|

市場調查報告書

商品編碼

1773471

伴侶動物診斷市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Companion Animal Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

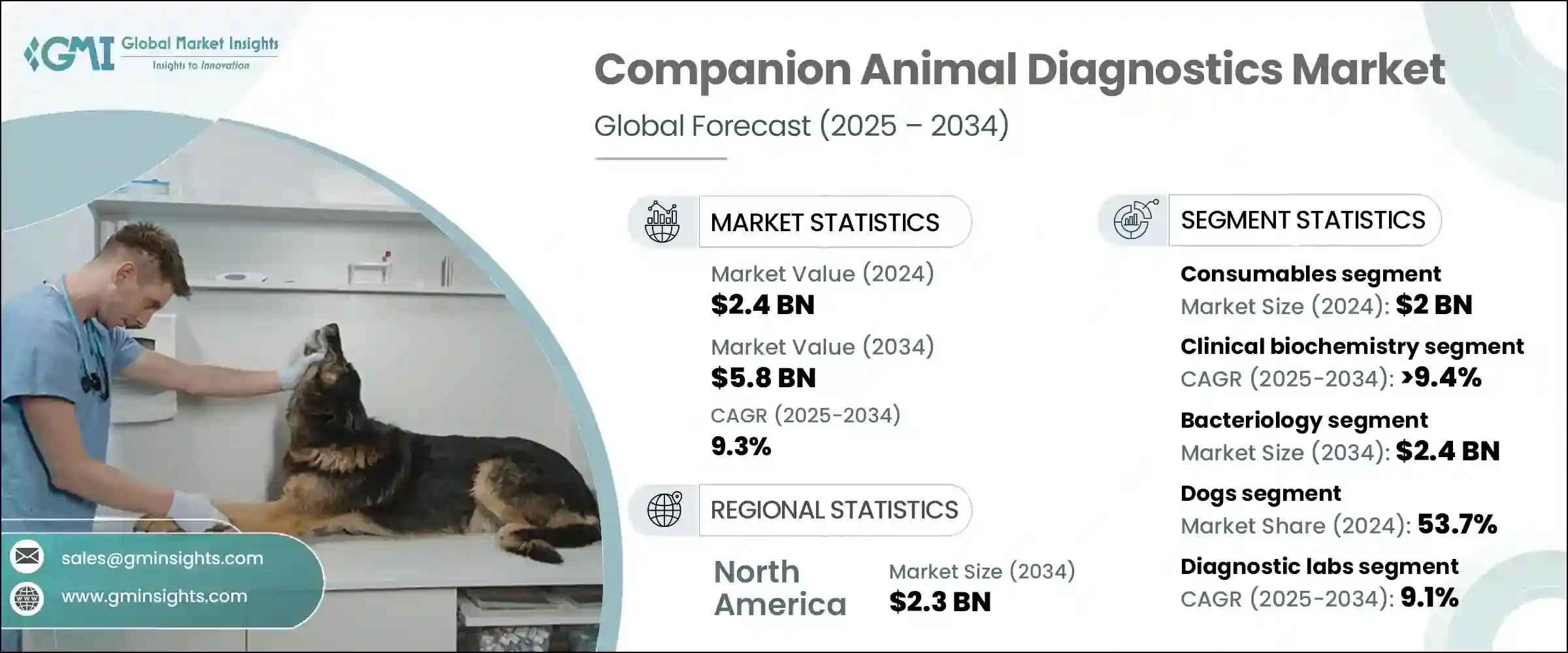

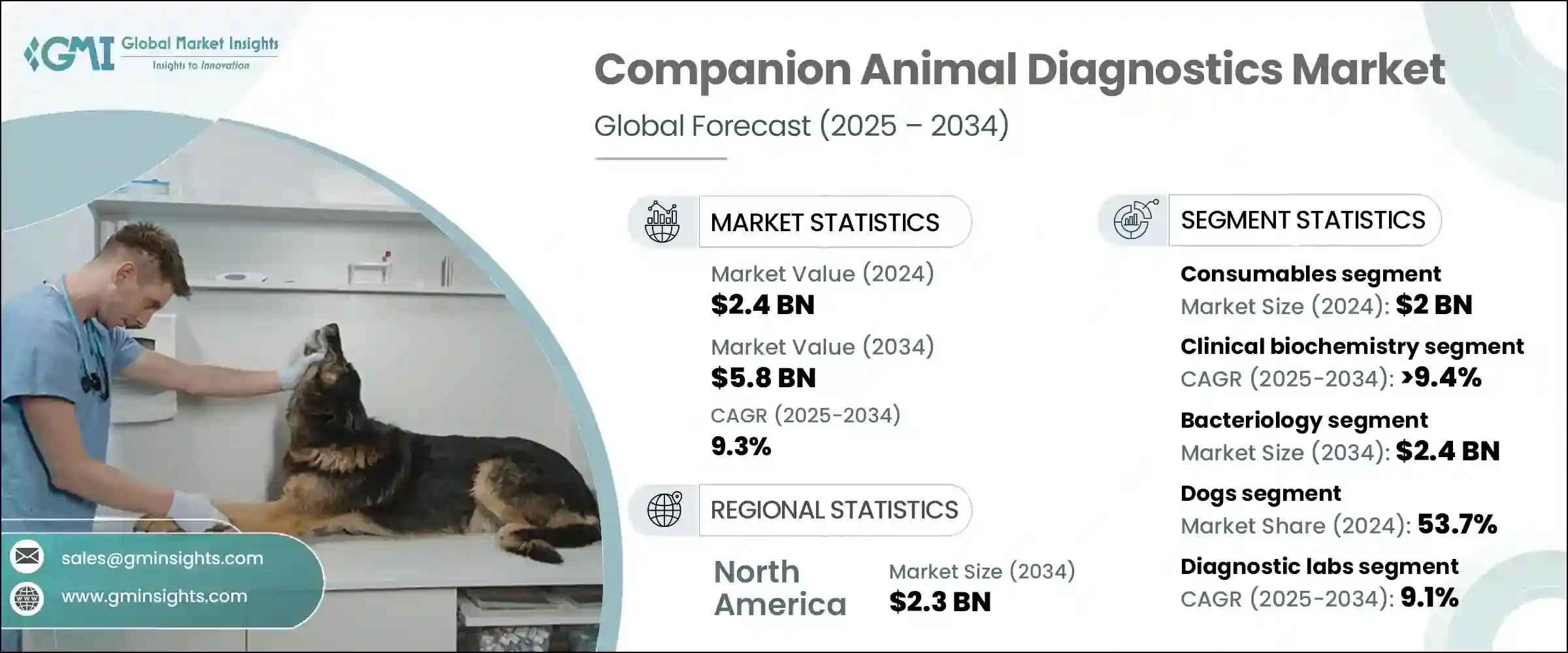

2024年,全球伴侶動物診斷市場規模達24億美元,預計2034年將以9.3%的複合年成長率成長,達到58億美元。推動這一成長的因素包括全球寵物主人數量的成長、人們對寵物陪伴的偏好日益成長,以及動物慢性病和傳染病診斷需求的激增。隨著寵物照護逐漸成為家庭生活不可或缺的一部分,獸醫服務支出持續攀升。寵物主人擴大將動物視為家庭成員,因此會定期進行健康檢查、預防性護理和及時診斷。這種文化轉變促使人們更加關注動物健康,從而顯著推高了對先進診斷工具和服務的需求。

市場擴張也得益於人們對人畜共通傳染病認知的不斷提高,以及早期診斷對於避免併發症的重要性。獸醫專業人員越來越依賴診斷來評估器官功能障礙、代謝問題和感染等情況,這進一步推動了該行業的發展。此外,技術進步正在重塑產業格局,使快速、準確、微創的診斷技術成為可能。