|

市場調查報告書

商品編碼

1782111

動態定價與收益管理市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Dynamic Pricing and Yield Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

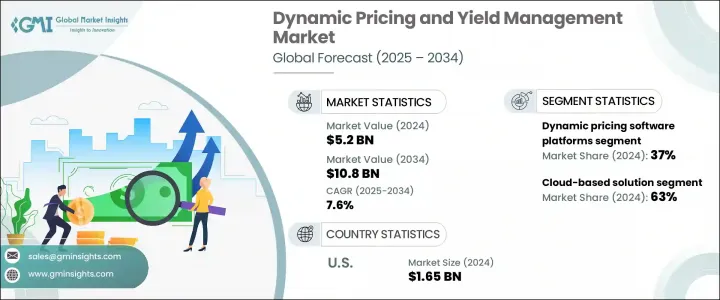

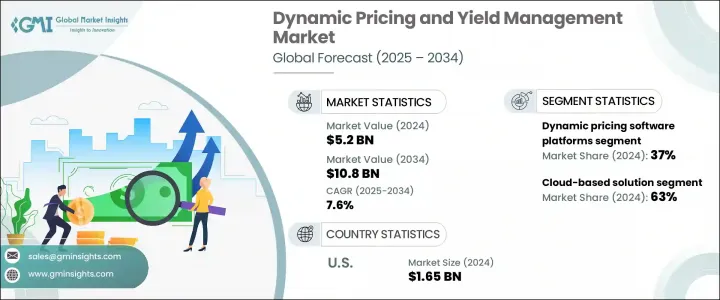

2024年,全球動態定價和收益管理市場規模達52億美元,預計到2034年將以7.6%的複合年成長率成長,達到108億美元。這一成長主要得益於數位轉型步伐的加速、電子商務產業的蓬勃發展,以及娛樂、旅遊、旅館和貿易等產業日益普及的即時定價解決方案。隨著定價機制根據客戶行為、競爭格局和供應動態而變得更加靈活,固定定價模式正迅速失去其重要性。企業正轉向採用基於先進演算法的智慧定價工具,以最佳化利潤率並快速回應需求變化。

人工智慧和機器學習在這些策略中發揮關鍵作用,幫助企業分析大量市場資料並即時自動調整價格。這些技術正在重塑企業管理庫存、改善客戶體驗以及透過動態響應市場力量保持領先地位的方式。它們使企業能夠做出更智慧、數據驅動的定價決策,這些決策將消費者行為、季節性、區域趨勢和競爭對手活動即時納入考慮。透過持續分析大量結構化和非結構化資料,這些工具有助於最佳化產品、品類甚至單一客戶層面的定價。企業可以最大限度地減少缺貨和庫存過剩,確保更好的庫存週轉率並提高營運效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 52億美元 |

| 預測值 | 108億美元 |

| 複合年成長率 | 7.6% |

2024年,動態定價軟體平台細分市場佔據37%的市場佔有率,預計到2034年將以8.4%的複合年成長率成長。隨著數位優先策略的不斷發展,這些平台提供的自動化和即時定價智慧對大型企業和中小型企業都日益重要。透過減少人工監督的需求,這些解決方案增強了敏捷性並改善了決策。線上零售和行動商務的不斷擴張,以及智慧城市的發展,進一步推動了對適應快速變化的數位生態系統的靈活定價系統的需求。

2024年,雲端平台佔據了63%的市場佔有率,預計在2025年至2034年期間的複合年成長率將達到7.5%。這些平台經濟高效、易於擴展且部署迅速,對新創公司和小型企業尤其具有吸引力。它們支援安全、即時的資料存取和持續的效能最佳化,使企業能夠快速更新定價策略。隨著數位領域資料可用性的不斷提高,雲端基礎架構使企業能夠靈活地跨多個管道動態管理定價,同時保持安全性和速度。

