|

市場調查報告書

商品編碼

1773440

切削刀具市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cutting Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

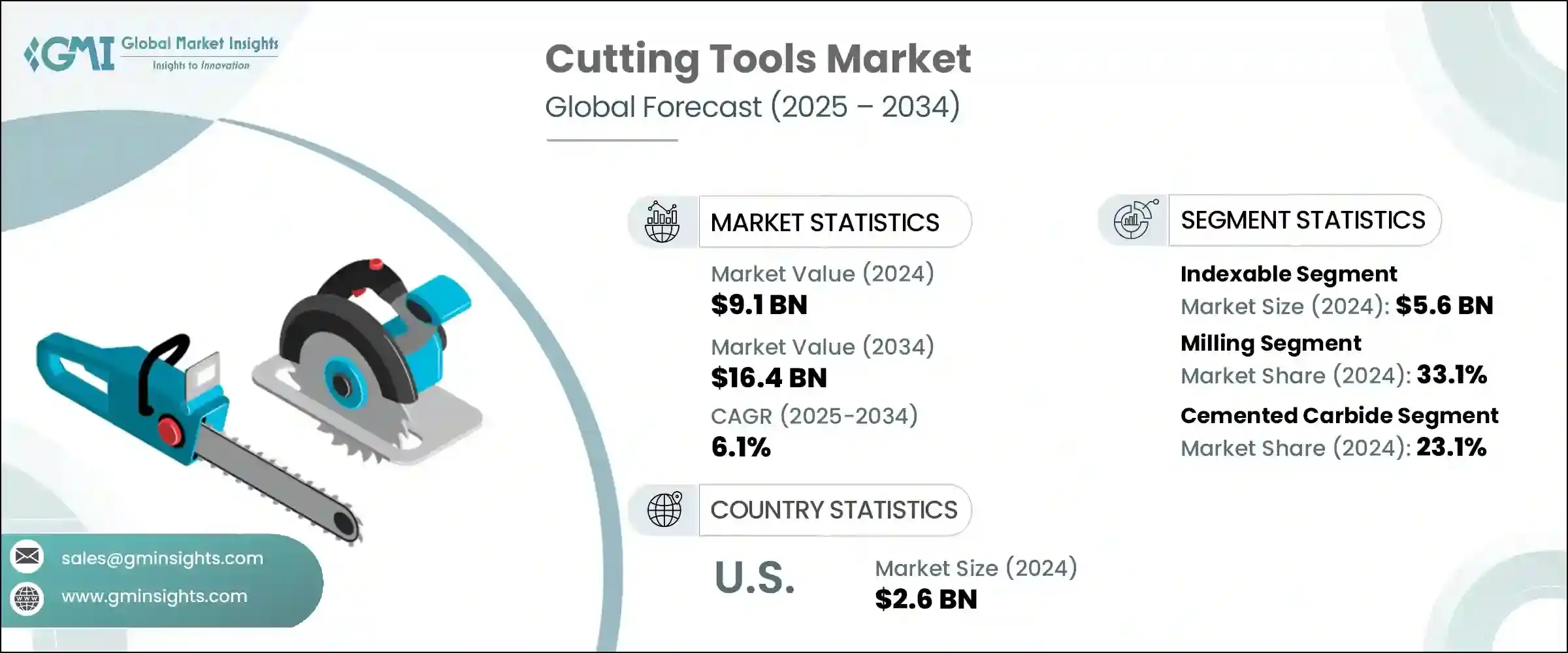

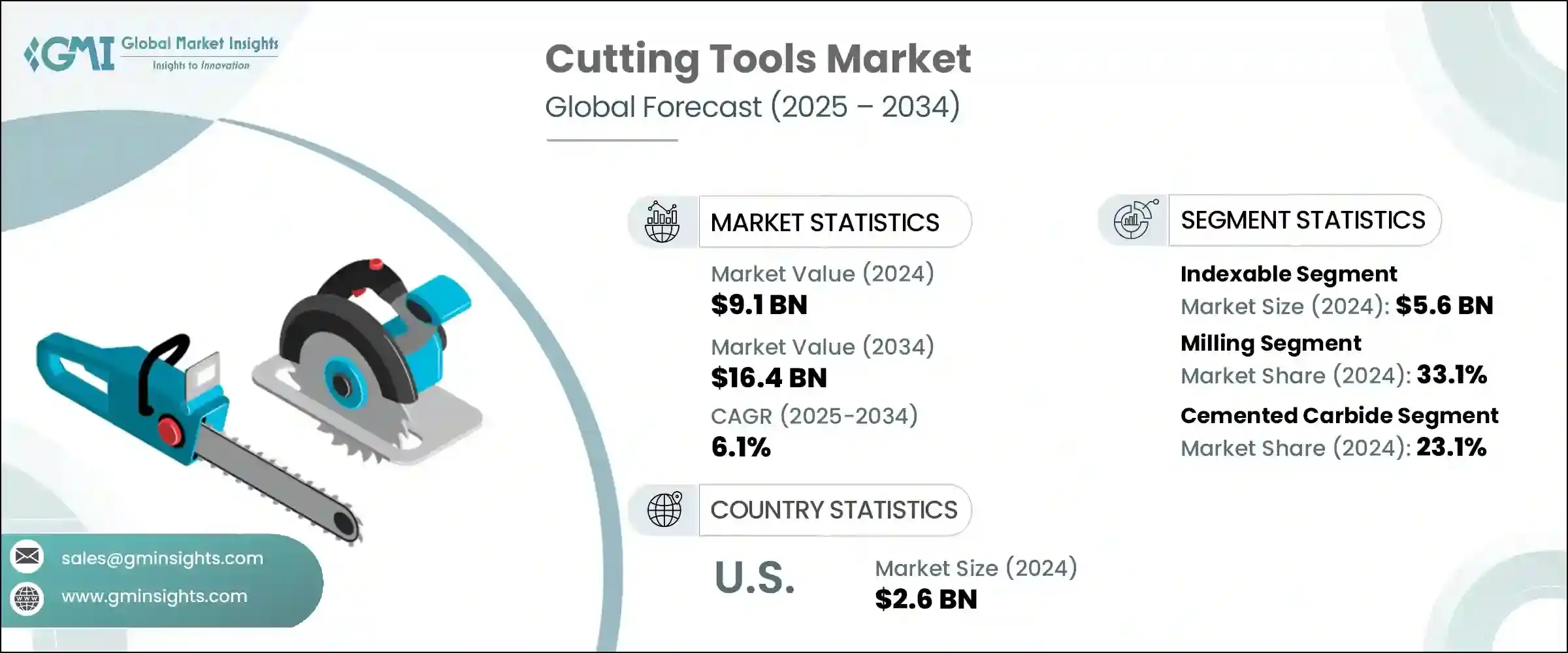

2024年,全球切削刀具市場規模達91億美元,預計到2034年將以6.1%的複合年成長率成長,達到164億美元。該市場正在經歷顯著成長,這主要得益於製造流程的進步。隨著自動化和工業4.0實踐的興起,對能夠生產無缺陷零件的精密刀具的需求日益成長。汽車、航太和電子等產業尤其受益於這種精確度。

此外,隨著複合材料和高強度合金等更輕更硬的材料的應用,需要更先進的切削刀具來處理這些堅韌的材料。另一個關鍵促進因素是持續的基礎設施建設熱潮,尤其是在快速發展的經濟體中,這增加了對適用於大型機器和現場設備的刀具的需求。此外,對最佳化原料使用和減少浪費的關注也不斷推動製造商尋求更耐用、更經濟高效的切削刀具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 91億美元 |

| 預測值 | 164億美元 |

| 複合年成長率 | 6.1% |

此外,隨著企業越來越重視永續性和性能,切削刀具產業對更環保生產方法的追求也正在加速。製造商在從原料採購到提高製造過程中的能源效率的各個環節都採取了環保措施。切削刀具塗層和材料的進步不僅延長了刀具的使用壽命,減少了浪費,還提高了切割效率。此外,人們越來越重視切削刀具的回收和再利用,以減少整體環境足跡。許多公司也致力於減少有害排放,並最大限度地減少生產過程中有害化學物質的使用。

