|

市場調查報告書

商品編碼

1782091

金屬家具市場機會、成長動力、產業趨勢分析及2025-2034年預測Metal Furniture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

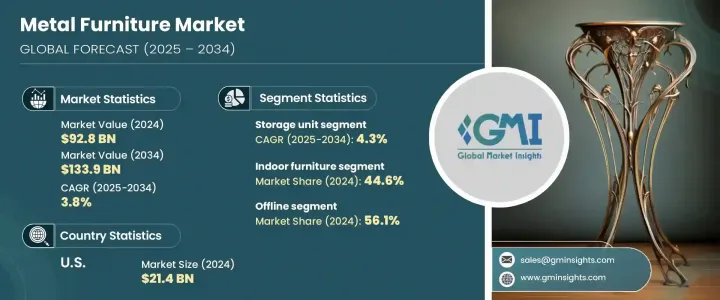

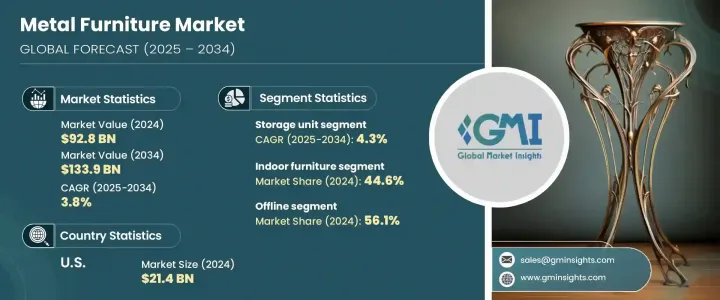

2024年,全球金屬家具市場規模達9,28億美元,預計2034年將以3.8%的複合年成長率成長,達到1,339億美元。該行業的成長主要受到全球基礎設施建設日益成長的勢頭的影響,各國政府和私營企業紛紛投入巨資,用於交通樞紐、公共設施、機構建築和商業綜合體的現代化建設。隨著基礎設施項目規模的擴大,對金屬長凳、儲物櫃、貨架和工作站等耐用且標準化的家具的需求正在迅速成長。這些家具經常被大量訂購,用於機場、市政大樓、學校、醫院和娛樂場所。

這一市場擴張的主要驅動力之一是消費者對耐用、衛生且防火家具解決方案的需求。金屬家具因其更長的使用壽命、易於維護且符合安全法規,在人流量大的區域和共享空間中,仍然比木質或塑膠家具更受青睞。尤其是在新興經濟體,教育機構和醫療機構的成長顯著推動了市場需求,因為新建築所需的家具不僅堅固耐用,還能創造無菌環境。此外,模組化和預製建築技術的採用與金屬家具製造商的大規模生產能力完美契合,這使得他們能夠更輕鬆地以省時省錢的方式為整個設施配備標準化單元。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 928億美元 |

| 預測值 | 1339億美元 |

| 複合年成長率 | 3.8% |

主要大都市地區的持續都市化是推動金屬家具銷售的另一個因素。隨著城市交通日益堵塞,對節省空間且功能齊全的家具解決方案的需求日益成長。無論是住宅還是商業地產,消費者和企業都越來越青睞緊湊、可堆疊或模組化的金屬家具,這些家具不僅能夠最大限度地利用可用空間,同時兼具強度和可靠性。建築師和室內設計師也青睞金屬材料,因為它們兼具美觀的靈活性,可以與木材、玻璃或織物無縫融合,打造出工業風、現代簡約和斯堪的納維亞風格等現代風格的室內空間。此外,由於金屬家具耐磨損,它已成為學校、酒店、醫院和辦公大樓等高使用率場所的首選。

按產品類型分類,金屬家具市場分為床、椅子、桌子、沙發、儲物單元(如櫥櫃和儲物櫃)、凳子和長凳、架子和擱板以及其他,包括模組化和可折疊設計。其中,儲物單元類別是最大的收入貢獻者,2024 年的收入為 309 億美元。預計 2025 年至 2034 年期間的複合年成長率為 4.3%。金屬收納解決方案因其強度高、防蟲防潮、高承載能力強等特點,越來越受歡迎。這些單位廣泛應用於辦公室、醫院、零售店、倉庫和機構場所,這些場所的安全性和使用壽命至關重要。在人口稠密的城市中心,節省空間的櫥櫃、滾動層架和儲物櫃有助於最佳化家庭和企業的小空間。