獸醫診斷領域的創新縮短了診斷週期,並使其與治療策略更好地融合,使診斷成為動物保健的重要組成部分。隨著全球獸醫護理基礎設施的加強,對診斷產品和服務的需求預計將保持上升趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 58億美元 |

| 複合年成長率 | 9.3% |

就產品細分而言,市場分為儀器與耗材兩大類。 2024年,耗材市場佔據主導地位,價值達20億美元。這種主導地位源自於試劑、檢測試劑盒、玻片和試管等耗材在每個診斷過程中都扮演著至關重要的角色。與儀器不同,耗材是每次檢測都需要的,因此會產生重複購買,並帶來穩定的市場收入。隨著診所和醫院動物檢測頻率的增加,預計耗材需求也將隨之增加。定期體檢和預防性篩檢的趨勢進一步推動了耗材的使用。此外,隨著越來越多的診斷程序轉向快速診斷和即時診斷,專為一次性應用量身定做的耗材正成為標準配置,從而推動該細分市場的成長。

按應用分析,細菌學領域在2024年成為領先類別,預計2034年將達到24億美元。該領域在檢測伴侶動物的細菌感染方面發揮著至關重要的作用,而細菌感染在各種健康狀況下都很常見。從皮膚和泌尿道感染到呼吸道和胃腸道疾病,準確識別細菌病原體對於治療計劃至關重要。細菌學診斷技術的現代進步,包括改進的培養方法和快速抗原檢測,顯著提高了診斷效率。此類技術在中心實驗室和即時醫療機構的日益普及,鞏固了細菌學在診斷領域的地位。