美國動態定價和收益管理市場佔85%的市場佔有率,2024年市場規模達16.5億美元。強大的先進數位業務和成熟的人工智慧定價系統持續推動該地區的領先地位。長期以來,美國在旅遊和酒店等領域一直運用收益管理策略,而這些領域的需求導向定價至關重要。美國強大的數位和電商基礎設施支援廣泛使用雲端運算和分析驅動的定價工具,這些工具能夠根據即時變數、客戶偏好和庫存狀況進行調整。

該領域的主要公司包括 Blue Yonder、PROS、Dynamic Yield、SAP SE、Revionics、Oracle、Pricefx、Duetto、Zilliant 和 IDeaS Revenue Solutions。為了鞏固市場地位,動態定價和收益管理行業的領先公司正專注於將人工智慧和預測分析技術融入其平台,以實現更精準的預測和自動化。各公司也優先考慮產品的可擴展性,確保其解決方案適用於大型企業和中小企業。許多公司正在提供模組化、基於雲端的系統,這些系統可以在極少的基礎設施下快速部署。與電商、連鎖飯店和物流公司的策略合作夥伴關係正在擴大其用戶群和市場准入。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 電子商務和數位零售蓬勃發展

- 增加人工智慧和機器學習演算法的使用

- 採用基於雲端的平台

- 營收最佳化需求不斷成長

- 全通路銷售模式的擴展

- 產業陷阱與挑戰

- 實施複雜度高

- 資料隱私和合規性問題

- 市場機會

- 訂閱和基於使用模式的成長

- 與預測分析和需求感知的整合

- 採用生成式人工智慧進行定價模擬

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 最佳情況

- 動態定價市場演變

- 歷史發展 1980-2023

- 2024-2025年市場現狀

- 未來市場軌跡(2026-2034)

- 定價策略框架

- 基於時間的定價策略

- 基於需求的定價模型

- 競爭性定價策略

- 客戶細分定價

- 績效衡量與分析

- 關鍵績效指標 (KPI)

- 投資報酬率和價值衡量

- 分析和報告框架

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按解決方案,2021 - 2034 年

- 主要趨勢

- 動態定價軟體平台

- 企業動態定價套件

- 中端市場定價解決方案

- 專業定價應用程式

- 收益管理系統

- 航空收益管理

- 酒店收益管理

- 其他

- 收益最佳化和分析工具

- 收益管理平台

- 定價分析和情報

- 商業智慧和報告

- 專業服務與實施

- 諮詢和策略服務

- 實施和整合服務

- 託管服務和支持

- 其他

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 收益管理

- 庫存最佳化

- 競爭性定價分析

- 促銷活動管理

- 其他

第7章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 基於雲端

- 本地

- 混合

第8章:市場估計與預測:按產業垂直分類,2021 - 2034 年

- 主要趨勢

- 航空公司和航空業

- 商業航空公司

- 機場和地面服務

- 飛機租賃和維護、修理和大修

- 飯店及餐飲業

- 飯店營運

- 其他住宿方式

- 餐飲服務

- 度假休閒服務

- 零售與電子商務產業

- 網路零售與電子商務

- 實體零售

- 時尚與服飾

- 客戶電子產品

- 交通運輸和移動服務

- 共乘和計程車服務

- 大眾運輸

- 汽車租賃和共享

- 物流和貨運

- 公用事業和能源部門

- 電力設施

- 瓦斯和水務設施

- 電信

- 體育和娛樂業

- 運動隊和場館

- 娛樂和活動

- 主題樂園與景點

- 其他

第9章:市場估計與預測:依定價策略,2021 - 2034 年

- 主要趨勢

- 基於時間的定價策略

- 基於需求的定價模型

- 基於競爭的定價

- 以客戶為中心的定價

第10章:市場估計與預測:依組織規模,2021 - 2034 年

- 大型企業

- 中小企業

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Atomize

- BlackCurve

- Blue Yonder

- Competera

- Duetto

- Dynamic Yield

- IDeaS Revenue Solutions

- Omnia Retail

- Oracle

- Pricefx

- PriceLabs

- Prisync

- PROS

- Qcue

- RealPage

- Revionics

- SAP

- Wheelhouse

- YieldPlanet

- Zilliant

The Global Dynamic Pricing and Yield Management Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 10.8 billion by 2034. This growth is driven by the accelerating pace of digital transformation, the booming e-commerce sector, and the increasing adoption of real-time pricing solutions across sectors such as entertainment, travel, hospitality, and trading. As pricing becomes more fluid in response to customer behavior, competitive landscapes, and supply dynamics, fixed pricing models are rapidly losing relevance. Businesses are turning to intelligent pricing tools powered by advanced algorithms to optimize profit margins and respond quickly to demand shifts.

