|

市場調查報告書

商品編碼

1773465

獸醫神經退化性疾病診斷市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Veterinary Neurodegenerative Disease Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

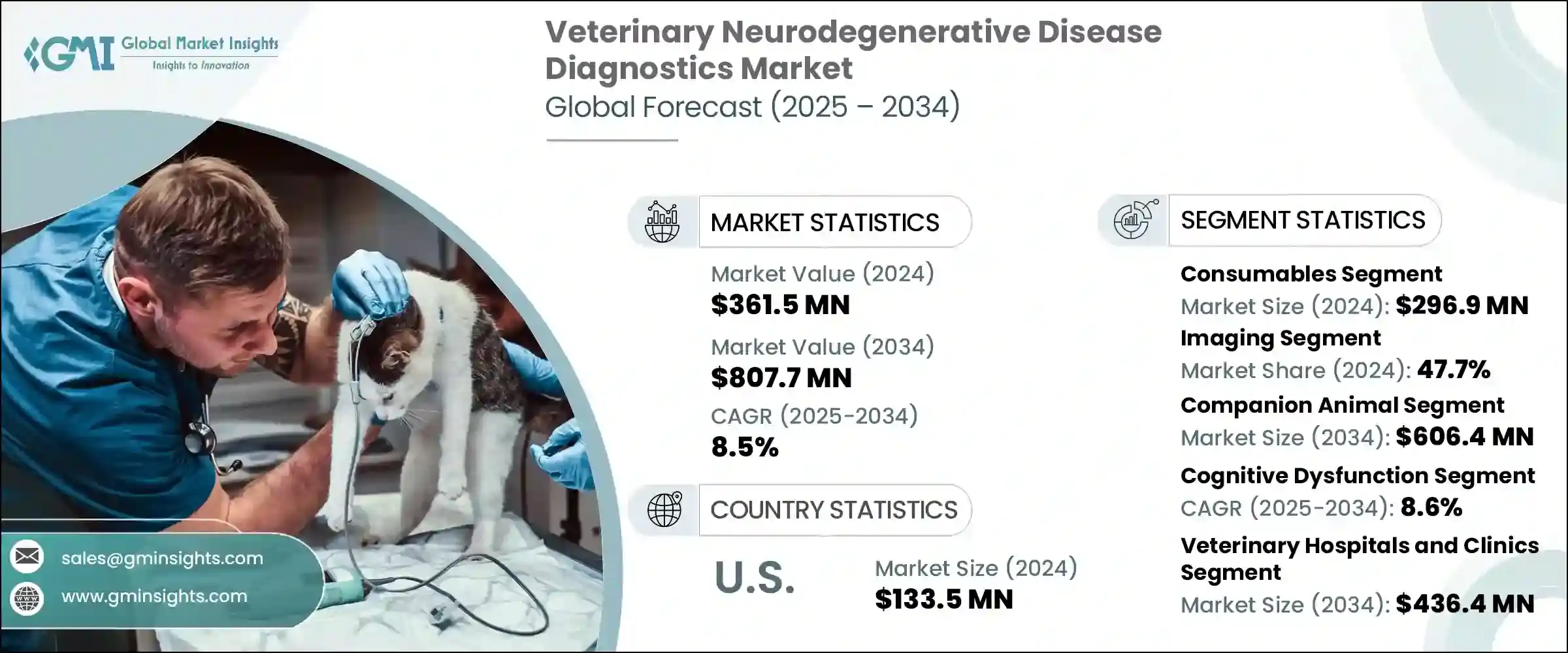

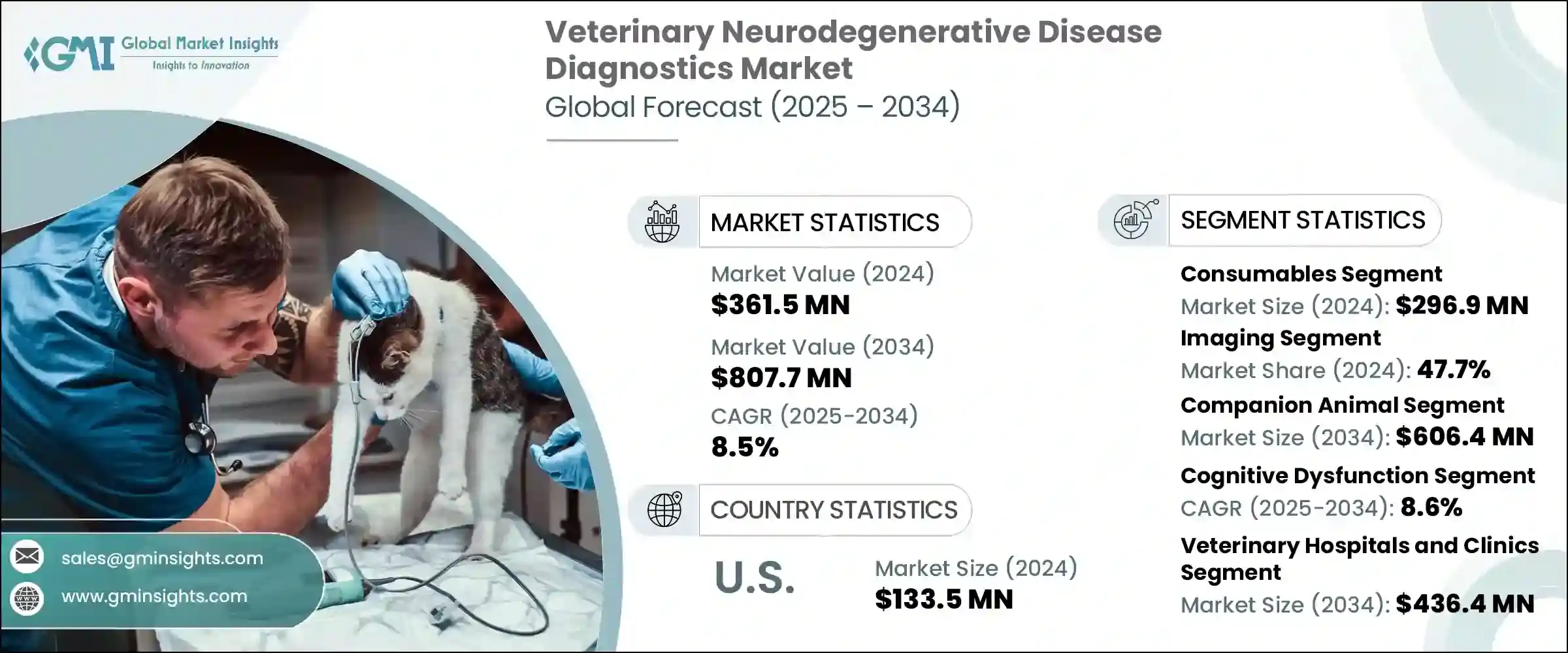

2024 年全球獸醫神經退化性疾病診斷市場價值為 3.615 億美元,預計到 2034 年將以 8.5% 的複合年成長率成長至 8.077 億美元。這一成長在 2025 年至 2034 年期間的複合年成長率為 8.5%,其驅動力來自幾個關鍵因素。動物神經系統疾病的增多,加上寵物擁有量和動物保健支出的激增,推動了對準確且易於獲取的診斷工具的需求。隨著全球伴侶動物和牲畜數量的迅速增加,對先進獸醫診斷的需求變得比以往任何時候都更加迫切。獸醫神經病學的技術進步也在重塑診斷方法方面發揮關鍵作用。成像、生物標記檢測方面的創新以及高靈敏度診斷試劑盒的開發顯著提高了疾病檢測的精確度。