從應用角度來看,金屬家具分為室內家具、戶外家具以及模組化或攜帶式家具。 2024年,室內家具佔據了全球家具市場的最大佔有率,達到44.6%。金屬因其維護成本低、設計時尚、易於適應現代室內裝潢趨勢等特點,在室內環境中的應用十分廣泛。金屬的韌性使其成為頻繁使用環境的理想選擇,而其與混合材料的兼容性則進一步增強了其在各種設計形式的多功能性。

從區域來看,北美在全球金屬家具市場佔據主導地位,擁有龐大的消費群體,注重品質、耐用性和便利性。 2024年,美國金屬家具市場規模達214億美元,預計到2034年將以4.2%的複合年成長率成長。高昂的消費支出、強勁的機構需求以及完善的基礎設施,共同推動了該地區的強勁成長。遠距辦公和混合辦公模式的興起也增加了對家庭辦公家具的需求,包括金屬辦公桌、儲物櫃和符合人體工學的座椅。此外,電商平台的普及簡化了即裝即用和平板包裝家具的購買流程,從而促進了整個地區的銷售。

隨著越來越多的消費者尋求耐用、可回收的家具選擇,永續發展趨勢正在進一步塑造市場偏好。製造商持續以環保的生產流程和耐用的材料來滿足這些需求。北美市場也受益於全球領先的企業,它們為企業、教育、酒店和工業環境等領域提供高品質的金屬家具。這些公司生產的產品種類繁多,從折疊椅和公共座椅解決方案到模組化辦公系統和金屬框架工作站,確保能夠全面滿足消費者和企業不斷變化的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 全球基礎建設發展

- 機構和商業需求

- 都市化與緊湊生活

- 耐久性和強度需求

- 產業陷阱與挑戰

- 原物料價格波動

- 初始成本高

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計(HS編碼940320)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 床

- 椅子

- 表格

- 沙發

- 儲存單元(櫥櫃、置物櫃)

- 凳子和長凳

- 架和層架

- 其他(折疊件、模組化件)

第6章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 鋼(不銹鋼、低碳鋼)

- 鋁

- 鐵(熟鐵、鑄鐵)

- 其他金屬合金

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 室內家具

- 戶外家具

- 模組化/攜帶式家具

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 辦公室

- 飯店和餐廳

- 教育機構

- 醫療保健設施

- 工業的

- 政府和軍隊

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 離線

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- Aldermans

- Chyuan Chern Furniture

- Foshan Kinouwell Furniture

- Haworth

- Herman Miller

- HNI

- KI

- Knoll

- Meco

- Okamura

- Samsonite

- Steelcase

- Vitra International

- Weiling Steel Furniture

- Xinyue Holding Group

The Global Metal Furniture Market was valued at USD 92.8 billion in 2024 and is estimated to grow at a CAGR of 3.8% to reach USD 133.9 billion by 2034. Growth across this sector is primarily influenced by the increasing momentum in global infrastructure development, as governments and private enterprises pour substantial investments into modernizing transport hubs, public utilities, institutional buildings, and commercial complexes. As infrastructure projects scale up, the demand for durable and standardized furnishings like metal benches, lockers, shelves, and workstations is rapidly gaining traction. These items are frequently ordered in bulk for use in airports, city administration buildings, schools, hospitals, and recreational facilities.

One of the major drivers behind this market expansion is the shift toward durable, hygienic, and fire-resistant furniture solutions. Metal furniture continues to be preferred over wood or plastic alternatives for high-traffic areas and shared spaces due to its extended service life, ease of maintenance, and compliance with safety regulations. In emerging economies, especially, the growth of educational institutions and healthcare facilities contributes significantly to market demand, as new buildings seek furnishings that are not only robust but also conducive to sterile environments. Additionally, the adoption of modular and prefabricated construction techniques aligns well with the mass production capabilities of metal furniture manufacturers, making it easier to outfit entire facilities with standardized units in a time- and cost-efficient manner.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $92.8 Billion |

| Forecast Value | $133.9 Billion |

| CAGR | 3.8% |

The continued urbanization of major metropolitan regions is another factor boosting metal furniture sales. As cities become more congested, the need for space-saving and functional furniture solutions is rising. In both residential and commercial properties, consumers and businesses are increasingly drawn to compact, stackable, or modular metal furniture that maximizes usable floor space while delivering strength and reliability. Architects and interior designers are also favoring metal materials for their aesthetic flexibility, allowing seamless integration with wood, glass, or fabric for contemporary styles such as industrial, modern minimalist, and Scandinavian-inspired interiors. Moreover, metal furniture has become a favored choice for high-use environments like schools, hotels, hospitals, and office buildings due to its resistance to wear and tear.