AI and machine learning play a critical role in these strategies, helping companies analyze large volumes of market data and automate price adjustments instantly. These technologies are reshaping how firms manage inventory, improve customer experience, and stay ahead of their competitors by responding dynamically to market forces. They enable organizations to make smarter, data-driven pricing decisions that account for consumer behavior, seasonality, regional trends, and competitor activity in real time. By continuously analyzing massive volumes of structured and unstructured data, these tools help optimize pricing at the product, category, or even individual customer level. Businesses can minimize stockouts and overstocks, ensuring better inventory turnover and improved operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $10.8 Billion |

| CAGR | 7.6% |

In 2024, the dynamic pricing software platforms segment held a 37% share and is anticipated to grow at 8.4% CAGR through 2034. As digital-first strategies continue to evolve, these platforms offer automation and real-time pricing intelligence that are increasingly essential for both large-scale enterprises and small to medium businesses. By reducing the need for manual oversight, these solutions enhance agility and improve decision-making. The expanding presence of online retail and mobile commerce, along with the development of smart cities, has further fueled the demand for adaptable pricing systems tailored to fast-changing digital ecosystems.

The cloud-based segment captured a 63% share in 2024 and is expected to grow at a CAGR of 7.5% during 2025- 2034. These platforms are cost-effective, easy to scale, and offer rapid deployment, making them particularly attractive to startups and smaller firms. They support secure, real-time data access and continuous performance optimization, allowing businesses to update pricing strategies swiftly. With ever-increasing data availability in the digital space, cloud infrastructure gives companies the flexibility to manage pricing dynamically across multiple channels while maintaining security and speed.

United States Dynamic Pricing and Yield Management Market held an 85% share, generating USD 1.65 billion in 2024. A strong presence of advanced digital businesses and established AI-powered pricing systems continues to drive the region's leadership. The U.S. has long leveraged yield management strategies in areas such as travel and hospitality, where demand-based pricing is essential. The country's robust digital and e-commerce infrastructure supports the widespread use of cloud and analytics-driven pricing tools that adapt to real-time variables, customer preferences, and inventory conditions.

Key companies operating in this space include Blue Yonder, PROS, Dynamic Yield, SAP SE, Revionics, Oracle, Pricefx, Duetto, Zilliant, and IDeaS Revenue Solutions. To solidify their market position, leading firms in the dynamic pricing and yield management industry are focusing on integrating AI and predictive analytics into their platforms for more accurate forecasting and automation. Companies are also prioritizing product scalability, ensuring their solutions are adaptable for both large enterprises and SMEs. Many players are offering modular, cloud-based systems that can be rapidly deployed with minimal infrastructure. Strategic partnerships with e-commerce providers, hospitality chains, and logistics firms are expanding their user base and market access.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Solution

- 2.2.3 Application

- 2.2.4 Deployment mode

- 2.2.5 Industry vertical

- 2.2.6 Pricing strategy

- 2.2.7 Organization size

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surging e-commerce and digital retail growth

- 3.2.1.2 Increased use of AI and machine learning algorithms

- 3.2.1.3 Cloud-based platform adoption

- 3.2.1.4 Rising demand for revenue optimization

- 3.2.1.5 Expansion of omnichannel sales models

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation complexity

- 3.2.2.2 Data privacy and compliance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in subscription and usage-based models

- 3.2.3.2 Integration with predictive analytics and demand sensing

- 3.2.3.3 Adoption of generative AI for pricing simulation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly Initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases

