|

市場調查報告書

商品編碼

1773448

裝盒機械市場機會、成長動力、產業趨勢分析及2025-2034年預測Cartoning Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

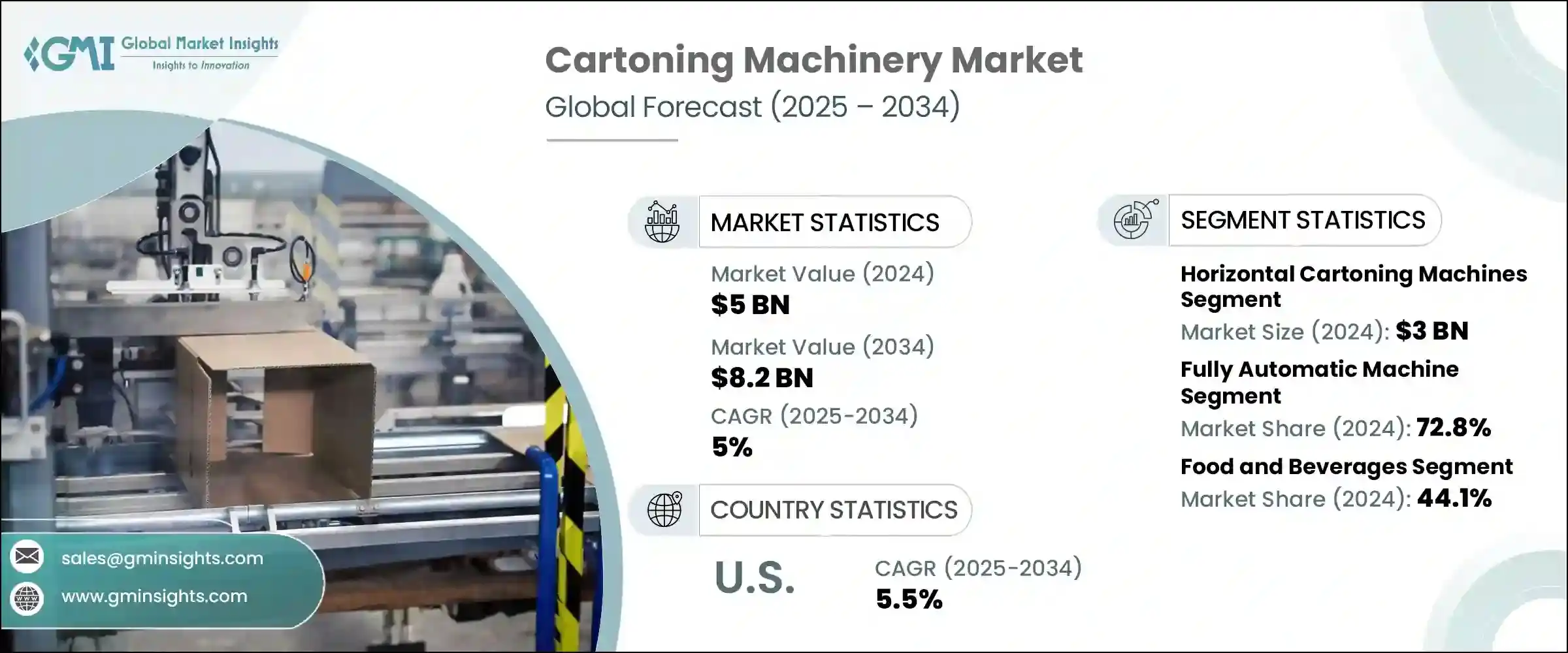

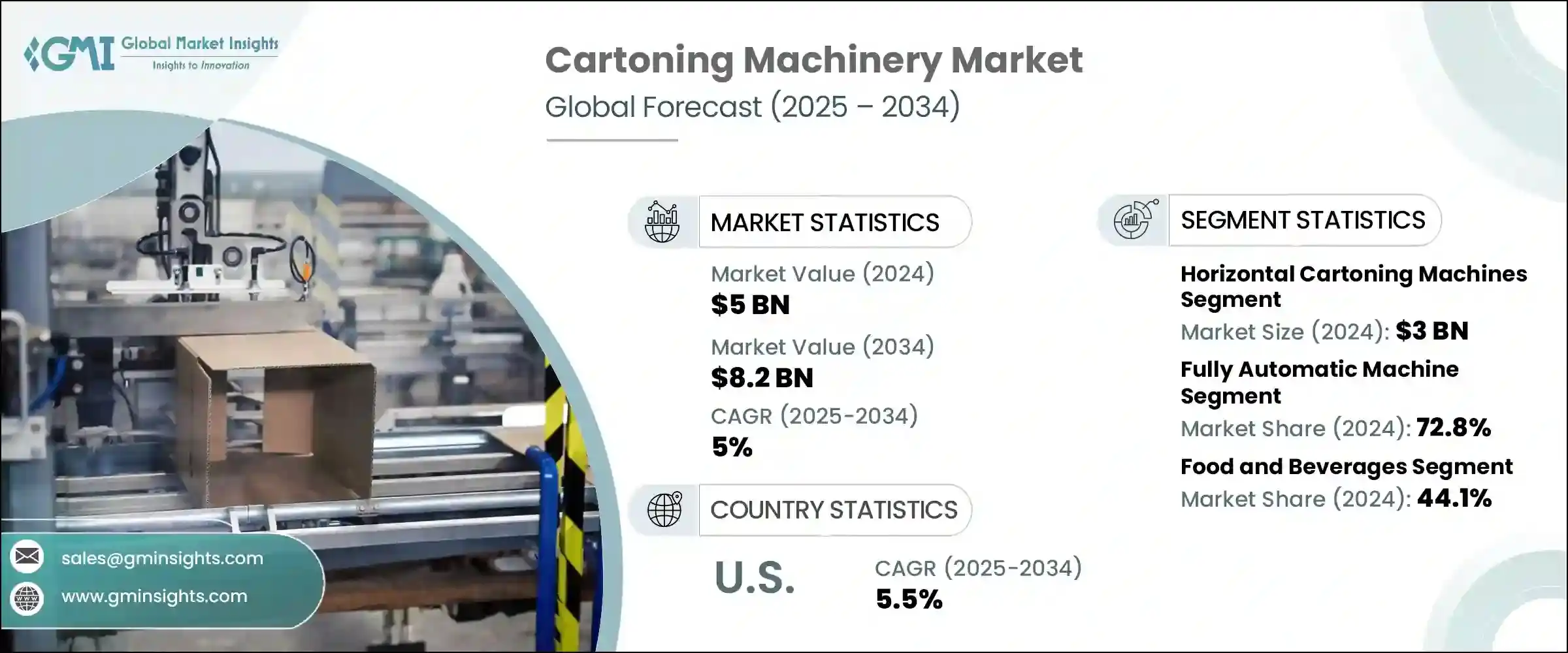

2024年,全球裝盒機械市場規模達50億美元,預計到2034年將以5%的複合年成長率成長,達到82億美元。隨著自動化成為各製造業的優先事項,食品飲料、製藥和個人護理等行業對先進裝盒機的需求日益成長。這些產業依賴大批量、高速的包裝,因此自動化裝盒系統成為提高生產力、減少對人工依賴的合理選擇。同時,隨著城鎮化和消費者生活方式的轉變,對包裝商品的需求也在不斷成長,這進一步推動了產業成長。

政府強制執行的包裝法規,尤其是在製藥和食品產業,正在加速安全可追溯包裝技術的採用。裝盒機正透過工業4.0功能進行增強,包括物聯網感測器和基於人工智慧的監控系統。這些功能可實現預測性維護和即時資料追蹤,從而提高營運效率。目前約有40%的包裝公司使用智慧自動化來簡化生產週期。此外,市場正日益轉向環保營運。超過75%的消費者現在更青睞永續的選擇,這促使製造商在裝盒生產線中採用可回收紙板和節能解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 50億美元 |

| 預測值 | 82億美元 |

| 複合年成長率 | 5% |

水平裝盒機市場在2024年創收30億美元,預計2034年將以5.2%的複合年成長率成長。臥式裝盒機因其多功能性和快速性而廣受歡迎,是處理不同產品形態的理想選擇。臥式裝盒機廣泛應用於個人護理和食品包裝領域,得益於伺服驅動系統等增強功能,該設備能夠提高精度和產量,並支援自動和手動裝盒。

