|

市場調查報告書

商品編碼

1773467

原發性免疫缺陷症市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Primary Immunodeficiency Disorders Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

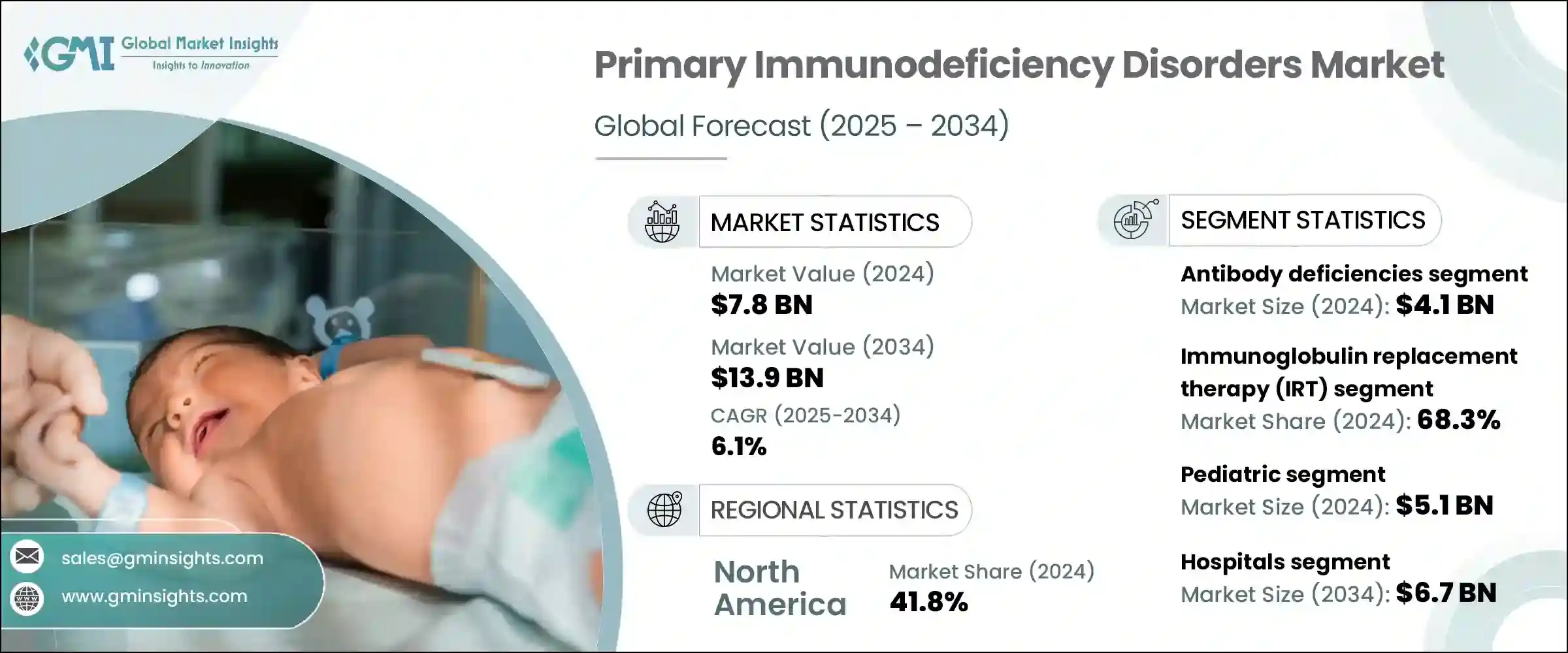

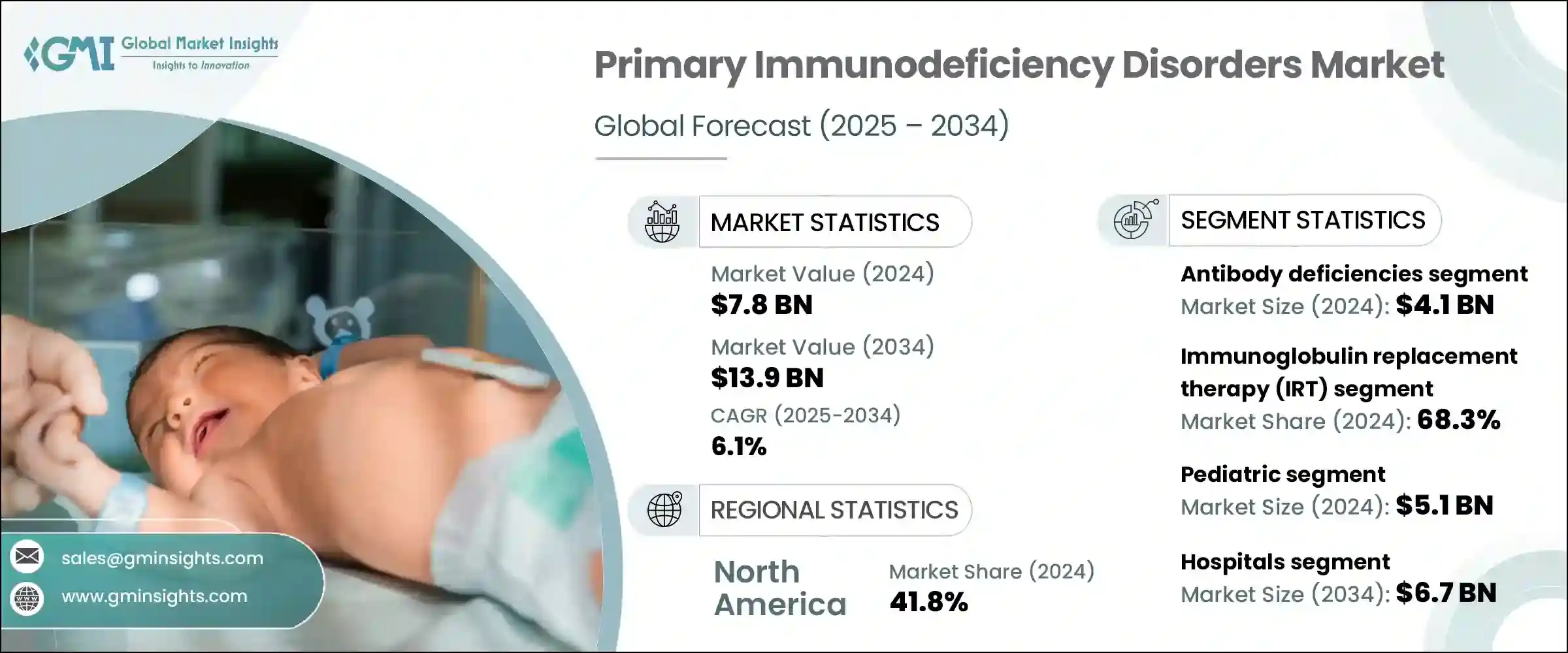

2024 年全球原發性免疫缺陷病市場價值為 78 億美元,預計到 2034 年將以 6.1% 的複合年成長率成長至 139 億美元。這一成長主要得益於原發性免疫缺陷疾病 (PID) 發病率的上升以及醫務人員和患者對這些疾病的認知度的提高。診斷方法和治療創新(例如基因療法和生物製劑)的進步為有效治療和管理創造了更多機會。研發投入的增加,加上對這些罕見遺傳疾病的認知不斷提高,正在改善獲得準確診斷和更有針對性的護理的機會。隨著醫療保健系統不斷發展以更全面地應對罕見疾病,患者透過早期介入、個人化治療和持續監測將獲得更好的治療效果和更高的生活品質。

