|

市場調查報告書

商品編碼

1782088

麵團基預混料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Dough-Based Premixes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

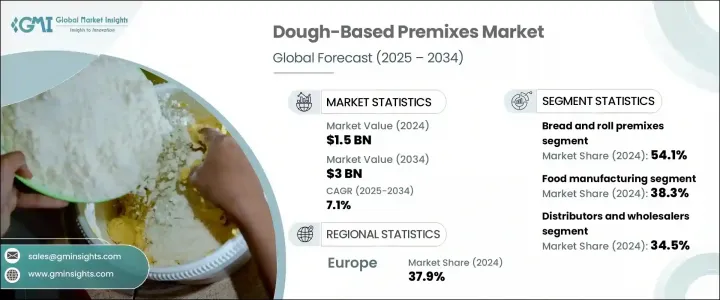

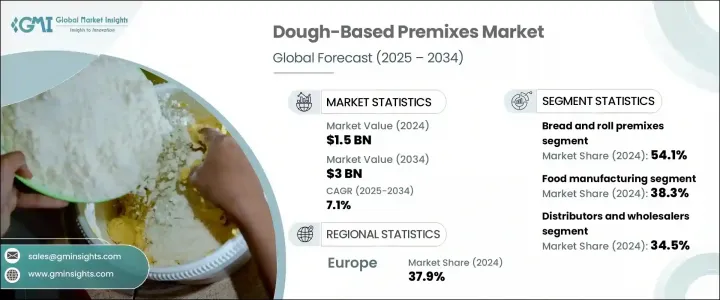

2024 年全球麵團預混料市場價值 15 億美元,預計年複合成長率為 7.1%,到 2034 年將達到 30 億美元。麵團預混料是預製的烘焙原料混合物,例如麵粉、膨鬆劑、酵素和乳化劑,旨在簡化麵包、麵包捲、糕點、披薩和鬆餅等產品的麵團製備。這些預混料可確保一致性,節省製備時間,並為商業烘焙師和家庭消費者提供便利。隨著對高效省時且品質穩定的產品的需求不斷成長,市場正在穩步成長。關鍵機會在於清潔標籤選項、無麩質配方、創新產品發布和強化預混料。餐飲連鎖店的擴張、城市化以及新興經濟體家庭烘焙的興起進一步推動了這一成長。

冷鏈物流、客製化預混料解決方案以及燕麥基、高蛋白和富含纖維的混合等功能性配料的創新,正在為包裝食品、快餐店和零售市場開闢新的發展方向。隨著全球健康意識和便利化趨勢的不斷提升,基於麵團的預混料越來越被視為打造下一代烘焙產品和解決方案的重要組成部分。消費者要求烘焙食品不僅節省時間,還要滿足更高的營養和清潔標籤成分標準。這種轉變推動了預混料配方的創新,包括無麩質、富含維生素和礦物質以及富含功能性纖維和蛋白質的選項。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15億美元 |

| 預測值 | 30億美元 |

| 複合年成長率 | 7.1% |

2024年,麵包和捲狀預混料佔據市場主導地位,佔54.1%,價值8.274億美元。該細分市場的領先地位源於零售和工業烘焙行業對白麵包、全麥麵包、特色麵包和手工麵包預混料的廣泛需求。消費者越來越尋求既省時又營養豐富、用途多樣的麵包選擇,以滿足健康趨勢和傳統偏好。

食品製造業佔38.3%的市場佔有率,2024年產值達5.873億美元。由於包裝和冷凍食品生產商以及自有品牌對一致、可擴展和可定製麵團配方的需求不斷成長,該行業佔據領先地位。預混料有助於簡化生產流程,並確保大型烘焙工廠的一致性。商業烘焙(包括大型工業化、中型和手工烘焙)也受益於即用型預混料的創新。同時,連鎖餐廳、獨立餐廳和機構廚房等餐飲服務機構也依賴預混料來提高便利性並縮短準備時間。

2024年,歐洲麵團預混料市場佔37.9%的市佔率。歐洲大陸濃厚的烘焙文化、手工和工業烘焙食品的高消費量,以及樂斯福、焙樂道和歐格等知名烘焙解決方案公司的存在,共同構成了其主導地位。德國、法國和英國等國家是主要驅動力,這主要源自於人們對便利、清潔標籤和健康麵團產品的需求。歐盟制定的嚴格品質標準以及人們對強化、無麩質和有機烘焙預混料日益成長的興趣,將繼續推動產品創新和市場成長。