按動物類型分類,犬類在2024年以53.7%的市佔率佔據市場主導地位。這種主導地位歸因於犬作為伴侶動物的廣泛飼養,以及對其醫療保健的投資不斷增加。犬類慢性病的發生率不斷上升,導致糖尿病、腎臟病、關節炎和心血管疾病等疾病的診斷檢測需求增加。常規診斷已成為犬類疾病管理的關鍵,進一步推動了該領域的需求。

就最終用途而言,診斷實驗室在2024年佔據了最大的市場佔有率,預計2025年至2034年期間的複合年成長率將達到9.1%。這些實驗室配備了高階診斷系統,並配備訓練有素的專業人員,能夠有效地處理大量樣本。它們能夠提供準確、快速和全面的結果,成為尋求可靠診斷支援的獸醫的首選。隨著寵物主人數量的增加,以及越來越多的人選擇定期為寵物進行健康評估,診斷實驗室的角色將變得更加重要。

從區域來看,北美引領全球伴侶動物診斷市場,2024 年市場價值達 10 億美元,預計到 2034 年將達到 23 億美元,複合年成長率為 8.8%。光是美國一國,2024 年的市場價值就達 8.933 億美元。高寵物擁有率和尖端診斷服務的普及推動了該地區的需求。此外,強大的獸醫醫療保健網路和不斷成長的動物保健消費者支出也持續支撐北美市場的表現。

競爭格局由多家全球和區域性企業主導,愛德士實驗室 (IDEXX Laboratories)、賽默飛世爾科技 (Thermo Fisher Scientific)、碩騰 (Zoetis) 和赫斯卡 (Heska Corporation) 等主要公司合計佔據全球約 60% 至 65% 的市場佔有率。這些公司憑藉著廣泛的產品組合、廣泛的地域覆蓋以及持續的研發投入,保持領先地位。同時,許多本地企業也透過提供經濟高效的診斷解決方案,並透過合作、收購和新產品開發來拓展產品線,加劇了競爭。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 收養寵物的趨勢日益成長

- 傳染病和人畜共通傳染病的盛行率上升

- 有利的政府舉措

- 伴隨診斷的進展

- 寵物保險的普及率不斷提高

- 產業陷阱與挑戰

- 動物試驗成本過高

- 獸醫護理自付費用低

- 市場機會

- 技術進步和即時診斷分子工具

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 耗材

- 儀器

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 臨床生物化學

- 血糖監測

- 血氣和電解質分析

- 其他臨床生化檢查

- 免疫診斷

- 橫向流動試驗

- 酵素連結免疫吸附試驗

- 免疫分析儀

- 其他免疫診斷測試

- 分子診斷

- 聚合酶連鎖反應

- 微陣列

- 其他分子診斷測試

- 血液學

- 尿液分析

- 其他技術

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 細菌學

- 病理

- 寄生蟲學

- 其他應用

第8章:市場估計與預測:按動物類型,2021 - 2034 年

- 主要趨勢

- 狗

- 貓

- 馬匹

- 其他動物類型

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 獸醫醫院和診所

- 診斷實驗室

- 居家照護環境

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 波蘭

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 菲律賓

- 泰國

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 秘魯

- 智利

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 埃及

- 以色列

第 11 章:公司簡介

- bioMerieux

- BioNote

- Bio-Rad Laboratories

- Boehringer Ingelheim International

- Heska Corporation (Mars)

- Idexx laboratories

- KogeneBiotech

- Median Diagnostics

- Neogen Corporation

- Randox

- Thermo Fischer Scientific

- Virbac

- VetAll Laboratories

- Qiagen

- Zoetis

The Global Companion Animal Diagnostics Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 5.8 billion by 2034. This growth is driven by a rising number of pet owners worldwide, a growing inclination toward pet companionship, and a surge in the diagnosis of chronic and infectious diseases in animals. With pet care becoming an integral part of households, spending on veterinary services continues to climb. Pet owners are increasingly treating animals as part of the family, which results in regular health checks, preventive care, and timely diagnosis. This cultural shift has led to a stronger focus on animal wellness, significantly pushing up the demand for advanced diagnostic tools and services.

The market expansion is also underpinned by the increasing awareness of zoonotic diseases and the importance of early diagnosis in avoiding complications. Veterinary professionals are relying more on diagnostics to assess conditions like organ dysfunction, metabolic issues, and infections, which has further fueled the growth of this sector. Moreover, technological advancements are reshaping the landscape by enabling fast, accurate, and less invasive diagnostic techniques. Innovations in veterinary diagnostics are allowing faster turnaround times and better integration with treatment strategies, making diagnostics a critical component of animal healthcare. As veterinary care infrastructure strengthens globally, the demand for diagnostic products and services is expected to remain on an upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 9.3% |

In terms of product segmentation, the market is divided into instruments and consumables. In 2024, the consumables segment dominated with a value of USD 2 billion. This dominance is due to the essential role of consumables like reagents, testing kits, slides, and tubes in each diagnostic process. Unlike instruments, consumables are required for every test, resulting in recurring purchases and consistent market revenue. As the frequency of animal testing increases across clinics and hospitals, the demand for consumables is expected to follow suit. The trend toward regular checkups and preventive screenings further boosts usage. Additionally, with more diagnostic procedures moving toward rapid and point-of-care formats, consumables tailored for single-use applications are becoming standard, pushing segmental growth.

