|

市場調查報告書

商品編碼

1773481

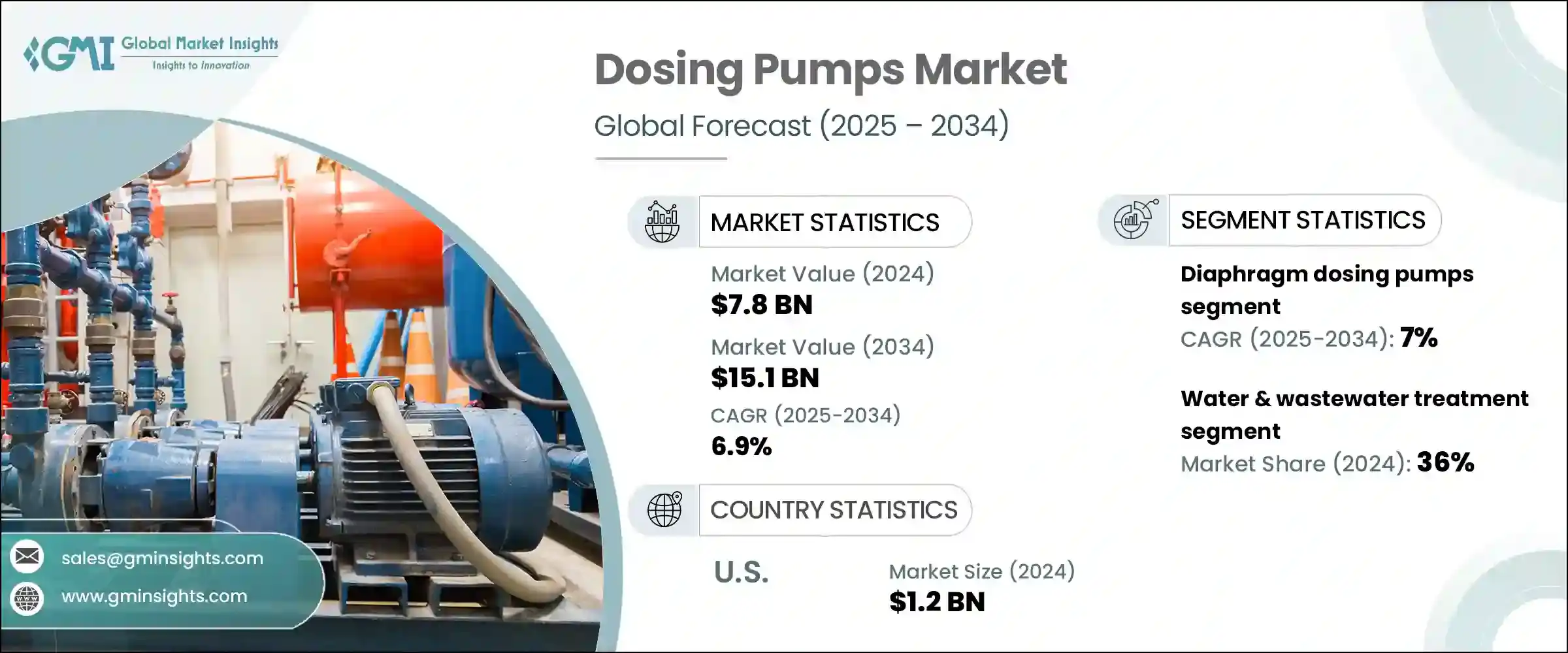

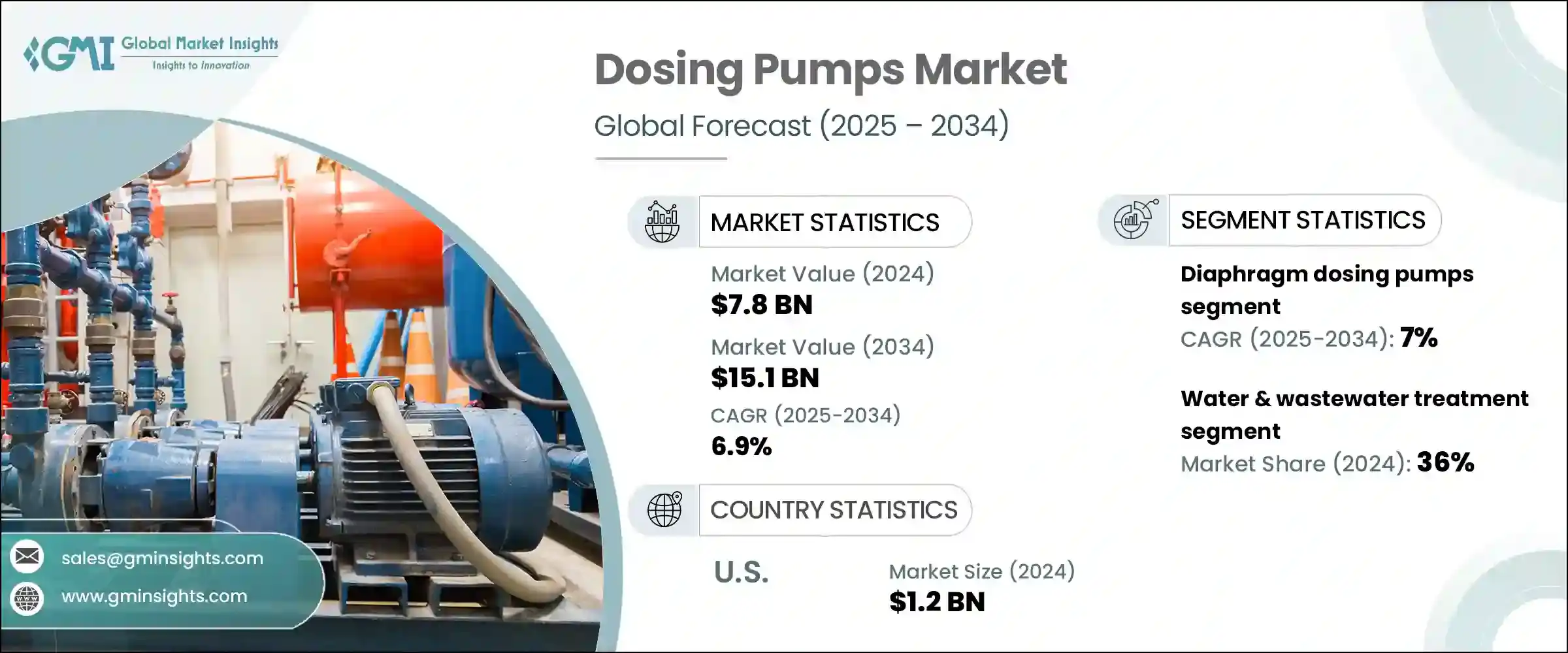

計量幫浦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Dosing Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年全球計量幫浦市場規模達78億美元,預計2034年將以6.9%的複合年成長率成長,達到151億美元。數位控制器的整合是關鍵的成長動力,它能夠實現精確的計量、即時監控和自動回饋控制。市政和工業廢水處理設施越來越依賴氯、臭氧和紫外線加藥系統,而城市中心則部署了本地淨水裝置。在食品和飲料行業,計量泵對於防腐劑、調味劑和著色劑的精準注入至關重要。石油和天然氣行業對用於腐蝕抑制劑的高壓泵、用於平台和浮式生產儲油船(FPSO)的耐鹽防爆系統以及海底管道中甲醇和乙二醇注入系統的需求激增。自動校準和支援物聯網的遠端連接正在進一步提高效率和預測性維護。

