|

市場調查報告書

商品編碼

1782112

碳化和氮化系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Carbonation and Nitrogenation Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

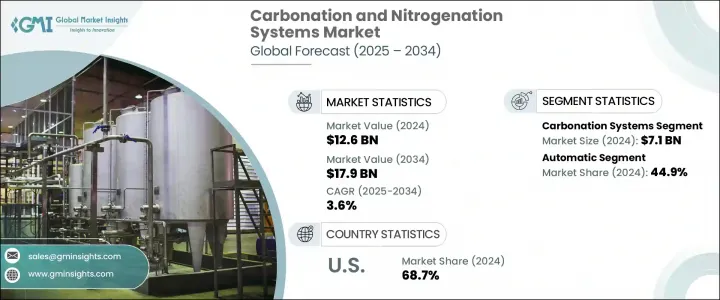

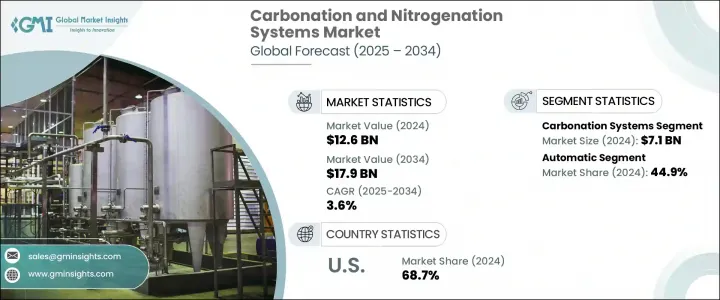

2024年,全球碳酸化和氮化系統市場規模達126億美元,預計2034年將以3.6%的複合年成長率成長,達到179億美元。該市場在食品和飲料製造生態系統中扮演著至關重要的角色,其中對含氣、碳酸和氮氣飲料的需求持續成長。消費者越來越青睞那些能帶來獨特感官體驗的飲品,而氣體注入系統是實現這種品質的核心。這些系統廣泛應用於各種飲料類別——從日常軟飲到專業健康飲品——以提升口感、口感和貨架穩定性。此外,這些系統在製藥製造和其他工業應用中的應用也日益廣泛,支援需要氣液混合的製程。

這個市場背後的關鍵成長動力之一是消費者對更健康、更高階飲料的選擇的偏好轉變,以及新興市場城鎮化和可支配收入不斷成長的普遍趨勢。因此,製造商面臨著快速創新和適應不斷變化的消費者偏好的壓力,尤其是在人口密集的地區,這些地區對即飲和便攜飲料的需求正在激增。科技在滿足這些期望方面發揮著變革性的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 126億美元 |

| 預測值 | 179億美元 |

| 複合年成長率 | 3.6% |

現代碳酸化和氮化設備已不再局限於基本功能。現今的系統自動化程度日益提高,不僅節能高效,營運成本也更低,並且具備高度可擴展性。與數位控制系統的整合增強,進一步幫助生產商精確調整氣體注入水平,從而提高產品品質和一致性。隨著飲料創新的不斷發展,口感更順滑、新鮮度更高的充氣配方正在開闢新的產品可能性,並推動這些先進系統的普及。

就設備類型而言,市場分為碳酸化系統和氮化系統。碳酸化系統細分市場(包括線上和批量碳酸化技術)在2024年佔據最大佔有率,創造了71億美元的收入。由於全球對碳酸飲料的持續需求,該細分市場正在廣泛應用。無論是蘇打水、調味健康飲料或其他碳酸飲料,碳酸飲料的吸引力依然強烈。這些系統的工作原理是將二氧化碳引入液體中,隨著技術改進,這項工藝已日益精煉,減少了氣體損失,提高了節能效果,並能夠無縫整合到高速生產線中。

