|

市場調查報告書

商品編碼

1782129

冠狀動脈切割球囊市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Coronary Cutting Balloon Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

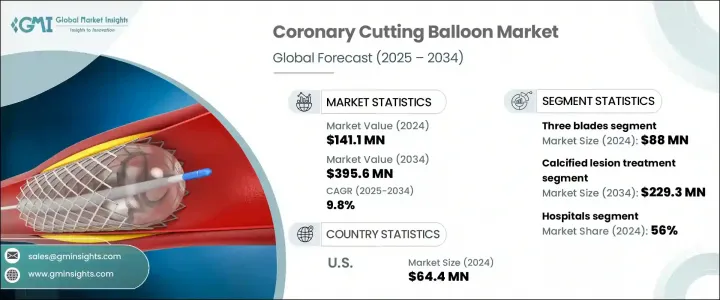

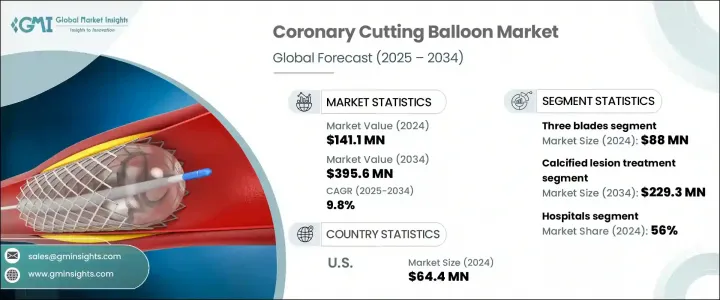

2024年,全球冠狀動脈切割球囊市場規模達1.411億美元,預計2034年將以9.8%的複合年成長率成長,達到3.956億美元。這一成長加速的主要原因是全球心血管疾病負擔的加重,以及醫療技術的不斷進步和微創心臟手術的日益普及。營養不良、缺乏運動、高血壓以及糖尿病患者人數的增加等因素,是導致冠狀動脈粥狀硬化斑塊形成的重要因素。

隨著越來越多的患者出現複雜病變,尤其是那些對傳統治療無效的患者,冠狀動脈切割球囊因其在斑塊修復方面的準確性和安全性而得到越來越廣泛的應用。血管內影像和冠狀動脈造影等先進診斷工具的日益普及,使得更早發現複雜的動脈阻塞成為可能,從而提高了切割球囊的及時治療效果。這些專用設備將傳統的球囊導管與微型刀片結合,可在充氣過程中形成精確的切口,從而實現更安全、更有效的病變擴張。隨著冠狀動脈疾病 (CAD) 在新興和已開發醫療市場的發病率不斷上升,全球對這些工具的臨床依賴度持續提升。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.411億美元 |

| 預測值 | 3.956億美元 |

| 複合年成長率 | 9.8% |

鈣化病變治療領域預計在2034年將產生2.293億美元的市場規模。重度鈣化冠狀動脈疾病的盛行率日益上升,尤其是在老年族群和糖尿病患者中,這使得該治療領域成為關注的焦點。切割球囊能夠精確評估斑塊,進而增強介入性心臟病專家的控制力,進而提高手術過程中支架的輸送和擴張能力。隨著複雜經皮冠狀動脈介入治療 (PCI) 的手術量不斷增加,臨床對切割球囊等可靠的病變準備設備的需求也日益成長。切割球囊在提高手術成功率和療效方面發揮重要作用,加速了其在全球心血管護理機構的應用。

2024年,醫院領域佔最大佔有率,預計在2025-2024年期間將繼續成長。醫院配備了先進的導管室和多學科心臟團隊,使其成為實施複雜PCI的主要中心。醫院能夠處理高風險冠狀動脈疾病(包括嚴重阻塞和支架內再狹窄),這使得醫院在有效利用冠狀動脈切割球囊方面具有領先優勢。三級醫院和城市醫院不斷成長的醫療投資和基礎設施建設,以及全天候心臟服務的提供,進一步支持了該領域的強勁需求。

2024年,美國冠狀動脈切割球囊市場規模達6,440萬美元。美國憑藉其龐大的冠狀動脈疾病(CAD)患者群體、先進的心臟設備普及率以及高容量的冠狀動脈介入(PCI)手術,在切割球囊的應用方面仍處於領先地位。創新醫療器材的早期採用和優惠的報銷政策繼續支撐著市場的成長。此外,血管內影像技術的日益普及,進一步支持了切割球囊在臨床上用於識別和治療複雜病變的應用。主要參與者的持續創新確保了穩定的供應和性能提升,從而促進了市場擴張。

該市場的領先公司包括樂普醫療、神奇醫療和波士頓科學。為了鞏固市場地位,冠狀動脈切割球囊領域的公司正在部署多項針對性策略。他們正在大力投資研發,以創新下一代設備,從而提供更高的精度和安全性。透過區域合作夥伴關係和在高成長國家獲得監管部門的批准,進行地理擴張,有助於公司進入尚未開發的市場。該公司還專注於醫生培訓項目,以提高公眾意識,並鼓勵在複雜手術中更廣泛地採用切割球囊。加強供應鏈、最佳化定價模式和擴大適用範圍是他們為保持競爭優勢和擴大全球影響力而採取的其他措施。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 心血管疾病盛行率不斷上升