全自動裝盒機市場在2024年佔據主導地位,市佔率達72.8%,預計2034年將達到61億美元。這類系統因其對人工的依賴程度低,並且能夠確保製藥和食品等高產量行業的穩定產出而備受青睞。人工智慧追蹤和無溶劑塗膠等創新技術也促進了其應用的成長,尤其是在注重減少環境影響的地區。

美國裝盒機械市場在2024年創收9.8億美元,預計2034年將以5.5%的複合年成長率成長。美國在醫療保健、食品和線上零售等行業對智慧裝盒機械的需求廣泛,處於領先地位。強大的技術基礎設施和經驗豐富的勞動力為自動化提供了有利的環境。美國包裝公司也受到永續發展法規的影響,這些法規不斷推動市場朝更環保的方向發展。

裝盒機械市場的主要參與者包括 Omori Machinery、Marchesini Group、Mpac Group、ShineBen Machinery、IMA Group、Jacob White Packaging、SaintyCo、Econocorp、BW Integrated Systems、Serpa Packaging Solution、Infinity Automated Solutions、Nichromery、ADCO Packaging Solutions、Mespack and Elite Packaging Solutions。裝盒機械市場的領先公司正專注於技術創新、產品客製化和永續性,以擴大其市場範圍。許多公司正在將人工智慧和物聯網整合到他們的系統中,以提供智慧互聯的解決方案,提供即時診斷和預測性維護。與包裝公司的合作幫助他們根據特定的營運需求客製化設備,特別是在食品、製藥和個人護理領域。擴大具有節能系統和環保功能的產品線是另一個優先事項,這與全球永續發展目標保持一致。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 水平裝盒機

