|

市場調查報告書

商品編碼

1782082

藥用及芳香植物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Medicinal and Aromatic Plant Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

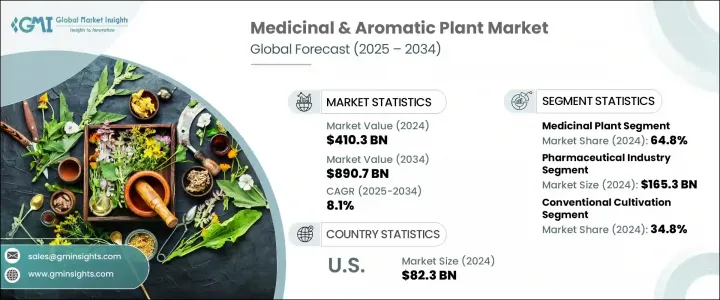

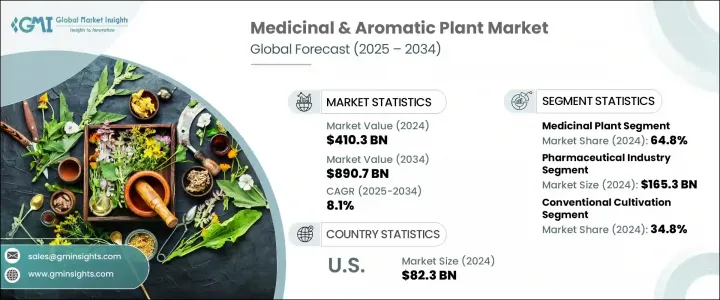

2024年,全球藥用和芳香植物市場價值達4,103億美元,預計到2034年將以8.1%的複合年成長率成長,達到8,907億美元。這一強勁成長趨勢的動力源自於消費者對天然植物性健康產品日益成長的興趣。越來越多的人正在尋求用於預防和治療目的的整體有機解決方案。全球對草藥補充劑、精油和植物性個人護理用品的需求持續成長。這些植物在多個行業中都至關重要,在替代醫學、心理健康和護膚領域具有治療功效。它們在促進整體健康和情緒平衡方面的作用已得到廣泛認可,促使製造商和消費者共同探索其全部潛力。

藥用植物和芳香植物廣泛應用於製藥、食品飲料和化妝品領域。在製藥業,它們是創造傳統和現代藥物配方的重要原料。它們也被納入食品飲料行業的調味系統和營養成分中。在化妝品領域,它們的天然芳香化合物有助於開發護膚和保健產品。提取技術、有機種植實踐和生態意識採收的進步進一步推動了市場擴張。消費者對清潔標籤、綠色和植物性替代品的偏好仍然對市場需求產生強烈影響。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4103億美元 |

| 預測值 | 8907億美元 |

| 複合年成長率 | 8.1% |

2024年,藥用植物市場佔據了64.8%的市場佔有率,預計到2034年將以8%的複合年成長率成長。藥用植物的重要性日益提升,源自於其在從傳統療法到現代補充劑和藥物等一系列醫療體系中的持續應用。這些植物被廣泛用於治療發炎、感染和慢性疾病,吸引了全球市場製造商和消費者的持續關注。

2024年,製藥業的市值達到1,653億美元,預計未來十年將以8.4%的複合年成長率快速成長。隨著醫療保健產業為滿足日益成長的治療需求而快速發展,藥用植物擴大被納入新的藥物配方、草藥療法和預防性治療中。該產業對持續研發的重視進一步推動了對植物投入品的需求。

美國藥用和芳香植物市場佔最大佔有率,2024年價值823億美元,預計到2034年複合年成長率為6.3%。強大的農業和分銷基礎設施確保了藥用和芳香植物領域可靠的供應鏈和高品質的產出。消費者對草藥、非合成藥物的偏好很高,這得益於值得信賴的監管環境,確保了產品的品質和安全。