- 不斷進步的技術

- 對精確且更安全的牙菌斑修復工具的需求

- 提高認知和改進診斷方法

- 產業陷阱與挑戰

- 產品成本高,加上替代技術的競爭

- 機會

- 微創心血管手術的採用日益增多

- 新興市場和未開發市場的需求

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 高壓冠狀動脈切割球囊

- 按產品分類的價格趨勢

- 未來市場趨勢

- 報銷場景

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按刀片數量,2021 - 2034

- 主要趨勢

- 三片刀片

- 四刀片

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 鈣化病變治療

- 支架內再狹窄

- 病變準備

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 導管室

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 世界其他地區 (RoW)

第9章:公司簡介

- Boston Scientific

- LEPU MEDICAL

- SHENQI MEDICAL

The Global Coronary Cutting Balloon Market was valued at USD 141.1 million in 2024 and is estimated to grow at a CAGR of 9.8% to reach USD 395.6 million by 2034. This acceleration is largely driven by the increasing global burden of cardiovascular conditions, along with growing advancements in medical technology and rising adoption of minimally invasive cardiac procedures. Factors such as poor nutrition, physical inactivity, hypertension, and the rising diabetic population contribute heavily to the development of atherosclerotic plaque in coronary arteries.

As more patients present with complex lesions, particularly those resistant to traditional treatment, coronary cutting balloons are being increasingly utilized for their accuracy and safety in plaque modification. The growing use of advanced diagnostic tools like intravascular imaging and coronary angiography has allowed for earlier detection of complex arterial blockages, enhancing timely treatment using cutting balloons. These specialized devices combine a conventional balloon catheter with microblades that create precise incisions during inflation, facilitating safer and more effective lesion dilation. With coronary artery disease (CAD) rising across both emerging and developed healthcare markets, clinical reliance on these tools continues to gain traction worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $141.1 Million |

| Forecast Value | $395.6 Million |

| CAGR | 9.8% |

The calcified lesion treatment segment is projected to generate USD 229.3 million in 2034. The increasing prevalence of heavily calcified coronary artery disease, especially among elderly populations and diabetic individuals, has made this treatment area a key focus. Cutting balloons provide interventional cardiologists with greater control by enabling refined plaque scoring, which enhances stent delivery and expansion during procedures. With procedural volumes rising for complex percutaneous coronary interventions (PCIs), the clinical need for reliable lesion preparation devices like cutting balloons continues to increase. Their role in improving procedural success rates and outcomes has accelerated their adoption across cardiovascular care settings globally.

In 2024, the hospitals segment, captured the largest share and projected to continue expanding during 2025-2024. Hospitals are equipped with advanced catheterization labs and multidisciplinary cardiac teams, making them the primary centers for performing complex PCIs. The ability to handle high-risk CAD cases, including severe blockages and in-stent restenosis, gives hospitals a leading edge in utilizing coronary cutting balloons effectively. Growing healthcare investments and infrastructure development in tertiary and urban hospitals, along with 24/7 availability of cardiac services, further support the strong demand from this segment.

United States Coronary Cutting Balloon Market generated USD 64.4 million in 2024. The U.S. remains at the forefront of cutting balloon adoption due to its large CAD patient pool, widespread availability of advanced cardiac facilities, and high volume of PCI procedures. Early adoption of innovative medical devices and favorable reimbursement policies continue to support the market's growth. In addition, the rising use of technologies for imaging inside blood vessels further supports the clinical use of cutting balloons in identifying and treating complex lesions. Ongoing innovation from key players ensures consistent supply and performance enhancements that contribute to market expansion.

Leading companies in this market include LEPU MEDICAL, SHENQI MEDICAL, and Boston Scientific. To strengthen their market position, companies in the coronary cutting balloon space are deploying several targeted strategies. They are investing heavily in R&D to innovate next-generation devices that offer greater precision and safety. Geographic expansion through regional partnerships and regulatory approvals in high-growth countries is helping firms enter untapped markets. Companies are also focusing on physician training programs to boost awareness and encourage broader adoption of cutting balloons in complex procedures. Strengthening supply chains, optimizing pricing models, and expanding indications for use are other approaches being adopted to maintain competitive advantage and increase global footprint.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates & calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Number of blades

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Growing technological advancements

- 3.2.1.3 Demand for precise and safer plaque-modification tools

- 3.2.1.4 Rising awareness and improved diagnostic methods

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High product cost coupled with competition from alternative technologies

- 3.2.3 Opportunities

- 3.2.3.1 Growing adoption of minimally invasive cardiovascular procedures

- 3.2.3.2 Demand in emerging and untapped markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.5.2.1 High-pressure coronary cutting balloon

- 3.6 Price trends, by product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Number of Blades, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Three blades

- 5.3 Four blades

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Calcified lesion treatment

- 6.3 In-stent restenosis

- 6.4 Lesion preparation

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Catheterization laboratories

- 7.4 Ambulatory surgery centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Rest of the world (RoW)

Chapter 9 Company Profiles

- 9.1 Boston Scientific

- 9.2 LEPU MEDICAL

- 9.3 SHENQI MEDICAL