|

市場調查報告書

商品編碼

1782113

腸溶空膠囊市場機會、成長動力、產業趨勢分析及2025-2034年預測Enteric Empty Capsules Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

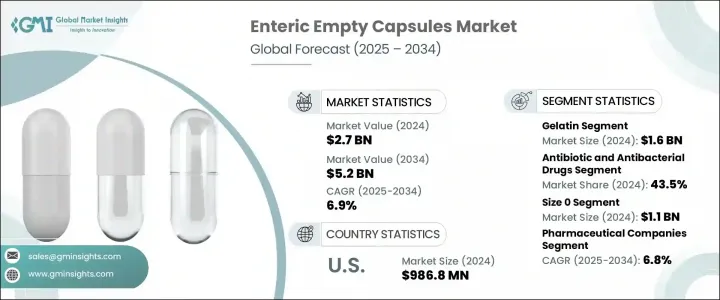

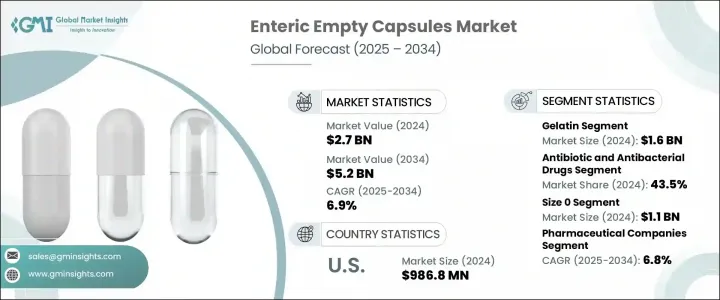

2024年,全球腸溶空膠囊市場規模達27億美元,預計到2034年將以6.9%的複合年成長率成長,達到52億美元。推動這一成長的動力源於對先進藥物輸送系統日益成長的需求,這些系統能夠確保活性藥物和營養成分的靶向緩釋。腸溶膠囊能夠保護敏感成分免受胃酸侵蝕,並將其直接輸送至腸道,因此對胃腸道藥物和酸敏療法至關重要。腸溶膠囊用途廣泛,涵蓋抗生素、制酸劑和酵素製劑,是現代製劑的重要組成部分。

個人化醫療和以患者為中心的設計模式的快速發展,得益於其配方靈活性以及與多種活性成分的兼容性,進一步推動了市場需求。在日益壯大的營養保健領域,腸溶膠囊(尤其是以羥丙基甲基纖維素 (HPMC) 為基礎的純素食型腸溶膠囊)越來越受到益生菌、酵素和草藥補充劑的青睞。人們對清潔標籤和植物性產品的青睞,促使製造商投資於無矽酮的素食膠囊替代品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 27億美元 |

| 預測值 | 52億美元 |

| 複合年成長率 | 6.9% |

2024年,明膠市場規模達16億美元。其價格實惠、成膜性好、易於生產,使其成為大規模膠囊生產的預設選擇,尤其是在非素食配方的領域。其監管便利性以及與多種API的兼容性,使其成為眾多製藥和補充劑生產商的首選。

腸溶空膠囊應用於抗生素和抗菌藥物領域,2024年該領域市佔率為43.5%。這些膠囊可以保護對酸敏感的抗生素免於胃分解,確保其在腸道中達到最佳吸收效果。它們還有助於最大限度地減少副作用,並掩蓋某些藥物的不良味道,從而提高患者的依從性和治療成功率。

2024年,美國腸溶空膠囊市場規模達9.868億美元,這得益於數千萬人普遍患有的胃腸道疾病,以及成年人補充劑攝取量的強勁成長。美國食品藥物管理局(FDA)和美國農業部(USDA)等機構的監管明確性,支持pH依賴型和緩釋膠囊技術的快速開發和應用。

該行業的主要製造商包括龍沙集團 (Lonza)、羅蓋特集團 (Roquette Freres)、Chemcaps、光明製藥 (Bright Pharma Caps)、青島一清 (Qingdao Yiqing)、ACG Worldwide、天然膠囊 (Natural Capsules)、益陽製藥 (Yiyaa Pharma)、Capsm、Fortm) Healthcare、CapsCanada、Suheung 和浙江匯利膠囊 (Zhezhou Huili Capsules)。為了鞏固市場地位,腸溶空心膠囊領域的領先製造商正在部署多項關鍵策略。他們正在投資研發創新膠囊材料,例如羥丙基甲基纖維素 (HPMC) 和植物性聚合物,以吸引注重健康的消費者並符合監管標準。

與製藥和營養保健品公司建立策略合作夥伴關係,有助於共同開發針對特定 API 和遞送系統的客製化解決方案。許多公司正在擴大產能,並在更靠近區域樞紐的地方建立生產設施,以提高供應鏈效率。專注於清潔標籤、純素認證和透明的生產流程,以滿足消費者對符合道德和安全產品的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 靶向藥物傳輸需求不斷成長

- 素食膠囊替代品日益受到青睞

- 個性化醫療解決方案的擴展

- 膠囊包衣技術的進步

- 產業陷阱與挑戰

- 腸溶製劑的監管複雜性

- 生產和塗層成本高

- 市場機會

- 全球營養保健品消費量不斷成長

- 發展中經濟體對非處方藥和補充劑的需求不斷增加

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 消費者行為分析

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 明膠膠囊

- 非明膠膠囊

- HPMC(羥丙基甲基纖維素)