亞太、拉丁美洲和部分非洲地區的新興經濟體正在顯著增加獸醫診所和流動醫療單位的建立。這些設施擴大配備了CT和MRI等尖端神經系統診斷工具,有助於提高診斷準確性和治療效果。政府推出的動物健康和疾病預防支持政策也鼓勵了公私投資。獸醫保健領域的主要企業正在擴大其服務網路,並與參考實驗室建立策略合作夥伴關係,以提高醫療服務匱乏地區的診斷服務覆蓋率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.615億美元 |

| 預測值 | 8.077億美元 |

| 複合年成長率 | 8.5% |

獸醫神經退化性疾病診斷涵蓋種類繁多的儀器和耗材,包括檢測試劑、試劑、試劑盒和其他支援組件。這些產品用於開發和應用診斷解決方案,幫助識別和監測動物的神經系統疾病。市場按產品類型細分為耗材和儀器,其中耗材類別佔據領先地位,2024 年的估值為 2.969 億美元。耗材用於每個診斷程序,因此需要不斷補充。這種重複使用確保了穩定的收入來源,並增強了對這些產品的需求。耗材的一次性使用特性、易於整合到獸醫工作流程以及標準化的格式提供了便利性、一致性和可靠性——這些關鍵因素促使它們在診所和實驗室中廣泛應用。

根據檢測類型,市場可分為影像學、生物標記診斷檢測和其他方法。 2024年,影像學佔據了47.7%的市場佔有率,佔據主導地位。它透過提供與脊椎退化或腦功能障礙等疾病相關的結構性問題的視覺洞察,在識別神經系統異常方面發揮著至關重要的作用。 CT和MRI技術在獸醫環境中的日益普及,提高了這些診斷方法的可用性和有效性,並最終推動了影像學在整個市場中的主導地位。

依動物類型分類,市場分為伴侶動物和家畜。伴侶動物細分市場在2024年佔據市場主導地位,預計2034年將達到6.064億美元。這個細分市場受益於寵物擁有量的增加、人們對動物神經系統疾病認知的提高以及寵物主人投資專業診斷的趨勢日益增強。隨著與年齡相關的神經系統疾病在寵物身上的認知度不斷提高,對精準早期檢測的需求持續成長,從而推動了先進診斷解決方案的進一步應用。

以適應症分析,預計到2034年,認知功能障礙領域的複合年成長率將達到8.6%,這主要得益於動物年齡相關性神經功能衰退的發生率不斷上升。這種疾病,尤其是在老年犬中,正日益引起寵物主人和獸醫專業人士的注意。正在進行的研究和新型診斷測試的開發,使得認知問題的識別速度和準確性得以提高,有助於滿足日益成長的需求。

就最終用途而言,市場細分為獸醫院和診所、診斷實驗室和其他最終用戶。獸醫院和診所在2024年成為領先細分市場,預計到2034年將達到4.364億美元。這些機構通常資源豐富,擁有先進的診斷工具和熟練的專業人員,能夠有效率地處理大量樣本。它們能夠提供準確及時的診斷,成為許多寵物主人的首選。對成像系統和神經診斷基礎設施的投資進一步鞏固了它們在該領域的主導地位。

從地理來看,北美在2024年以40.6%的市佔率領先全球市場。光是美國一國的市場價值就達到了1.335億美元,延續了前幾年的上升趨勢。該地區受益於強大的獸醫基礎設施、較高的寵物飼養率以及日益增強的寵物健康意識。先進的動物保健服務和日益普及的寵物保險政策也是推動該地區成長的重要因素。此外,城鄉獸醫設施網路的不斷擴大也有助於擴大市場滲透率。

獸醫神經退化性疾病診斷市場的競爭格局由全球巨頭和區域專家組成。愛德士實驗室 (IDEXX Laboratories)、默克動物保健 (Merck Animal Health)、維克 (Virbac) 和碩騰 (Zoetis) 等領先公司合計佔約 45%-50% 的市場佔有率。他們的主導地位歸功於廣泛的產品組合、全球影響力以及對技術創新的持續投入。這些參與者正專注於收購、新產品開發和地理擴張等策略性舉措,以鞏固其市場地位。同時,區域和本地供應商正在透過提供價格合理的診斷解決方案並採取併購和合作等成長策略來擴大市場佔有率,從而加劇競爭。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 動物神經系統疾病發生率上升

