|

市場調查報告書

商品編碼

1773470

寵物服務市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pet Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

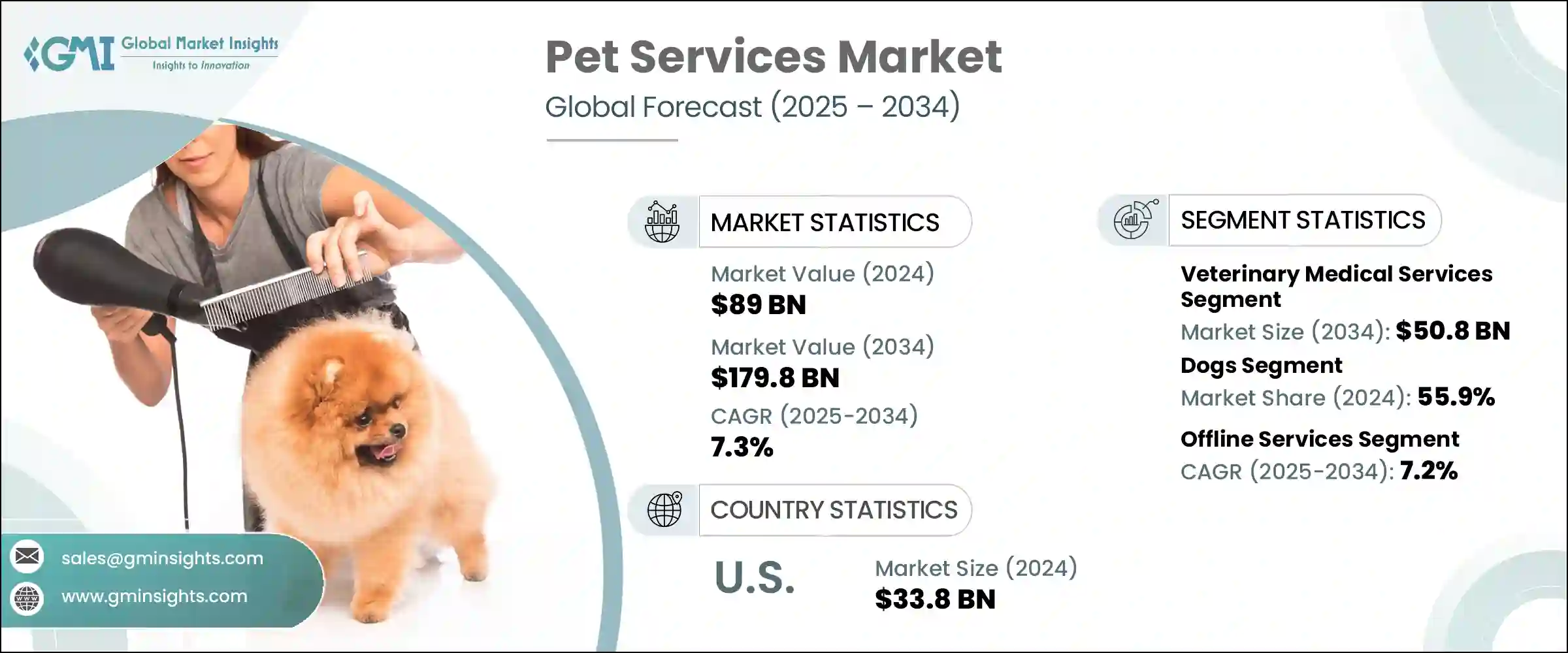

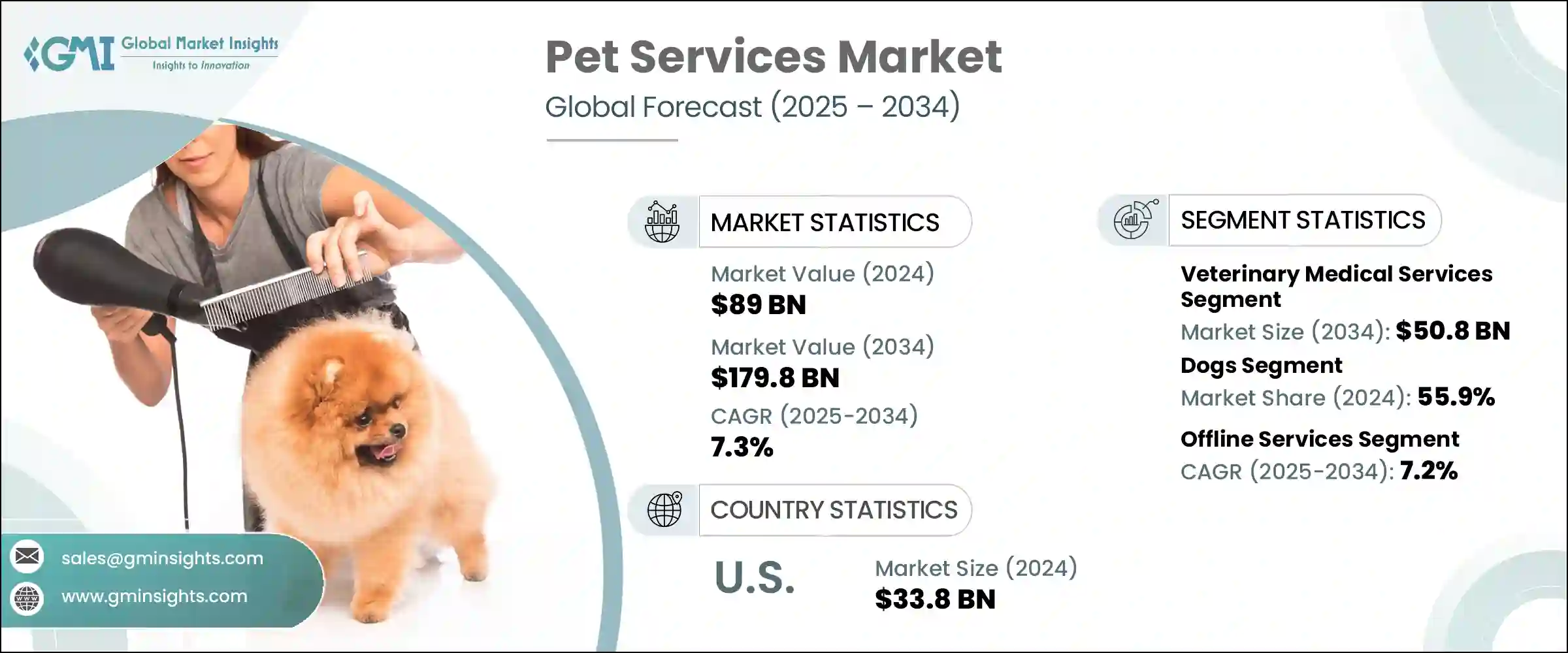

2024年,全球寵物服務市場規模達890億美元,預計到2034年將以7.3%的複合年成長率成長,達到1,798億美元。這一成長主要源於寵物慢性健康問題(例如關節炎、糖尿病和肥胖症)發病率的上升,這促使寵物對常規體檢、復健護理和專科治療的需求不斷增加。寵物主人越來越重視寵物的健康和衛生,導致專業美容、獸醫診療和保險投保數量激增。

此外,向數位化工具(例如虛擬獸醫預約和線上預約系統)的轉變提升了護理服務的可近性。這種科技驅動的轉型,加上寵物擁有量的上升和人性化趨勢,正在強化全球市場的寵物照護服務生態系統。寵物服務涵蓋了廣泛的服務,以滿足伴侶動物的需求,包括醫療和非醫療服務。這些服務包括美容、獸醫護理、日托、寄養和訓練。