氮化系統(包括灌注、清洗和填充設備)也越來越受歡迎,尤其是在質地和產品差異化至關重要的配方中。然而,碳酸化系統因其更廣泛的應用範圍仍將保持領先地位。

依自動化程度細分,市場可分為手動、半自動和全自動系統。 2024年,全自動系統成為主導類別,佔全球市場佔有率的44.9%,價值57億美元。這些系統旨在以最少的人工監督完成複雜的氣體注入任務。自動化解決方案採用可程式邏輯控制器、先進的感測器和使用者友好的數位介面,可精確控制劑量和壓力水平。這不僅提高了產品質量,還提高了營運效率,減少了手動調整的需求並降低了人力成本。這些特性使得自動化系統對於尋求靈活性和快速產品切換的新興新創公司和成熟飲料生產商都極具吸引力。

這些系統的可擴展性使製造商能夠快速響應市場趨勢,尤其是在高階飲料領域,而氮氣飲料正日益受到歡迎。此外,永續發展的驅動力促使設備製造商開發能耗更低、廢棄物產生更少、且易於融入環保生產流程的機器。

從區域來看,美國在2024年佔據了北美市場的大部分佔有率,貢獻了68.7%的區域佔有率。這一強勁表現得益於對飲料加工基礎設施的大量投資以及技術的快速應用。自動化解決方案正在成為美國工廠的標配,在這些工廠中,效率、產品一致性和適應性對於滿足消費者的期望至關重要。此外,利基飲料細分市場的興起持續刺激了對能夠提供更佳口感和客製化碳酸化或氮化特性的系統的需求。

碳酸化和氮化系統領域的領導者正在積極尋求併購和策略合作,以擴大市場佔有率並實現產品多樣化。該行業競爭激烈,大型企業、中型製造商和專業新創公司都透過創新、客製化和永續產品開發爭奪市場佔有率。雖然全球企業將高科技整合系統推向市場,但許多區域供應商專注於提供經濟高效、適應本地需求的解決方案,以滿足特定的生產需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 碳酸飲料和氮化飲料的需求不斷成長

- 工業和製藥應用的採用率不斷提高

- 技術進步

- 產業陷阱與挑戰

- 資本和營運成本高

- 技術複雜性

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按設備類型,2021 - 2034 年

- 主要趨勢

- 碳酸化系統

- 線上碳酸化系統

- 批量碳酸化系統

- 氮化系統

- 輸液系統

- 灌裝系統

- 吹掃系統

- 其他

第6章:市場估計與預測:按自動化水平,2021 - 2034 年

- 主要趨勢

- 手動的

- 半自動

- 自動的

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 食物

- 飲料

- 製藥

- 化學品

- 其他

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- APV

- Arol SpA

- Feldmeier Equipment Inc.

- GEA Group

- KHS GmbH

- Krones AG

- Linde Engineering

- MBE Technology

- NDC Technologies

- Procomac

- Schaefer Technologies Inc.

- Sidel Group

- Tenco Equipment Inc.

- Tetra Pak

- Zhejiang Shenghui Machinery Co., Ltd.

The Global Carbonation and Nitrogenation Systems Market was valued at USD 12.6 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 17.9 billion by 2034. This market plays a crucial role in the food and beverage manufacturing ecosystem, where the demand for sparkling, carbonated, and nitrogen-infused beverages continues to accelerate. Consumers are increasingly drawn to drinks that offer unique sensory experiences, and gas infusion systems are at the core of delivering such quality. These systems are used across a broad spectrum of beverage categories-from everyday soft drinks to specialized wellness drinks-enhancing texture, taste, and shelf stability. Additionally, these systems are finding expanding utility across pharmaceutical manufacturing and other industrial applications, supporting processes that require gas-liquid mixing.

One of the key growth drivers behind this market is the shifting consumer inclination toward healthier and more premium beverage options, as well as the broader trend of urbanization and rising disposable incomes in emerging markets. As a result, manufacturers are under pressure to innovate rapidly and adapt to changing preferences, especially in densely populated regions where demand for ready-to-drink and on-the-go beverages is surging. Technology is playing a transformative role in meeting these expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.6 Billion |

| Forecast Value | $17.9 Billion |

| CAGR | 3.6% |

Modern carbonation and nitrogenation equipment is no longer limited to basic functionality. Today's systems are increasingly automated, offering energy-efficient performance, reduced operational costs, and high scalability. Enhanced integration with digital control systems is further enabling producers to fine-tune gas infusion levels, resulting in better quality and consistency. As beverage innovation continues to evolve, gas-infused formulations with smoother mouthfeel and improved freshness are opening up new product possibilities, spurring the adoption of these advanced systems.

