|

市場調查報告書

商品編碼

1782099

磁致伸縮材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Magnetostrictive Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

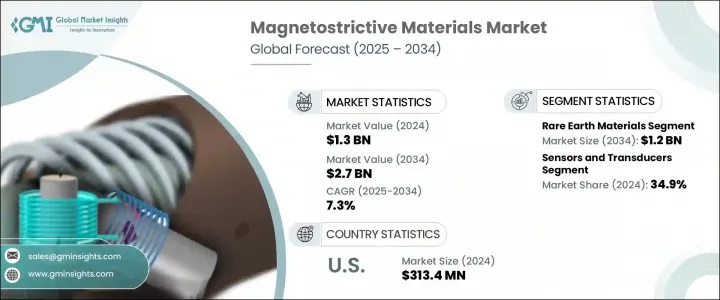

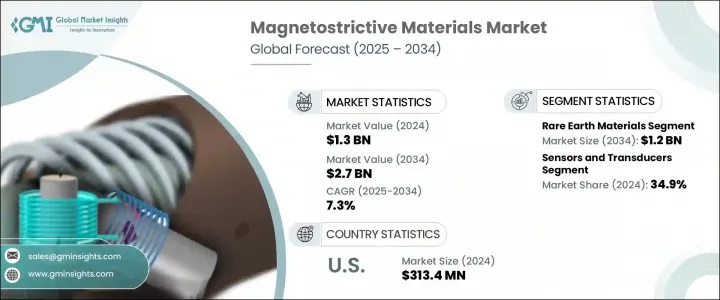

2024年,全球磁致伸縮材料市場規模達13億美元,預計到2034年將以7.3%的複合年成長率成長,達到27億美元。磁致伸縮材料因其獨特的磁場改變形狀或尺寸的能力而日益成長,使其成為先進技術應用中不可或缺的材料。磁致伸縮材料的應用領域涵蓋汽車、醫療保健、航太和消費性電子等多個領域。在汽車領域,這些材料作為感測器和執行器(尤其是在動力轉向系統中)的組成部分,可以提高車輛的性能、效率和安全性。

電動和混合動力汽車的成長進一步推動了這個市場的發展。醫療保健應用受益於其卓越的精確度,從而實現更精準的診斷和針對性治療,改善患者預後。同時,航太公司依靠這些材料進行有效的振動控制和持續的結構健康監測,確保關鍵零件的安全性和性能。這種跨產業的雙重效用不僅拓寬了它們的應用範圍,也顯著擴大了市場需求,因為各行各業都在尋求可靠、高效能的解決方案來應對不斷變化的技術挑戰。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 27億美元 |

| 複合年成長率 | 7.3% |

稀土材料領域在2024年創造了5.895億美元的市場規模,預計到2034年將達到12億美元。該領域佔據主導地位,因為铽等稀土元素具有優異的磁性和高磁係數。這些特性使其成為對精度和效率要求高的應用的理想選擇,例如感測器、執行器和變壓器。汽車、航空和消費性電子領域對先進技術的日益普及,推動了稀土基磁致伸縮材料的發展。

感測器和換能器在2024年佔據34.9%的市場佔有率,成為最大的應用領域。磁致伸縮材料因其能夠將磁能轉換為機械能以及將機械能轉換為磁能的能力而備受推崇,非常適合感測器和換能器製造。其高靈敏度、高耐用性和高精確度使其成為汽車和消費性電子設備中不可或缺的組件。

2024年,美國磁致伸縮材料市場規模達3.134億美元。這一成長主要源於這些材料在感測器、執行器和變壓器等各種工業應用中的廣泛應用。製造業、汽車業和航太等產業都依賴磁致伸縮材料來提高操作精度和效率。在工業自動化領域,磁致伸縮感測器廣泛用於精確的位置和位移測量。持續的自動化關注和對先進感測技術的需求預計將在整個預測期內推動市場成長。

磁致伸縮材料市場的領先公司包括 Cedrat Technologies、TdVib LLC、Grirem Advanced Materials Co., Ltd.、Metglas Inc. 和 Aperam SA。為了鞏固市場地位並獲得競爭優勢,這些製造商採取了推出創新產品、擴大生產能力和進行併購等策略。

