EV transition.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 Billion |

| Forecast Value | $59.1 Billion |

| CAGR | 20.5% |

The High-power DC chargers rated above 22 kW segment held a 57.3% share in 2024. These systems are recognized for their ability to support fast charging and are favored for use in demanding applications. Manufacturers are aligning their on-board charger configurations with anticipated highway fast-charging infrastructure developments. The greater power capabilities of these chargers support vehicle manufacturers in delivering quicker charging times and better driving convenience, which is becoming a key competitive advantage.

U.S. DC BEV On-Board Charger Market was valued at USD 800 million in 2024. Strong EV adoption rates, rapid infrastructure development, and growing federal and state-level support for clean transportation solutions have all contributed to the market's rapid acceleration in North America. There is growing momentum among EV manufacturers and energy solution providers to integrate faster, more flexible charging systems that meet both consumer and regulatory expectations.

The leading companies shaping the DC BEV On-Board Charger Market include Toyota Industries Corporation, Valeo, Powell Industries, Kirloskar Electric Company, and Eaton Corporation. These key players are actively driving innovation and scaling production to meet evolving market needs. Leading firms are focusing on strategic product innovation, including the development of next-gen compact chargers with higher power densities and lower thermal output. They are investing in R&D to incorporate bidirectional capabilities for vehicle-to-grid (V2G) integration and smart energy management. Many companies are forming alliances with EV manufacturers and infrastructure providers to ensure system interoperability and smooth integration into vehicle platforms. Market leaders are also expanding their global footprint through partnerships and acquisitions, while simultaneously ramping up localized production to lower costs and enhance supply chain resilience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Rating, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 > 11 kW to 22 kW

- 5.3 > 22 kW

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Netherlands

- 6.3.5 UK

- 6.3.6 Sweden

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Alfanar Group

- 7.2 Avid Technology

- 7.3 Bell Power Solution

- 7.4 BorgWarner

- 7.5 Brusa Elektronik

- 7.6 Current Ways

- 7.7 Delphi Technologies

- 7.8 Delta Energy Systems

- 7.9 Eaton Corporation

- 7.10 Ficosa International

- 7.11 Innolectric

- 7.12 Kirloskar Electric Company

- 7.13 Powell Industries

- 7.14 Stercom Power Solutions

- 7.15 STMicroelectronics

- 7.16 Toyota Industries Corporation

- 7.17 Valeo

- 7.18 Xepics Italia