|

市場調查報告書

商品編碼

1773472

無乳糖益生菌市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Lactose-Free Probiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

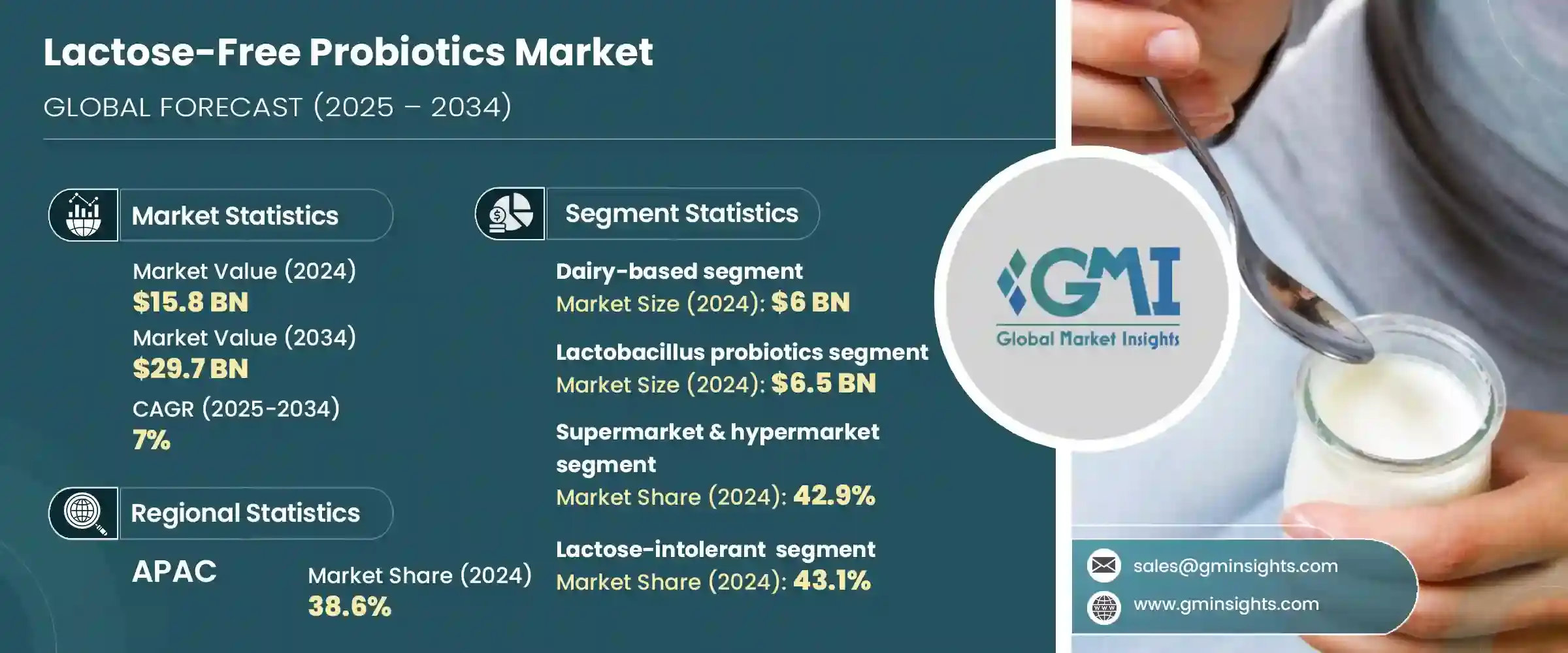

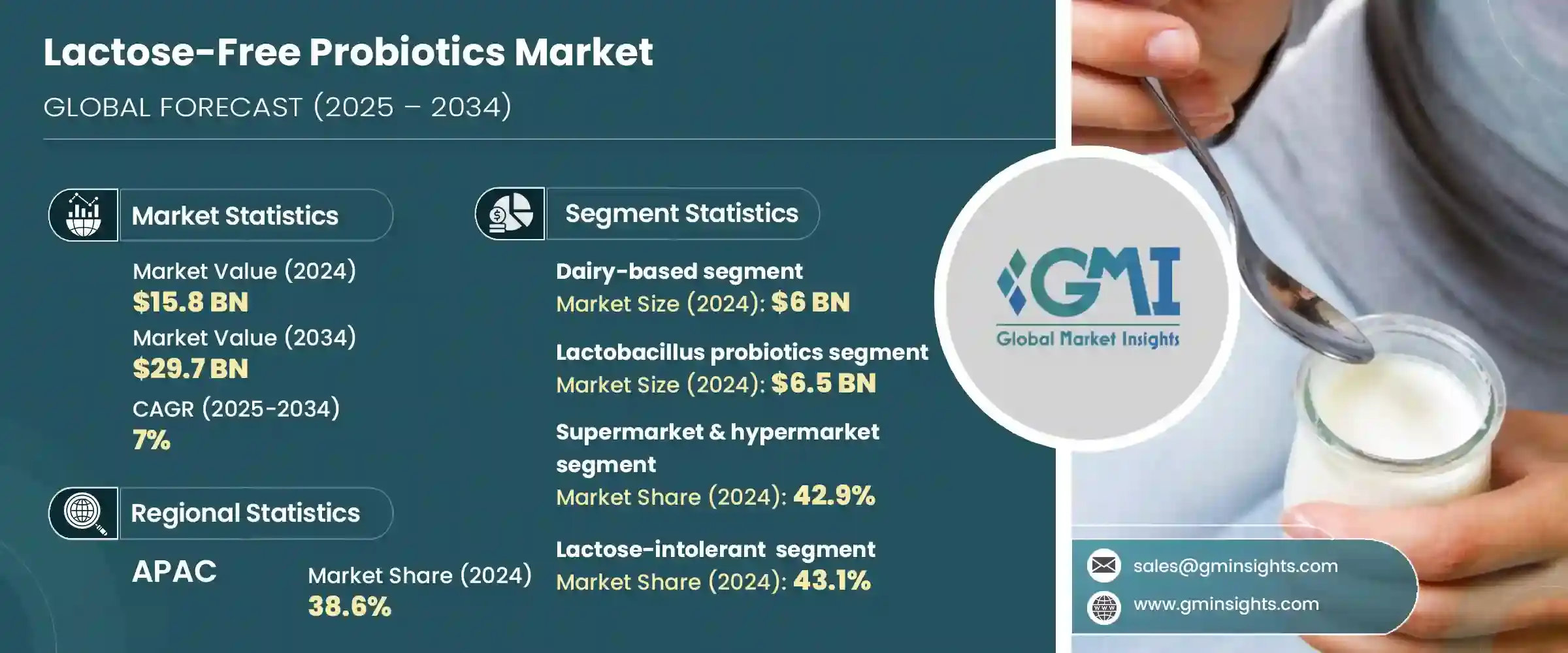

2024 年全球無乳糖益生菌市場規模達 158 億美元,預計年複合成長率為 7%,到 2034 年將達到 297 億美元。這些益生菌不含乳糖,有助於維持消化系統和免疫系統健康,是乳糖不耐症患者、乳製品過敏者或植物性飲食者的理想選擇。由於消費者對腸道健康的關注以及乳糖吸收不良的普遍存在,不斷擴張的功能性食品和營養保健品行業已開始關注這一類別。優格、飲料、補充劑和零食等產品富含益生菌益處,不會引起消化不適。隨著北美和亞太地區消費者對健康無乳替代品的需求日益成長,各大品牌紛紛創新地使用杏仁、大豆、燕麥和椰子等植物性成分。含有嗜酸乳桿菌和乳雙歧桿菌等菌株的耐儲存膠囊和粉末的需求也在增加。清潔標籤、無過敏原產品和個人化營養的興起正在刺激需求。