保險覆蓋範圍的擴大進一步提升了優質服務的可近性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 890億美元 |

| 預測值 | 1798億美元 |

| 複合年成長率 | 7.3% |

同時,獸醫醫療保健產業正在經歷數位轉型,這正在重新定義寵物服務的提供和取得方式。遠距會診的日益普及不僅為寵物主人帶來了便利,也確保了及時的醫療干預,尤其是在偏遠或醫療資源匱乏的地區。智慧健康追蹤設備,包括穿戴式項圈和可植入感測器,能夠即時監測寵物的生命徵象、活動量和行為變化,為獸醫和寵物主人提供切實可行的洞察。

2024年,獸醫醫療服務領域產值達264億美元,預計到2034年將達到508億美元,複合年成長率為6.8%。此領域涵蓋普通醫療、專科治療和緊急服務。寵物數量的成長,加上傳染病和慢性病的發病率上升,加速了獸醫照護的需求。此外,城市環境中寵物人性化程度的提高正在影響消費模式,越來越多的家庭開始為高階寵物服務和產品預留預算。醫療基礎設施的改善使寵物主人更容易獲得先進的獸醫護理。因此,醫療服務仍然是整個市場的基礎支柱,而人們日益成長的寵物健康意識和投資意願也為醫療服務的發展提供了支持。