- 增進對動物神經生物學的理解

- 分子和影像診斷技術的進步

- 寵物擁有量和寵物醫療保健支出不斷成長

- 擴大伴侶動物保險覆蓋範圍

- 產業陷阱與挑戰

- 已驗證的生物標記供應有限

- 獸醫神經科醫生和訓練有素的專業人員短缺

- 機會

- 獸醫基礎設施快速發展

- 人工智慧和數位平台在診斷中的整合

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 耗材

- 儀器

第6章:市場估計與預測:按測試類型,2021 - 2034 年

- 主要趨勢

- 影像學

- MRI(磁振造影)

- CT(電腦斷層掃描)

- 其他影像學檢查

- 生物標記診斷測試

- 腦脊髓液 (CSF) 生物標記

- 血液生物標記

- 其他生物標記診斷測試

- 其他測試類型

第7章:市場估計與預測:按動物類型,2021 - 2034 年

- 主要趨勢

- 伴侶動物

- 狗

- 貓

- 馬匹

- 其他伴侶動物

- 牲畜

- 牛

- 綿羊和山羊

- 其他牲畜

第8章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 認知功能障礙

- 小腦萎縮

- 海綿狀腦病

- 其他適應症

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 獸醫醫院和診所

- 診斷實驗室

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Antech Diagnostics

- Avacta Animal Health Limited

- ACUVET BIOTECH

- Carestream Health

- IDEXX Laboratories

- Life Diagnostics

- Neurologica Corporation

- Merck Animal Health

- MI:RNA Diagnostics

- Mercodia AB

- Neogen Corporation

- Randox Laboratories

- Siemens Healthineers

- Virbac

- Zoetis

The Global Veterinary Neurodegenerative Disease Diagnostics Market was valued at USD 361.5 million in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 807.7 million by 2034. This growth, occurring at a CAGR of 8.5% from 2025 to 2034, is being driven by several key factors. The rise in neurological disorders among animals, coupled with a surge in pet ownership and spending on animal healthcare, is pushing demand for accurate and accessible diagnostic tools. With both companion and livestock animal populations increasing rapidly across the globe, the need for advanced veterinary diagnostics has become more pressing than ever. Technological advancements in veterinary neurology are also playing a crucial role in reshaping diagnostic approaches. Innovations in imaging, biomarker testing, and the development of highly sensitive diagnostic kits have significantly improved the precision of disease detection.

Emerging economies in Asia-Pacific, Latin America, and parts of Africa are witnessing a notable boost in the establishment of veterinary clinics and mobile care units. These facilities are increasingly equipped with cutting-edge neurological diagnostic tools such as CT and MRI, helping improve diagnostic accuracy and treatment outcomes. Supportive government policies focused on animal health and disease prevention are also encouraging public-private investments. Major corporations in the veterinary healthcare space are expanding their service networks and entering into strategic partnerships with reference laboratories, enhancing the availability of diagnostics in underserved regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $361.5 Million |

| Forecast Value | $807.7 Million |

| CAGR | 8.5% |

Veterinary neurodegenerative disease diagnostics comprise a wide array of instruments and consumables, including assays, reagents, kits, and other supporting components. These are used to develop and apply diagnostic solutions that help in the identification and monitoring of neurological conditions in animals. The market, segmented by product type into consumables and instruments, saw the consumables category leading with a valuation of USD 296.9 million in 2024. Consumables are used in every diagnostic procedure and thus need constant replenishment. This repetitive use ensures a steady revenue stream and strengthens the demand for these products. Their single-use nature, ease of integration into veterinary workflows, and standardized formats offer convenience, consistency, and reliability-key factors that contribute to their widespread adoption in clinics and labs.

On the basis of test type, the market is categorized into imaging, biomarker diagnostic tests, and other methods. Imaging held the dominant market share of 47.7% in 2024. It plays a vital role in identifying neurological abnormalities by providing visual insights into structural issues associated with diseases like spinal degeneration or brain dysfunction. The increasing integration of CT and MRI technologies in veterinary settings has improved the availability and effectiveness of these diagnostic methods, contributing to the dominance of imaging in the overall market.

By animal type, the market is segmented into companion animals and livestock animals. The companion animal segment led the market in 2024 and is projected to reach USD 606.4 million by 2034. This segment benefits from rising pet ownership, increasing awareness of animal neurological conditions, and the growing tendency among pet owners to invest in specialized diagnostics. As age-related neurological disorders become more recognized in pets, the need for precise and early detection continues to grow, prompting further use of advanced diagnostic solutions.