2024年,可轉位刀具市場規模達56億美元。該領域因其成本效益和多功能性而日益受到歡迎。可轉位刀具允許使用者更換磨損的刀片,而無需丟棄整個刀具,這有助於降低營運成本,使其在汽車和航太等精密驅動行業中極具吸引力。這些刀具還支援高速加工,從而提高效率和耐用性,這對製造商至關重要。向永續發展的轉變進一步增強了它們的吸引力,因為使用可更換刀片可以減少廢金屬的產生和浪費,這與日益成長的綠色製造程序需求相一致。

2024年,銑削刀具細分市場佔據33.1%的市佔率。此細分市場的快速擴張得益於銑削刀具在多個行業中能夠處理的各種任務。這些刀具對於生產高精度複雜輪廓至關重要,並且常用於汽車、航太和電子產品。隨著產品設計對更輕巧耐用零件的需求不斷成長,銑削刀具因其能夠切割先進材料的能力而日益受到歡迎。多功能設計和改進的塗層等創新技術也透過延長刀具壽命和降低營運成本促進了該細分市場的成長。

2024年,美國切削刀具市場規模達26億美元,位居全球領先地位。美國製造業涵蓋眾多產業,是推動其主導的關鍵因素。汽車和航太產業對符合嚴格品質標準的高精度刀具的需求不斷成長。此外,機器人、感測器和雲端分析技術在製造業中的整合,透過提高營運效率,進一步促進了市場成長。

切削刀具產業的主要公司包括 Ceratizit SA、Cougar Cutting Tools、Emuge Corporation、Greenleaf Corporation、Ingersoll Cutting Tools、Iscar Ltd.、Kennametal Inc.、Mapal Inc.、三菱綜合材料株式會社、Mohawk Special Cutting Tools、OSG Corporation、山特維克可樂滿、Tungak Technologies Corporation, Walter、Tunga。為了滿足對尖端產品日益成長的需求,切削刀具市場的公司正專注於技術進步,以提升其市場地位。

領先的企業正在大力投資研發,以提高其工具的性能並延長其使用壽命。他們也積極探索永續製造技術,以滿足環境法規和消費者對更環保產品的需求。此外,他們還利用策略夥伴關係、併購來擴大產品供應並強化供應鏈。企業也正在整合智慧感測器和物聯網設備等數位工具,以提高製造的精度和營運效率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按工具類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依工具類型,2021-2034

- 主要趨勢

- 可轉位

- 實心圓形

第6章:市場估計與預測:依工藝,2021-2034

- 主要趨勢

- 銑削

- 鑽孔

- 無聊的

- 轉彎

- 研磨

- 其他

第7章:市場估計與預測:依材料類型,2021-2034

- 主要趨勢

- 硬質合金

- 高速鋼(HSS)

- 陶瓷

- 立方氮化硼(CBN)

- 聚晶鑽石(PCD)

- 特殊材料

- 不銹鋼

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 汽車

- 航太與國防

- 建造

- 電子產品

- 發電

- 石油和天然氣

- 木工

- 模具製造

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Ceratizit SA

- Cougar Cutting Tools

- Emuge Corporation

- Greenleaf Corporation

- Ingersoll Cutting Tools

- Iscar Ltd.

- Kennametal Inc.

- Mapal Inc.

- Mitsubishi Materials Corporation

- Mohawk Special Cutting Tools

- OSG Corporation

- Sandvik Coromant

- Seco Tools AB

- Tungaloy Corporation

- Walter Technologies

The Global Cutting Tools Market was valued at USD 9.1 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 16.4 billion by 2034. This market is experiencing significant growth, driven largely by advancements in manufacturing methods. With the rise of automation and Industry 4.0 practices, there is an increasing demand for precision tools that can produce defect-free parts. Industries like automotive, aerospace, and electronics particularly benefit from such accuracy.

Additionally, the shift toward using lighter and stronger materials, including composites and high strength alloys, necessitates more advanced cutting tools that can handle these tough materials. Another key driver is the ongoing infrastructure boom, especially in rapidly developing economies, which raises the need for tools suitable for large machines and site equipment. Along with this, the focus on optimizing raw material use and minimizing waste continues to push manufacturers toward more durable, cost-effective cutting tools.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 6.1% |

Furthermore, the drive for greener production methods is accelerating within the cutting tools industry, as companies increasingly prioritize sustainability alongside performance. Manufacturers are adopting eco-friendly practices at every stage, from sourcing raw materials to improving energy efficiency during the manufacturing process. Advances in cutting tool coatings and materials are enabling longer tool lifespans and reduced waste, while also enhancing cutting efficiency. Additionally, there is a growing emphasis on recycling and reusing cutting tools, reducing the overall environmental footprint. Many companies are also focusing on reducing hazardous emissions and minimizing the use of harmful chemicals during the production process.