阿徹丹尼爾斯米德蘭公司 (ADM)、通用磨坊、嘉吉公司、Dawn Foods 和 Puratos Group 等領先企業憑藉其創新能力和廣泛的分銷網路脫穎而出,在塑造市場格局中發揮關鍵作用。為了鞏固其在麵團預混料市場的立足點,各公司專注於持續的產品創新,開發符合當前健康趨勢的清潔標籤、無麩質和強化配方。他們投資研發,以創建可自訂的預混料,以滿足不同地區的口味和用途。與餐飲服務提供者、零售連鎖店和大型烘焙商建立策略合作夥伴關係和合作關係,使這些公司能夠擴大業務範圍並快速回應市場需求。此外,公司透過採用先進的冷鏈物流來增強其供應鏈,以維持產品品質並支援全球分銷。行銷工作也強調對消費者進行便利性、營養和永續性方面的教育,以提高品牌忠誠度和市場滲透率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 麵包和麵包卷混合物

- 白麵包預拌粉

- 全麥和特殊麵包混合物

- 手工麵包預拌粉

- 蛋糕和鬆餅預拌粉

- 分層蛋糕混合物

- 紙杯蛋糕和鬆餅預拌粉

- 特色蛋糕粉

- 披薩麵團混合物

- 傳統披薩麵團

- 薄皮品種

- 無麩質披薩麵團

- 糕點和餅乾混合物

- 丹麥麵包和羊角麵包混合物

- 餅乾混合物

- 特色糕點預拌粉

- 特種和功能性混合物

- 無麩質配方

- 有機和清潔標籤產品

- 高蛋白和強化混合物

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 商業烘焙

- 大型工業麵包店

- 中型商業麵包店

- 小型手工麵包店

- 餐飲服務

- 連鎖餐廳

- 獨立餐廳

- 機構餐飲服務

- 食品製造

- 包裝食品生產商

- 冷凍食品製造商

- 自有品牌製造商

- 零售和消費者

- 雜貨店和超市連鎖店

- 特色食品店

- 線上零售平台

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 製造商到最終用戶

- 合約製造

- 分銷商和批發商

- 食品服務分銷商

- 特殊配料經銷商

- 零售通路

- 超市和大賣場

- 特色食品店

- 線上零售平台

- 設備和技術合作夥伴關係

- 綜合解決方案提供者

- 技術平台合作夥伴關係

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Dawn Foods

- Lesaffre Group

- Puratos Group

- Kerry Group

- General Mills (North America)

- ADM (Archer Daniels Midland)

- Cargill, Incorporated

- Goodman Fielder Food Service (Asia-Pacific)

- Eurogerm KB

- Ardent Mills

- Lallemand Baking

- FRITSCH Group

- Rheon Automatic Machinery

- Rondo AG

The Global Dough-Based Premixes Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 3 billion by 2034. Dough-based premixes are ready-made blends of baking ingredients such as flour, leavening agents, enzymes, and emulsifiers designed to simplify dough preparation for products like bread, rolls, pastries, pizzas, and muffins. These premixes ensure consistency, save preparation time, and provide convenience for both commercial bakers and home consumers. The market is steadily growing as demand rises for products that offer time efficiency and consistent quality. Key opportunities lie in clean-label options, gluten-free formulations, innovative product launches, and fortified mixes. This growth is further fueled by the expansion of foodservice chains, urbanization, and the rising trend of home baking in emerging economies.

Innovations in cold chain logistics, customizable premix solutions, and the inclusion of functional ingredients like oat-based, high-protein, and fiber-enriched blends are creating new avenues in packaged foods, quick-service restaurants, and retail markets. As health consciousness and convenience trends continue to rise worldwide, dough-based premixes are increasingly recognized as vital components in creating the next generation of bakery products and solutions. Consumers are demanding baked goods that not only save time but also meet higher standards for nutrition and clean-label ingredients. This shift is driving innovation in premix formulations to include options that are gluten-free, fortified with vitamins and minerals, and enriched with functional fibers and proteins.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3 Billion |

| CAGR | 7.1% |

The bread and roll premixes segment dominated the market in 2024, holding a 54.1% share and was valued at USD 827.4 million. This segment's leadership stems from the widespread demand for white, whole grain, specialty, and artisanal bread mixes across retail and industrial baking sectors. Consumers increasingly seek bread options that are not only timesaving but also nutritious and versatile enough to meet both health trends and traditional preferences.

The food manufacturing segment held a 38.3% share and generated USD 587.3 million in 2024. This sector leads due to rising demand from packaged and frozen food producers as well as private label brands requiring consistent, scalable, and customizable dough formulas. Premixes contribute to streamlining production processes and ensuring uniformity in large-scale bakery operations. Commercial baking-which includes large industrial, medium-scale, and artisanal bakeries-also benefits from ready-to-use premix innovations. Meanwhile, foodservice establishments such as chain restaurants, standalone eateries, and institutional kitchens rely on premixes to enhance convenience and reduce preparation time.