用於處理高黏度、腐蝕性或磨蝕性化學品的計量幫浦技術的持續創新,正在顯著拓展各行各業的市場機會。增強聚合物和耐腐蝕合金等先進材料如今正融入泵浦的構造中,以提高其在極端工況下的耐用性和使用壽命。此外,增強的密封機制、變速驅動相容性以及精確的流量控制功能使這些泵浦能夠在採礦、廢水處理、紙漿和造紙以及石油和天然氣等高挑戰性應用中高效運作。隨著各行各業尋求以最少的停機時間和維護成本實現複雜化學品計量流程的自動化,對這些堅固耐用、高性能計量系統的需求正在穩步成長,為成長和產品多樣化開闢了新的途徑。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 78億美元 |

| 預測值 | 151億美元 |

| 複合年成長率 | 6.9% |

預計到2034年,蠕動計量幫浦市場規模將達到25億美元,這得益於對衛生流體處理和無污染操作有更高要求的行業需求的不斷成長。其密封、非侵入式流體通道使其非常適合生物技術、製藥和食品生產等對產品純度要求極高的產業。無需工具即可輕鬆更換泵管,不僅簡化了維護,還能最大限度地延長設備正常運行時間,減少操作延誤並降低勞動強度。由於潔淨室合規性和產品完整性仍然是這些行業的首要任務,蠕動泵憑藉其確保無菌處理環境並將交叉污染風險降至最低的能力,將繼續獲得廣泛的應用。