In 2024, the indexable tools segment generated USD 5.6 billion. This segment is growing in popularity due to its cost-effectiveness and versatility. Indexable tools allow users to replace worn-out inserts instead of discarding the entire tool, which helps lower operational costs, making them highly attractive in precision-driven industries like automotive and aerospace. These tools also support high-speed machining, enhancing efficiency and durability, which are crucial for manufacturers. The shift toward sustainability further adds to their appeal, as using replaceable inserts generates less scrap metal and reduces waste, aligning with the growing demand for greener manufacturing processes.

The milling tools segment accounted for a 33.1% share in 2024. The rapid expansion of this segment can be attributed to the wide range of tasks milling tools are capable of handling in multiple industries. These tools are essential for producing complex profiles with high precision, and they are commonly used in automotive, aerospace, and electronics. As product designs demand lighter yet more durable parts, milling tools are gaining popularity due to their ability to cut through advanced materials. Innovations, such as multi-purpose designs and improved coatings, have also contributed to the segment's growth by extending tool life and reducing operational costs.

United States Cutting Tools Market was valued at USD 2.6 billion in 2024, leading the global market. The U.S. manufacturing sector, which spans a wide range of industries, is a key factor driving this dominance. The automotive and aerospace sectors fuel the demand for highly accurate tools that meet stringent quality standards. Additionally, the integration of robotics, sensors, and cloud analytics in manufacturing further boosts market growth by enhancing operational efficiency.

Key companies in the Cutting Tools Industry include Ceratizit S.A., Cougar Cutting Tools, Emuge Corporation, Greenleaf Corporation, Ingersoll Cutting Tools, Iscar Ltd., Kennametal Inc., Mapal Inc., Mitsubishi Materials Corporation, Mohawk Special Cutting Tools, OSG Corporation, Sandvik Coromant, Seco Tools AB, Tungaloy Corporation, and Walter Technologies. In response to the increasing demand for cutting-edge products, companies in the cutting tools market are focusing on technological advancements to enhance their market position.

Leading players are investing heavily in research and development to improve the performance of their tools and increase their lifespan. They are also actively exploring sustainable manufacturing techniques to meet environmental regulations and consumer demands for greener products. Additionally, strategic partnerships, mergers, and acquisitions are being utilized to expand product offerings and strengthen supply chains. Companies are also incorporating digital tools, such as smart sensors and IoT-enabled devices, to enhance precision and operational efficiency in manufacturing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Tool type

- 2.2.3 Process

- 2.2.4 Material Type

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By tool type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Tool Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Indexable

- 5.3 Solid Round

Chapter 6 Market Estimates & Forecast, By Process, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Milling

- 6.3 Drilling

- 6.4 Boring

- 6.5 Turning

- 6.6 Grinding

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Cemented Carbide

- 7.3 High-Speed Steel (HSS)

- 7.4 Ceramics

- 7.5 Cubic Boron Nitride (CBN)

- 7.6 Polycrystalline Diamond (PCD)

- 7.7 Exotic Materials

- 7.8 Stainless Steel

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace & Defense

- 8.4 Construction

- 8.5 Electronics

- 8.6 Power Generation

- 8.7 Oil & Gas

- 8.8 Woodworking

- 8.9 Die and Mold Manufacturing

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ceratizit S.A.

- 11.2 Cougar Cutting Tools

- 11.3 Emuge Corporation

- 11.4 Greenleaf Corporation

- 11.5 Ingersoll Cutting Tools

- 11.6 Iscar Ltd.

- 11.7 Kennametal Inc.

- 11.8 Mapal Inc.

- 11.9 Mitsubishi Materials Corporation

- 11.10 Mohawk Special Cutting Tools

- 11.11 OSG Corporation

- 11.12 Sandvik Coromant

- 11.13 Seco Tools AB

- 11.14 Tungaloy Corporation

- 11.15 Walter Technologies