醫療保健提供者的免疫學培訓不斷提升,使得疑似免疫缺陷疾病患者能夠更早發現和介入。病人權益組織和社區支持團體在連結個人與醫療網路、推動醫療政策系統性變革方面發揮著至關重要的作用。這種更廣泛的參與有助於擴大先進診斷工具的可及性,例如基因定序和流式細胞儀,這些工具正在全球範圍內被廣泛用於輔助檢測和分類PID。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 78億美元 |

| 預測值 | 139億美元 |

| 複合年成長率 | 6.1% |

隨著城市化進程的加速、醫療服務水準的提高以及南非、巴西、印度和中國等發展中地區可支配收入的不斷成長,人們越來越傾向於尋求醫療評估和合適的治療。原發性免疫缺陷症是一種遺傳性免疫系統疾病,會導致患者更容易感染、罹患慢性疾病,並導致整體免疫功能下降。治療創新的重點是提高免疫力、緩解症狀並最大程度地減少疾病復發。

抗體缺陷領域是2024年最大的細分市場,估值達41億美元。這種主導地位源自於與抗體生成受損相關的免疫疾病的高發性。其中最常見的是免疫缺陷,它會導致頻繁且嚴重的感染,需要終生治療。患有這些疾病的患者通常需要透過靜脈或皮下注射的方式定期接受免疫球蛋白治療,這有助於持續的產品需求。持續的醫學進步確保了更有效率、更患者友善的給藥系統,從而擴大了該領域的成長潛力。