When analyzed by application, the bacteriology segment emerged as the leading category in 2024 and is expected to reach USD 2.4 billion by 2034. This segment plays a crucial role in detecting bacterial infections in companion animals, which are commonly seen across a wide range of health conditions. From skin and urinary infections to respiratory and gastrointestinal issues, accurate identification of bacterial pathogens is essential for treatment planning. Modern advancements in bacteriological diagnostics, including improved culturing methods and rapid antigen detection, have significantly elevated diagnostic efficiency. The increasing availability of such technologies at both central labs and point-of-care facilities strengthens the position of bacteriology in the diagnostics landscape.

Based on animal type, the dogs segment led the market with a commanding share of 53.7% in 2024. This dominance is attributed to the widespread ownership of dogs as companion animals and the rising investment in their healthcare. The higher frequency of chronic diseases in dogs has resulted in increased demand for diagnostic tests for conditions such as diabetes, kidney disorders, arthritis, and cardiovascular problems. Routine diagnostics have become essential for disease management in dogs, further driving the demand within this segment.

Regarding end use, diagnostic labs held the largest market share in 2024 and are anticipated to expand at a CAGR of 9.1% from 2025 to 2034. These labs are equipped with high-end diagnostic systems and staffed with trained professionals, allowing them to handle large sample volumes efficiently. Their ability to deliver accurate, quick, and comprehensive results makes them a preferred choice for veterinarians seeking reliable diagnostic support. As the number of pet owners increases and more people opt for regular health assessments for their animals, the role of diagnostic labs becomes even more central.

Regionally, North America led the global companion animal diagnostics market with a value of USD 1 billion in 2024, projected to reach USD 2.3 billion by 2034, growing at a CAGR of 8.8%. The U.S. alone accounted for USD 893.3 million in 2024. High pet ownership rates and the widespread availability of cutting-edge diagnostic services drive demand in the region. Additionally, a strong veterinary healthcare network and rising consumer expenditure on animal wellness continue to bolster market performance in North America.

The competitive landscape is shaped by several global and regional players, with key companies such as IDEXX Laboratories, Thermo Fisher Scientific, Zoetis, and Heska Corporation collectively holding around 60% to 65% of the global market. These firms maintain their leadership through broad product portfolios, geographic reach, and continuous investment in research and development. Alongside them, numerous local players are intensifying competition by offering cost-effective diagnostic solutions and expanding their product lines through partnerships, acquisitions, and new product development.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Animal type

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing trend of adopting pet animals

- 3.2.1.2 Rising prevalence of infectious and zoonotic diseases

- 3.2.1.3 Favorable government initiatives

- 3.2.1.4 Advancements in companion diagnostics

- 3.2.1.5 Increasing adoption of pet insurance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Prohibitive cost associated with animal tests

- 3.2.2.2 Low out of pocket expenditure on veterinary care

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements and point-of-care molecular tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical biochemistry

- 6.2.1 Glucose monitoring

- 6.2.2 Blood gas and electrolyte analysis

- 6.2.3 Other clinical biochemistry tests

- 6.3 Immunodiagnostics

- 6.3.1 Lateral flow assays

- 6.3.2 ELISA

- 6.3.3 Immunoassay analyzers

- 6.3.4 Other immunodiagnostic tests

- 6.4 Molecular diagnostics

- 6.4.1 PCR

- 6.4.2 Microarrays

- 6.4.3 Other molecular diagnostic tests

- 6.5 Hematology

- 6.6 Urinalysis

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bacteriology

- 7.3 Pathology

- 7.4 Parasitology

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Dogs

- 8.3 Cats

- 8.4 Horses

- 8.5 Other animal types

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Diagnostic labs

- 9.4 Home care settings

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Poland

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.5.5 Peru

- 10.5.6 Chile

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

- 10.6.5 Egypt

- 10.6.6 Israel

Chapter 11 Company Profiles

- 11.1 bioMerieux

- 11.2 BioNote

- 11.3 Bio-Rad Laboratories

- 11.4 Boehringer Ingelheim International

- 11.5 Heska Corporation (Mars)

- 11.6 Idexx laboratories

- 11.7 KogeneBiotech

- 11.8 Median Diagnostics

- 11.9 Neogen Corporation

- 11.10 Randox

- 11.11 Thermo Fischer Scientific

- 11.12 Virbac

- 11.13 VetAll Laboratories

- 11.14 Qiagen

- 11.15 Zoetis