Europe Dough-Based Premixes Market held a 37.9% share in 2024. The continent's strong baking culture, high consumption of both artisanal and industrial baked goods, and the presence of established bakery solutions companies like Lesaffre, Puratos, and Eurogerm contribute to its dominance. Countries like Germany, France, and the United Kingdom are key drivers, propelled by demand for convenient, clean-label, and health-enhanced dough products. Strict quality standards set by the European Union and rising interest in fortified, gluten-free, and organic bakery premixes continue to fuel product innovation and market growth.

Leading players such as Archer Daniels Midland Company (ADM), General Mills, Cargill Incorporated, Dawn Foods, and Puratos Group stand out for their innovation capabilities and broad distribution networks, playing pivotal roles in shaping the market landscape. To strengthen their foothold in the dough-based premixes market, companies focus on continuous product innovation by developing clean-label, gluten-free, and fortified formulations that align with current health trends. They invest in R&D to create customizable premixes tailored to different regional tastes and applications. Strategic partnerships and collaborations with foodservice providers, retail chains, and large-scale bakers allow these firms to expand their reach and respond quickly to market needs. Additionally, companies enhance their supply chains by adopting advanced cold chain logistics to maintain product quality and support global distribution. Marketing efforts also emphasize consumer education around convenience, nutrition, and sustainability to boost brand loyalty and market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Bread and roll mixes

- 5.2.1 White bread mixes

- 5.2.2 Whole grain and specialty bread mixes

- 5.2.3 Artisanal bread mixes

- 5.3 Cake and muffin mixes

- 5.3.1 Layer cake mixes

- 5.3.2 Cupcake and muffin mixes

- 5.3.3 Specialty cake mixes

- 5.4 Pizza dough mixes

- 5.4.1 Traditional pizza dough

- 5.4.2 Thin crust varieties

- 5.4.3 Gluten-free pizza dough

- 5.5 Pastry and cookie mixes

- 5.5.1 Danish and croissant mixes

- 5.5.2 Cookie and biscuit mixes

- 5.5.3 Specialty pastry mixes

- 5.6 Specialty and functional mixes

- 5.6.1 Gluten-free formulations

- 5.6.2 Organic and clean label products

- 5.6.3 High-protein and fortified mixes

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Commercial baking

- 6.2.1 Large-scale industrial bakeries

- 6.2.2 Medium-scale commercial bakeries

- 6.2.3 Small artisanal bakeries

- 6.3 Food service

- 6.3.1 Restaurant chains

- 6.3.2 Independent restaurants

- 6.3.3 Institutional food service

- 6.4 Food manufacturing

- 6.4.1 Packaged food producers

- 6.4.2 Frozen food manufacturers

- 6.4.3 Private label manufacturers

- 6.5 Retail and consumer

- 6.5.1 Grocery and supermarket chains

- 6.5.2 Specialty food stores

- 6.5.3 Online retail platforms

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.2.1 Manufacturer to end-user

- 7.2.2 Contract manufacturing

- 7.3 Distributors and wholesalers

- 7.3.1 Food service distributors

- 7.3.2 Specialty ingredient distributors

- 7.4 Retail channels

- 7.4.1 Supermarkets and hypermarkets

- 7.4.2 Specialty food stores

- 7.4.3 Online retail platforms

- 7.5 Equipment and technology partnerships

- 7.5.1 Integrated solutions providers

- 7.5.2 Technology platform partnerships

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 1.1 Key trends

- 1.2 North America

- 1.2.1 U.S.

- 1.2.2 Canada

- 1.3 Europe

- 1.3.1 Germany

- 1.3.2 UK

- 1.3.3 France

- 1.3.4 Spain

- 1.3.5 Italy

- 1.3.6 Netherlands

- 1.3.7 Rest of Europe

- 1.4 Asia Pacific

- 1.4.1 China

- 1.4.2 India

- 1.4.3 Japan

- 1.4.4 Australia

- 1.4.5 South Korea

- 1.4.6 Rest of Asia Pacific

- 1.5 Latin America

- 1.5.1 Brazil

- 1.5.2 Mexico

- 1.5.3 Argentina

- 1.5.4 Rest of Latin America

- 1.6 Middle East and Africa

- 1.6.1 Saudi Arabia

- 1.6.2 South Africa

- 1.6.3 UAE

- 1.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Dawn Foods

- 9.2 Lesaffre Group

- 9.3 Puratos Group

- 9.4 Kerry Group

- 9.5 General Mills (North America)

- 9.6 ADM (Archer Daniels Midland)

- 9.7 Cargill, Incorporated

- 9.8 Goodman Fielder Food Service (Asia-Pacific)

- 9.9 Eurogerm KB

- 9.10 Ardent Mills

- 9.11 Lallemand Baking

- 9.12 FRITSCH Group

- 9.13 Rheon Automatic Machinery

- 9.14 Rondo AG