|

市場調查報告書

商品編碼

1782092

胸腔外科器械市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Thoracic Surgery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

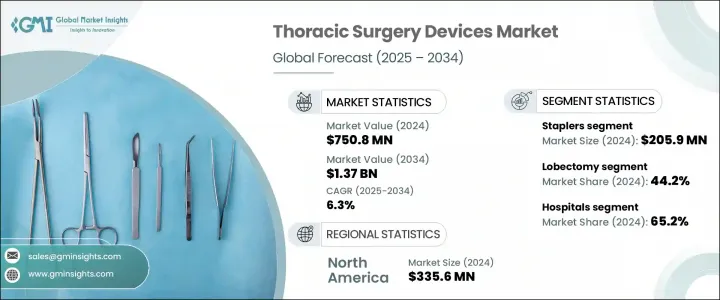

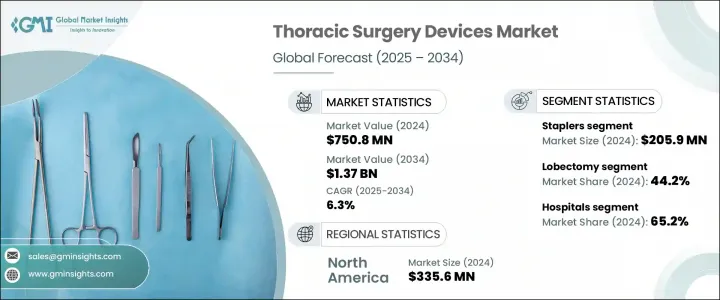

2024 年全球胸腔外科手術設備市場價值為 7.508 億美元,預計到 2034 年將以 6.3% 的複合年成長率成長,達到 13.7 億美元。慢性阻塞性肺病 (COPD)、肺癌等胸部疾病以及需要外科手術干預的疾病的發生率不斷上升,推動了市場的發展勢頭。人口老化、環境污染物暴露以及持續的吸煙習慣導致這些疾病的盛行率上升。病例激增直接增加了對能夠帶來更好療效的先進胸腔外科手術器械的需求。視訊輔助和機器人輔助胸腔外科手術等微創手術因具有恢復時間短、術後不適感減輕和併發症風險降低等優點,越來越受到人們的青睞。

這些先進的手術方法不僅改善了患者的康復,還顯著縮短了住院時間,使得更多類型的手術能夠在門診環境中進行。這一轉變促進了門診手術中心 (ASC) 的快速發展,如今,它們被視為傳統住院治療的高效、經濟且對患者友好的替代方案。 ASC 可以縮短病患週轉時間,降低營運成本,並提高排班彈性,使其成為醫療服務提供者和病患日益青睞的選擇。隨著微創技術日益精進,設備日益緊湊和專業化,ASC 正在擴展其處理複雜胸腔外科手術的能力,而這些手術曾經只能在高危重症醫院環境中進行,這進一步加速了市場對專為這些機構客製化的先進手術設備的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.508億美元 |

| 預測值 | 13.7億美元 |

| 複合年成長率 | 6.3% |

2024年,吻合器市場成為最大貢獻者,市場規模達2.059億美元。電動吻合器、數位吻合器和關節吻合器等設計創新正在不斷提升手術精準度,減少組織滲漏等併發症,並提高手術效率。這些先進功能改善了組織處理,縮短了手術時間,同時幫助外科醫生更自信、更安全地處理複雜的胸腔解剖結構。

2024年,肺葉切除術佔最大佔有率,達44.2%。此技術仍是早期非小細胞肺癌的首選治療方法,而早期非小細胞肺癌佔肺癌確診病例的絕大部分。隨著篩檢技術和診斷方法的改進,越來越多的患者,尤其是老年人和高風險族群,能夠更早被識別並成為手術治療的候選對象。可手術病例的增加推動了對肺葉切除術專用工具的需求,包括血管封閉器械、解剖器械和高性能吻合器。

2024年,美國胸腔外科器械市場規模達3.028億美元。美國肺癌和慢性阻塞性肺病(COPD)的發生率持續居高不下,這兩種疾病在晚期通常都需要手術介入。由於數百萬患者受這些疾病的影響,美國的醫療服務提供者正在醫院和癌症中心穩步進行胸腔外科手術。持續的外科治療需求確保了全國醫療機構對胸腔外科器械的需求仍然強勁。

塑造這一市場的關鍵參與者包括通用電氣醫療、Biolitec、美德樂、富士膠片控股、奧林巴斯、微創醫療、庫克醫療、康美醫療、貝朗、直覺外科、美敦力、康德樂、波士頓科學、卡爾史托斯和強生。為了鞏固其在胸腔外科設備市場的地位,領先的公司正專注於創新驅動策略。這些措施包括推出具有增強的人體工學、精確度和即時回饋的下一代手術工具。許多參與者正在透過策略合作夥伴關係和區域分銷協議擴大其全球影響力。其他公司則在投資研發,以創建與微創和機器人輔助手術相容的設備。為特定手術應用提供客製化解決方案並最佳化門診環境的成本效益也是重中之重。此外,公司正在將數位技術整合到設備中,以提高手術準確性和術後效果,幫助它們吸引更廣泛的醫療服務提供者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 肺癌和慢性呼吸系統疾病盛行率上升

- 微創技術的應用日益廣泛

- 胸腔外科器械的技術進步

- 擴大門診手術中心

- 產業陷阱與挑戰

- 先進胸腔外科設備和機器人系統成本高昂

- 缺乏熟練的胸腔外科醫生和專門培訓

- 市場機會

- 增加新興經濟體的醫療保健投資

- 人工智慧和數位平台在手術規劃和儀器中的整合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 專利分析