在治療方面,免疫球蛋白替代療法 (IRT) 領域在 2024 年佔據了 68.3% 的市場佔有率。 IRT 作為大多數抗體相關免疫缺陷症的標準治療方案,持續受到重視,這鞏固了其強大的市場地位。這些療法能夠長期預防感染,這對於管理這些終身疾病至關重要。近期治療劑型的改進,包括延長半衰期和重組技術的方案,進一步提高了治療效果和患者舒適度。此外,更高的認知度和宣傳力度支持早期啟動治療並提高依從性,這直接促進了該市場的擴張。醫療保健提供者現在已將 IRT 視為骨盆腔發炎性疾病 (PID) 治療的基石療法,從而促進了其更廣泛的接受和應用。

2024年,美國原發性免疫缺陷症市場規模達29億美元。美國憑藉著強大的醫療基礎設施、先進診斷技術的廣泛應用以及公眾和臨床對免疫缺陷疾病的高度認知,引領全球市場。免疫分析、流式細胞儀和先進的基因檢測等診斷工具被廣泛用於確診和分類原發性免疫缺陷疾病(PID),尤其是在兒童中。基因編輯技術和幹細胞介入等尖端療法的出現,使美國患者能夠獲得全球最具創新性的治療方案。專科診所、專注於免疫學的醫院以及居家照護模式都促進了市場的成熟。對標靶生物製劑、下一代免疫球蛋白和罕見疾病新型療法的大力研發投入,將持續引領市場的發展。

原發性免疫缺陷症市場的領導公司包括 Orchard Therapeutics、美天旎生物技術公司 (Miltenyi Biotec)、傑特貝林公司 (CSL Behring)、百特國際公司 (Baxter International)、Medac、Octapharma、ADMA Biologics、武田製藥 (Takeda Pharmaceutical)、羅氏製藥公司 (F. Leadiant Biosciences。在原發性免疫缺陷疾病市場中營運的公司正在採取多種策略來提升其市場佔有率。

其中一個主要重點是投資標靶生物製劑、基因療法以及具有更高生物利用度和更低給藥頻率的下一代免疫球蛋白療法的先進研發管線。各公司也正在擴大生產能力,以滿足對終身免疫球蛋白替代療法日益成長的需求。與學術機構和研究中心的策略合作使企業能夠獲得新興技術和新的適應症。各公司正在透過地理擴張來提高市場滲透率,尤其是在診斷意識不斷提升的發展中地區。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 原發性免疫缺陷病患病率高

- 兒科人口不斷增加

- 診斷和治療技術的進步

- 免疫球蛋白替代療法(IRT)的需求不斷成長

- 產業陷阱與挑戰

- 治療費用高昂

- 血漿製品短缺

- 市場機會

- 擴大免疫球蛋白治療的適應症

- 基因治療和生物製劑的研發管線擴展

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 未來市場趨勢

- 管道分析

- 消費者行為分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

第5章:市場估計與預測:依疾病類型,2021 年至 2034 年

- 主要趨勢

- 抗體缺陷

- 聯合免疫缺陷

- 補體缺陷

- 吞噬細胞失調

- 其他疾病類型

第6章:市場估計與預測:依治療類型,2021 年至 2034 年

- 主要趨勢

- 免疫球蛋白替代療法(IRT)

- 造血幹細胞移植(HSCT)

- 基因治療

- 其他治療類型

第7章:市場估計與預測:依年齡層,2021 年至 2034 年

- 主要趨勢

- 兒科

- 成人

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 專科診所

- 家庭護理設置

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ADMA Biologics

- Baxter International

- Biotest (Grifol Group)

- Bluebird Bio

- CSL Behring

- F. Hoffmann La Roche

- Leadiant Biosciences

- Medac

- Miltenyi Biotec

- Takeda Pharmaceutical

- Octapharma

- Orchard Therapeutics

The Global Primary Immunodeficiency Disorders Market was valued at USD 7.8 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 13.9 billion by 2034. This growth is primarily driven by the rising incidence of primary immunodeficiency disorders (PIDs) and the increasing recognition of these conditions among medical professionals and patients. Advancements in both diagnostic approaches and therapeutic innovations, such as gene-based therapies and biologics, are creating expanded opportunities for effective treatment and management. Enhanced investment in research and development, coupled with growing awareness of these rare genetic disorders, is improving access to accurate diagnoses and more targeted care. As healthcare systems evolve to address rare conditions more holistically, patients are benefiting from better outcomes and improved quality of life through early intervention, personalized therapies, and continuous monitoring.