為了鞏固市場地位並擴大市場佔有率,磁致伸縮材料領域的公司專注於幾個關鍵策略方針。這些方針包括大力投資研發,推出滿足不斷變化的產業需求的創新高性能材料。他們還優先考慮擴大產能,以滿足日益成長的需求,尤其是來自汽車和航太等快速發展的行業的需求。併購有助於公司拓寬產品組合和地理覆蓋範圍,而策略合作夥伴關係則有助於公司獲得新技術和新市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場規模及預測:依材料類型,2021-2034

- 主要趨勢

- 稀土材料

- Terfenol-D(铽-鏑-鐵)

- 釤鐵化合物

- 其他稀土材料

- 鐵基合金

- 蓋爾芬諾(Fe-Ga)

- 阿爾芬諾爾(Fe-Al)

- 其他鐵基合金

- 鎳基合金

- 鎳鐵合金

- 其他鎳基合金

- 鈷基合金

- 其他材料

第6章:市場規模及預測:依形式,2021-2034

- 主要趨勢

- 散裝材料

- 桿

- 盤子

- 區塊

- 其他散裝形式

- 薄膜

- 複合材料

- 顆粒複合材料

- 層壓複合材料

- 其他複合形式

- 粉末

- 其他形式

第7章:市場規模及預測:依應用,2021-2034

- 主要趨勢

- 感應器和換能器

- 力和扭矩感測器

- 位置和位移感測器

- 應力和應變感測器

- 磁場感測器

- 聲學和超音波換能器

- 其他感測器和換能器

- 執行器和運動控制

- 線性執行器

- 旋轉執行器

- 精密定位系統

- 振動控制系統

- 其他執行器應用

- 能量收集系統

- 振動能量收集器

- 聲能收集器

- 其他能量收集應用

- 聲納和水下聲學

- 結構健康監測

- 其他應用

第 8 章:市場規模與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 汽車

- 引擎和動力系統應用

- 懸吊和底盤應用

- 感測器應用

- 其他汽車應用

- 航太和國防

- 飛機系統

- 國防應用

- 空間應用

- 其他航太和國防應用

- 能源和電力

- 能量收集

- 發電

- 其他能源和電力應用

- 工業的

- 生產設備

- 過程控制

- 其他工業應用

- 消費性電子產品

- 醫療保健和醫療

- 海洋

- 其他

第9章:市場規模及預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- TdVib

- Grirem Advanced Materials

- Metglas

- Cedrat Technologies

- Aperam

- Arnold Magnetic Technologies

- Sensor Technology

- AK Steel Holding Corporation

- Xinetics

The Global Magnetostrictive Materials Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 2.7 billion by 2034. Demand for magnetostrictive materials is rising due to their unique ability to change shape or size when subjected to magnetic fields, making them indispensable in advanced technological applications. Their usage spans a variety of sectors such as automotive, healthcare, aerospace, and consumer electronics. In the automotive field, these materials enhance vehicle performance, efficiency, and safety by being integral in sensors and actuators, particularly in power steering systems.

The growth of electric and hybrid vehicles is further propelling this market. Healthcare applications benefit greatly from their exceptional precision, enabling more accurate diagnostics and targeted treatments that improve patient outcomes. Meanwhile, aerospace companies rely on these materials for effective vibration control and continuous structural health monitoring, ensuring safety and performance in critical components. This dual utility across sectors not only broadens their application scope but also significantly amplifies market demand as industries seek reliable, high-performance solutions to meet evolving technological challenges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 7.3% |

The rare earth materials segment generated USD 589.5 million in 2024 and is expected to reach USD 1.2 billion by 2034. This segment dominates because rare earth elements like terbium provide superior magnetic properties and high magnetic coefficients. These qualities make them ideal for applications requiring precision and efficiency, including sensors, actuators, and transformers. The increasing adoption of advanced technology in the automotive, aviation, and consumer electronics sectors fuels the growth of rare earth-based magnetostrictive materials.

The sensors and transducers accounted for a 34.9% share in 2024, making this the largest application segment. Magnetostrictive materials are prized for their ability to convert magnetic energy into mechanical energy and vice versa, lending themselves perfectly to sensor and transducer manufacturing. Their high sensitivity, durability, and accuracy make them essential components in automotive and consumer electronics devices.