In terms of equipment type, the market is divided into carbonation and nitrogenation systems. The carbonation systems segment-which includes inline and batch carbonation technologies-held the largest share in 2024, generating USD 7.1 billion in revenue. This segment is seeing widespread use due to the continued global demand for carbonated beverages. Whether it's sparkling water, flavored health drinks, or other fizzy refreshments, the appeal of carbonated options remains strong. These systems function by introducing carbon dioxide into liquids, a process that has become increasingly refined with technological improvements that reduce gas loss, enhance energy conservation, and enable seamless integration into high-speed production lines.

Nitrogenation systems-comprising infusion, purging, and filling equipment-are also gaining traction, especially in formulations where texture and product differentiation are critical. However, carbonation systems continue to lead due to their broader application scope.

When segmented by automation level, the market is categorized into manual, semi-automatic, and automatic systems. In 2024, automatic systems emerged as the dominant category, accounting for 44.9% of the global market share with a value of USD 5.7 billion. These systems are engineered to perform complex gas infusion tasks with minimal human oversight. Featuring programmable logic controllers, advanced sensors, and user-friendly digital interfaces, automatic solutions allow precise control over dosing and pressure levels. This enhances not just product quality but also operational efficiency, reducing the need for manual adjustments and lowering labor costs. These features make automatic systems particularly attractive for both emerging startups and established beverage producers who seek flexibility and rapid product switching on their lines.

The scalability of these systems enables manufacturers to respond swiftly to market trends, especially in the premium beverage segment, where nitrogen-infused drinks are gaining popularity. Additionally, the drive for sustainability has prompted equipment makers to develop machines that consume less energy, produce less waste, and integrate easily into environmentally conscious production workflows.

Regionally, the United States accounted for a major portion of the North American market in 2024, contributing 68.7% of the regional share. This strong performance can be linked to significant investments in beverage processing infrastructure and rapid technological adoption. Automated solutions are becoming standard in U.S. facilities, where efficiency, product consistency, and adaptability are crucial to meeting consumer expectations. Furthermore, the emergence of niche beverage segments continues to fuel demand for systems capable of delivering enhanced mouthfeel and customized carbonation or nitrogenation profiles.

Leading companies in the carbonation and nitrogenation systems space are actively pursuing mergers, acquisitions, and strategic collaborations to expand their market presence and diversify product offerings. The industry is marked by intense competition, with major players, mid-sized manufacturers, and specialized startups all vying for market share through innovation, customization, and sustainable product development. While global firms bring high-tech integrated systems to the market, many regional providers focus on cost-effective, locally adapted solutions that meet specific production needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Automation level

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for carbonated and nitrogenated beverages

- 3.2.1.2 Rising adoption in industrial and pharmaceutical applications

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and operating costs

- 3.2.2.2 Technological complexity

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Carbonation systems

- 5.2.1 Inline carbonation systems

- 5.2.2 Batch carbonation systems

- 5.3 Nitrogenation systems

- 5.3.1 Infusion systems

- 5.3.2 Filling systems

- 5.3.3 Purging systems

- 5.3.4 Others

Chapter 6 Market Estimates and Forecast, By Automation Level, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Automatic

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Food

- 7.3 Beverages

- 7.4 Pharmaceuticals

- 7.5 Chemicals

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 APV

- 10.2 Arol S.p.A.

- 10.3 Feldmeier Equipment Inc.

- 10.4 GEA Group

- 10.5 KHS GmbH

- 10.6 Krones AG

- 10.7 Linde Engineering

- 10.8 MBE Technology

- 10.9 NDC Technologies

- 10.10 Procomac

- 10.11 Schaefer Technologies Inc.

- 10.12 Sidel Group

- 10.13 Tenco Equipment Inc.

- 10.14 Tetra Pak

- 10.15 Zhejiang Shenghui Machinery Co., Ltd.