隨著健康意識的增強,無乳糖益生菌對於注重健康的消費者日益重要。這些產品不僅迎合了乳糖不耐症族群的需求,也吸引了那些積極尋求消化支持、免疫系統益處和整體腸道健康,同時又不想承受乳製品帶來的不適的消費者。消費者越來越重視清潔標示產品和天然成分,這使得無乳糖益生菌成為日常營養的首選。預防性醫療保健和功能性食品的趨勢進一步推動了這種需求,因為越來越多的人將益生菌視為均衡生活方式的基礎。隨著人們對植物性和無過敏原替代品的興趣日益濃厚,無乳糖益生菌已成為現代飲食習慣中的關鍵元素,這反映出各個年齡層的消費者正在轉向更具包容性和更注重健康的食品選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 158億美元 |

| 預測值 | 297億美元 |

| 複合年成長率 | 7% |

2024年,乳製品無乳糖益生菌市場佔據38.2%的市場佔有率,價值60億美元。該市場包括優格和克菲爾等傳統乳製品的無乳糖版本,提供熟悉的口感和風味,並添加了嗜酸乳桿菌和乳雙歧桿菌等有益菌株。消費者通常選擇這些產品,因為它們在不犧牲口感的情況下提供消化益處。

2024年,乳酸菌菌株市場規模達65億美元,佔41.1%。這一市場主導地位源於其已被證實的消化健康益處,以及在無乳優格、飲料和營養補充劑中的廣泛應用。其中,嗜酸乳桿菌尤其受歡迎,因為它能夠支持腸道健康,並幫助乳糖敏感族群消化。

2024年,亞太地區無乳糖益生菌市場佔比38.6%,這得益於乳糖不耐症的普遍存在、腸道健康意識的不斷增強、城鎮化進程的加快以及可支配收入的增加。該地區各國正在大力投資營養研究和產品開發,尤其是在富含益生菌的食品和嬰兒營養領域。科技創新、監管激勵措施和消費者需求的共同作用,使該地區在無乳糖益生菌市場成長方面處於領先地位。

該行業的主要參與者包括達能公司、Probi AB、雀巢公司、科漢森控股公司和養樂多本社株式會社,它們均以其在產品創新和分銷方面的領導地位而聞名。無乳糖益生菌市場的領先公司正在追求創新、產品組合擴張和策略合作夥伴關係,以擴大其影響力。各公司正在投資研發新菌株和交付形式,例如植物優格、即飲配方和環保包裝,以滿足清潔標籤和個人化營養的需求。與研究機構的合作和臨床試驗有助於驗證健康聲明,增強消費者信任。製造商也正在與零售商和直接面對消費者的管道建立聯盟,以擴大市場准入。在地化的產品線和文化客製化行銷支援向新興市場的地理擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 乳製品無乳糖益生菌

- 優格

- 克菲爾

- 起司

- 冰淇淋

- 其他

- 植物益生菌

- 大豆基

- 杏仁基

- 椰子基

- 燕麥基

- 其他

- 水果益生菌

- 果汁

- 冰沙

- 其他

- 益生菌補充劑

- 膠囊

- 平板電腦

- 粉末

- 液體

- 其他

第6章:市場估計與預測:按益生菌菌株,2021 - 2034 年

- 主要趨勢

- 乳酸桿菌

- 嗜酸乳桿菌

- 鼠李糖乳桿菌

- 植物乳酸桿菌

- 其他

- 雙歧桿菌

- 雙歧桿菌

- 長雙歧桿菌

- 乳酸雙歧桿菌

- 其他

- 鏈球菌

- 嗜熱鏈球菌

- 其他

- 芽孢桿菌

- 凝結芽孢桿菌

- 枯草桿菌

- 其他

- 酵母菌

- 布拉氏酵母菌

- 其他

- 其他

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 超市和大賣場

- 專賣店

- 藥局和藥局

- 網路零售

- 其他

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 乳糖不耐症患者

- 注重健康的消費者

- 老年人口

- 兒童和嬰兒

- 其他

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 消化健康

- 免疫支持

- 體重管理

- 女性健康

- 兒童健康

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Nestle SA

- Danone SA

- Yakult Honsha Co., Ltd.