United States Magnetostrictive Materials Market generated USD 313.4 million in 2024. This growth is driven by the increased use of these materials in various industrial applications, including sensors, actuators, and transformers. Industries such as manufacturing, automotive, and aerospace rely on magnetostrictive materials to improve operational accuracy and efficiency. In industrial automation, magnetostrictive sensors are widely used for precise position and displacement measurements. The ongoing focus on automation and the demand for advanced sensing technologies are expected to boost market growth throughout the forecast period.

Leading companies in the Magnetostrictive Materials Market include Cedrat Technologies, TdVib LLC, Grirem Advanced Materials Co., Ltd., Metglas Inc., and Aperam S.A. To strengthen their market positions and gain competitive advantages, these manufacturers pursue strategies such as launching innovative products, expanding production capacity, and engaging in mergers and acquisitions.

To solidify their foothold and expand market presence, companies in the magnetostrictive materials sector focus on several key strategic approaches. These include investing heavily in research and development to introduce innovative, higher-performance materials that meet evolving industry needs. They also prioritize capacity expansion to handle growing demand, especially from rapidly developing sectors like automotive and aerospace. Mergers and acquisitions help companies broaden their product portfolios and geographic reach, while strategic partnerships enable access to new technologies and markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Rare earth materials

- 5.2.1 Terfenol-D (Tb-Dy-Fe)

- 5.2.2 Samarium-iron compounds

- 5.2.3 Other rare earth materials

- 5.3 Iron-based alloys

- 5.3.1 Galfenol (Fe-Ga)

- 5.3.2 Alfenol (Fe-Al)

- 5.3.3 Other iron-based alloys

- 5.4 Nickel-based alloys

- 5.4.1 Nickel-iron alloys

- 5.4.2 Other nickel-based alloys

- 5.5 Cobalt-based alloys

- 5.6 Other materials

Chapter 6 Market Size and Forecast, By Form, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Bulk materials

- 6.2.1 Rods

- 6.2.2 Plates

- 6.2.3 Blocks

- 6.2.4 Other bulk forms

- 6.3 Thin films

- 6.4 Composites

- 6.4.1 Particulate composites

- 6.4.2 Laminated composites

- 6.4.3 Other composite forms

- 6.5 Powders

- 6.6 Other forms

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Sensors and transducers

- 7.2.1 Force and torque sensors

- 7.2.2 Position and displacement sensors

- 7.2.3 Stress and strain sensors

- 7.2.4 Magnetic field sensors

- 7.2.5 Acoustic and ultrasonic transducers

- 7.2.6 Other sensors and transducers

- 7.3 Actuators and motion control

- 7.3.1 Linear actuators

- 7.3.2 Rotary actuators

- 7.3.3 Precision positioning systems

- 7.3.4 Vibration control systems

- 7.3.5 Other actuator applications

- 7.4 Energy harvesting systems

- 7.4.1 Vibration energy harvesters

- 7.4.2 Acoustic energy harvesters

- 7.4.3 Other energy harvesting applications

- 7.5 Sonar and underwater acoustics

- 7.6 Structural health monitoring

- 7.7 Other applications

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.2.1 Engine and powertrain applications

- 8.2.2 Suspension and chassis applications

- 8.2.3 Sensor applications

- 8.2.4 Other automotive applications

- 8.3 Aerospace and defense

- 8.3.1 Aircraft systems

- 8.3.2 Defense applications

- 8.3.3 Space applications

- 8.3.4 Other aerospace and defense applications

- 8.4 Energy and power

- 8.4.1 Energy harvesting

- 8.4.2 Power generation

- 8.4.3 Other energy and power applications

- 8.5 Industrial

- 8.5.1 Manufacturing equipment

- 8.5.2 Process control

- 8.5.3 Other industrial applications

- 8.6 Consumer electronics

- 8.7 Healthcare and medical

- 8.8 Marine

- 8.9 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 TdVib

- 10.2 Grirem Advanced Materials

- 10.3 Metglas

- 10.4 Cedrat Technologies

- 10.5 Aperam

- 10.6 Arnold Magnetic Technologies

- 10.7 Sensor Technology

- 10.8 AK Steel Holding Corporation

- 10.9 Xinetics