- 普魯蘭多醣膠囊

- 澱粉基膠囊

- 其他非明膠膠囊

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 制酸劑和抗脹氣劑

- 抗生素和抗菌藥物

- 其他應用

第7章:市場估計與預測:按膠囊尺寸,2021 - 2034 年

- 主要趨勢

- 00號

- 0號尺寸

- 尺寸 1

- 其他膠囊尺寸

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥公司

- 營養保健品製造商

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ACG Worldwide

- Bright Pharma Caps

- CapsCanada

- Capsuline

- Chemcaps

- Fortcaps Healthcare

- Lonza

- Natural Capsules

- Qingdao Yiqing

- Roquette Freres

- Shaoxing Zhongya Capsule

- Suheung

- Yiyang Pharma

- Zhejiang Huili Capsules

The Global Enteric Empty Capsules Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 5.2 billion by 2034. This surge is being driven by the increasing need for advanced drug delivery systems that ensure targeted, delayed release of active pharmaceutical and nutraceutical compounds. By shielding sensitive ingredients from stomach acidity and delivering them directly to the intestines, enteric capsules are critical for gastrointestinal medications and acid-sensitive therapies. Their versatility extends to antibiotics, antacids, and enzyme treatments, making them an essential component of modern formulations.

The rapid growth of personalized medicine and patient-centric design is further boosting demand, thanks to formulation flexibility and compatibility with diverse active ingredients. In the expanding nutraceutical arena, enteric capsules-especially HPMC-based, vegan-friendly types-are increasingly favored for probiotic, enzyme, and herbal supplement delivery. The preference for clean-label, plant-based options is prompting manufacturers to invest in silicone-free, vegetarian capsule alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 6.9% |

The Gelatin segment generated USD 1.6 billion in 2024. Its affordability, film-forming quality, and ease of production make it the default choice for large-scale capsule manufacturing, especially where non-vegetarian formulations are acceptable. Its regulatory convenience and compatibility with a variety of APIs make it a top choice for many pharmaceutical and supplement producers.

Enteric empty capsules are employed in the antibiotic and antibacterial drugs segment, which held a 43.5% share in 2024. These capsules protect acid-sensitive antibiotics from gastric degradation, ensuring optimal absorption in the intestines. They also help minimize side effects and mask the unpleasant taste of certain medications, improving patient adherence and treatment success.

U.S. Enteric Empty Capsules Market accounted for USD 986.8 million in 2024, driven by widespread gastrointestinal conditions affecting tens of millions of people, and a robust supplement intake among adults. Regulatory clarity from agencies like the FDA and USDA supports fast-track development and adoption of pH-dependent and delayed-release capsule technologies.

Key manufacturers in this industry include Lonza, Roquette Freres, Chemcaps, Bright Pharma Caps, Qingdao Yiqing, ACG Worldwide, Natural Capsules, Yiyang Pharma, Capsuline, Shaoxing Zhongya Capsule, Fortcaps Healthcare, CapsCanada, Suheung, and Zhejiang Huili Capsules. To bolster their market position, leading manufacturers in the enteric empty capsules space are deploying several key strategies. They're investing in R&D to develop innovative capsule materials-such as HPMC and plant-based polymers-that appeal to health-conscious consumers and meet regulatory standards.

Strategic partnerships with pharmaceutical and nutraceutical firms facilitate the co-development of customized solutions tailored to specific APIs and delivery systems. Many companies are expanding production capacities and establishing facilities closer to regional hubs to improve supply chain efficiency. Emphasis on clean-label, vegan-friendly certification, and transparent manufacturing processes addresses consumer demand for ethical and safe products.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Capsule size

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for targeted drug delivery

- 3.2.1.2 Growing shift toward vegetarian capsule alternatives

- 3.2.1.3 Expansion of personalized medicine solutions

- 3.2.1.4 Advancements in capsule coating technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory complexity for enteric formulations

- 3.2.2.2 High production and coating costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing consumption of nutraceutical globally

- 3.2.3.2 Increasing demand for over-the-counter medications and supplements in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Consumer behaviour analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East and Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gelatin capsules

- 5.3 Non-gelatin capsules

- 5.3.1 HPMC (hydroxypropyl methylcellulose)

- 5.3.2 Pullulan capsules

- 5.3.3 Starch-based capsules

- 5.3.4 Other non-gelatin capsules

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antacid and antiflatulent preparations

- 6.3 Antibiotic and antibacterial drugs

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Capsule Size, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Size 00

- 7.3 Size 0

- 7.4 Size 1

- 7.5 Other capsule size

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Nutraceutical manufacturers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ACG Worldwide

- 10.2 Bright Pharma Caps

- 10.3 CapsCanada

- 10.4 Capsuline

- 10.5 Chemcaps

- 10.6 Fortcaps Healthcare

- 10.7 Lonza

- 10.8 Natural Capsules

- 10.9 Qingdao Yiqing

- 10.10 Roquette Freres

- 10.11 Shaoxing Zhongya Capsule

- 10.12 Suheung

- 10.13 Yiyang Pharma

- 10.14 Zhejiang Huili Capsules