|

市場調查報告書

商品編碼

1782128

加工工業物料搬運設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Processing Industry Material Handling Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

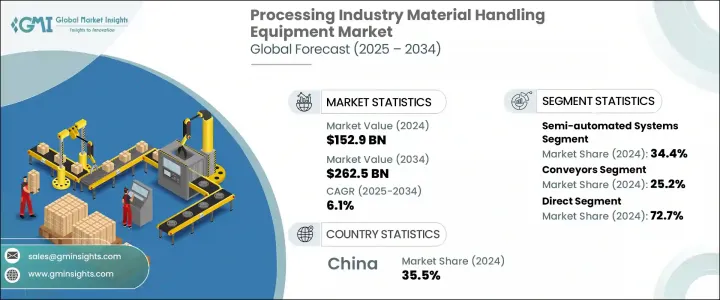

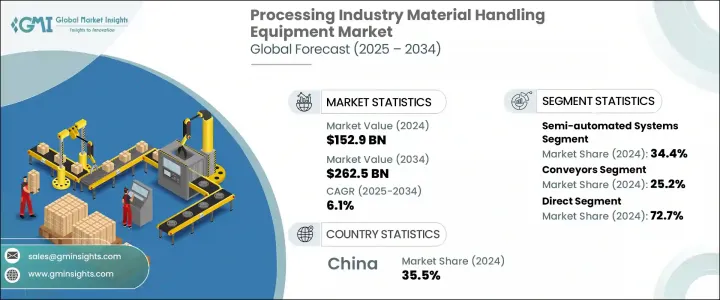

2024年,全球加工工業物料搬運設備市場規模達1,529億美元,預計2034年將以6.1%的複合年成長率成長,達到2,625億美元。這一穩定成長主要得益於加工產業對先進自動化解決方案日益成長的需求。在智慧技術的融合推動下,該產業正日益擁抱數位轉型,這些技術正在重塑物料的運輸、儲存和管理方式。自動化不再是未來的趨勢,而是成為提高營運效率、降低成本和保障員工安全的重要因素。

各行各業的企業正在利用機器人、人工智慧和物聯網等創新技術來簡化工作流程,增強即時視覺性,並透過更最佳化的流程控制來獲得競爭優勢。這些數位化系統不僅能夠提高產量,還能透過減少對人工的依賴、最大限度地減少操作錯誤並延長正常運作時間,支援精實製造。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1529億美元 |

| 預測值 | 2625億美元 |

| 複合年成長率 | 6.1% |

隨著企業在快速發展的市場中面臨提升生產力和保持敏捷性的日益成長的壓力,向現代物料搬運設備的轉變也在不斷加速。智慧搬運解決方案的採用使企業能夠更快地響應動態生產需求,同時透過節能營運和最大程度減少材料浪費來支援永續發展目標。此外,這些自動化系統可以根據各種行業需求進行客製化,使其成為對精度、一致性和適應性至關重要的加工應用的理想選擇。

從食品飲料加工到化學品和電子產品,企業都在投資能夠提升流程、減少瓶頸並確保設施內無縫銜接的設備。這種現代化的動力不僅正在改變大型製造業務,也對那些希望在不投入大量資金打造全自動系統的情況下保持競爭力的中型工廠大有裨益。這些轉變的累積效應,使得專門針對加工環境的物料搬運設備需求呈現強勁成長態勢。

就操作模式而言,市場分為手動系統、半自動化系統、全自動系統和支援物聯網的智慧搬運系統。其中,半自動化系統在2024年成為市場領導者,約佔總收入的34.4%。預計在預測期內,該領域的複合年成長率將超過4.4%。半自動化設備將自動化優勢與操作員控制完美結合,這對於需要靈活性和精確度的企業尤其具有吸引力。這些系統尤其適用於工作流程各異的設施,使操作員能夠有效率地管理客製化任務,同時實現重複性活動的機械化。半自動化系統價格實惠、易於整合且維護要求較低,使其成為許多希望擴大規模但又不想完全轉向自主營運的加工企業的實用選擇。

根據應用,市場細分為輸送機、起重機和提昇機、堆高機和工業卡車、自動導引車 (AGV)、儲存和檢索系統、機器人物料搬運系統、散裝物料搬運設備等。輸送機細分市場在 2024 年佔據市場主導地位,收入佔有率為 25.2%,預計 2025 年至 2034 年的複合年成長率將超過 5.5%。輸送機系統的廣泛部署是由於它們能夠在加工廠內的不同地點之間無縫運輸物料。它們的多功能設計支援從輕型物品到散裝貨物的各種貨物的運輸,從而提高吞吐量並最大限度地縮短搬運時間。這些系統透過確保不間斷的物料流為流程最佳化做出了重要貢獻,這對於連續生產週期運作的產業至關重要。