2024年,狗狗細分市場佔據了55.9%的市場佔有率,這得益於狗狗作為伴侶動物的廣泛普及以及寵物與主人之間日益成長的情感紐帶。狗狗主人在日托、美容和健康體檢等高品質服務上的支出不斷增加,進一步強化了全面寵物照護的價值。針對特定犬種的美容、專業訓練和高級醫療保健服務的需求持續激增。此外,商業寵物護理機構的擴張和數位服務平台的興起,使得與狗狗相關的服務更加便捷易得,鞏固了其在全球市場的地位。

2024年,北美寵物服務市場規模達357億美元,預計2034年將達到694億美元,複合年成長率為6.9%。該地區的領先地位源於其高度發展的寵物護理基礎設施、日益成長的寵物擁有量以及日益增強的寵物健康意識。該地區各國對預防性獸醫護理和個人化美容等高階服務的需求激增。現代獸醫診所、高階服務連鎖店和數位化寵物護理解決方案的普及也推動了這一成長。此外,寵物主人正在積極利用科技驅動的平台來安排和管理服務。區域性公司正在擴展服務組合,並充分利用消費者偏好,這有助於持續的市場擴張。

全球寵物服務市場的知名企業包括 IDEXX Laboratories、Dogtopia、PetIQ、VIP Petcare、Petfirst Healthcare、PetSmart、Hartville Group、Vetcor、Anicom Holding、The Barkley Pet Hotel & Day Spa、DogVacay、Mars、K9 Resorts、Rover、Figo Insurance、Holleter為了鞏固市場地位,寵物服務領域的公司正在投資服務多元化和數位轉型。

許多公司正在採用基於應用程式的平台和遠距醫療服務,以簡化客戶體驗並提高服務便利性。與獸醫網路、保險公司和科技公司建立策略夥伴關係,有助於擴大服務範圍,同時提升護理品質。該公司還推出了健康計劃和訂閱模式,以提高客戶忠誠度和經常性收入來源。此外,針對獸醫和護理人員的持續培訓計畫正在提升服務標準。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有率上升

- 寵物人性化趨勢

- 提高寵物主人的健康意識

- 獸醫服務技術不斷進步

- 產業陷阱與挑戰

- 服務成本高

- 動物福利監理挑戰

- 市場機會

- 數位轉型和線上預訂的成長

- 擴大寵物保險

- 成長動力

- 成長潛力分析

- 2024年寵物數量統計

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 擴張計劃

第5章:市場估計與預測:依服務類型,2021 年至 2034 年

- 主要趨勢

- 寵物美容

- 寵物寄養和日托

- 寵物訓練服務

- 寵物保險

- 獸醫醫療服務

- 一般服務

- 專業服務

- 緊急服務

- 其他服務類型

第6章:市場估計與預測:按寵物類型,2021 年至 2034 年

- 主要趨勢

- 狗

- 貓

- 鳥類

- 魚類

- 馬匹

- 其他寵物類型

第7章:市場估計與預測:依交付方式,2021 年至 2034 年

- 主要趨勢

- 線上服務

- 線下服務

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Anicom Holding

- Dogtopia

- DogVacay

- Ethos Veterinary Health

- Figo Pet Insurance

- Hartville Group

- Hollard

- IDEXX Laboratories

- K9 Resorts

- Mars

- Petfirst Healthcare

- PetIQ

- PetSmart

- Rover

- The Barkley Pet Hotel & Day Spa

- Vetcor

- VIP Petcare

The Global Pet Services Market was valued at USD 89 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 179.8 billion by 2034. This growth is largely driven by the increasing incidence of chronic health issues in pets, such as arthritis, diabetes, and obesity, which prompts a higher demand for routine check-ups, rehabilitation care, and specialty treatments. Pet owners are placing more importance on wellness and hygiene, resulting in a spike in professional grooming, veterinary visits, and insurance enrollments.

Additionally, the shift toward digital tools-such as virtual vet appointments and online booking systems-has enhanced the accessibility of care services. This tech-driven transformation, combined with rising pet ownership and humanization trends, is strengthening the pet care service ecosystem across global markets. Pet services encompass a wide range of offerings tailored to companion animals' needs, both medical and non-medical. These include grooming, veterinary care, daycare, boarding, and training. Expanding insurance coverage has further boosted access to premium services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $89 Billion |

| Forecast Value | $179.8 Billion |

| CAGR | 7.3% |

In parallel, the veterinary healthcare sector is undergoing a digital transformation that is redefining how pet services are delivered and accessed. The growing integration of teleconsultations is not only improving convenience for pet owners but also ensuring timely medical intervention, especially in remote or underserved areas. Smart health tracking devices, including wearable collars and implantable sensors, are enabling real-time monitoring of pets' vital signs, activity levels, and behavioral changes-empowering both veterinarians and owners with actionable insights.