By product type, the metal furniture market is segmented into beds, chairs, tables, sofas, storage units (such as cabinets and lockers), stools and benches, racks and shelves, and others, including modular and foldable designs. Among these, the storage unit category was the highest revenue contributor, accounting for USD 30.9 billion in 2024. It is forecast to grow at a CAGR of 4.3% between 2025 and 2034. The popularity of metal storage solutions continues to rise due to their strength, resistance to pests and moisture, and suitability for high-load capacities. These units are widely used in spaces like offices, hospitals, retail stores, warehouses, and institutional settings where safety and longevity are crucial. In densely populated urban centers, space-efficient cabinets, rolling shelves, and lockers are helping optimize small areas in both homes and businesses.

In terms of application, metal furniture is classified into indoor furniture, outdoor furniture, and modular or portable units. Indoor furniture captured the largest portion of the global market in 2024, holding a 44.6% share. The use of metal in indoor settings is widespread due to its low maintenance, sleek design potential, and adaptability to modern interior trends. Its resilience makes it ideal for frequent-use environments, and its compatibility with mixed materials further enhances its versatility for various design formats.

Regionally, North America dominates the global metal furniture market and is home to a large consumer base that prioritizes quality, longevity, and convenience. In 2024, the US metal furniture market was valued at USD 21.4 billion and is expected to grow at a CAGR of 4.2% through 2034. High consumer spending, robust institutional demand, and well-established infrastructure all contribute to strong regional growth. The rise in remote and hybrid work models has also increased the demand for home office furniture, including metal desks, storage cabinets, and ergonomic seating. Additionally, the prevalence of e-commerce platforms has simplified the purchase of ready-to-assemble and flat-packed furniture, boosting sales across the region.

Sustainability trends are further shaping market preferences, as more consumers seek durable, recyclable furniture options. Manufacturers continue to respond to these demands with environmentally responsible production processes and materials designed to last. The North American market also benefits from the presence of leading global players that supply high-quality metal furnishings across sectors such as corporate, educational, hospitality, and industrial environments. These companies produce a wide variety of products ranging from folding chairs and public seating solutions to modular office systems and metal-framed workstations, ensuring that they meet evolving consumer and business needs across the board.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Material

- 2.2.4 Application

- 2.2.5 End user

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Global infrastructure development

- 3.2.1.2 Institutional and Commercial Demand

- 3.2.1.3 Urbanization and Compact Living

- 3.2.1.4 Durability and Strength Demand

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Fluctuating raw material price

- 3.2.2.2 High initial cost

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code 940320)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Beds

- 5.3 Chairs

- 5.4 Tables

- 5.5 Sofas

- 5.6 Storage units (cabinets, lockers)

- 5.7 Stools & benches

- 5.8 Racks & shelves

- 5.9 Others (folding, modular pieces)

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Steel (stainless, mild)

- 6.3 Aluminum

- 6.4 Iron (wrought iron, cast iron)

- 6.5 Other metal alloys

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Indoor furniture

- 7.3 Outdoor furniture

- 7.4 Modular/portable furniture

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Offices

- 8.3.2 Hotels & restaurants

- 8.3.3 Educational institutions

- 8.3.4 Healthcare facilities

- 8.4 Industrial

- 8.5 Government & military

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aldermans

- 11.2 Chyuan Chern Furniture

- 11.3 Foshan Kinouwell Furniture

- 11.4 Haworth

- 11.5 Herman Miller

- 11.6 HNI

- 11.7 KI

- 11.8 Knoll

- 11.9 Meco

- 11.10 Okamura

- 11.11 Samsonite

- 11.12 Steelcase

- 11.13 Vitra International

- 11.14 Weiling Steel Furniture

- 11.15 Xinyue Holding Group