隨著製造商尋求能夠處理腐蝕性流體和危險化學品的耐用、高精度系統,預計到2034年,化學加工計量幫浦市場規模將達到35億美元。它們與閉迴路系統相容,旨在最大限度地減少蒸汽排放並最大程度地提高工作場所安全性,使其成為化學、石化和工業製造環境中不可或缺的一部分。這些泵浦擴大配置為在高容量工廠中全天候連續使用,在這些工廠中,不間斷的化學計量對生產效率至關重要。它們能夠在極端溫度和壓力下運行,再加上自動化程度,使其成為高要求應用的首選。

受基礎設施升級和更嚴格的環保合規要求的推動,北美計量幫浦市場規模預計到2034年將達到30億美元。隨著公用事業單位面臨日益成長的現代化老舊水處理基礎設施的壓力,數位計量幫浦正在迅速取代傳統的機械系統。氯、氟化物和其他處理化學品的計量精度提升,確保其符合不斷演變的美國環保署(EPA)標準。公用事業單位和工業營運商都優先考慮具有遠端監控功能的智慧連網泵,以符合永續發展、降低成本和保護公眾健康等更廣泛的目標。

全球計量幫浦市場的主要參與者有 Ark Electric & Mechanical、Blue White、Dosimix Technologies、Emec、Firemiks、Grundfos Holding、IDEX Corporation、Ingersoll Rand、IWAKI、KNAUER Wissenschaftliche Gerate、NETZSCH、Nikki Engineering、Phoenix Pumps、ProMinFlow、Wqui、RD、RESS、RESD、MicS、SESSP、AxSP、JMin製造商正在大力投資數位創新,整合物聯網連接、遠端診斷和自動校準功能,以滿足對智慧計量解決方案的需求並減少停機時間。他們也正在開發用於嚴苛的石油、天然氣和工業環境的耐腐蝕、耐熱、耐鹽和防爆泵。策略性成長策略包括與工程公司和市政公用事業公司建立合作夥伴關係,試行先進系統,特別是在廢水和水處理領域。產品組合正在擴展,包括針對食品和生物技術無菌應用量身定做的蠕動模型,而閉式系統化學泵則確保安全性和合規性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 隔膜泵

- 活塞泵

- 蠕動幫浦

- 其他

第6章:市場規模與預測:按流量,2021 - 2034 年

- 主要趨勢

- ≤50(公升/分鐘)

- 50至100(公升/分鐘)

- >100(公升/分鐘)

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 水和廢水處理

- 化學加工

- 石油和天然氣

- 食品和飲料

- 製藥

- 其他

第8章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 商業的

- 工業的

- 市政

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 馬來西亞

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 奈及利亞

- 拉丁美洲

- 巴西

- 秘魯

- 阿根廷

第10章:公司簡介

- Ark Electric & Mechanical

- Blue-White

- Dosimix Technologies

- Emec

- Firemiks

- Grundfos Holding

- IDEX Corporation

- Ingersoll Rand

- IWAKI

- KNAUER Wissenschaftliche Gerate

- NETZSCH

- Nikkiso

- Phoenix Pumps

- ProMinent

- PSG

- Roto Pumps

- SEKO

- SPX Flow

- Verder Liquids

- Verito Engineering

- WES

The Global Dosing Pumps Market was valued at USD 7.8 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 15.1 billion by 2034. The integration of digital controllers, which enable precise dosing, real-time monitoring, and automated feedback control, is a key growth driver. Municipal and industrial wastewater facilities increasingly rely on chlorine, ozone, and UV dosing systems, while urban centers deploy local water purification units. In the food and beverage sector, dosing pumps are vital for accurate injection of preservatives, flavorings, and colorants. The oil and gas industry boosts demand for high-pressure pumps for corrosion inhibitors, salt-resistant and explosion-proof systems for platforms and FPSOs, and methanol and glycol injection in subsea pipelines. Auto-calibration and IoT-enabled remote connectivity are further enhancing efficiency and predictive maintenance.