塑造該市場競爭格局的知名公司包括 Forest Essential、Emami Limited、doTERRA International、Givaudan SA 和 Dabur India Limited。為了確保競爭優勢,藥用和芳香植物市場的公司正專注於垂直整合和對有機農業實踐的投資。許多公司正在擴大生產設施,與當地種植者合作,並提升加工能力,以確保一致的品質和可追溯性。他們也利用萃取和純化方面的技術進步來提供高效的植物成分。透過清潔標籤、永續採購和供應鏈透明度來建立信任仍然是核心。此外,各公司正透過客製化產品線和策略合作瞄準國際市場,以擴大全球影響力並鞏固其市場地位。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對天然和有機產品的需求不斷成長

- 提高醫療保健意識和預防醫學

- 製藥業採用率不斷上升

- 產業陷阱與挑戰

- 供應鏈漏洞

- 氣候變遷對種植業的影響

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按植物類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依工廠類型,2021-2034

- 主要趨勢

- 藥用植物

- 適應原植物

- Ashwagandha(睡茄)

- 人參(人參屬)

- 紅景天(Rhodiola rosea)

- 抗發炎植物

- 薑黃(Curcuma longa)

- 生薑(Zingiber officinale)

- 乳香樹(齒葉乳香樹)

- 消化健康植物

- 蘆薈(庫拉索蘆薈)

- 薄荷(Mentha piperita)

- 洋甘菊(Matricaria chamomilla)

- 呼吸健康植物

- 桉樹(藍桉)

- 百里香(Thymus vulgaris)

- 甘草(Glycyrrhiza glabra)

- 心血管健康植物

- 免疫支持植物

- 認知健康植物

- 適應原植物

- 芳香植物

- 精油植物

- 薰衣草(Lavandula angustifolia)

- 茶樹(互葉白千層)

- 迷迭香(Rosmarinus officinalis)

- 牛至(Origanum vulgare)

- 芳香植物

- 玫瑰(薔薇屬)

- 茉莉花(茉莉屬)

- 檀香木(檀香木)

- 烹飪香草

- 羅勒(Ocimum basilicum)

- 鼠尾草(Salvia officinalis)

- 肉桂(肉桂屬)

- 精油植物

第6章:市場估計與預測:依產品形式,2021-2034

- 主要趨勢

- 原料

- 新鮮植物和草藥

- 乾燥植物和粉末

- 植物各部位(根、葉、花、種子)

- 萃取物和濃縮物

- 標準化萃取物

- 液體萃取物和酊劑

- 濃縮粉

- 油樹脂和樹脂

- 精油

- 純精油

- 混合精油

- 有機精油

- 治療級油

- 製成品

- 膠囊和片劑

- 液體製劑

- 局部應用

- 功能性食品

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 製藥業

- 藥物開發與製造

- 營養保健品和膳食補充劑

- 傳統藥物配方

- 臨床研究與開發

- 化妝品和個人護理

- 保養產品

- 護髮產品

- 香水和香料

- 天然和有機化妝品

- 食品和飲料業

- 功能性食品和飲料

- 天然調味劑

- 食品保鮮和添加劑

- 草本茶和沖泡茶

- 芳香療法與健康

- 精油療法

- 水療和健康中心

- 家用香薰產品

- 治療應用

- 農業和獸醫

- 生物農藥和植物保護

- 動物健康和營養

- 有機農業應用

- 土壤健康與改良

第8章:市場估計與預測:以種植方式,2021-2034 年

- 主要趨勢

- 常規種植

- 傳統耕作方法

- 商業種植系統

- 綜合農業方法

- 有機栽培

- 經過認證的有機生產

- 生物動力農業

- 自然耕作法

- 野生採伐

- 永續野生採集

- 森林採伐

- 社區收集

- 受控環境農業

- 溫室栽培

- 水耕系統

- 垂直農業應用

- 組織培養和微繁殖

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Dabur India Limited

- doTERRA International

- Emami Limited

- Forest Essentials

- Givaudan SA

- Himalaya Drug Company

- Kama Ayurveda

- Khadi Natural

- Patanjali Ayurved Limited

- Shahnaz Husain

- Symrise AG

- Tongrentang

- Young Living Essential Oils

The Global Medicinal and Aromatic Plant Market was valued at USD 410.3 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 890.7 billion by 2034. This strong upward trend is powered by growing consumer interest in natural, plant-based wellness products. More people are seeking holistic and organic solutions for both preventive and therapeutic purposes. The demand for herbal supplements, essential oils, and botanically derived personal care items continues to rise globally. These plants are essential in multiple industries, offering healing benefits in alternative medicine, mental wellness, and skincare. Their role in promoting overall health and emotional balance is widely recognized, pushing manufacturers and consumers alike to explore their full potential.