根據配銷通路,市場分為直接通路和間接通路。 2024年,直銷通路佔據主導地位,營收佔有率達72.7%,預計整個預測期內的複合年成長率將超過4.7%。直接管道為買家提供更便利的客製化解決方案和技術支持,從而創造強大的價值主張。然而,間接通路在市場擴張中仍扮演關鍵角色。它能夠擴大客戶覆蓋範圍,並提供客製化、售後支援和靈活融資方案等額外服務,這些服務對中小企業尤其具有吸引力。這種雙通道模式有助於製造商在個人化服務和大規模覆蓋之間取得平衡。

從區域來看,中國在2024年成為亞太地區加工產業物料搬運設備市場的領跑者,佔了約35.5%的區域佔有率。預計到2034年,中國市場規模將超過20億美元。這一主導地位得益於快速的工業發展、強大的製造業基礎設施以及旨在推動自動化和智慧製造的強大政府舉措。持續的城鎮化和區域工業化過程進一步推動了對先進搬運系統的需求,使中國成為亞太地區該產業成長的關鍵貢獻者。

塑造全球加工產業物料搬運設備市場格局的知名企業包括大福、皇冠設備公司、德馬泰克集團、基伊埃、法孚集團、海斯特-耶魯物料搬運公司、JBT公司、Intelligrated、永恆力、林德物料搬運公司、凱傲田、三菱Logisnext、利樂、勝斐豐田集團。這些公司正在大力投資研發、合作和全球擴張,以增強其競爭地位,並滿足日益成長的智慧整合物料搬運解決方案需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 技術進步和自動化

- 電子商務和物流的成長

- 工業和製造業的擴張

- 產業陷阱與挑戰

- 維護費用和複雜性

- 熟練勞動力短缺

- 初期投資高

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按運作方式

- 監理框架

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依營運模式,2021-2034 年

- 主要趨勢

- 手動搬運設備

- 半自動化系統

- 全自動系統

- 支援物聯網的智慧處理系統

第6章:市場估計與預測:依設備類型,2021-2034 年

- 主要趨勢

- 傳送帶

- 起重機和升降機

- 堆高機和工業用卡車

- 自動導引車(AGV)

- 儲存和檢索系統

- 機器人物料搬運系統

- 散裝物料處理設備

- 其他

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 高效率的物料運輸

- 儲存和組織

- 提高安全性

- 提高生產力

- 其他

第8章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 食品和飲料加工

- 化學和製藥加工

- 採礦和金屬加工

- 製藥製造業

- 石油和天然氣

- 後勤

- 汽車和電子製造業

- 其他

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Crown Equipment Corporation

- Daifuku

- Dematic Group

- Fives Group

- GEA

- Hyster-Yale Materials Handling

- Intelligrated (a Honeywell company)

- JBT Corporation

- Jungheinrich

- KION Group

- Linde Material Handling

- Mitsubishi Logisnext

- SSI Schaefer Group

- Tetra Pak

- Toyota Industries Corporation

The Global Processing Industry Material Handling Equipment Market was valued at USD 152.9 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 262.5 billion by 2034. This steady rise is primarily attributed to the growing demand for advanced, automated solutions across processing sectors. The industry is increasingly embracing digital transformation, driven by the integration of intelligent technologies that are reshaping how materials are moved, stored, and managed. Automation is no longer a future trend-it has become an essential element of operational efficiency, cost reduction, and workforce safety.

Companies across processing industries are leveraging innovations such as robotics, AI, and IoT to streamline workflows, enhance real-time visibility, and gain a competitive edge through better process control. These digital systems not only improve production output but also support lean manufacturing by reducing reliance on manual labor, minimizing operational errors, and increasing uptime.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $152.9 Billion |

| Forecast Value | $262.5 Billion |

| CAGR | 6.1% |

As businesses face heightened pressure to boost productivity and maintain agility in rapidly evolving markets, the shift toward modern material handling equipment continues to accelerate. The adoption of smart handling solutions has enabled companies to respond faster to dynamic production needs, while also supporting sustainability goals through energy-efficient operations and minimizing material waste. Furthermore, these automated systems can be tailored for various industrial requirements, making them ideal for processing applications where precision, consistency, and adaptability are critical.

From food and beverage processing to chemicals and electronics, enterprises are investing in equipment that enhances flow, reduces bottlenecks, and ensures seamless intra-facility movement. This push toward modernization is not only transforming large manufacturing operations but is also proving beneficial for mid-sized facilities aiming to stay competitive without investing heavily in fully autonomous systems. The cumulative effect of these shifts is a robust demand trajectory for material handling equipment tailored specifically to processing environments.