- 定價分析

- 按產品

- 按地區

- 差距分析

- 波特的分析

- PESTLE 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 夾具

- 鉗子

- 抓取器

- 訂書機

- 剪刀

- 傳播者

- 持針器

- 其他產品

第6章:市場估計與預測:依手術類型,2021 - 2034 年

- 主要趨勢

- 肺葉切除術

- 楔形切除術

- 肺切除術

- 其他手術類型

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- B. Braun

- Biolitec

- Boston Scientific

- Cardinal Health

- ConMed

- Cook Medical

- Fujifilm Holdings

- GE Healthcare

- Intuitive Surgical

- Johnson & Johnson

- Karl Storz

- Medela

- Medtronic

- MicroPort

- Olympus

The Global Thoracic Surgery Devices Market was valued at USD 750.8 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 1.37 billion by 2034. The market's momentum is being fueled by the rising incidence of thoracic conditions such as chronic obstructive pulmonary disease (COPD), lung cancer, and other diseases requiring surgical intervention. A growing aging population, exposure to environmental pollutants, and persistent smoking habits are contributing to the increased prevalence of these conditions. This surge in cases is directly raising the demand for advanced thoracic surgical instruments that can deliver better outcomes. Minimally invasive procedures such as video-assisted and robot-assisted thoracic surgeries are gaining ground due to benefits like reduced recovery time, minimized postoperative discomfort, and lower risks of complications.

These advanced surgical approaches have not only improved patient recovery but also significantly reduced hospitalization time, enabling a broader range of procedures to be performed in outpatient environments. This shift has spurred the rapid growth of ambulatory surgical centers (ASCs), which are now seen as efficient, cost-effective, and patient-friendly alternatives to conventional inpatient hospital care. ASCs allow for quicker patient turnaround, lower overhead costs, and improved scheduling flexibility, making them an increasingly attractive option for both healthcare providers and patients. As minimally invasive techniques become more refined and equipment more compact and specialized, ASCs are expanding their capabilities to handle complex thoracic surgeries that were once only possible in high-acuity hospital settings, further accelerating market demand for advanced surgical devices tailored to these facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $750.8 Million |

| Forecast Value | $1.37 Billion |

| CAGR | 6.3% |

In 2024, the staplers segment emerged as the top contributor, generating USD 205.9 million. Ongoing innovations in design, such as powered, digital, and articulating staplers, are enhancing precision, reducing complications like tissue leaks, and increasing surgical efficiency. These advanced features improve tissue handling and reduce operative time while assisting surgeons in managing complex thoracic anatomy with greater confidence and safety.

The lobectomy procedures segment held the largest share at 44.2% in 2024. This technique remains the preferred treatment for early-stage non-small cell lung cancer, which accounts for a significant majority of lung cancer diagnoses. As screening technologies and diagnostic methods improve, more patients, particularly older individuals and those with higher risk factors-are being identified earlier and becoming candidates for surgical treatment. This rise in operable cases is driving demand for specialized tools used in lobectomies, including vessel sealing instruments, dissection devices, and high-performance staplers.

United States Thoracic Surgery Devices Market was valued at USD 302.8 million in 2024. The country continues to see high rates of lung cancer and COPD, both of which frequently require surgical intervention during advanced stages. With millions affected by these conditions, healthcare providers in the U.S. are steadily performing thoracic surgeries in hospitals and cancer center settings. The consistent demand for surgical treatment ensures that the need for thoracic devices remains strong across healthcare institutions nationwide.

Key players shaping this market include GE Healthcare, Biolitec, Medela, Fujifilm Holdings, Olympus, MicroPort, Cook Medical, ConMed, B. Braun, Intuitive Surgical, Medtronic, Cardinal Health, Boston Scientific, Karl Storz, and Johnson & Johnson. To solidify their position in the thoracic surgery devices market, leading companies are focusing on innovation-driven strategies. These include launching next-generation surgical tools with enhanced ergonomics, precision, and real-time feedback. Many players are expanding their global footprint through strategic partnerships and regional distribution agreements. Others are investing in R&D to create devices compatible with minimally invasive and robotic-assisted procedures. Offering customized solutions for specific surgical applications and optimizing cost-effectiveness for outpatient settings are also top priorities. Additionally, companies are integrating digital technology into devices to improve surgical accuracy and postoperative outcomes, helping them attract a broader range of healthcare providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Surgery type

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of lung cancer and chronic respiratory diseases

- 3.2.1.2 Growing adoption of minimally invasive techniques

- 3.2.1.3 Technological advancements in thoracic surgical instruments

- 3.2.1.4 Expansion of ambulatory surgical centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced thoracic surgical devices and robotic systems

- 3.2.2.2 Shortage of skilled thoracic surgeons and specialized training

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing healthcare investments in emerging economies

- 3.2.3.2 Integration of AI and digital platforms in surgical planning and instrumentation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter’s analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Clamps

- 5.3 Forceps

- 5.4 Graspers

- 5.5 Staplers

- 5.6 Scissors

- 5.7 Spreaders

- 5.8 Needle holders

- 5.9 Other products

Chapter 6 Market Estimates and Forecast, By Surgery Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lobectomy

- 6.3 Wedge resection

- 6.4 Pneumonectomy

- 6.5 Other surgery types

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profile

- 9.1 B. Braun

- 9.2 Biolitec

- 9.3 Boston Scientific

- 9.4 Cardinal Health

- 9.5 ConMed

- 9.6 Cook Medical

- 9.7 Fujifilm Holdings

- 9.8 GE Healthcare

- 9.9 Intuitive Surgical

- 9.10 Johnson & Johnson

- 9.11 Karl Storz

- 9.12 Medela

- 9.13 Medtronic

- 9.14 MicroPort

- 9.15 Olympus