Medicinal and aromatic plants are widely used across the pharmaceutical, food and beverage, and cosmetics sectors. In pharma, they act as vital inputs for creating both traditional and modern medicinal formulations. They are also incorporated into flavor systems and nutritional ingredients across the F&B industry. On the cosmetic front, their natural aromatic compounds help develop skincare and wellness products. Advances in extraction technologies, organic cultivation practices, and eco-conscious harvesting have further supported market expansion. The demand remains strongly influenced by consumer preference for clean-label, green, and plant-based alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $410.3 Billion |

| Forecast Value | $890.7 Billion |

| CAGR | 8.1% |

In 2024, the medicinal plants segment captured 64.8% share and is forecast to grow at a CAGR of 8% through 2034. Their rising importance stems from their continued use in a range of health systems, from traditional therapies to contemporary supplements and pharmaceuticals. These plants are extensively employed to address inflammation, infections, and chronic illnesses, drawing steady interest from manufacturers and consumers across global markets.

The pharmaceutical sector generated a market value of USD 165.3 billion in 2024 and is anticipated to grow at a faster CAGR of 8.4% over the next decade. As the healthcare sector rapidly evolves to meet growing needs for treatment options, medicinal plants are increasingly integrated into new drug formulations, herbal therapies, and preventative treatments. The sector's focus on continuous R&D further propels the demand for botanical inputs.

U.S. Medicinal and Aromatic Plant Market accounted for the largest share, valued at USD 82.3 billion in 2024, with expected growth at a CAGR of 6.3% through 2034. Strong agricultural and distribution infrastructure enables reliable supply chains and high-quality output across the medicinal and aromatic plant sector. Consumer preference for herbal, non-synthetic remedies is high, supported by a trusted regulatory environment that assures quality and safety.

Prominent companies shaping the competitive landscape of this market include Forest Essential, Emami Limited, doTERRA International, Givaudan SA, and Dabur India Limited. To secure a competitive edge, companies in the medicinal and aromatic plant market are focusing on vertical integration and investment in organic farming practices. Many are expanding production facilities, partnering with local growers, and enhancing processing capabilities to ensure consistent quality and traceability. They are also leveraging technological advancements in extraction and purification to deliver high-potency plant-based ingredients. Building trust through clean labeling, sustainable sourcing, and transparency in supply chains remains central. Additionally, companies are targeting international markets through customized product lines and strategic collaborations to grow global reach and reinforce their foothold.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Plant type

- 2.2.3 Product form

- 2.2.4 Application

- 2.2.5 Cultivation method

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for natural and organic products

- 3.2.1.2 Increasing healthcare awareness and preventive medicine

- 3.2.1.3 Rising adoption in pharmaceutical industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain vulnerabilities

- 3.2.2.2 Climate change impact on cultivation

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By plant type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Plant Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trend

- 5.2 Medicinal Plants

- 5.2.1 Adaptogenic Plants

- 5.2.1.1 Ashwagandha (Withania somnifera)

- 5.2.1.2 Ginseng (Panax species)

- 5.2.1.3 Rhodiola (Rhodiola rosea)

- 5.2.2 Anti-inflammatory Plants

- 5.2.2.1 Turmeric (Curcuma longa)

- 5.2.2.2 Ginger (Zingiber officinale)

- 5.2.2.3 Boswellia (Boswellia serrata)

- 5.2.3 Digestive Health Plants

- 5.2.3.1 Aloe Vera (Aloe barbadensis)

- 5.2.3.2 Peppermint (Mentha piperita)

- 5.2.3.3 Chamomile (Matricaria chamomilla)

- 5.2.4 Respiratory Health Plants

- 5.2.4.1 Eucalyptus (Eucalyptus globulus)

- 5.2.4.2 Thyme (Thymus vulgaris)

- 5.2.4.3 Licorice (Glycyrrhiza glabra)