- 3.11 Best-case scenario

- 3.12 Dynamic pricing market evolution

- 3.12.1 Historical Development 1980-2023

- 3.12.2 Current market status 2024-2025

- 3.13 Future market trajectory (2026-2034)

- 3.14 Pricing strategy frameworks

- 3.14.1 Time-based pricing strategies

- 3.14.2 Demand-based pricing models

- 3.14.3 Competitive pricing strategies

- 3.14.4 Customer segmentation pricing

- 3.15 Performance measurement and analytics

- 3.15.1 Key Performance Indicators (KPIs)

- 3.15.2 ROI and value measurement

- 3.15.3 Analytics and reporting frameworks

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Dynamic pricing software platforms

- 5.2.1 Enterprise dynamic pricing suites

- 5.2.2 Mid-market pricing solutions

- 5.2.3 Specialized pricing applications

- 5.3 Revenue management systems

- 5.3.1 Airline revenue management

- 5.3.2 Hotel revenue management

- 5.3.3 Other

- 5.4 Yield optimization and analytics tools

- 5.4.1 Yield management platforms

- 5.4.2 Pricing analytics and intelligence

- 5.4.3 Business intelligence and reporting

- 5.5 Professional services and implementation

- 5.5.1 Consulting and strategy services

- 5.5.2 Implementation and integration services

- 5.5.3 Managed services and support

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Revenue management

- 6.3 Inventory optimization

- 6.4 Competitive pricing analysis

- 6.5 Promotional campaign management

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud based

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Airlines and aviation industry

- 8.2.1 Commercial airlines

- 8.2.2 Airport and ground services

- 8.2.3 Aircraft leasing and MRO

- 8.3 Hotels and hospitality industry

- 8.3.1 Hotel operations

- 8.3.2 Alternative accommodations

- 8.3.3 Food and beverage services

- 8.3.4 Resort and leisure services

- 8.4 Retail and e-commerce industry

- 8.4.1 Online retail and e-commerce

- 8.4.2 Brick-and-mortar retail

- 8.4.3 Fashion and apparel

- 8.4.4 Customer electronics

- 8.5 Transportation and mobility service

- 8.5.1 Ride sharing and taxi services

- 8.5.2 Public transportation

- 8.5.3 Car rental and sharing

- 8.5.4 Logistics and freight

- 8.6 Utilities and energy sector

- 8.6.1 Electric utilities

- 8.6.2 Gas and water utilities

- 8.6.3 Telecommunications

- 8.7 Sports and entertainment industry

- 8.7.1 Sports teams and venues

- 8.7.2 Entertainment and events

- 8.7.3 Theme parks and attractions

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Pricing Strategy, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Time based pricing strategy

- 9.3 Demand based pricing models

- 9.4 Competitive based pricing

- 9.5 Customer-centric pricing

Chapter 10 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 10.1 Large enterprises

- 10.2 SME

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 North America

- 11.1.1 U.S.

- 11.1.2 Canada

- 11.2 Europe

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Italy

- 11.2.5 Spain

- 11.2.6 Russia

- 11.2.7 Nordics

- 11.3 Asia Pacific

- 11.3.1 China

- 11.3.2 India

- 11.3.3 Japan

- 11.3.4 Australia

- 11.3.5 South Korea

- 11.3.6 Singapore

- 11.3.7 Indonesia

- 11.3.8 Vietnam

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.2 Mexico

- 11.4.3 Argentina

- 11.4.4 Chile

- 11.5 MEA

- 11.5.1 South Africa

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

Chapter 12 Company Profiles

- 12.1 Atomize

- 12.2 BlackCurve

- 12.3 Blue Yonder

- 12.4 Competera

- 12.5 Duetto

- 12.6 Dynamic Yield

- 12.7 IDeaS Revenue Solutions

- 12.8 Omnia Retail

- 12.9 Oracle

- 12.10 Pricefx

- 12.11 PriceLabs

- 12.12 Prisync

- 12.13 PROS

- 12.14 Qcue

- 12.15 RealPage

- 12.16 Revionics

- 12.17 SAP

- 12.18 Wheelhouse

- 12.19 YieldPlanet

- 12.20 Zilliant