Training in immunology continues to improve among healthcare providers, allowing earlier identification and intervention for patients with suspected immunodeficiency disorders. Patient advocacy organizations and community support groups are playing a crucial role in connecting individuals to care networks and pushing for systemic changes in healthcare policy. This broader engagement is helping increase access to advanced diagnostic tools, such as genetic sequencing and flow cytometry, which are being adopted globally to aid in detecting and classifying PIDs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 6.1% |

The rise of urbanization and access to better healthcare services, along with increasing disposable incomes in developing regions such as South Africa, Brazil, India, and China, is encouraging people to seek medical evaluations and pursue proper treatment. Primary immunodeficiency disorders are inherited immune system conditions that lead to higher vulnerability to infections, chronic illnesses, and overall weakened immune function. Treatment innovations are focused on improving immunity, alleviating symptoms, and minimizing disease recurrence.

The antibody deficiencies segment represented the largest market segment in 2024, with a valuation of USD 4.1 billion. This dominance stems from the high prevalence of immune disorders linked to impaired antibody production. Among the most common are immunodeficiencies that result in frequent, severe infections requiring lifelong therapy. Patients with these conditions typically need regular immunoglobulin therapy administered through intravenous or subcutaneous methods, which contributes to sustained product demand. Ongoing medical advancements are ensuring more efficient and patient-friendly delivery systems, expanding this segment's growth potential.

In terms of treatment, the immunoglobulin replacement therapy (IRT) segment held a 68.3% share in 2024. The continued reliance on IRT as a standard care protocol for most antibody-related immunodeficiencies reinforces its strong market presence. These therapies offer long-term protection from infections, which is essential in managing these lifelong conditions. Recent improvements in treatment formulations, including options with extended half-lives and recombinant technology, are further increasing therapy effectiveness and patient comfort. Additionally, greater awareness and advocacy support early treatment initiation and improved adherence, which directly supports this market's expansion. Healthcare providers now recognize IRT as a cornerstone therapy in PID treatment, prompting its broader acceptance and usage.

U.S. Primary Immunodeficiency Disorders Market was valued at USD 2.9 billion in 2024. The country leads the global market with a robust healthcare infrastructure, widespread adoption of advanced diagnostics, and strong public and clinical awareness of immunodeficiency disorders. Diagnostic tools, including immune profiling, flow cytometry, and advanced genetic testing, are widely used to confirm and classify PID cases, especially among children. The availability of cutting-edge therapies such as gene editing technologies and stem cell-based interventions is giving U.S. patients access to some of the most innovative treatments globally. Specialized clinics, immunology-focused hospitals, and home-based care delivery models have all contributed to market maturity. Strong research investments in targeted biologics, next-generation immunoglobulins, and novel therapies for rare diseases continue to shape the market's evolution.

Leading companies in the Primary Immunodeficiency Disorders Market include Orchard Therapeutics, Miltenyi Biotec, CSL Behring, Baxter International, Medac, Octapharma, ADMA Biologics, Takeda Pharmaceutical, F. Hoffmann La Roche, Bluebird Bio, Biotest (Grifol Group), Avanos, and Leadiant Biosciences. Companies operating in the primary immunodeficiency disorders market are pursuing several strategies to enhance their market presence.

One major focus is investing in advanced R&D pipelines for targeted biologics, gene therapies, and next-gen immunoglobulin therapies with enhanced bioavailability and reduced administration frequency. Firms are also expanding manufacturing capabilities to meet the growing demand for lifelong immunoglobulin replacement therapies. Strategic collaborations with academic institutions and research centers allow access to emerging technologies and new indications. Companies are increasing market penetration through geographic expansion, especially in developing regions with rising diagnostic awareness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Disease type

- 2.2.3 Treatment type

- 2.2.4 Age group

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High prevalence of primary immunodeficiency disorders

- 3.2.1.2 Rising pediatric population

- 3.2.1.3 Technological advancement in diagnostics and treatment

- 3.2.1.4 Growing demand for immunoglobulin replacement therapy (IRT)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Shortage of plasma-derived products

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding indications for immunoglobulin therapy

- 3.2.3.2 Pipeline expansion in gene therapy and biologics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Consumer behaviour analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antibody deficiencies

- 5.3 Combined immunodeficiencies

- 5.4 Complement deficiencies

- 5.5 Phagocytic disorders

- 5.6 Other disease types

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Immunoglobulin replacement therapy (IRT)

- 6.3 Hematopoietic stem cell transplantation (HSCT)

- 6.4 Gene therapy

- 6.5 Other treatment types

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatric

- 7.3 Adult

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty Clinics

- 8.4 Homecare Settings

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ADMA Biologics

- 10.2 Baxter International

- 10.3 Biotest (Grifol Group)

- 10.4 Bluebird Bio

- 10.5 CSL Behring

- 10.6 F. Hoffmann La Roche

- 10.7 Leadiant Biosciences

- 10.8 Medac

- 10.9 Miltenyi Biotec

- 10.10 Takeda Pharmaceutical

- 10.11 Octapharma

- 10.12 Orchard Therapeutics