- 5.2.5 Cardiovascular Health Plants

- 5.2.6 Immune Support Plants

- 5.2.7 Cognitive Health Plants

- 5.2.1 Adaptogenic Plants

- 5.3 Aromatic Plants

- 5.3.1 Essential Oil Plants

- 5.3.1.1 Lavender (Lavandula angustifolia)

- 5.3.1.2 Tea Tree (Melaleuca alternifolia)

- 5.3.1.3 Rosemary (Rosmarinus officinalis)

- 5.3.1.4 Oregano (Origanum vulgare)

- 5.3.2 Fragrance Plants

- 5.3.2.1 Rose (Rosa species)

- 5.3.2.2 Jasmine (Jasminum species)

- 5.3.2.3 Sandalwood (Santalum album)

- 5.3.3 Culinary Herbs

- 5.3.3.1 Basil (Ocimum basilicum)

- 5.3.3.2 Sage (Salvia officinalis)

- 5.3.3.3 Cinnamon (Cinnamomum species)

- 5.3.1 Essential Oil Plants

Chapter 6 Market Estimates & Forecast, By Product Form, 2021-2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Raw materials

- 6.2.1 Fresh plants and herbs

- 6.2.2 Dried plants and powders

- 6.2.3 Plant parts (roots, leaves, flowers, seeds)

- 6.3 Extracts and concentrates

- 6.3.1 Standardized extracts

- 6.3.2 Liquid extracts and tinctures

- 6.3.3 Concentrated powders

- 6.3.4 Oleoresins and resins

- 6.4 Essential oils

- 6.4.1 Pure essential oils

- 6.4.2 Blended essential oils

- 6.4.3 Organic essential oils

- 6.4.4 Therapeutic grade oils

- 6.5 Finished products

- 6.5.1 Capsules and tablets

- 6.5.2 Liquid formulations

- 6.5.3 Topical applications

- 6.5.4 Functional food products

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Tons)

- 7.1 Key trend

- 7.2 Pharmaceutical industry

- 7.2.1 Drug development and manufacturing

- 7.2.2 Nutraceuticals and dietary supplements

- 7.2.3 Traditional medicine formulations

- 7.2.4 Clinical research and development

- 7.3 Cosmetics and personal care

- 7.3.1 Skincare products

- 7.3.2 Hair care products

- 7.3.3 Fragrance and perfumery

- 7.3.4 Natural and organic cosmetics

- 7.4 Food and beverage industry

- 7.4.1 Functional foods and beverages

- 7.4.2 Natural flavoring agents

- 7.4.3 Food preservation and additives

- 7.4.4 Herbal teas and infusions

- 7.5 Aromatherapy and wellness

- 7.5.1 Essential oil therapy

- 7.5.2 Spa and wellness centers

- 7.5.3 Home aromatherapy products

- 7.5.4 Therapeutic applications

- 7.6 Agriculture and veterinary

- 7.6.1 Biopesticides and plant protection

- 7.6.2 Animal health and nutrition

- 7.6.3 Organic farming applications

- 7.6.4 Soil health and enhancement

Chapter 8 Market Estimates & Forecast, By Cultivation Method, 2021-2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Conventional cultivation

- 8.2.1 Traditional farming methods

- 8.2.2 Commercial plantation systems

- 8.2.3 Integrated farming approaches

- 8.3 Organic cultivation

- 8.3.1 Certified organic production

- 8.3.2 Biodynamic farming

- 8.3.3 Natural farming methods

- 8.4 Wild harvesting

- 8.4.1 Sustainable wild collection

- 8.4.2 Forest-based harvesting

- 8.4.3 Community-based collection

- 8.5 Controlled environment agriculture

- 8.5.1 Greenhouse cultivation

- 8.5.2 Hydroponic systems

- 8.5.3 Vertical farming applications

- 8.5.4 Tissue culture and micropropagation

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Dabur India Limited

- 10.2 doTERRA International

- 10.3 Emami Limited

- 10.4 Forest Essentials

- 10.5 Givaudan SA

- 10.6 Himalaya Drug Company

- 10.7 Kama Ayurveda

- 10.8 Khadi Natural

- 10.9 Patanjali Ayurved Limited

- 10.10 Shahnaz Husain

- 10.11 Symrise AG

- 10.12 Tongrentang

- 10.13 Young Living Essential Oils