When analyzed by indication, cognitive dysfunction segment is expected to register a CAGR of 8.6% through 2034, driven by the rising occurrence of age-related neurological decline in animals. This condition, particularly in older dogs, is gaining greater awareness among pet owners and veterinary professionals alike. Ongoing research and the development of new diagnostic tests are enabling the identification of cognitive issues with improved speed and accuracy, helping to meet growing demand.

In terms of end use, the market is segmented into veterinary hospitals and clinics, diagnostic laboratories, and other end users. Veterinary hospitals and clinics emerged as the leading segment in 2024 and are anticipated to reach USD 436.4 million by 2034. These institutions are typically well-resourced, with advanced diagnostic tools and skilled professionals capable of processing a high volume of samples efficiently. Their ability to deliver accurate and timely diagnoses makes them the go-to choice for many pet owners. Investments in imaging systems and neurodiagnostic infrastructure further solidify their dominance in this space.

Geographically, North America led the global market with a share of 40.6% in 2024. The United States alone reached a market value of USD 133.5 million in 2024, continuing its upward trend from previous years. The region benefits from strong veterinary infrastructure, high rates of pet ownership, and growing awareness regarding pet health. The presence of advanced animal healthcare services and increasing adoption of pet insurance policies are also important factors fueling regional growth. Additionally, the expanding network of veterinary facilities in both urban and rural areas contributes to broader market penetration.

The competitive landscape in the veterinary neurodegenerative disease diagnostics market features a mix of global giants and regional specialists. Leading companies such as IDEXX Laboratories, Merck Animal Health, Virbac, and Zoetis collectively hold approximately 45%-50% of the market. Their dominance is attributed to broad product portfolios, global reach, and consistent investment in technological innovation. These players are focusing on strategic initiatives like acquisitions, new product development, and geographic expansion to strengthen their positions. Meanwhile, regional and local providers are intensifying competition by offering affordable diagnostic solutions and adopting growth strategies such as mergers and collaborations to expand their market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Test type

- 2.2.4 Animal type

- 2.2.5 Indication

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of neurological disorders in animals

- 3.2.1.2 Improved understanding of animal neurobiology

- 3.2.1.3 Technological advancements in molecular and imaging diagnostics

- 3.2.1.4 Growing pet ownership and pet healthcare spending

- 3.2.1.5 Expansion of companion animal insurance coverage

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited availability of validated biomarkers

- 3.2.2.2 Shortage of veterinary neurologists and trained professionals

- 3.2.3 Opportunities

- 3.2.3.1 Rapid veterinary infrastructure development

- 3.2.3.2 Integration of AI and digital platforms in diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Imaging

- 6.2.1 MRI (magnetic resonance imaging)

- 6.2.2 CT (computed tomography)

- 6.2.3 Other imaging tests

- 6.3 Biomarker diagnostic tests

- 6.3.1 CSF (cerebrospinal fluid) biomarkers

- 6.3.2 Blood-based biomarkers

- 6.3.3 Other biomarker diagnostic tests

- 6.4 Other test types

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Horses

- 7.2.4 Other companion animals

- 7.3 Livestock animals

- 7.3.1 Cattle

- 7.3.2 Sheep and goats

- 7.3.3 Other livestock animals

Chapter 8 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cognitive dysfunction

- 8.3 Cerebellar abiotrophy

- 8.4 Spongiform encephalopathies

- 8.5 Other indications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Diagnostic laboratories

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Antech Diagnostics

- 11.2 Avacta Animal Health Limited

- 11.3 ACUVET BIOTECH

- 11.4 Carestream Health

- 11.5 IDEXX Laboratories

- 11.6 Life Diagnostics

- 11.7 Neurologica Corporation

- 11.8 Merck Animal Health

- 11.9 MI:RNA Diagnostics

- 11.10 Mercodia AB

- 11.11 Neogen Corporation

- 11.12 Randox Laboratories

- 11.13 Siemens Healthineers

- 11.14 Virbac

- 11.15 Zoetis