- 立式裝盒機

第6章:市場估計與預測:按自動化,2021 - 2034 年

- 主要趨勢

- 手動機

- 半自動機

- 全自動機器

第7章:市場估計與預測:依產能,2021 - 2034 年

- 主要趨勢

- 高達 100 箱/分鐘

- 100至200箱/分鐘

- 200至400箱/分鐘

- 400箱/分鐘以上

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 製藥

- 食品和飲料

- 消費品

- 化妝品和個人護理

- 其他(營養保健品等)

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- ADCO Packaging Solutions

- BW Integrated Systems

- Econocorp

- Elite Packaging Machinery

- IMA Group

- Infinity Automated Solutions

- Jacob White Packaging

- Marchesini Group

- Mespack

- Mpac Group

- Nichrome

- Omori Machinery

- SaintyCo

- Serpa Packaging Solution

- ShineBen Machinery

The Global Cartoning Machinery Market was valued at USD 5 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 8.2 billion by 2034. As automation becomes a priority across manufacturing sectors, demand for advanced cartooning machines is rising in industries such as food and beverages, pharmaceuticals, and personal care. These sectors rely on high-volume, high-speed packaging, making automated carton systems a logical choice for improved productivity and reduced reliance on manual labor. In parallel, the demand for packaged goods is rising with urbanization and shifting consumer lifestyles, further fueling industry growth.

Government-enforced packaging regulations, particularly in the pharmaceutical and food industries, are accelerating the adoption of secure and traceable packaging technologies. Cartoning machines are being enhanced with Industry 4.0 capabilities, including IoT sensors and AI-based monitoring systems. These features enable predictive maintenance and real-time data tracking, improving operational efficiency. About 40% of packaging firms now use smart automation to streamline their production cycles. Additionally, the market is seeing a growing shift toward eco-conscious operations. More than 75% of consumers now prefer sustainable options, prompting manufacturers to incorporate recyclable paperboard and energy-efficient solutions into cartoning lines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 5% |

Horizontal cartoning machines segment generated USD 3 billion in 2024 and is forecasted to grow at a CAGR of 5.2% through 2034. Their popularity lies in their versatility and speed, making them ideal for processing different product forms. These machines are widely used in personal care and food packaging and can handle both automatic and manual loading, thanks to enhanced features like servo-driven systems that increase precision and throughput.

The fully automatic cartoning machines segment held a dominant share of 72.8% in 2024 and is projected to hit USD 6.1 billion by 2034. These systems are preferred for their minimal dependency on human labor and their ability to ensure consistent output in high-volume sectors such as pharmaceuticals and food production. Innovations such as AI-enabled tracking and solvent-free gluing have also contributed to their growing usage, particularly in regions focused on reducing environmental impact.

U.S. Cartoning Machinery Market generated USD 980 million in 2024 and is on track to grow at a 5.5% CAGR through 2034. The country leads with widespread demand for smart cartoning machinery across industries including healthcare, food, and online retail. Strong technological infrastructure and an experienced workforce make it a favorable environment for automation. U.S. packaging firms are also influenced by sustainability regulations, which continue to push the market toward greener operations.

Key players in the Cartoning Machinery Market include Omori Machinery, Marchesini Group, Mpac Group, ShineBen Machinery, IMA Group, Jacob White Packaging, SaintyCo, Econocorp, BW Integrated Systems, Serpa Packaging Solution, Infinity Automated Solutions, Nichrome, ADCO Packaging Solutions, Mespack, and Elite Packaging Machinery. Leading companies in the cartoning machinery market are focusing on technological innovation, product customization, and sustainability to expand their market reach. Many are integrating AI and IoT into their systems to offer smart, connected solutions that provide real-time diagnostics and predictive maintenance. Partnerships with packaging companies help them tailor equipment for specific operational needs, especially in the food, pharma, and personal care sectors. Expanding product lines with energy-efficient systems and eco-friendly features is another priority, aligning with global sustainability goals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Automation

- 2.2.4 Capacity

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO Perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behaviour analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Horizontal cartoning machines

- 5.3 Vertical cartoning machines

Chapter 6 Market Estimates & Forecast, By Automation, 2021 - 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Manual machine

- 6.3 Semi-automatic machine

- 6.4 Fully automatic machine

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Up to 100 cartons/ min

- 7.3 100 to 200 cartons/ min

- 7.4 200 to 400 cartons/ min

- 7.5 Above 400 cartons/ min

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Pharmaceuticals

- 8.3 Food and beverages

- 8.4 Consumer goods

- 8.5 Cosmetics and personal care

- 8.6 Others (nutraceuticals etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion)(Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 ADCO Packaging Solutions

- 11.2 BW Integrated Systems

- 11.3 Econocorp

- 11.4 Elite Packaging Machinery

- 11.5 IMA Group

- 11.6 Infinity Automated Solutions

- 11.7 Jacob White Packaging

- 11.8 Marchesini Group

- 11.9 Mespack

- 11.10 Mpac Group

- 11.11 Nichrome

- 11.12 Omori Machinery

- 11.13 SaintyCo

- 11.14 Serpa Packaging Solution

- 11.15 ShineBen Machinery