The veterinary medical services segment generated USD 26.4 billion in 2024 and is projected to reach USD 50.8 billion by 2034, growing at a CAGR of 6.8%. This segment includes general medical care, specialized treatments, and emergency services. A growing population of pets combined with increasing occurrences of both infectious and chronic conditions is accelerating the demand for veterinary care. Additionally, rising pet humanization in urban settings is influencing spending patterns, as more households allocate budgets for premium pet services and products. Improvements in healthcare infrastructure are making advanced veterinary care more accessible to pet owners. As a result, medical services remain a foundational pillar in the overall market, supported by growing awareness and willingness to invest in pet health.

The dogs segment held a 55.9% share in 2024 fueled by the widespread adoption of dogs as companion animals and the increasing emotional bond shared between pets and owners. Dog owners are spending more on high-quality services such as daycare, grooming, and health checkups, reinforcing the value of comprehensive pet care. The demand for breed-specific grooming, specialized training, and advanced healthcare options continues to surge. Additionally, the expansion of commercial pet care establishments and the emergence of digital service platforms have made dog-related services more convenient and accessible, solidifying their position in the global market.

North America Pet Services Market generated USD 35.7 billion in 2024 and is expected to reach USD 69.4 billion by 2034, with a CAGR of 6.9%. The region's leadership stems from its highly developed pet care infrastructure, increasing pet ownership, and heightened awareness about pet well-being. Countries across the region are seeing a surge in demand for high-end services such as preventive veterinary care and personalized grooming. The growth is also propelled by widespread access to modern veterinary clinics, premium service chains, and digital pet care solutions. Moreover, pet owners are actively engaging with technology-driven platforms to schedule and manage services. Regional companies are expanding service portfolios and capitalizing on consumer preferences, which is contributing to consistent market expansion.

Prominent players in the Global Pet Services Market include IDEXX Laboratories, Dogtopia, PetIQ, VIP Petcare, Petfirst Healthcare, PetSmart, Hartville Group, Vetcor, Anicom Holding, The Barkley Pet Hotel & Day Spa, DogVacay, Mars, K9 Resorts, Rover, Figo Pet Insurance, Hollard, Ethos Veterinary Health. To strengthen their market positioning, companies in the pet services space are investing in service diversification and digital transformation.

Many are adopting app-based platforms and telehealth services to streamline customer experiences and increase service convenience. Strategic partnerships with veterinary networks, insurance providers, and tech firms help expand their service footprint while also improving care quality. Firms are also launching wellness programs and subscription-based models to enhance customer loyalty and recurring revenue streams. Moreover, continuous training programs for veterinary and care staff are elevating service standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service type

- 2.2.3 Pet type

- 2.2.4 Delivery mode

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership rate

- 3.2.1.2 Pet humanization trend

- 3.2.1.3 Increasing health awareness among pet owners

- 3.2.1.4 Growing technological advancements in veterinary services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High service costs

- 3.2.2.2 Regulatory challenges on animal welfare

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in digital transformation and online booking

- 3.2.3.2 Expanding pet insurance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pet population statistics 2024

- 3.5 Regulatory landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pet grooming

- 5.3 Pet boarding and daycare

- 5.4 Pet training services

- 5.5 Pet insurance

- 5.6 Veterinary medical services

- 5.6.1 General services

- 5.6.2 Specialty services

- 5.6.3 Emergency services

- 5.7 Other service types

Chapter 6 Market Estimates and Forecast, By Pet Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Fishes

- 6.6 Horses

- 6.7 Other pet types

Chapter 7 Market Estimates and Forecast, By Delivery Mode, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online services

- 7.3 Offline services

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anicom Holding

- 9.2 Dogtopia

- 9.3 DogVacay

- 9.4 Ethos Veterinary Health

- 9.5 Figo Pet Insurance

- 9.6 Hartville Group

- 9.7 Hollard

- 9.8 IDEXX Laboratories

- 9.9 K9 Resorts

- 9.10 Mars

- 9.11 Petfirst Healthcare

- 9.12 PetIQ

- 9.13 PetSmart

- 9.14 Rover

- 9.15 The Barkley Pet Hotel & Day Spa

- 9.16 Vetcor

- 9.17 VIP Petcare