- Chr. Hansen Holding A/S

- Probi AB

- BioGaia AB

- Lifeway Foods, Inc.

- General Mills, Inc. (Yoplait)

- Fonterra Co-operative Group

- Kerry Group

- Lallemand Inc.

- DSM

- DuPont (IFF)

- Morinaga Milk Industry Co., Ltd.

- Bifodan A/S

- Probiotical SpA

- Winclove Probiotics

- Biosearch Life

- Culturelle (i-Health, Inc.)

- GoodBelly (NextFoods, Inc.)

- Ganeden, Inc. (Kerry)

- Attune Foods

- Valio Ltd.

- Arla Foods

- Organic Valley

- Stonyfield Farm, Inc.

- Meiji Holdings Co., Ltd.

- Chobani, LLC

- Yili Group

- Mengniu Dairy

The Global Lactose-Free Probiotics Market was valued at USD 15.8 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 29.7 billion by 2034. These probiotics support digestive and immune health without containing lactose, making them ideal for lactose-intolerant individuals, those allergic to dairy, or people following plant-based diets. The expanding functional food and nutraceutical sector has embraced this category due to consumer interest in gut health and the prevalence of lactose malabsorption. Products such as yogurts, beverages, supplements, and snacks offer probiotic benefits without digestive discomfort. With consumers in North America and Asia-Pacific increasingly demanding healthy, dairy-free alternatives, brands are innovating using plant-based bases like almond, soy, oat, and coconut. There's also growth in shelf-stable capsules and powders featuring strains such as Lactobacillus acidophilus and Bifidobacterium3lactis. The rise of clean-label, allergen-free options, and personalized nutrition is fueling demand.

As awareness around health grows, lactose-free probiotics are becoming essential for wellness-focused consumers. These products not only cater to individuals with lactose intolerance but also appeal to those actively seeking digestive support, immune system benefits, and overall gut health without the discomfort associated with dairy. Consumers are increasingly prioritizing clean-label products and natural ingredients, making lactose-free probiotics a preferred option in daily nutrition. The trend toward preventive healthcare and functional foods has further fueled this demand, as more people view probiotics as a foundational part of a balanced lifestyle. With rising interest in plant-based and allergen-free alternatives, lactose-free probiotics are positioned as a key element in modern dietary habits, reflecting a shift toward more inclusive and health-conscious food choices across age groups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $29.7 Billion |

| CAGR | 7% |

Dairy-based lactose-free probiotics segment held a 38.2% share in 2024, representing USD 6 billion. This segment includes lactose-free versions of traditional dairy products like yogurt and kefir, offering familiar textures and flavors enhanced with beneficial strains like Lactobacillus acidophilus and Bifidobacterium lactis. Consumers often choose these options because they provide digestive benefits without sacrificing taste.

The Lactobacillus strain segment generated USD 6.5 billion or 41.1% in 2024. This dominance stems from its proven digestive health benefits and its extensive use in dairy-free yogurts, beverages, and supplement products. Among its varieties, Lactobacillus acidophilus is especially popular for supporting gut wellness and aiding digestion in lactose-sensitive individuals.

Asia-Pacific Lactose-Free Probiotics Market held 38.6% in 2024, propelled by widespread lactose intolerance and growing awareness of gut health, rising urbanization, and increased disposable income. Countries in this region are investing in nutritional research and product development, especially in probiotic-rich foods and baby nutrition. The combination of scientific innovation, regulatory incentives, and consumer demand has positioned the region at the forefront of lactose-free probiotic growth.