In terms of operation mode, the market is categorized into manual systems, semi-automated systems, fully automated systems, and IoT-enabled smart handling systems. Among these, the semi-automated segment emerged as the market leader in 2024, capturing around 34.4% of the overall revenue. This segment is forecasted to grow at a CAGR of over 4.4% through the forecast period. Semi-automated equipment offers an optimal blend of automation benefits and operator control, which is particularly appealing to businesses that require both flexibility and precision. These systems are especially suitable for facilities with varying workflows, enabling operators to manage customized tasks efficiently while mechanizing repetitive activities. Their affordability, ease of integration, and lower maintenance requirements make them a practical choice for many processing firms aiming to scale without transitioning fully to autonomous operations.

On the basis of application, the market is segmented into conveyors, cranes and hoists, forklifts and industrial trucks, automated guided vehicles (AGVs), storage and retrieval systems, robotic material handling systems, bulk material handling equipment, and others. The conveyors segment led the market in 2024 with a revenue share of 25.2%, and it is anticipated to register a CAGR of over 5.5% from 2025 to 2034. The widespread deployment of conveyor systems is due to their ability to transport materials seamlessly across different points within processing plants. Their design versatility supports the movement of a wide range of goods, from lightweight items to bulk loads, thereby improving throughput and minimizing handling times. These systems contribute significantly to process optimization by ensuring uninterrupted material flow, which is essential for industries that operate on continuous production cycles.

The market, based on distribution channel, is divided into direct and indirect channels. In 2024, the direct sales segment held the dominant position with a revenue share of 72.7% and is projected to grow at a CAGR of over 4.7% throughout the forecast period. Direct channels offer buyers better access to tailored solutions and technical support, creating strong value propositions. However, the indirect segment continues to play a critical role in market expansion. It enables broader customer reach and provides additional services such as customization, post-sale assistance, and flexible financing options, which are especially appealing to small and mid-sized enterprises. This dual-channel approach helps manufacturers maintain a balance between personalized service and wide-scale accessibility.

Regionally, China emerged as the front-runner in the Asia-Pacific processing industry material handling equipment market in 2024, securing approximately 35.5% of the regional share. The country's market is projected to exceed USD 2 billion by 2034. This dominance is fueled by rapid industrial development, a robust manufacturing infrastructure, and strong governmental initiatives aimed at boosting automation and smart manufacturing. Continued urbanization and regional industrialization efforts further drive the demand for advanced handling systems, making China a key contributor to the sector's growth across APAC.

Prominent players shaping the global landscape of the processing industry material handling equipment market include Daifuku, Crown Equipment Corporation, Dematic Group, GEA, Fives Group, Hyster-Yale Materials Handling, JBT Corporation, Intelligrated, Jungheinrich, Linde Material Handling, KION Group, Mitsubishi Logisnext, Tetra Pak, SSI Schaefer Group, and Toyota Industries Corporation. These companies are investing heavily in R&D, partnerships, and global expansions to strengthen their competitive positions and cater to the increasing need for intelligent and integrated material handling solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Mode of operation

- 2.2.2 Equipment type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements and automation

- 3.2.1.2 Growth of e-commerce and logistics

- 3.2.1.3 Expansion of industrial and manufacturing sectors

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Maintenance expenses and complexity

- 3.2.2.2 Shortage of skilled workforce

- 3.2.2.3 High initial investment

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By mode of operation

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Mode of Operation, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual handling equipment

- 5.3 Semi-automated systems

- 5.4 Fully automated systems

- 5.5 IoT-enabled smart handling systems

Chapter 6 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Conveyors

- 6.3 Cranes & Hoists

- 6.4 Forklifts & Industrial Trucks

- 6.5 Automated Guided Vehicles (AGVs)

- 6.6 Storage & Retrieval Systems

- 6.7 Robotic Material Handling Systems

- 6.8 Bulk Material Handling Equipment

- 6.9 Other

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Efficient movement of materials

- 7.3 Storage and organization

- 7.4 Improving safety

- 7.5 Increasing productivity

- 7.6 Other

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage processing

- 8.3 Chemical and pharmaceutical processing

- 8.4 Mining & metals processing

- 8.5 Pharmaceutical manufacturing

- 8.6 Oil & gas

- 8.7 Logistics

- 8.8 Automotive and electronics manufacturing

- 8.9 Other

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Crown Equipment Corporation

- 11.2 Daifuku

- 11.3 Dematic Group

- 11.4 Fives Group

- 11.5 GEA

- 11.6 Hyster-Yale Materials Handling

- 11.7 Intelligrated (a Honeywell company)

- 11.8 JBT Corporation

- 11.9 Jungheinrich

- 11.10 KION Group

- 11.11 Linde Material Handling

- 11.12 Mitsubishi Logisnext

- 11.13 SSI Schaefer Group

- 11.14 Tetra Pak

- 11.15 Toyota Industries Corporation