Continuous innovation in dosing pump technology designed to handle highly viscous, corrosive, or abrasive chemicals is significantly expanding market opportunities across various industrial sectors. Advanced materials, such as reinforced polymers and corrosion-resistant alloys, are now being integrated into pump construction to improve durability and lifespan under extreme operating conditions. Additionally, enhanced sealing mechanisms, variable-speed drive compatibility, and precision flow control features enable these pumps to operate efficiently in challenging applications like mining, wastewater treatment, pulp and paper, and oil & gas. As industries seek to automate complex chemical dosing processes with minimal downtime and maintenance, demand for these rugged, high-performance dosing systems is rising steadily, opening new avenues for growth and product diversification.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $15.1 Billion |

| CAGR | 6.9% |

The peristaltic dosing pumps segment is forecasted to reach USD 2.5 billion by 2034, driven by increasing demand from industries requiring hygienic fluid handling and contamination-free operation. Their sealed, non-invasive fluid pathways make them highly suitable for sectors like biotechnology, pharmaceuticals, and food production, where product purity is critical. The convenience of tool-free tubing replacement not only simplifies maintenance but also maximizes equipment uptime, reducing operational delays and minimizing labor intensity. As cleanroom compliance and product integrity remain top priorities in these industries, peristaltic pumps continue to gain ground for their ability to ensure sterile processing environments with minimal risk of cross-contamination.

The chemical processing dosing pumps segment is expected to reach USD 3.5 billion by 2034 as manufacturers seek durable, high-precision systems capable of handling aggressive fluids and hazardous chemicals. Their compatibility with closed-loop systems-designed to minimize vapor emissions and maximize workplace safety-makes them indispensable in chemical, petrochemical, and industrial manufacturing settings. These pumps are increasingly configured for continuous 24/7 use in high-capacity plants, where uninterrupted chemical dosing is vital to production efficiency. Their capacity to operate under extreme temperatures and pressures, coupled with automation readiness, makes them a preferred choice for demanding applications.

North America Dosing Pumps Market is expected to reach USD 3 billion by 2034, propelled by infrastructure upgrades and stricter environmental compliance mandates. As public utilities face mounting pressure to modernize outdated water treatment infrastructure, digital dosing pumps are rapidly replacing traditional mechanical systems. Enhanced precision in dosing chlorine, fluoride, and other treatment chemicals ensures regulatory alignment with evolving EPA standards. Utilities and industrial operators alike are prioritizing smart, networked pumps with remote monitoring and control capabilities, aligning with broader goals of sustainability, cost reduction, and public health protection.

Key players involved in the Global Dosing Pumps Market are Ark Electric & Mechanical, Blue White, Dosimix Technologies, Emec, Firemiks, Grundfos Holding, IDEX Corporation, Ingersoll Rand, IWAKI, KNAUER Wissenschaftliche Gerate, NETZSCH, Nikkiso, Phoenix Pumps, ProMinent, PSG, Roto Pumps, SEKO, SPX Flow, Verder Liquids, Verito Engineering, W.E.S. Manufacturers are investing heavily in digital innovation-integrating IoT connectivity, remote diagnostics, and auto-calibration features to meet demand for smart dosing solutions and reduce downtime. They are also developing corrosion-, heat-, salt-, and explosion-resistant pumps for demanding oil, gas, and industrial environments. Strategic growth tactics include forming partnerships with engineering firms and municipal utilities to pilot advanced systems, especially in wastewater and water treatment. Product portfolios are being expanded with peristaltic models tailored for food and biotech sterile applications, while closed-system chemical pumps ensure safety and compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Diaphragm pumps

- 5.3 Piston pumps

- 5.4 Peristaltic pumps

- 5.5 Others

Chapter 6 Market Size and Forecast, By Flow Rate, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 ≤ 50 (L/min)

- 6.3 50 to 100 (L/min)

- 6.4 > 100 (L/min)

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Water & wastewater treatment

- 7.3 Chemical processing

- 7.4 Oil & gas

- 7.5 Food & beverage

- 7.6 Pharmaceutical

- 7.7 Others

Chapter 8 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Industrial

- 8.4 Municipal

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 South Africa

- 9.5.5 Nigeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Peru

- 9.6.3 Argentina

Chapter 10 Company Profiles

- 10.1 Ark Electric & Mechanical

- 10.2 Blue-White

- 10.3 Dosimix Technologies

- 10.4 Emec

- 10.5 Firemiks

- 10.6 Grundfos Holding

- 10.7 IDEX Corporation

- 10.8 Ingersoll Rand

- 10.9 IWAKI

- 10.10 KNAUER Wissenschaftliche Gerate

- 10.11 NETZSCH

- 10.12 Nikkiso

- 10.13 Phoenix Pumps

- 10.14 ProMinent

- 10.15 PSG

- 10.16 Roto Pumps

- 10.17 SEKO

- 10.18 SPX Flow

- 10.19 Verder Liquids

- 10.20 Verito Engineering

- 10.21 W.E.S.