Key players in the industry include Danone S.A., Probi AB, Nestle S.A., Chr. Hansen Holding A/S, and Yakult Honsha Co., Ltd., are all known for their leadership in product innovation and distribution. Leading companies in the lactose-free probiotics market are pursuing innovation, portfolio expansion, and strategic partnerships to enhance their footprint. Firms are investing in R&D to develop new strains and delivery formats-such as plant-based yogurts, ready-to-drink formulations, and eco-friendly packaging-to meet clean-label and personalized nutrition demands. Collaboration with research institutions and clinical trials helps validate health claims, strengthening consumer trust. Manufacturers are also forging alliances with retailers and direct-to-consumer channels to expand market access. Geographic expansion into emerging markets is supported by localized product lines and culturally tailored marketing.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dairy-based lactose-free probiotics

- 5.2.1 Yogurt

- 5.2.2 Kefir

- 5.2.3 Cheese

- 5.2.4 Ice cream

- 5.2.5 Others

- 5.3 Plant-based probiotics

- 5.3.1 Soy-based

- 5.3.2 Almond-based

- 5.3.3 Coconut-based

- 5.3.4 Oat-based

- 5.3.5 Others

- 5.4 Fruit-based probiotics

- 5.4.1 Juices

- 5.4.2 Smoothies

- 5.4.3 Others

- 5.5 Probiotic supplements

- 5.5.1 Capsules

- 5.5.2 Tablets

- 5.5.3 Powders

- 5.5.4 Liquids

- 5.5.5 Others

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Lactobacillus

- 6.2.1 L. acidophilus

- 6.2.2 L. rhamnosus

- 6.2.3 L. plantarum

- 6.2.4 Others

- 6.3 Bifidobacterium

- 6.3.1 B. bifidum

- 6.3.2 B. longum

- 6.3.3 B. lactis

- 6.3.4 Others

- 6.4 Streptococcus

- 6.4.1 S. thermophilus

- 6.4.2 Others

- 6.5 Bacillus

- 6.5.1 B. coagulans

- 6.5.2 B. subtilis

- 6.5.3 Others

- 6.6 Saccharomyces

- 6.6.1 S. boulardii

- 6.6.2 Others

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarkets & hypermarkets

- 7.3 Specialty stores

- 7.4 Pharmacies & drugstores

- 7.5 Online retail

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Lactose-intolerant individuals

- 8.3 Health-conscious consumers

- 8.4 Elderly population

- 8.5 Children & infants

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Digestive health

- 9.3 Immune support

- 9.4 Weight management

- 9.5 Women's health

- 9.6 Pediatric health

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Nestle S.A.

- 11.2 Danone S.A.

- 11.3 Yakult Honsha Co., Ltd.

- 11.4 Chr. Hansen Holding A/S

- 11.5 Probi AB

- 11.6 BioGaia AB

- 11.7 Lifeway Foods, Inc.

- 11.8 General Mills, Inc. (Yoplait)

- 11.9 Fonterra Co-operative Group

- 11.10 Kerry Group

- 11.11 Lallemand Inc.

- 11.12 DSM

- 11.13 DuPont (IFF)

- 11.14 Morinaga Milk Industry Co., Ltd.

- 11.15 Bifodan A/S

- 11.16 Probiotical S.p.A.

- 11.17 Winclove Probiotics

- 11.18 Biosearch Life

- 11.19 Culturelle (i-Health, Inc.)

- 11.20 GoodBelly (NextFoods, Inc.)

- 11.21 Ganeden, Inc. (Kerry)

- 11.22 Attune Foods

- 11.23 Valio Ltd.

- 11.24 Arla Foods

- 11.25 Organic Valley

- 11.26 Stonyfield Farm, Inc.

- 11.27 Meiji Holdings Co., Ltd.

- 11.28 Chobani, LLC

- 11.29 Yili Group

- 11.30 Mengniu Dairy